Canadian writers and researchers, Alex and Don Tapscott, authors of the new book Blockchain Revolution, explain that blockchain goes way beyond the second coming of the internet. The pair, like so many others, stumbled across blockchain via the bitcoin association, quickly realising the genie is out of the bottle.

For beginners, blockchain is essentially a database, a giant network, known as a distributed ledger, which records ownership and value, and allows anyone with access to view and take part. A network is updated and verified through consensus of all the parties involved. When something is added it cannot be altered and, if it looks valid to everyone, the update is approved.

“The first generation brought us the internet of information. The second generation, powered by blockchain, is bringing us the internet of value, a new, distributed platform that can help us reshape the world of business and transform the old order of human affairs for the better. But like the internet in the late-1980s and early-1990s, this is still early days.”

Join us as we break down the future of blockhain in eight charts.

Blockchain, a distributed ledger, is an asset database that can be shared across a network of multiple sites, geographies or institutions. All participants within a network can have their own identical copy of the ledger. Any changes to the ledger are reflected in all copies, similar to a Google doc. On the other hand, a centralized asset ledger, or clearing house, the model currently used by financial services globally, is a list of transactions that is controlled by a single entity.

Following on from the chart above, with a distributed ledger between financial institutions, most transactions would be real-time and therefore instant.

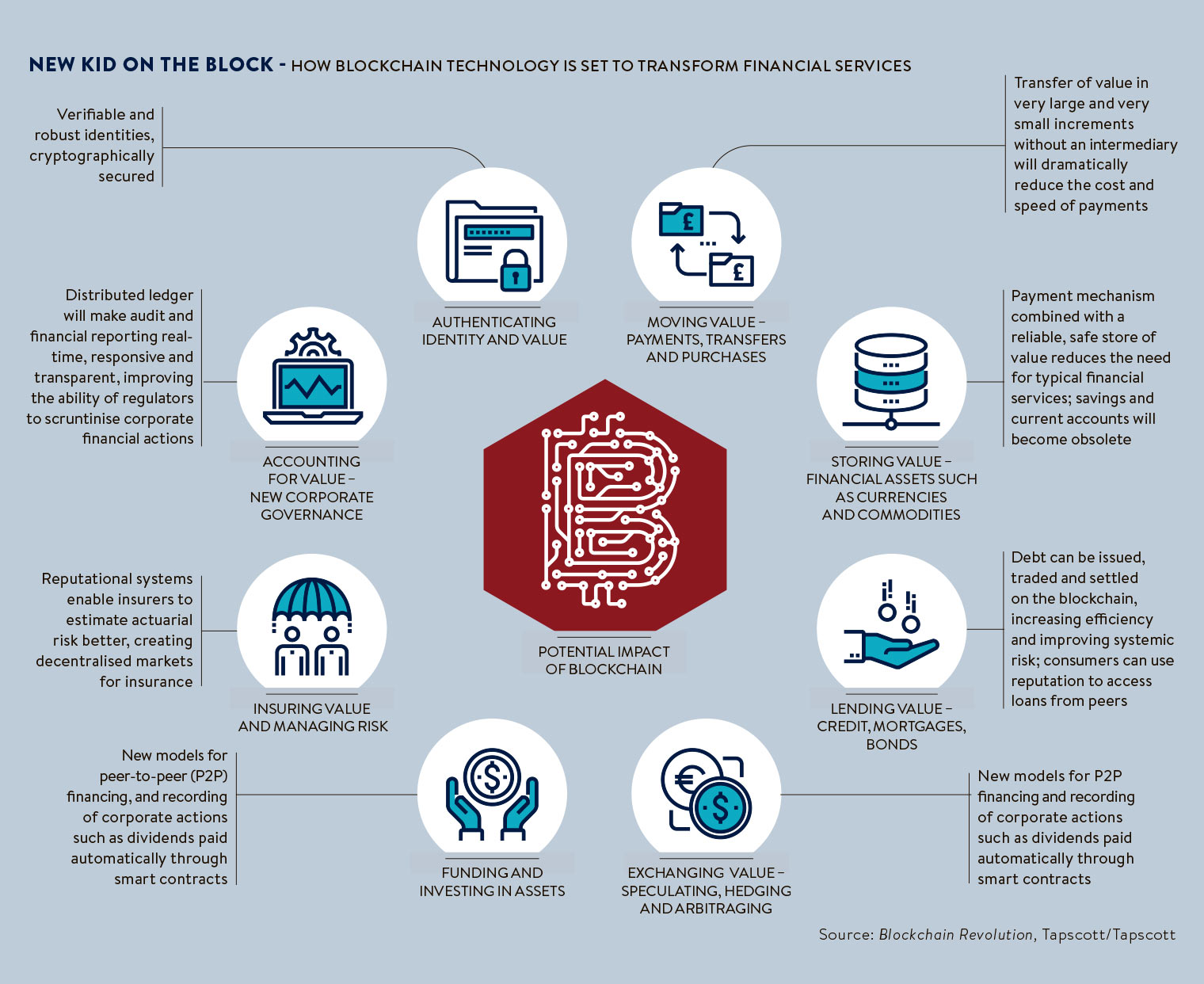

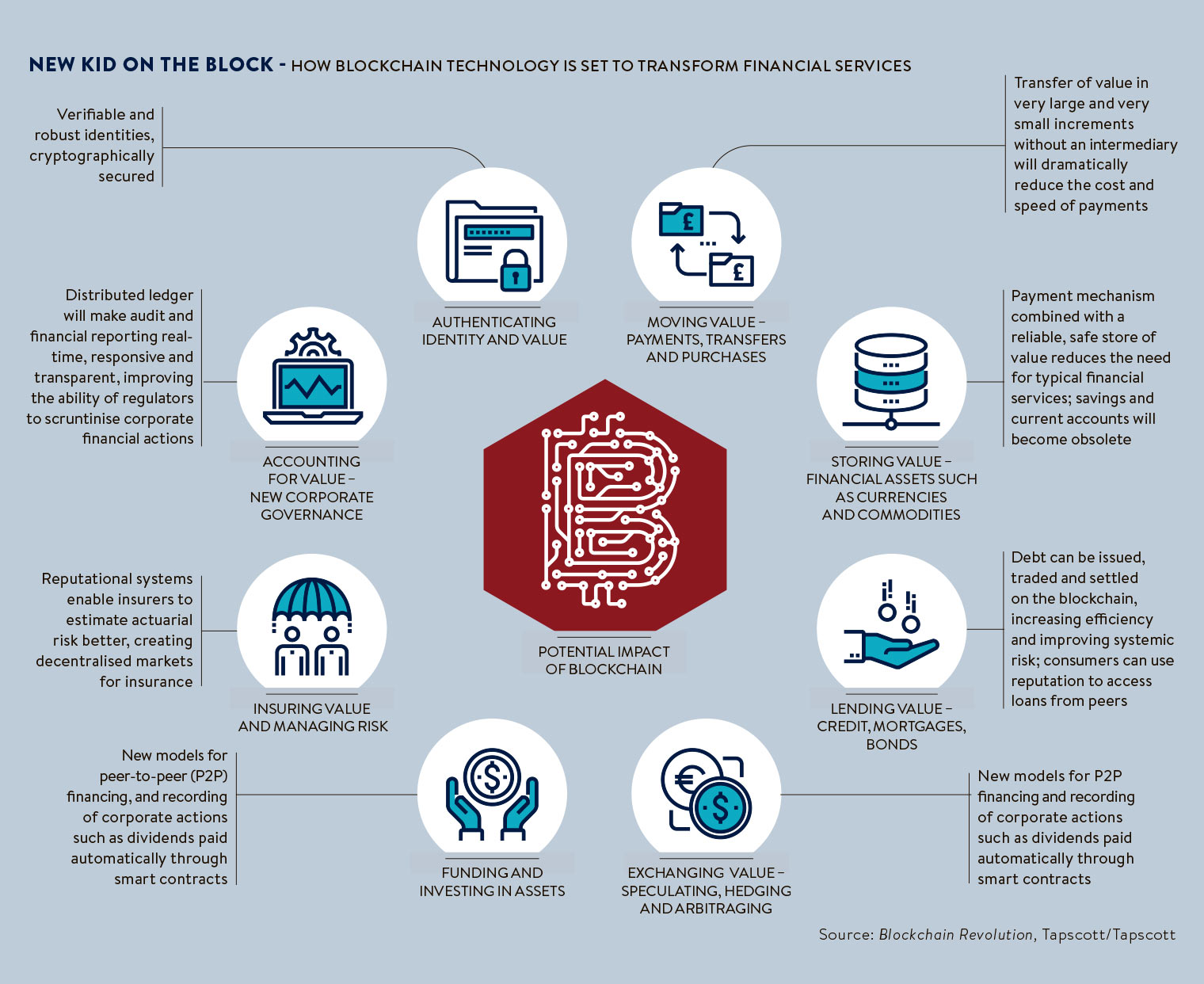

The illustration below shows eight key areas of financial services which blockchain technology is likely to transform, ranging from making current accounts obsolete to creating new peer-to-peer (P2P) financing models.

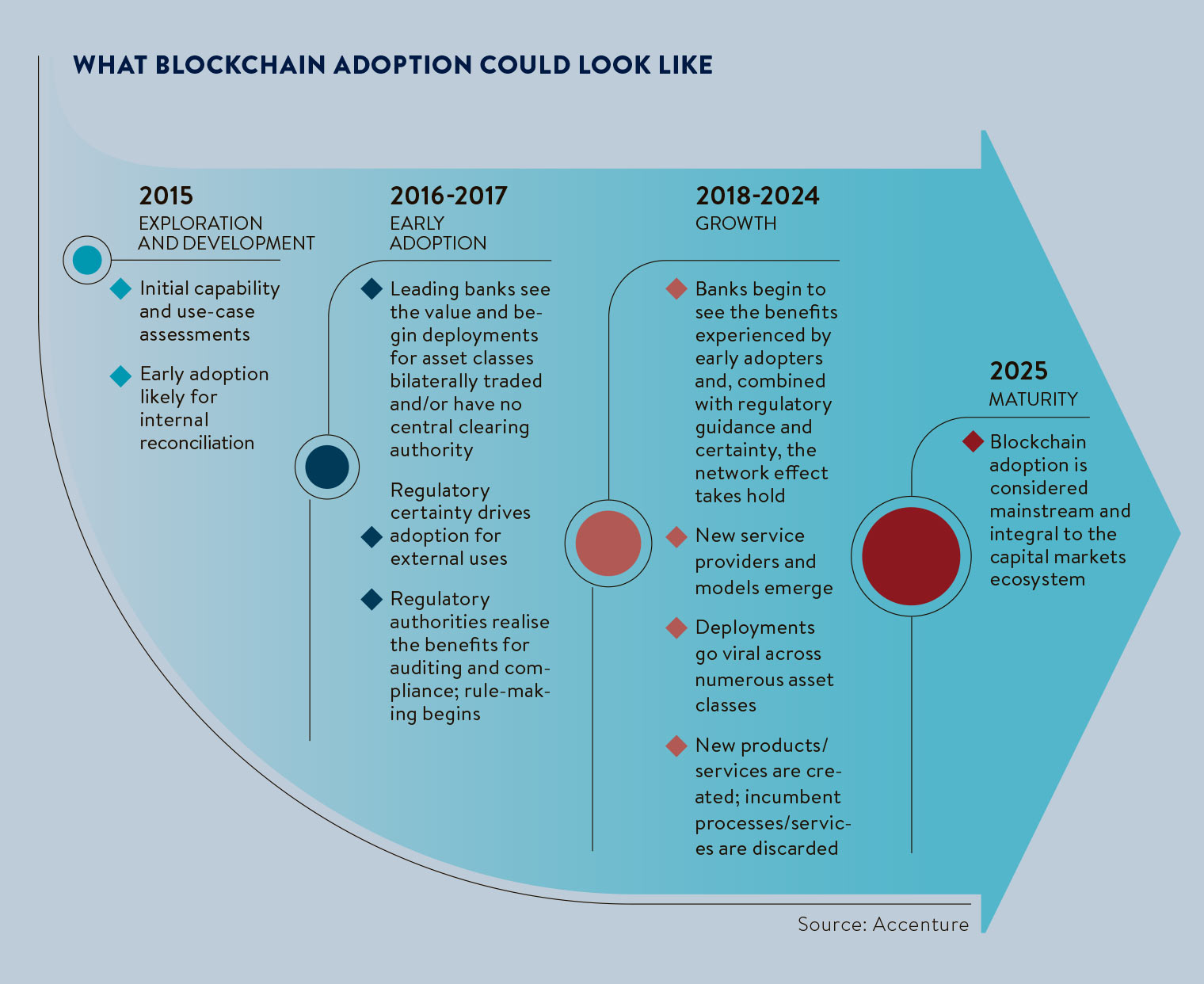

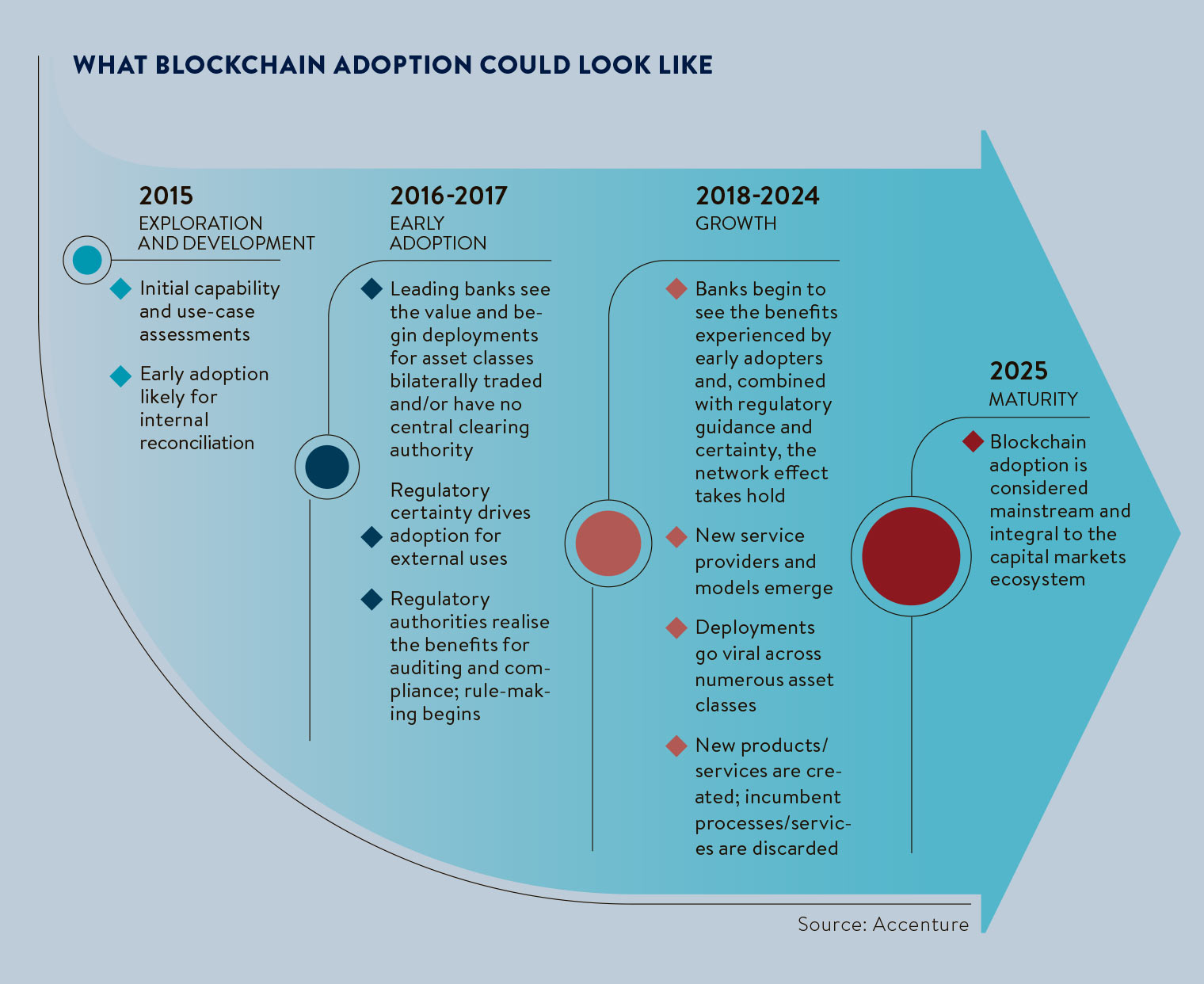

Using the law of diffusion of innovation curve, blockchain is predicted to move past the ‘Innovators’ phase in 2016 and reach the 13,5 per cent of “early adopters” within financial services. The “tipping point”, according to Accenture, is then expected to happen in 2018 when the early majority of financial services begin to see the benefits of the early adopters and new models emerge. This growth phase is predicted by Accenture to last until 2025 when blockchain will finally become mainstream within financial services.

[embed_related]

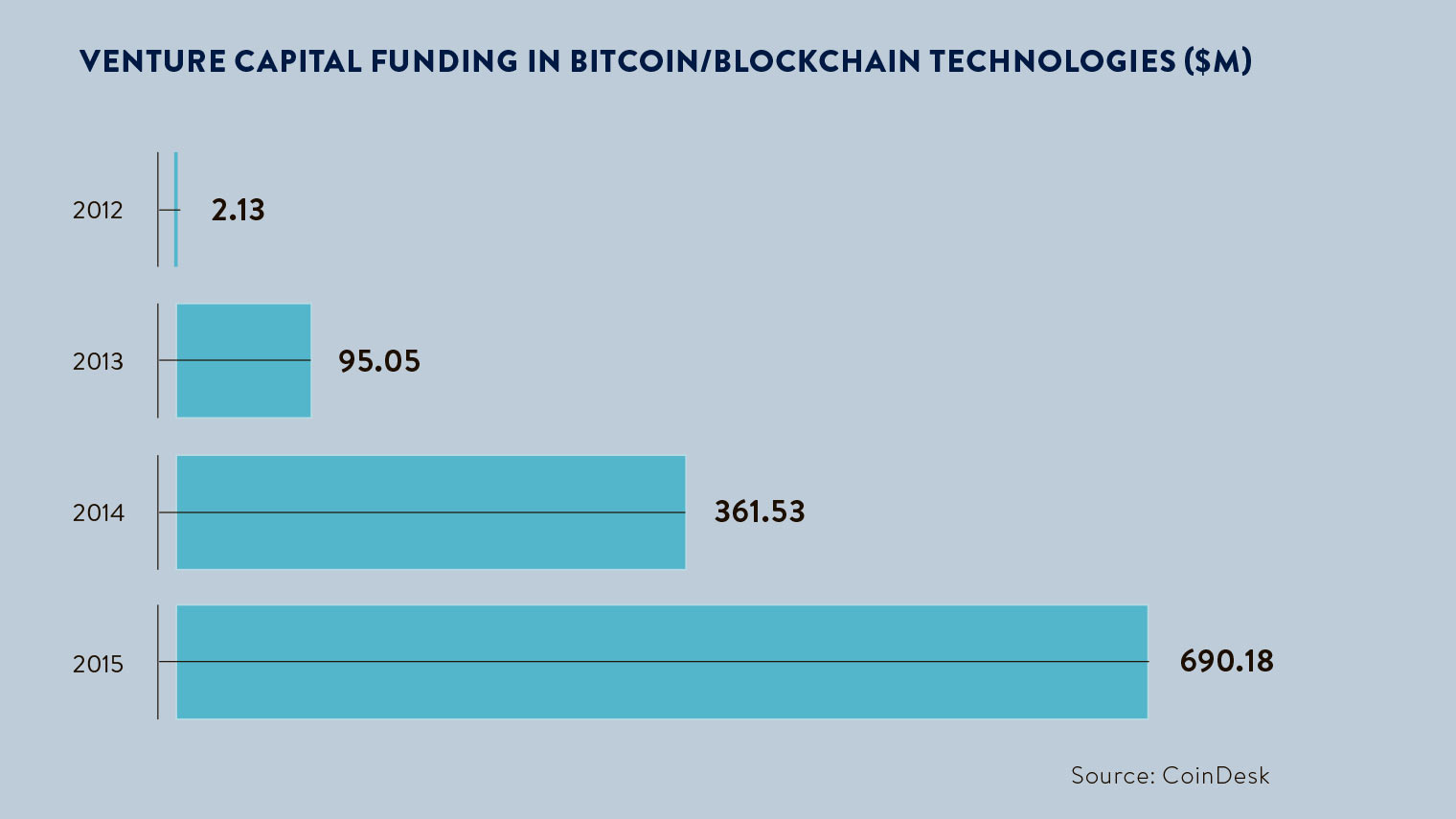

Global venture capital funding grew by 91 per cent in 2015 compared to the year before, or an incredible 726 per cent over the last two years. $216m was inveseted in blockchain in the first quarter of 2016 and it was the first time that blockchain and hybrid startups raised more money than bitcoin startups according to CoinDesk.

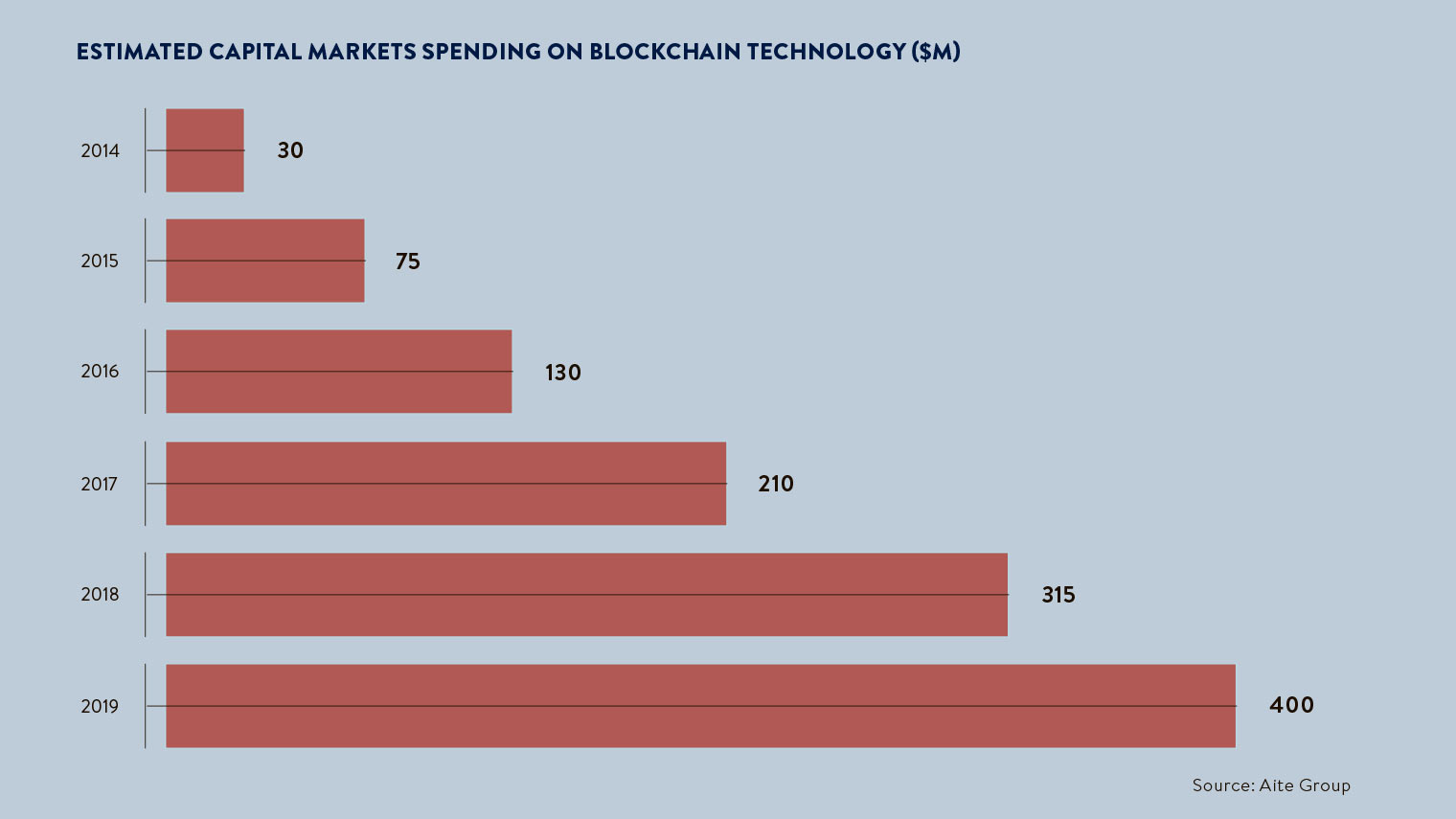

Interestingly, looking at historical venture capital spend (see earlier chart) vs future capital markets spend, it would appear that the main funding for blockchain technologies will come from outside of the financial services industry (incumbents).

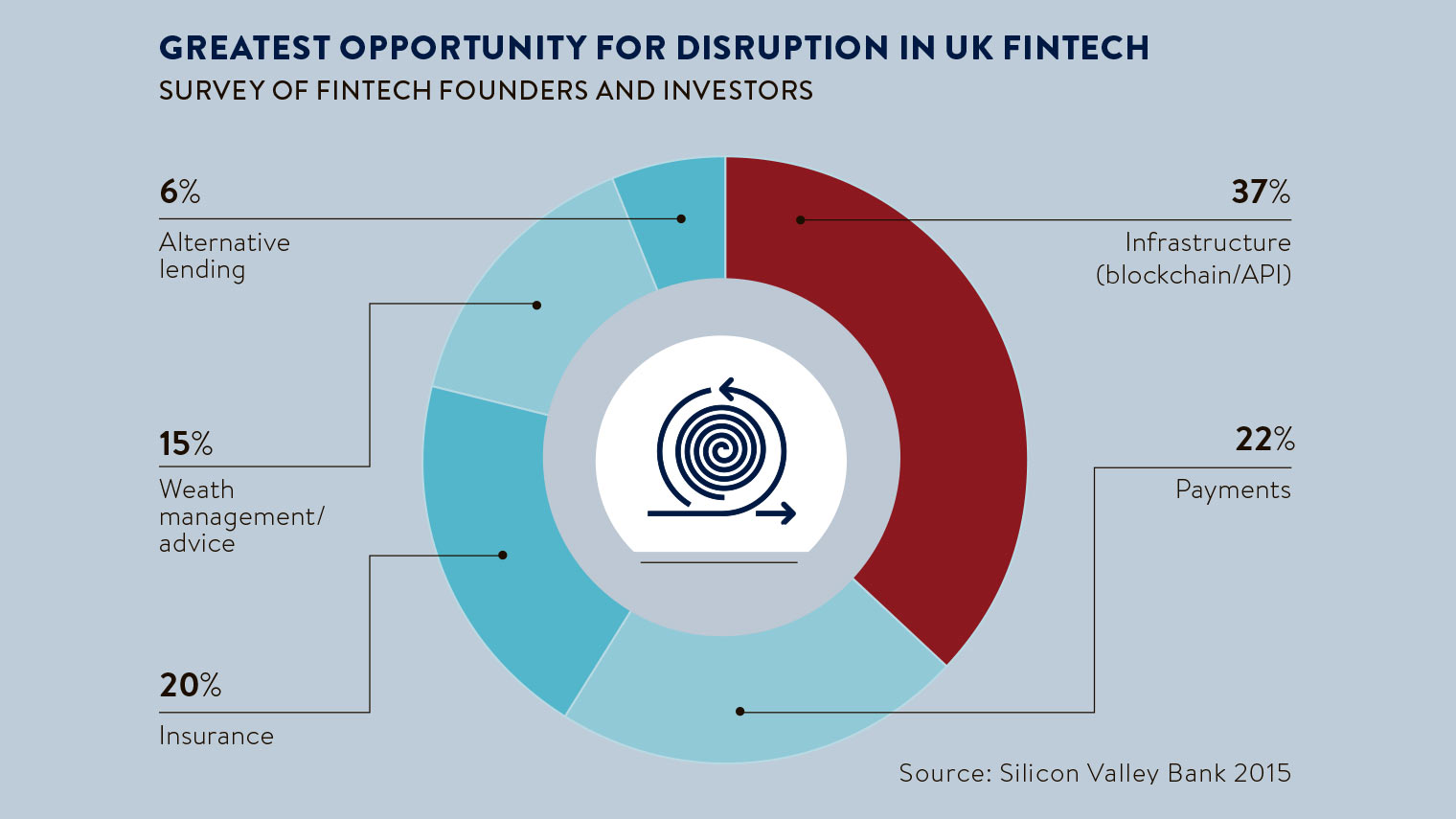

When Silicon Valley Bank asked 68 UK fintech leaders to identify the greatest opportunity for fintech disruption in 2016, “infrastructure” (including blockchain and API) was the top pick according to 37 per cent of respondents.

Author of Blockchain Revolution Alex Tapscott concludes,“With blockchain technology, a world of possibilities has opened and we now have a true peer-to-peer platform that enables personal economic empowerment. We can own our identities and our personal data; we can do transactions, creating and exchanging value without powerful intermediaries acting as the arbiters of money and information.”

It’s clear for those watching the evolution of blockchain that we’re at the start of a digital turning point, an evolutionary step in the way value and opportunity are created and distributed.

Click here for our special report on UK fintech