Fancy yourself as a bit of a venture capitalist? For some individual investors, the most exciting thing about the rapid growth in the alternative finance sector is the opportunity to enjoy potentially better returns while investing in small and medium-sized businesses at key points in their development.

Yet even if you can’t think of anything worse than being a panellist on TV’s Dragons’ Den, there are plenty of alternative finance options that might suit your needs. Just as with any other investment, there are risks involved and this should all be considered as part of a balanced portfolio. But given its rapid growth and steady move towards mainstream status, it’s also a sector that every investor should at least be aware of when allocating their assets.

Become a lender

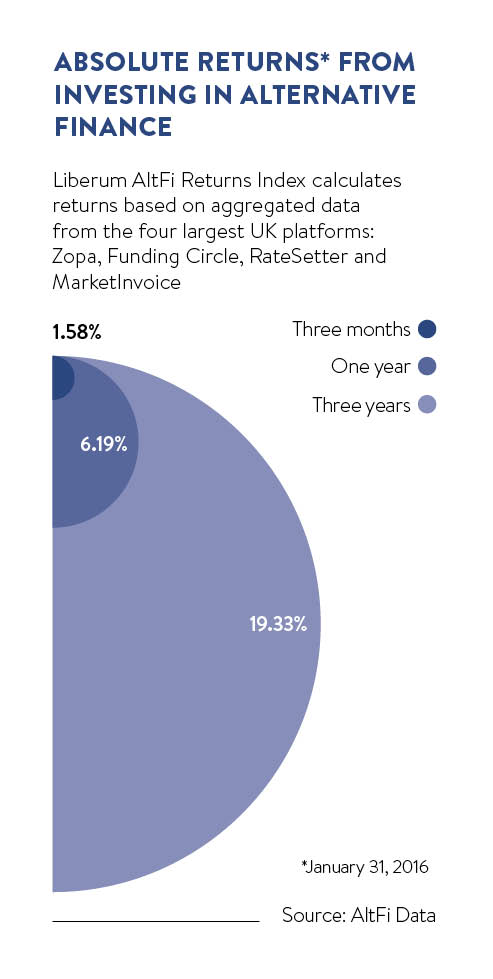

As with mainstream investment options, there are two main ways to invest in a business. You can lend money to it or you can buy a stake in the company itself. Let’s start with the lending option. The volume of loans made to British businesses, as opposed to consumers, via peer-to-peer (P2P) lending platforms has grown strongly in the last year, according to the Liberum AltFi Volume Index UK, more than doubling to around £2.4 billion.

These platforms are, of course, not banks themselves. They simply exist as marketplaces where business that need money come together with investors who are willing to lend them that money in exchange for interest payments. Broadly speaking, loans are conducted via auctions as potential lenders make offers to potential borrowers. By taking the middleman – the bank – out of the process, both lender and borrower can get a better deal, and the platform takes an arrangement fee.

The biggest player in Britain’s dedicated P2P business loans sector, as opposed to the consumer sector where Zopa and RateSetter dominate, is Funding Circle, which has funded over £1-billion-worth of small-business loans since launch. The attraction to investors is clear. As of the start of February 2016, Funding Circle estimates you can make an annual return of 7.1 per cent before tax, but after the company’s 1 per cent fee and estimated bad debts.

By taking the middleman – the bank – out of the process, both lender and borrower can get a better deal, and the platform takes an arrangement fee

Now, clearly the main risk with lending via any of these platforms is that the companies to which you lend your money could go bust and fail to repay. Bad debt levels have been pretty benign so far, but P2P is a relatively new sector and the vast majority of platforms were launched after the financial crisis of 2008, so have not yet been tested during a full-blown recession. To spread this credit risk, Funding Circle recommends that you lend money to at least 100 businesses, with no more than 1 per cent of your total capital in each one. With a minimum loan per business of £20, this would suggest that you need £2,000 to be fully diversified. The platform provides an autobid facility, which will automatically split your funds across a range of businesses.

Another significant player in the market, having enabled more than £150 million in secured loans, is ThinCats. It has a minimum loan size of £1,000, which arguably means it is more suitable for investors with larger portfolios.

Other platforms to investigate include those in the P2P real estate loans sector, such as LendInvest, Wellesley & Co and Landbay. For now, returns made on these loans will be taxed as income, but later this year, the new innovative finance Isa or individual savings account launches, which will allow loans issued via P2P lenders to be contained within an Isa wrapper, shielding them from tax and therefore meaning more attractive returns for most investors.

If you’re looking for an alternative way to invest in the sector, you could consider an investment trust, which is a stock-exchange listed company that invests in other businesses. For example, one of the older trusts in this relatively young sector P2P Global Investment, listed under ticker P2P, both lends money on peer-to-peer platforms across the UK, US and Europe, and also owns equity stakes in several of the platforms themselves. Other options include Funding Circle’s recently launched Funding Circle SME Income Fund, under the ticker FCIF, which invests in small-business loans made by Funding Circle in the UK and US.

Buying a stake

A higher-risk option is to buy stakes in small companies, with the goal of finding promising minnows that grow into massive players in their fields. This is known as crowdfunding, where companies sell stakes in themselves to private investors via a crowdfunding platform.

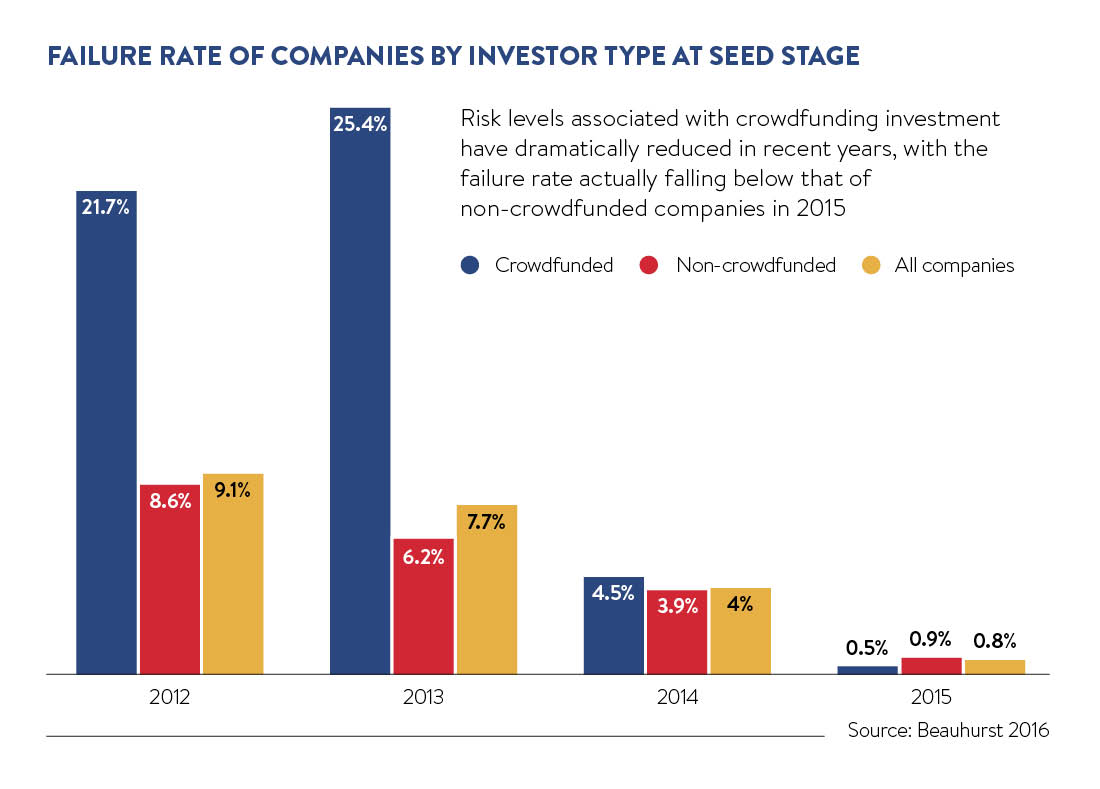

The sector is a lot smaller than P2P lending, but it’s growing fast. Clearly, investing in the equity of small companies is highly risky as they fail regularly and even experienced “angel” investors regularly have to write off investments. Of course, the potential rewards are commensurate with the risks; back a successful company at the right stage of its development and you can easily make multiples of your original investment. But again, if you intend to put money into companies via these platforms, then you need to ensure that you diversify your investments and you also need to make sure that it forms just a small component of your overall portfolio.

The sector is a lot smaller than P2P lending, but it’s growing fast. Clearly, investing in the equity of small companies is highly risky as they fail regularly and even experienced “angel” investors regularly have to write off investments. Of course, the potential rewards are commensurate with the risks; back a successful company at the right stage of its development and you can easily make multiples of your original investment. But again, if you intend to put money into companies via these platforms, then you need to ensure that you diversify your investments and you also need to make sure that it forms just a small component of your overall portfolio.

It’s also worth remembering that the danger of a company going bust isn’t the only risk you might encounter. Investments in these sorts of businesses are illiquid. If you invest in a FTSE 100 stock, you get a minute-by-minute update of exactly what your investment is worth. With crowdfunding, even if a company is doing well, there’s no way to know for sure how much you might fetch for your stake or how long it might take you to sell it on if you need access to your money quickly.

You also have no idea how long it might take for your investment to come good and achieve a profitable exit, perhaps via a stock market listing or a takeover. There’s also the risk of dilution, the danger that a company has to raise more capital further down the line, diluting the stake held by earlier shareholders. So it’s important to be aware of all these potential pitfalls.

However, from the point of view of pure satisfaction, crowdfunding can also be far more engaging than investing via the stock market and it’s also one of the few ways that a small investor can easily invest in very early-stage companies. Two of the biggest players in the market are Crowdcube and Seedrs. You can invest sums starting from £10 on each platform, so it’s possible to build up a diversified portfolio with a relatively small total investment.