01 The Ordinary

Hit skincare brand The Ordinary set one of the biggest beauty trends in motion when it launched in late-2017, offering low-cost, high-performance, no-frills skincare. The Ordinary revolution brought the generic drug model to cosmeceuticals. Every item is sold as close as possible to cost price, many for as little as £5.

It is of course a misnomer that “unbranded” goods are truly unbranded. Every detail of The Ordinary’s packaging design, from its dark laboratory pipettes and vials to its chic pharmaceutical labelling, has been carefully designed to strike the right note of reassuring simplicity.

What does set its visual identity apart is that every item has exactly the same packaging design and product names are given according to active ingredient and percentage strength, rather than intended effect. For instance, Niacinamide 10% + Zinc 1% (30ml) is called just that, rather than blemish and congestion reducing serum.

Letting the ingredients speak for themselves dispenses with another layer of marketing spin and indeed the kind of obfuscation that besets the beauty industry. Consumers, male and female alike, are charged with educating themselves, with the help of in-store staff, about ingredients and which combinations would benefit their skin.

02 Thinx

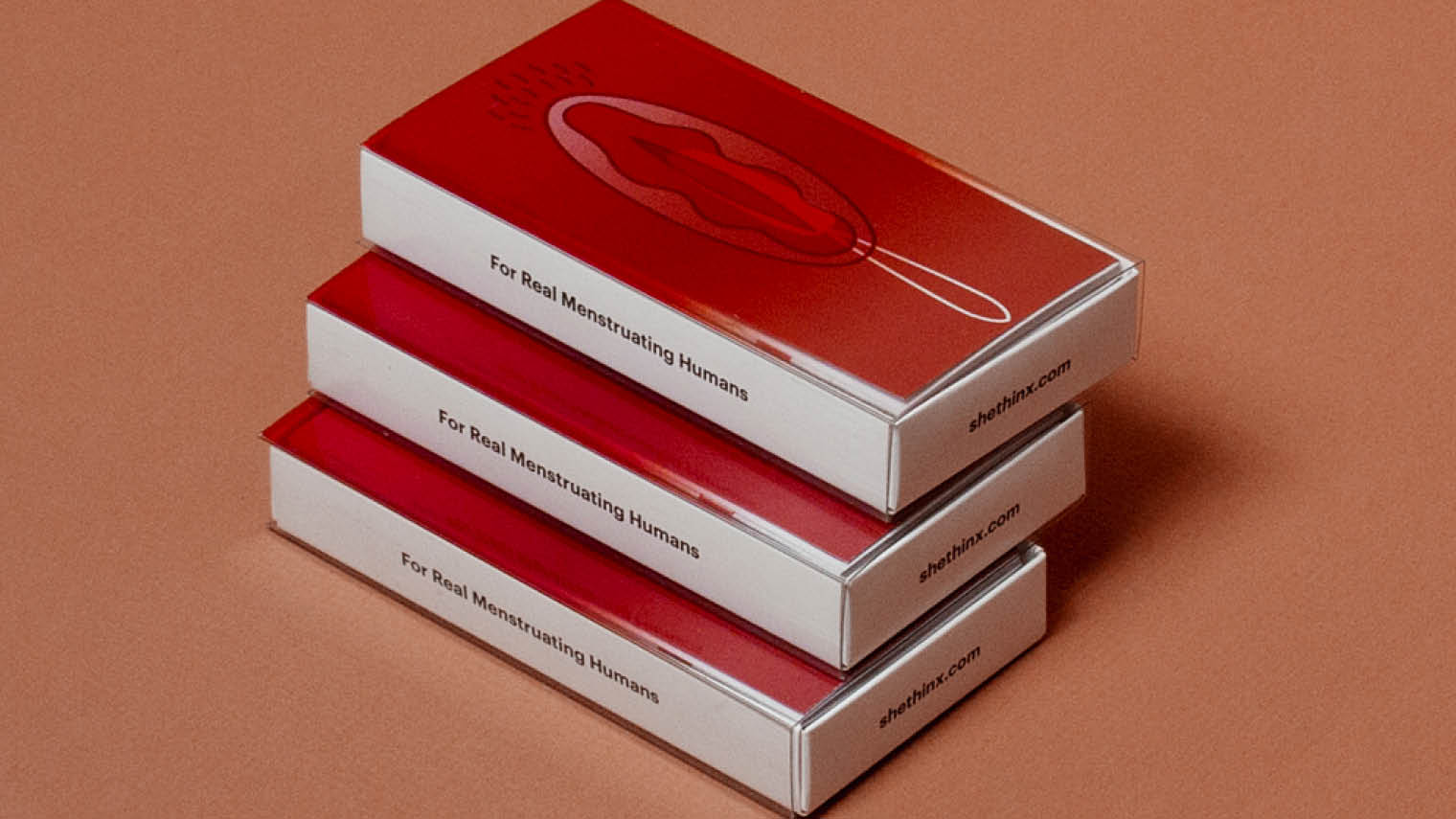

American company Thinx, behind the innovative period-proof underwear stocked in Selfridges, has launched a tampon range that comes packaged in a smart red carton illustrated with a simple pop-art drawing of a tampon. A clear outer sheath slides over the box which, emblazoned with a labia, leaves no room for coyness about what tampons are for. In case there was any doubt, a tagline reads: “For real menstruating humans.”

Thinx may be the most upfront of the new challenger tampon brands, but they share a commitment to savvy packaging design and straight-talking about menstruation. Like Thinx, new UK-based tampon brands Freda, Callaly and Lola sell beautifully presented tampons made from organic cotton and donate a percentage of their profits to charities providing women in developing countries with sanitaryware.

The popularity of these brands among millennial women represents a backlash against the clinical and euphemistic marketing of the major tampon brands which has dominated the market for so long.

03 Snact

UK fruit jerky company Snact has impressive environmental credentials. It promotes healthy eating and reduces supermarket waste by using surplus and store-spoiled fruit that would otherwise end up in landfill. Plastic wrapping, however, presented an environmental problem.

Snact turned to the Israeli packaging design company Tipa, which also supplies carrier bags to designers Stella McCartney and Gabriela Hearst, to produce an entirely biodegradable wrapper. Made from a multi-layer film of plant-based polymers, the Snact wrapper decomposes like an orange within six months.

Tipa’s biodegradable plastic shares the same durability, sealing strength, printability, flexibility and transparency of regular plastics, but without the environmental risk. While Tipa products are more expensive than standard plastic, biodegradable wrapping has all the potential to disrupt the packaging design industry as more consumers consider the price a fair one to pay.

04 adidas Parley

Among consumer brands, adidas is perhaps the most committed to upcycling ocean plastics, much of which would have originated from plastic bottles, bags and other forms of packaging. Since 2015, the company has partnered with sustainable design studio Parley for the Oceans to upcycle marine plastics into high-performance materials that make its swimwear, trainers, Stella McCartney range and even a Manchester United kit.

For consumer-facing brands, packaging is one of the most visible waste products. As such, adidas uses only recycled and recyclable materials. With the declaration: “The production of one pair of Parley shoes prevents approximately 11 plastic bottles from entering our oceans,” the adidas Parely campaign is specifically framed around packaging waste.

The Parley range includes almost 100 products, but by 2024 the brand has pledged to use recycled marine plastics in every product it sells. Not only will adidas’s global reach bring with it enormous benefits of scale, but its market standing has the potential to convince other brands that neither style, performance nor sales need be compromised by switching to recycled materials.

05 Assurpak

The legalised or decriminalised recreational marijuana market in North America is barely six years old, but is already worth $9.2 billion and over the next decade is expected to increase fivefold, surpassing $47.3 billion. Packaging and marketing have been essential to building brands in entirely new and mind-boggling categories, such as edibles, topicals and concentrates.

Indeed, Canadian research found that brand visibility bolsters consumer confidence in cannabis products, with two thirds of consumers finding branded products more reassuring than plain packaged.

At the same time, brands have had to comply with medicinal-level regulations. In Colorado and California, products must be child safe and tamper evident propelling packaging design companies to think creatively about making products both eye-catching and safe.

Assurpak has rode the wave by developing an array of child-resistant, customisable, US Consumer Product Safety Commission-certified and bisphenol A-free formats, including pouches, cartons, spray bottles, boxes and blister cards, for some of the industry’s largest players, such as Organa Brands.

Jim Burack, director of Colorado’s Marijuana Enforcement Division, notes: “There has been an evolution and sophistication of different containers and packaging as the industry has evolved.”