The global payments industry is growing fast as go-ahead startups in financial technology develop emerging technologies and investment from big banks filters through.

A 2016 report by Boston Consulting Group estimates the transaction banking market will reach some $2 trillion by 2024, up from $1.1 trillion in 2014.

While the spotlight has been on innovation and technology, businesses are now beginning to realise the benefits of new payment methods to fuel corporate growth and improve the bottom line.

Matteo Stefanel, managing partner of catalyst investor group Apis Partners, says the international networks for making payments have been considerably upgraded in recent years.

“Payments infrastructure globally is continuing to move towards more efficient real-time, 24/7 ubiquity, such as the Faster Payments system in the UK and IMPS in India,” he says.

Businesses harness disruptive technologies

Global businesses, such as taxi-hailing service Uber, owe much of their growth to the success of real-time payments. The Californian group, which started up in 2009, is now estimated to be worth more than $62 billion.

Its growth in profits has largely been down to harnessing disruptive technologies to gain a share in multiple markets.

Vaughan Rowsell, founder and chief product officer at Vend, says: “Uber offers a number of ways to pay, including Google Wallet and PayPal as well as credit card.

“Popular businesses are showing others that those payment solutions, which were new a few years ago, like contactless cards or mobile wallets, are now real, reliable and widely used. As adoption has been slow, but steady, the technology has been able to evolve and become better over time.”

Mr Stefanel agrees, stressing that payments should be thought of in the context of their role in enabling commerce.

“The level to which payments are frictionless can determine whether online baskets make it to checkout,” he says. “Amazon and Uber, with their one-click and invisible checkout processes, can very much attribute a portion of their success to this.”

Mr Rowsell says there is a lesson here for businesses that the biggest part of growing the bottom line is the number of options on offer to the customer.

He says: “The payment aspect of the buying process is hugely important to the customer experience. Shoppers expect choice, they expect payment to be quick and painless, and they expect it to be modern – on mobile, for example. Our patience for standing in a queue to pay for an item is diminishing.

More people are realising that using contactless with their mobile is easier than digging around for spare change when paying for lower-cost items

“By offering these new ways to pay, businesses can create a better customer experience, reduce queues and sell to more customers in a shorter timeframe, and therefore grow their profits.”

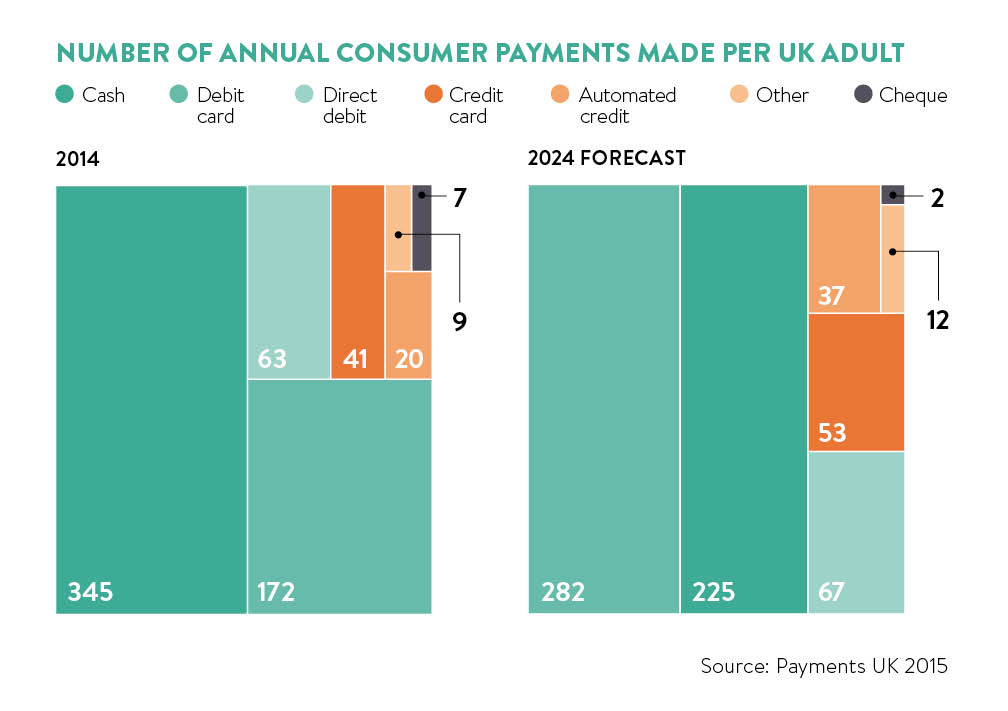

So, for businesses, quicker, cheaper systems and increased customer payment options mean there is now less reliance on cash. However, it also means that customer expectations are increasing.

Nigel Hyslop, president and UK managing director of Global Payments, says: “We have seen a sharp increase in the number of people using their mobile phone to make purchases online or pay with contactless for items up to £30.

“More people are realising that using contactless with their mobile is easier than digging around for spare change when paying for lower-cost items.”

In the last 12 months, there has been large-scale adoption of contactless payments at the physical point of sale (POS).

Figures from the UK Cards Association show the number of contactless transactions in January 2016 was up 212 per cent on the same month last year.

This has been spurred by banks continuing to issue contactless-enabled cards and retailers continuing to activate compatible POS terminals to take advantage of the lower acceptance costs of contactless payments.

However, payment innovation internationally goes much further than mobile and contactless payments.

Ian Foottit, head of UK financial services strategy team at consultancy group Deloitte, says small and medium-sized enterprises are benefitting from improved record keeping and integrated invoice management, while new fintech ideas are leading to flexible supplier financing and competitive foreign exchange rates for businesses.

“Large-scale retailers can use payments data to better understand the shopping behaviour of their customers and integrate payments with loyalty programmes,” he says.

“Small-scale merchants may benefit from the scope provided by secure online payments and convenience of mobile acceptance technology.”

Mr Foottit says businesses that embrace innovation in payments are likely to find they are able to streamline their operations and offer a greater customer experience.

Improving customer experience

Some of the largest companies in the world are using new payment methods to go one step further than paying for goods. They are using them to enhance buyer interaction with their products.

Starbucks is one example. The coffee giant launched mobile order and pay, which has been integrated with its rewards card system, enabling UK and US customers to pre-order through their mobile phone and collect on arrival.

The importance of the shifting payments landscape is probably best illustrated by looking at the world’s banks.

A recent report by consultants McKinsey notes that 11 of the world’s major banks have already started innovation hubs and a further six are directly investing in enhancing payment technologies.

Of those that aren’t, five are partnering with fintech firms, three are looking to acquire specialists in the market and three more are building brand new divisions from scratch.

At the beginning of April, banking co-operative SWIFT announced that 21 banks had signed up to a brand new global payments innovation initiative intended to improve the customer experience by increasing the speed, transparency and predictability of cross-border payments.

Participating banks include some of the biggest names in banking, such as Bank of America Merrill Lynch, Bank of China, Barclays, J.P. Morgan Chase, Royal Bank of Canada and Wells Fargo.