When it comes to disruption, few industries have experienced quite as much in recent years as banking. Once a traditional, slow-moving stalwart of British society, banking is now witnessing the arrival of challenger banks that are doing things faster and doing them differently.

One such example is Monzo. This app-only banking service gives users access to a pre-paid debit card from their phones, with lots of helpful notifications to make it easy to manage money. Services such as current accounts and overdrafts are on the way, but if you’d like to use Monzo now, you’d better get your name on the waiting list fast as you’ll be joining roughly 250,000 others in the queue.

“The waiting list is a mechanism to give the cards out to the keenest early adopters while we fine-tune the service, but we didn’t anticipate the demand,” says founder Tom Blomfield. “We think it’s taken off because we’ve created something that people really want. When it comes to controlling your money on a day-to-day basis, the future is on mobile. It gives you an amazing connection with the customer on a minute-by-minute basis.”

Beyond banking

Of course it’s not just the banking industry that’s looking to mobile. There are an increasing number of businesses describing themselves as “mobile first” that are serving customers on mobile at every step of their journey.

“Delivering a full-service mobile experience is fundamentally important today when trying to reach, engage and retain modern mobile-first audiences,” says Julian Smith, head of strategy and innovation at mobile strategy agency Fetch. “For mobile app-only businesses like Uber, it is business critical. If you are a traditional brand or business, with a high street presence, it will provide a competitive advantage, especially when targeting younger adult audiences.”

These mobile-first businesses are interacting with customers on the platform from the very start. The audience numbers on mobile make it the most sensible place to fish for new customers. According to Refused Car Finance, 85 per cent of its audience views its website on mobile and more than 80 per cent of its conversions are completed using a mobile device. “Advertising on Facebook is one of the key ways for us to reach our target audience, so our recent campaigns have been tailored to mobile users exclusively,” says managing director Craig Rutherford.

“Using features within the campaign manager section of Facebook, we were able to analyse our audience and identify which devices they were viewing our advert campaigns and Facebook page on. We changed our adverts to display only to those on a mobile device and created effective landing pages for the campaign that were mobile optimised. We identified our customer touchpoints to ensure we had an overall holistic view to fully track the customer journey at all stages.”

There are many businesses that after securing a sale deliver their service through mobile touchpoints. Monzo lets customers handle their finances at the push of a button. Companies such as Uber are offering an offline commodity delivered through a mobile service. People order cabs though the app and can then be contacted directly by drivers on their mobiles. By taking the customer through the service on mobile, companies are able to track their activities and therefore get to know their customers better.

[embed_related]

How it works

“Data lies at the heart of managing a full customer life cycle through mobile,” says Mr Smith. “Data and insights need to direct everything companies do from acquisition to delivery to retention. For service delivery, companies need to understand the depth of engagement customers have with mobile services and optimise these to reduce friction and provide a more seamless experience.”

If a brand can produce helpful content, as well as their core service, it can remain at the forefront of a customer’s mind without becoming an annoyance

By understanding a customer’s behaviour and preferences, a company can deliver personalised experiences that will help with the next step of the journey, retention and aftersales care. If a company understands when someone usually requires its service, it can create relevant and timely offers, giving the customer what they need and keeping them engaged.

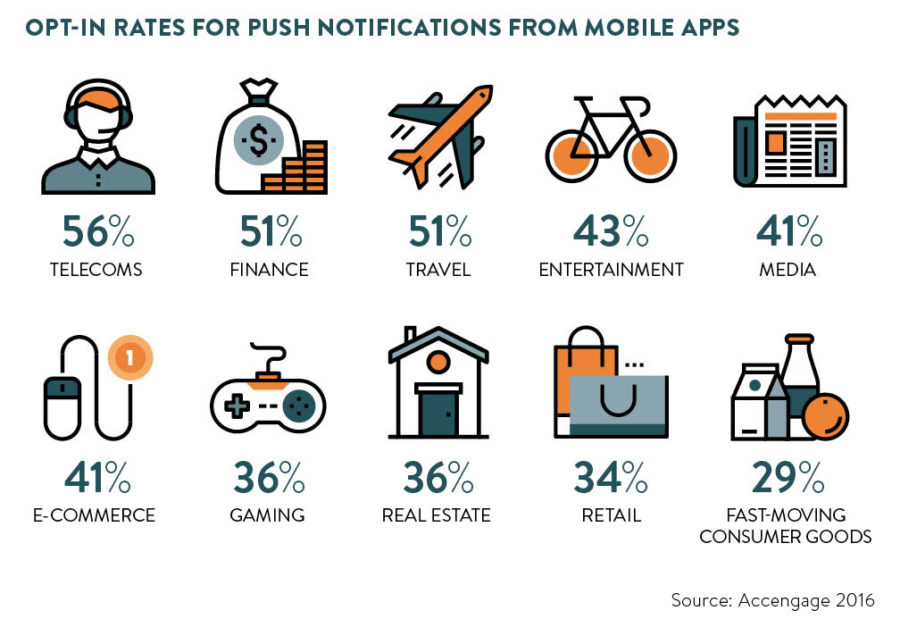

“The mobile life cycle also depends on delivery and aftersales messaging,” explains Marise Treseder, head of marketing at Zeta Interactive. “Proving you care beyond the point of purchase will build loyalty and keep customers coming back for more. And while push messaging can feel intrusive if it comes at the wrong moment, a timely contact can reinforce a positive perception of the brand and its emphasis on customer care. Eurostar’s customer satisfaction survey text messages, for example, arrive as you pull into your destination station and are a great example of time-sensitive messages that reinforce positive perceptions which begin to address any service issues.”

Overcoming challenges

Of course, with any business strategy there are pitfalls. One of the benefits of managing a customer life cycle through mobile is that you are always with them. Using a mobile is a more personal experience, so when a brand has a customer in that kind of space, it needs to be respectful. “It’s a fine line between being helpful and intrusive, and brands need to be careful in how they are tracking and proactively contacting customers on mobile,” says Ms Treseder.

One of the ways a brand can mitigate this is by adding another thread of conversation with the customer that has nothing to do with sales. If a brand can produce helpful content, as well as their core service, it can remain at the forefront of a customer’s mind without becoming an annoyance. Columbia Sportswear is a good example of this. The brand developed an app called What Knot to Do, which gives customers guidance on how to tie various different knots.

“Almost entirely devoid of sales material, the app transcends the transaction, encouraging engagement with their existing audience and tapping into new customers by establishing Columbia as a relevant and helpful brand for sailing customers,” says Ms Treseder. “Creating a ‘mobile value exchange’ where customers feel like they are getting as much as they give on their smartphones will help brands to deepen engagement and drive loyalty beyond the transaction.”

Beyond banking