KPMG and the Consumer Goods Forum have just released research revealing that retail and manufacturing executives are investing significantly in smarter analytics and technologies.

According to the research, usage of techniques such as predictive analytics, customer path to purchase analytics and artificial intelligence (AI) are expected to double over the next two years to 59 per cent, 54 per cent and 43 per cent respectively.

It’s no surprise why. We expect the human touch and if we haven’t got the human touch, we expect immediacy and accuracy.

The role of AI

According to the Institute of Customer Service Customer of the Future report, by 2025 customers will have a much lower tolerance threshold for mistakes, errors or technology problems and consumer power will play a more prominent role in influencing an organisation’s reputation and success. And AI plays a key role in this.

“AI may, on the surface, seem a daunting prospect, but in truth the technology presents a great deal of opportunity to help upskill workers and improve the worker experience,” says Justin Anderson, Europe, Middle East and Africa general manager at Appirio.

“For businesses, the implementation of AI should act as an extension to the current consumer-grade technology which is already finding its way into the business. The introduction of AI will allow workers to free up their time to take on more creative, strategic roles such as focusing on engagement and innovative leadership, things that will, at least in some sense, always require a human touch.

“AI systems aren’t here to create havoc in the way which horror-meets-science-fiction films would have us believe; they’re here to shepherd us into the next age of work for both human and machine.”

Some software works by using natural language processing to enable computers to understand words and meaning accurately in real time. Rant & Rave, for example, is a customer engagement technology currently powering the customer service of more than half of the FTSE. Rant & Rave’s technology involves fast feedback, analysing customer feedback in real time, through the use of a so-called sentiment engine, which accounts for things like sarcasm, idioms and emoticons, but flags ambiguities for human attention.

Time saving

Banking group Swedbank has introduced its own Nuance Nina, an AI-driven virtual assistant, which delivers human-like conversational customer service. The bank says Nuance Nina has helped it improve the customer experience, including a 78 per cent first-contact resolution within the initial three months and a hit rate of eight out of ten questions answered.

Swedbank’s research found that 89 per cent of consumers want to engage in conversation with virtual assistants to find information quickly, instead of searching through web pages or a mobile app on their own.

Use of intelligent software can enhance the customer service experience without being intrusive

“When we talk about AI, one of the biggest misconceptions is the idea that it involves a sentient and conversational machine or software,” says Stephen Parker, chief executive of digital engagement specialist Parker Software. AI can be anything from simple software analysing sentiment to artificially augmented intelligence.

“In customer service, there’s been a trend recently of using chatbots to deliver pre-determined messages to customer inquiries, removing humans from the equation,” says Mr Parker. “This seems like a simple solution and it is, though it isn’t the most effective one. In order for companies to make a connection with customers that truly matters, there needs to be a different use of artificial resources.

“For example, if a customer spends a lot of time on the customer service page of a website, it is highly likely they have a problem, query or complaint. Using reverse IP look-up, companies can identify these individuals and use automation software to notify the right member of the customer service team, while also using intelligent analysis to cross-reference with any inbound messages the customer may previously have sent.”

Use of intelligent software like this can enhance the customer service experience without being intrusive.

Software such as Trax is transforming in-store analytics by giving manufacturers visual access to stores. Trax offers AI to consumer goods manufacturers, such as Coca-Cola and Heineken, to understand better how products are performing on the supermarket shelf, and ultimately improve in-store execution and consumer engagement. Trax enables retailers to check that promotions are running correctly, items are not out of stock and are in the right position.

Retail management software company Retail Pro International is using AI to recommend relevant products to customers. Performing a kiosk function, the system draws upon three key data sets to provide relevant recommendations both at the time of purchase and when customers speak to a store associate.

Chief executive Kerry Lemos explains: “These recommendations can be made based on three key metrics – customer purchase behaviour, associated products and like purchases from other consumers. The system can begin recommending options to a consumer much in the way a store associate would be doing with direct interaction and engagement.

“We can begin to see a migration where an AI system in a kiosk environment serves as a store concierge to the consumer, giving them the freedom to explore and buy at their comfort of engagement. Doing otherwise would require a lot of time and research on the part of the store personnel and likely leave the consumer with a perception that the retailer doesn’t, or worse cannot, understand their needs and likes.”

Information and personalisation

However, for any AI to automate accurate responses and serve customers most effectively, it must have access to the right pools of information and data.

Peter Wilson, strategic consultant at analytics company Verint Systems, says: “If a customer profile is incomplete, it limits the AI machine’s ability to manage customer interactions successfully. This can be challenging as many businesses struggle to aggregate and house their data effectively.”

Mr Wilson says transparency around the collection and use of data will be key for brands to capitalise on the power of AI. “Global research conducted by Verint found that UK consumers are more comfortable sharing data with their banks and financial service providers than other suppliers, so it’s not surprising banks are the front runners in implementing AI technologies,” he says.

Danny Bagge, IBM’s retail industry director, says machine learning is industry-changing. “A fashion retailer might have six or so high-level segments and a number of seasons. That’s a low number of ranges, but they have armies of people doing detailed and complex work. Imagine if I could give you a personalised range,” he says.

Machines can learn about styles, materials and cuts, related products and weather, resulting in an individually tailored offer.

Mr Bagge adds: “The bar on personalisation just gets higher, but where it really gets interesting is in the product area. Personalisation has been heralded as the thing that helps retailers get back to personal service. You have to be a big player with a lot of data to do this, but understanding your product in fantastic detail gives you an equal chance to offer great customer service.”

IS THIS THE END OF THE CALL CENTRE?

“By implementing a digital workforce of software robots, organisations can ensure that work is done around the clock, eliminate human error, reduce human dependency to drive revenue and ensure an ‘always-on’ service for customers,” says Gajen Kandiah, executive vice president of business process services at technology consulting and services firm Cognizant.

Mr Kandiah doesn’t believe it means the end of human interaction. “Businesses that are embracing these technologies are capturing more data, improving processes and generally empowering workers to be more effective at their jobs,” he says.

“Having more customer data at employees’ fingertips and being able to share it across the business can allow them to respond to customer queries directly and more quickly without having to ask colleagues across different departments.”

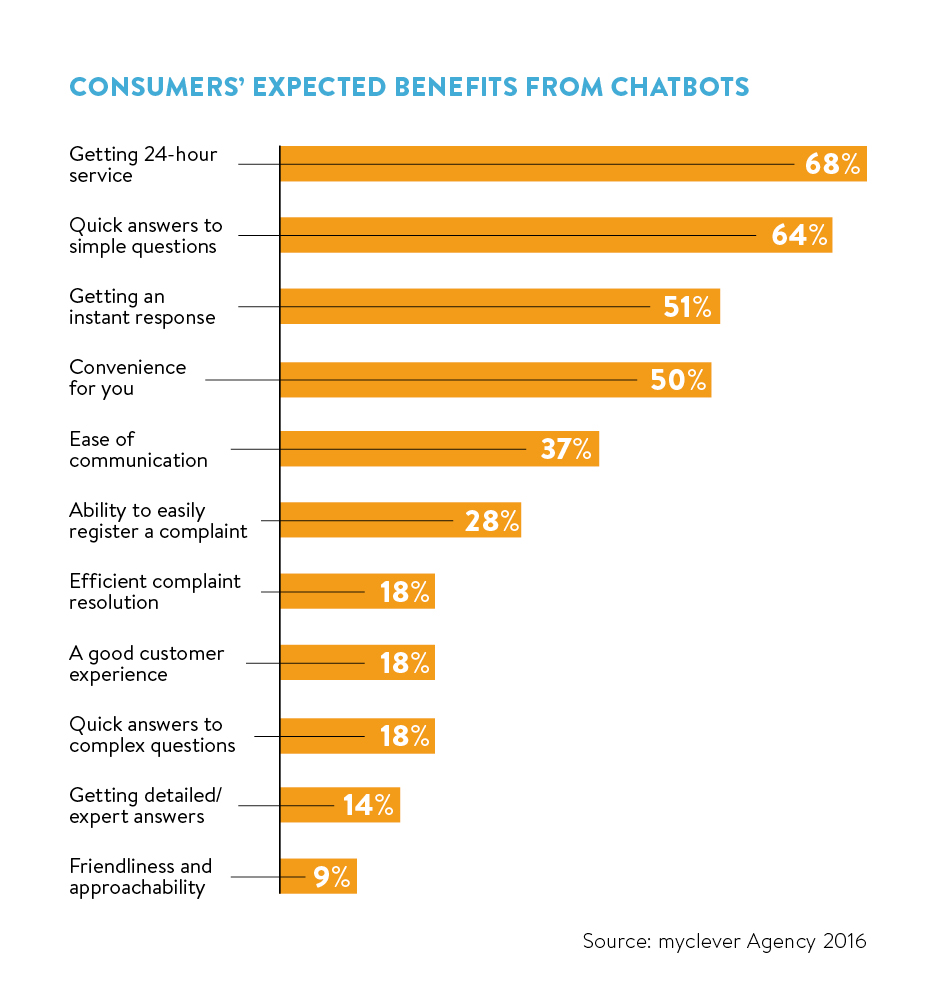

Research into chatbots from social media experts at myclever has found that 68 per cent of consumers like the idea of the 24-hour service provided by bots. When told about the benefits, consumers in the research regarded chatbots as the key-holders to speed, unlocking immediacy and convenience in online services.

But Verint Systems’ Peter Wilson says: “At this stage, a principal benefit of AI is to field many of the more one-dimensional inquires, such as balance checking and password changing, via virtual assistants, in-store virtual helpdesks and automated chat.”

Mr Wilson believes that human customer service offering will remain integral as many customers will still value the personal touch for more complex or personal issues. “AI will allow businesses to prioritise these interactions and empower customer service agents to focus on responding in a timely and appropriate manner, helping to forge closer relationships and promoting loyalty,” he says.