Breakfasting with angel investors in Zurich, followed by a lunchtime tour around your factory in Turin, then a hop down to Cannes to attend a red carpet gala that evening – it’s all comfortably doable when you have your own private jet. Even arranging the logistics can be a doddle if you understand the options and know how to access them.

Bringing new clarity and transparency to the sometimes inscrutable world of private aviation are two driving forces – disruption and technology

But to the business jet newbie, there’s a perplexing array of choices: outright ownership, charter, fractional ownership, plane-sharing schemes, empty-leg flights – the list seems daunting.

Some of these options are established business models, some are upstarts taking inspiration from the sharing-economy paradigms pioneered by Uber and Airbnb. The thing is, there isn’t a best option, only the option that’s best for you, depending on a complex equation of factors, such as how soon you need to fly, where you’re going, how frequently you need to travel, whether you’re flying solo or travelling with an entourage and the level of inflight service you require. Plus there’s the not inconsiderable matter of your budget.

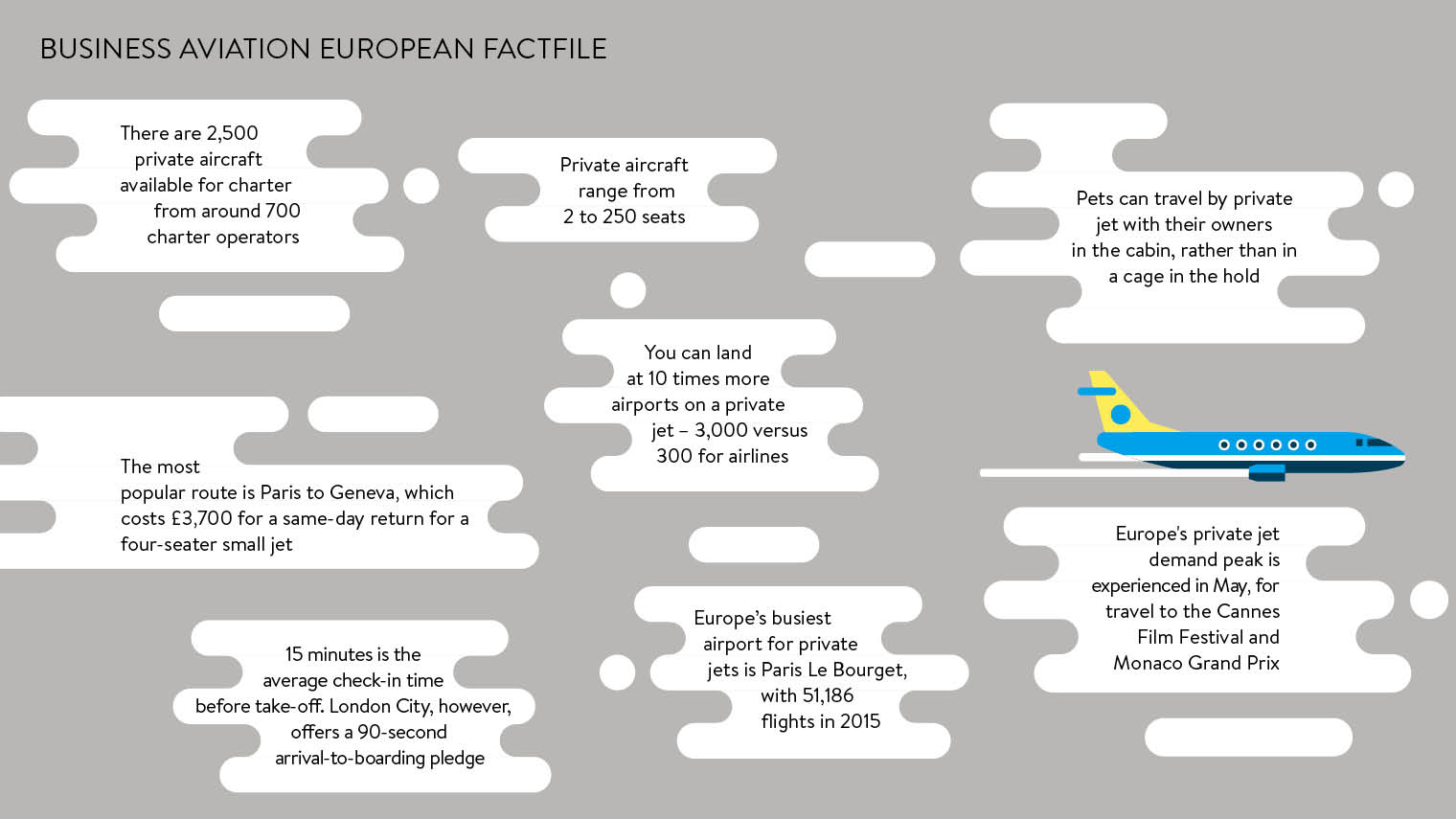

On top of that, there are seasonal spikes in demand. For example, when it’s the week of the Monaco Grand Prix, private charter flights to the Riviera get snapped up faster than you can say “Lewis Hamilton”.

New technologies

Bringing new clarity and transparency to the sometimes inscrutable world of private aviation are two driving forces – disruption and technology.

Branded a disruptor when it introduced the fractional jet business model to Europe in 1996, Berkshire Hathaway-backed NetJets Europe is now a prevailing and mainstream force in the market, with a business-centric client demographic.

“Seventy per cent of our customers – we prefer to call them owners – are chairmen and CEOs of their own private companies,” says Marine Eugène, NetJets Europe head of sales. “These tend to be businesspeople who make extensive use of their share, meeting clients during the week, but then flying with family down to their chalet in the South of France for the weekend. Fifteen per cent of NetJets’ clientele comprise publically listed multinationals whose board members fly intensively through the week; the remaining 15 per cent are celebrities.”

But then, these days, most celebs are business savvy or at least have business advisers operating in the background. It’s all a far cry from the lingering fallacy that private aviation’s customer base is dominated by rock stars and royalty.

It may no longer be the new kid on the block, but NetJets is still very much a change-instigating presence in the executive aviation market as it pioneers new technologies.

Inside the cabin, for example, it offers Gogo Text & Talk giving passengers mobile phone connectivity. NetJets has also developed an app which provides access to on-board wi-fi plus a vast selection of entertainment and news content which is uploaded to on-board servers just before take-off.

“Your iPad automatically connects with the aircraft system,” says Ms Eugène. “Suddenly you have hundreds of movies, and the app even controls cabin temperature and lighting. We’re implementing it in Europe, but it’s already live in the US.”

However, will technology supersede the concierge-like personal experience that executive jet users have become accustomed to? “Of course we have an app to book; everybody has an app to book. We see it as a bolt-on, it’s not a replacement for human interaction,” says Ms. Eugène.

“If you’re a NetJets owner, we have a 24/7 multilingual team that speaks your language, they know you personally – on average our customers have been with us eight to ten years. Our team knows your family, your assistant and we find our clientele demand a personalisation of service. Human contact remains very prevalent and we do not want to replace that with an app, though it’s popular with some of our tech-savvy owners.”

Business models

But what if you’re not in the NetJets league? Say you want to peruse a range of private flying options underpinned with the type of online price-comparison technologies and transparency we already use for food shopping, buying pet insurance or booking cinema tickets?

That’s part of the mission ex-RAF and ex-NetJets pilot Adam Twidell had in mind when he set up PrivateFly, a global booking service for private jet charter which uses a unique online platform and apps to source “a live global network of over 7,000 accredited aircraft, to pinpoint the best available private aircraft at the most competitive, transparent market price”.

That’s part of the mission ex-RAF and ex-NetJets pilot Adam Twidell had in mind when he set up PrivateFly, a global booking service for private jet charter which uses a unique online platform and apps to source “a live global network of over 7,000 accredited aircraft, to pinpoint the best available private aircraft at the most competitive, transparent market price”.

Mr Twidell realised at the inception that his company, based in St Albans, had to be available on all channels to its customers. “We’re not just a website, we’re not just an app, we employ flight advisers who have loved aviation since the age of five and they’ve just got such a deep knowledge,” he says. “They’ll be able to tell customers if a fuel stop will be required or if six sets of golf clubs can fit in a Citation Excel.”

PrivateFly’s service advantage is to combine the booking technology and transparent choices with a human voice. “Often our customers will book online, but then they might give us a call just before the flight to discuss the finer details of the catering,” says Mr Twidell.

Another innovative and technology-driven initiative was PrivateFly’s decision to open its service to the scrutiny of the broader public through its inclusion on online customer review site trustpilot.com, where prospective users of PrivateFly can surf through reviews from customers who have used the service.

Mashing up business models, another player in the sector is New York-based Wheels Up, which some commentators have dubbed the Uber of the executive aviation world. Operating a fleet of King Air 350i and Citation Excel/XLS aircraft, the service uses a membership club model, offering “two ways to buy” and “two ways to fly”.

Business jets are like time machines, accelerating personal productivity by facilitating multiple face-to-face meetings across geographic borders within the working day

Individual/family membership costs a one-time $17,500 initiation fee with annual dues of $8,500; corporate membership costs $29,500 initiation plus $14,500 annually. Members choose from “pay as you fly” fixed hourly rates for occupied hours or there’s a “pre-purchase programme” where, by putting your money down in advance, you can access additional guarantees and benefits. Celebrity customer endorsements come from the likes of tennis icon Serena Williams and golfer Rickie Fowler.

Closer to home, and ruffling more than a few feathers in the process, Ryanair has mooted the notion of introducing a 60-seater Boeing 737-700 corporate jet service. A publicity stunt to counter easyJet’s success among business travellers or is it really a viable and imminent proposition? It would certainly align with Ryanair’s new-found commitment to up its game in the customer service stakes.

“If they went for it, I think they would do very well in the market,” says PrivateFly’s Mr Twidell, “because there’s a gap in that market for that size of aircraft for football teams, for conferences – and obviously, with their buying power for aircraft and fuel discounts, Ryanair could run it very leanly.”

Business jets are like time machines, accelerating personal productivity by facilitating multiple face-to-face meetings across geographic borders within the working day. With new business models popping up, increased transparency and evermore providers entering this complex but fascinating sector, the prospective customer is spoilt for choice.

CHOOSING THE BEST OPTION FOR YOU

Chartered flights

Chartered flights

These offer the freedom to select the appropriate aircraft for the number of passengers, the range of the flight and the level of service you require. Some small private airports can’t accommodate larger aircraft and some smaller jets might not have the range you need, but charter providers can solve that equation for you. After touchdown, you walk away from it all – no sleepless nights worrying about volatile fuel prices, the latest maintenance requirements, insurance costs or aircraft parking fees at the airport.

Fractional ownership

This is a compelling option if you require private flight on a regular and intensive basis. Typically, owners own a sixteenth of an aircraft within a fleet comprising a range of different aircraft types, so you have access to other planes, not just the plane you partly own. There’s flexibility to even change your destination mid-flight, which would be a costlier option on a chartered flight.

Outright ownership

This suits uncompromising high-net-worth individuals with the passion to fly in an aircraft that’s configured to their precise specification. Want to redecorate the cabin with crocodile-skin covered seats or install a gold-plated Jacuzzi? No problem – it’s your jet. You can hire or employ your own personal pilots, flight attendants and on-board chef. Downside is new jets depreciate at 20 per cent in the first year and by 10 per cent annually thereafter. When the plane goes into the hangar for maintenance, you’ll have to charter a jet to get airborne.

Empty-leg flights

These are flights that become available when a chartered flight has dropped its passengers off and is heading back to its home base or the airport for its next chartered trip. These flights go ahead regardless of whether passengers are on board, so they’re made available at very competitive rates via specialised online booking engines. Sharp-eyed clientele have been known to travel in style for less than a flight on a low-cost carrier, but you have to be quick off the mark to bag a deal as more and more people are becoming aware of this option.

Shared flights

These are the new upstarts, courtesy of the sharing economy. The idea is that empty seats on chartered flights or flights on planes that are owned outright are made available via social networks. But do you really want to share your executive jet flight with a total stranger?