There can’t be many people who want to be insurance salesmen when they grow up. Train drivers, yes; chefs, perhaps; DJs and Olympic gold medalists, understandable. But insurers?

Perhaps one reason is that most of us only encounter insurers when we have a problem. Research from Accenture shows that nearly a third (30 per cent) of insurance customers have not had a positive experience.

The industry is well aware of the problem. According to the Association of British Insurers (ABI): “For an industry full of people passionate about making a difference for customers, it is extremely disappointing that the sector has so badly failed to secure their trust.”

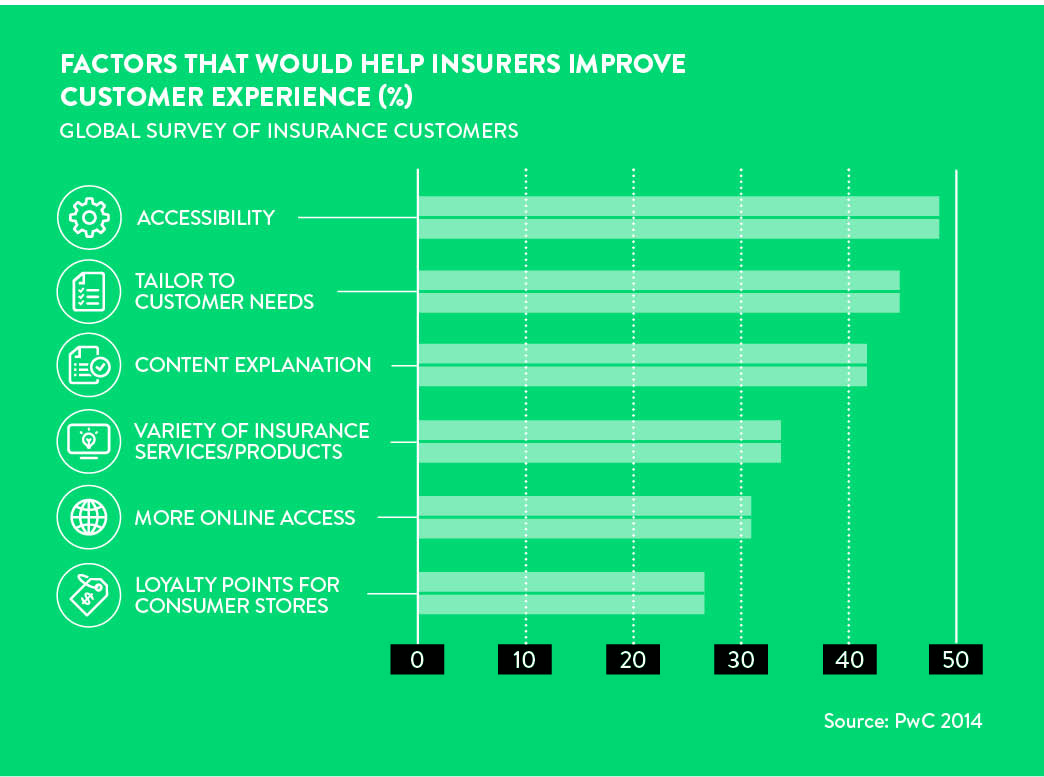

So what can be done to improve the customer experience? Digital technology has been cited as the answer to solve not only some of the consumer’s most hated aspects of insurance, such as the speed of a claim, but more importantly to offer new experiences that will change how we look at insurance.

“Digital transformation isn’t simply about insurers making better use of technology,” says John Cusano, senior managing director, global insurance industry, at Accenture. “It’s about enabling their people to accomplish more with technology.”

Digitisation

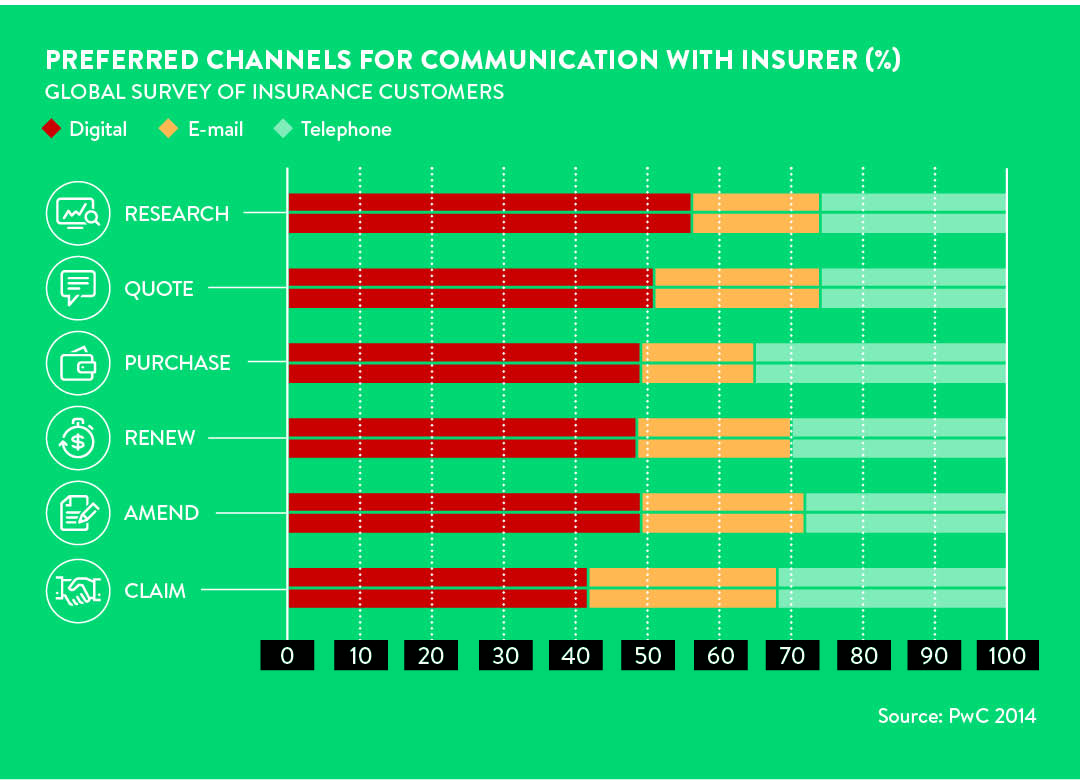

The digitisation of insurance has been happening for some time. Consumers, evermore demanding of ever-higher standards of service, are looking for the same kind of experience they can now find elsewhere in their life. They want an unprecedented level of choice; they want price transparency; they want immediate answers to questions.

Dutch general insurer InShared was one of the first of the new breed of companies to be a fully digital insurer, offering a virtual assistant on its website from 2012 that answers 56 per cent of the company’s non-claims customer contacts. From initial quote to making a claim to booking any necessary repairs, everything can be done online, which keeps costs low and makes the customer feel in control.

The leaders are developing deeper, more personal and longer-lasting relationships by using their digital capabilities to gain an enhanced knowledge of their customers

But established insurers have been slower to meet the challenges of this brave new world, hampered partly by legacy systems, and the costs of updating and upgrading, as well as partly by a lack of understanding of what is required. “Their focus on risk, ratings and products means that their understanding of their customers lags behind the advanced techniques being developed by internet and telecommunications businesses,” according to a report from PwC, Insurance 2020. “Most insurers are still primarily focused on e-commerce, doing what they do already, but digitally.

“The leaders are developing deeper, more personal and longer-lasting relationships by using their digital capabilities to gain an enhanced knowledge of their customers.”

As insurance has become increasingly commoditised and consumer decisions increasingly price driven, insurers have found margins squeezed and customer engagement decreasing.

That digitisation is what customers want is not in doubt; 79 per cent of consumers worldwide say they will use a digital channel for insurance interactions over the next few years, according to a 2015 report from consultants Bain & Co. What has been missing from some insurers is a recognition that going digital is an opportunity to win back the reputation, loyalty and engagement losses of the past few years.

So, digitisation can lead to more engagement with the customer. PwC research found that 68 per cent of consumers would be willing to download and use an app from their insurance provider; two-thirds (67 per cent) would be willing to have a sensor attached to their car or home, if it meant a reduction in premiums.

Deeper relationships

According to David Law, insurance global leader, at PwC: “Technology is going to be an important part of insurers’ ability to capture and analyse new sources of customer data and develop deeper relationships. Yet, the real differentiator is how effectively this information is turned into insights and a readiness to lead the innovations in the marketplace.”

Challengers such as InShared have prompted existing insurers to raise their game. Flexibility and personalisation are the watchwords as companies learn to use customer information better, not just to cut costs by reducing premiums, but to change behaviour and increase loyalty.

But none of this detracts from the need for real humans. Accenture’s Mr Cusano says: “Technology will change many insurance jobs and even eliminate some. But a much bigger trend is the support that technologies like artificial intelligence will provide, enabling insurance professionals to spend less time on routine admin tasks and more on adding value: engaging with customers, solving problems, making better decisions.”

After all, all the data in the world is of no use if it isn’t analysed and if that analysis isn’t converted into action. So the trick for insurance companies now is to translate data patterns into better products and services for their customers – and that’s where humans come in.

Instead of developing and selling products, it means working backwards from customer needs and expectations

“People are being deployed in higher value roles that include more customer contact than ever before,” says Mr Cusano. “They like that.”

It means an about-turn in how insurers have operated historically. Instead of developing and selling products, it means working backwards from customer needs and expectations – and that requires the right people.

Internet of things

According to the ABI: “Insurers will become real-time risk consultants. Through big data and the increasing prevalence of connected sensors in our lives – the internet of things – customers and insurers will be able to constantly share insights with each other.”

So your insurer might be warning you about skipping a red light; pointing out that you forgot to lock the front door; even spotting a potential medical condition before it develops into something dangerous. Of course, insurers have been pricing according to personalised risk for decades, as smokers and newly qualified male drivers will testify; but the digital world will help break down the personalisation further and potentially change the riskier behaviour.

“Given the inextricable link between physical risks and financial risks, insurers have always had an interest in their customers mitigating risk in order to minimise financial losses, but until now have not often been in a position to help. The connected world will change this,” says the ABI.

To do this better, insurers will need to form partnerships with other companies. Insurers are starting to develop closer ties with car manufacturers, offering lower premiums for customers who opt for safety features such as self-parking. The internet of things brings more change; Aviva, for example, has linked up with HomeServe, to trial LeakBot, a device that will spot water leaks. Given that the insurance industry handled water damage claims worth £650 million last year, it could make quite a difference.

So far, so traditional; much of the data gleaned from social interaction is simply helping insurers to price their products and target the risks better. Instead of the cost of risk being spread through a wide population, it will be borne by the individual displaying the risky behaviour.

But insurers will also be able to develop services that reward not only through lower-priced premiums, but by taking a leaf out of retailers’ books and developing, for example, loyalty programmes that allow more regular interaction than the once-a-year renewal. PwC research suggests that more than half of global participants would be prepared to provide their insurer with additional personal and lifestyle information to enable them to seek the best deal for relevant services on the customers’ behalf, moving insurers from reactive to proactive.

So insurers will move from being salesmen focusing on the benefits of a product to consultants focusing on an outcome for the customer. Now who wants to be an insurer when they grow up?