Blockchain, a distributed ledger that provides an immutable record of transactions, promises to fix the problems of trust and a fragmented value chain that have kept the marine insurance sector moored to antiquated, often paper-based, processes.

Solve these structural issues and you have a marine insurer’s dream. “Blockchain connects the shipping industry and brings risk closer to capital,” says Sean Crawford, EY global insurance leader. Insurchainconnect, an EY collaboration with shipping giant Maersk, insurers XL Catlin, Willis Towers Watson, MS Amlin, initiated last September, is finalising proof of concept with a commercial announcement imminent.

Blockchain’s immutable properties make it a natural partner for insurance

Blockchain’s immutable properties make it a natural partner for insurance, where settlements and reconciliation between multiple parties across the insurance and reinsurance chain can be painful and protracted. The ledger achieves distributed consensus through its continuously growing chain of records, or blocks, with each transaction linked to the previous block, and cryptographically secured and date stamped.

Introducing blockchain to share big data transparently in real time is the game-changer being tested by Insurchainconnect. In the past, marine insurance has basically been a bet, says Mr Crawford. “You don’t know whether a ship has left or arrived, if it’ll go through war zone, be hit by a hurricane or lose cargo.” Maersk’s logistical data about ships and on-board internet of things devices collating data such as temperature and swell change that.

The oldest, most inefficient sector is set to transform to a digital leader as blockchain enables automated, real-time claim resolution, smart contracts and even auctions for prices for ships entering war zones. “Any party with the privileges can view relevant data at any point of time through the distributed ledger. Ultimately, it enables insurers to have more certainty about the risk they are putting on the balance sheet,” says Mr Crawford.

The oldest, most inefficient sector is set to transform to a digital leader as blockchain enables automated, real-time claim resolution, smart contracts and even auctions for prices for ships entering war zones. “Any party with the privileges can view relevant data at any point of time through the distributed ledger. Ultimately, it enables insurers to have more certainty about the risk they are putting on the balance sheet,” says Mr Crawford.

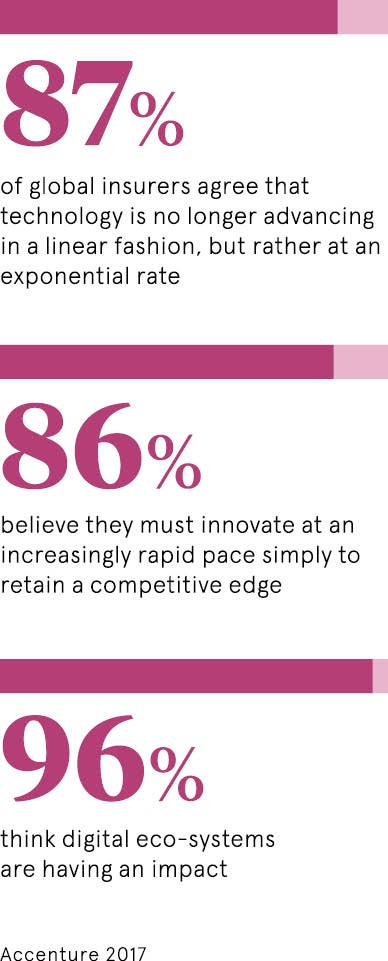

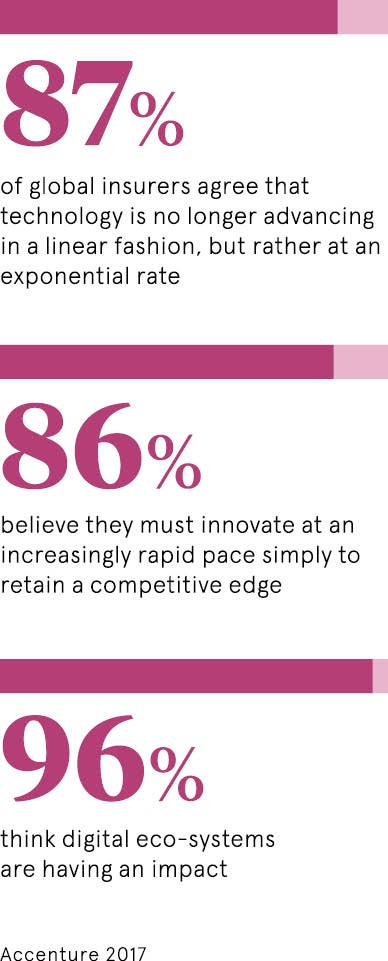

Insurchainconnect’s account supports Gartner Group’s forecast of a suite of benefits awaiting the insurance sector, detailed in Blockchain Use-Cases for Insurance. These scenarios encompass seven types of benefits, including improved know-your-customer processes, cost and risk reduction, better customer experience and data exchange, new product development, and combating fraud.

A clutch of proof of concepts, including the EY-Maersk initiative and B3i consortium, comprising Allianz, Aegon, Munich Re, Swiss Re and Zurich, aim to deliver all these benefits in end-to-end solutions. But while insurance incumbents wait for a blockchain that connects the entire value chain, a plethora of point solutions servicing the sharing economy and niche verticals are showcasing the technology’s potential.

Everledger, for example, uses blockchain to track the provenance of diamonds by establishing ownership, while SafeShare’s blockchain enables tenants in office shares and the like to buy insurance cover on demand. Another development is AXA’s Fizzy, a blockchain-enabled smart contract product which automatically pays out when a flight is delayed by two hours or more.

Blockchain has introduced transparency, and therefore trust, for underwriters who are automating up to 80 per cent of their work, freeing them up to solve complex cases. “Blockchain creates an element of trust previously unseen in insurance,” says Sandeep Kumar, managing director at Synechron and developer of the underwriter accelerator, who maintains transparency improves the entire insurance eco-system.

From fraud detection to healthcare and reinsurance, the potential applications are vast. Blockchain is being anticipated as a solution to the industry’s big challenges, and will enable insurers to come up with entirely different products and markets, say advocates.

“It will create a virtualised marketplace,” says Michael Cook, blockchain insurance lead at consultancy PwC. “Lloyds of London is still a physical market, but creating a virtualised market means risk can be placed globally and need not require geographic proximity to an underwriter.” Mr Cook compares it to banking’s big bang in 1986 when open outcry on the Stock Exchange trading floors was replaced by electronic trading.

“Blockchain promises to disrupt insurance in the same way, replacing a physical trading floor with virtual, instantaneous trading and control across the entire value chain. Historically, this has not been achievable because of limitations of technology.” Given the scale of the vision, it’s hardly surprising that insurance chief information officers are struggling to articulate use- cases and benefits, according to the Gartner paper.

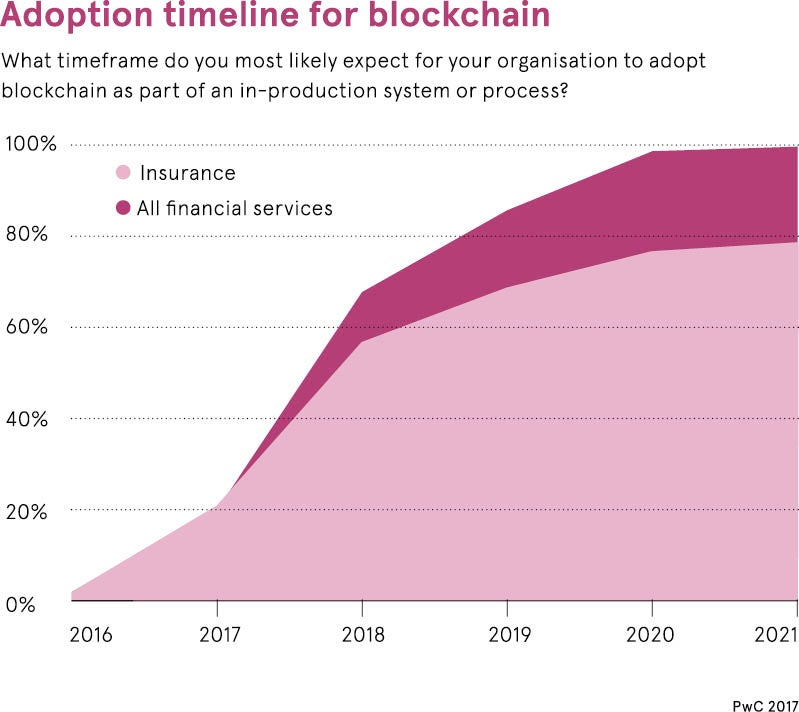

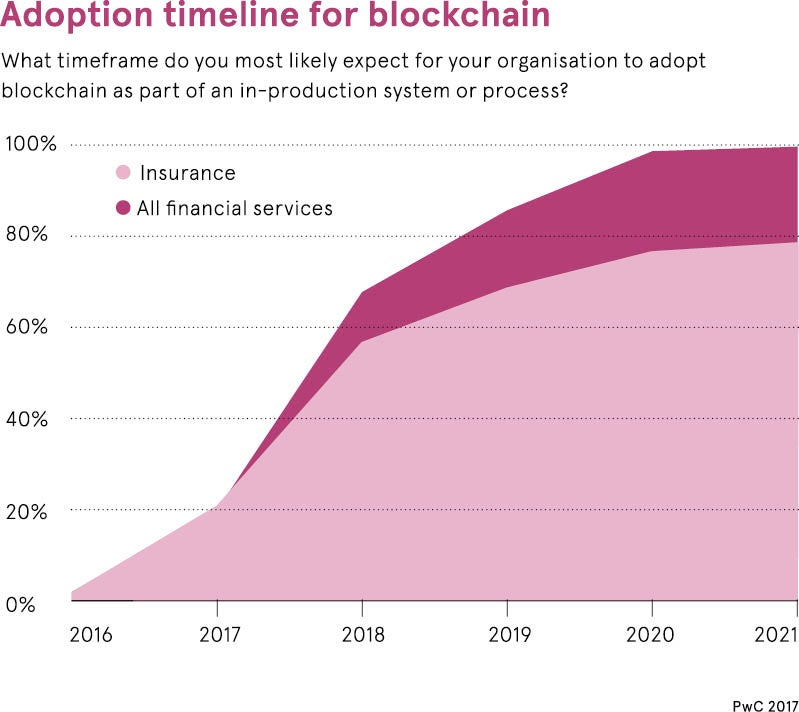

PwC’s Mr Cook, believes engagement with blockchain is advancing fast, however. “Today insurance stakeholders are more knowledgeable and focused, and the conversation is about how and where we can use it,” he says. Intense interest focused on proof of concepts has stoked expectations across the sector and Mr Cook cautions against unrealistic expectations that blockchain will offer a swift panacea.

Fly-on-the-wall feedback from the EY-Maersk initiative suggests the need for patience. “Moving from proof of concept to reality is fundamentally different,” says EY’s Mr Crawford. “Once we got down to building and testing systems and processes, we had to re-engineer a few times. We’re not digitising existing processes; we’re creating a new business model and you have to architect the right way.”

Partnership between innovators and incumbents brings essential perspectives, and is the only path to blockchain, says Zafar Kanani, network manager at Forbury Investment Network. “Incumbents see innovators as a way to gain insight and engagement with end-customers, enabling development of relevant products while innovators benefit from an efficient pathway to scale.”

And the most important partner is the customer. “If you’re trying to disrupt insurance, go to your biggest customer,” Mr Crawford concludes.