At a hackathon in 2014, Kevin McCoy, a digital artist and entrepreneur based in New York, and Anil Dash, an entrepreneur, had an idea. In a world where digital artwork was circulating freely and replicated all over the internet, they would use blockchain technology to enable people to own original works of digital art.

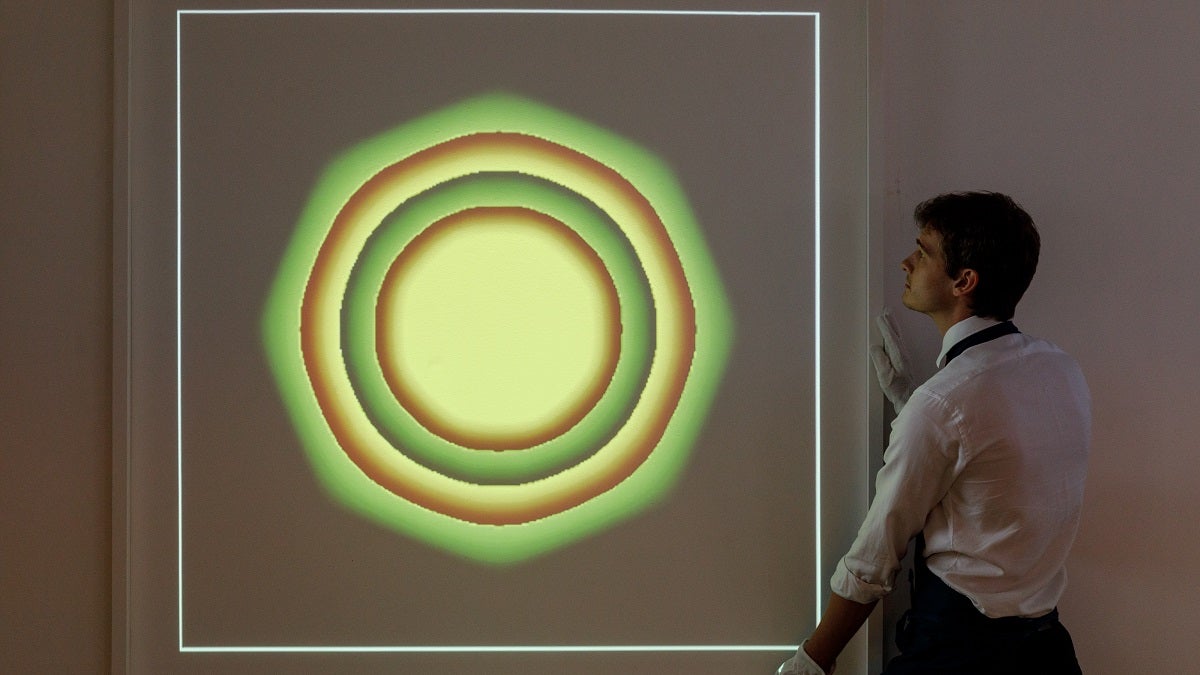

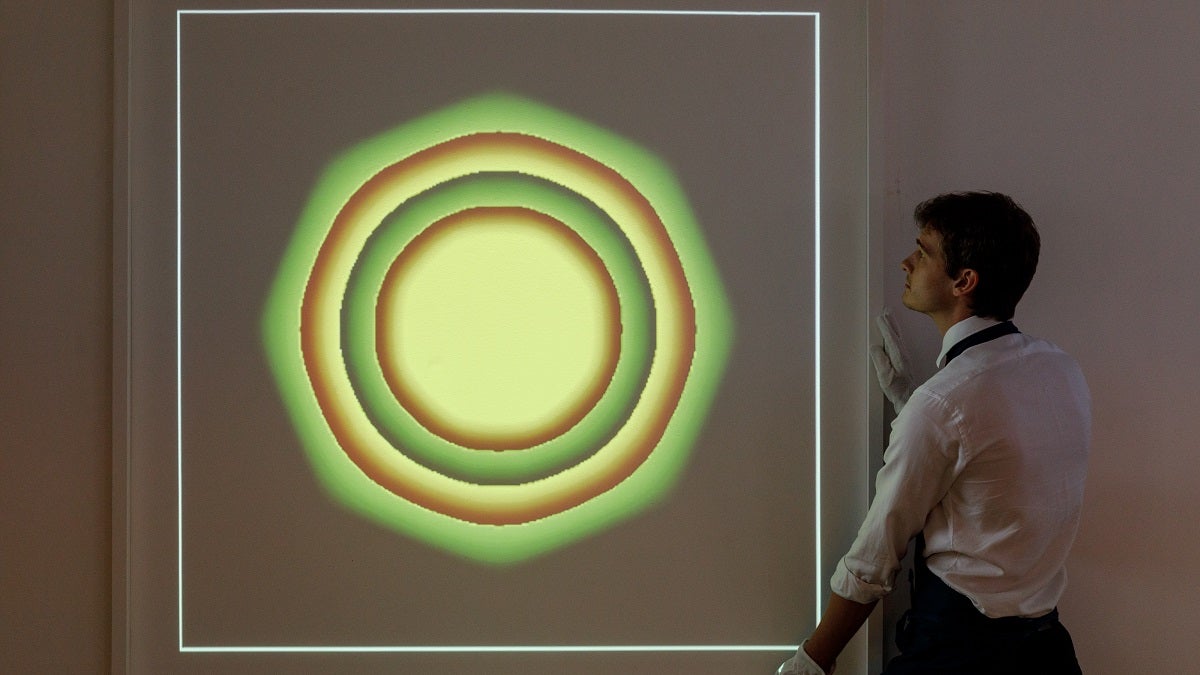

At the event, McCoy minted a gif he had created with his partner, Jennifer, and called it Quantum. He also made two other works at the same time, one of which, called Cars, he registered in a Namecoin cryptocurrency wallet. Later that day, Dash gave McCoy the $4 he had in his wallet to transfer ownership of Cars on stage at the event.

At first, McCoy and Dash described Quantum and Cars as “monetised assets”. Quantum would later be known as the first example of a non-fungible token (NFT), and Cars as the first transaction in a dynamic global market that is today worth billions of dollars.

“I wanted to give power back to artists,” says New York-based McCoy.

In the early days of digital art, before social media and smartphones, artists established their online presence in ways they could control, developing their own tools and technology, McCoy says. However, this soon began to change.

“I saw that erode over time with the emergence of these centralised platforms and social media, and the rise of the technology giants in their epic scale,” he says.

McCoy realised that technology like Bitcoin allowed people to control their own value propositions. Essentially, NFTs enable artists to cut out the “middle person”. Consumers can buy directly from artists, while creating a traceable and unique digital imprint that allows them to check the authenticity of the art. As the art is bought and resold down the chain, artists continue to benefit financially.

You have people who have been dabbling in meme cryptocurrencies for the last few years buying an original Damien Hirst, purchasing digital land for games or buying digital horses to race

In June this year, Quantum was sold for $1.4m through auction house Sotheby’s. “It was an interesting hybrid moment when the traditional art world was able to understand exactly what was going on in the NFT world,” McCoy says.

In 2020, McCoy tweeted that he was “way ahead of [his] time, but [he] was right”. Looking at the NFT market today, where an estimated $2.5bn of sales took place in the first half of this year, it’s impossible to disagree.

A whole new world

Today, an art collector who isn’t clued up on NFTs is more the exception than the rule. In the first week of September, fashion house Dolce & Gabbana announced its first ever NFT collection: dresses, crowns, jackets, suits and tiaras that can be worn by digital avatars, which are set to be sold later this month. In the same week, Cryptopunks – one of the earliest examples of collectible pieces of generative art – surpassed $1bn in total sales, while Oscar-winning actor Anthony Hopkins announced that his latest film, Zero Contact, would be released as an NFT on Vuele, the world’s first NFT viewing platform.

In a traditionally slow-moving market, this pace of change cannot be understated. “Until the advent of NFTs, digital art had never really been able to enter the art market in an effective way, and it was largely the preserve of institutions,” says Sebastian Fahey, Managing Director of EMEA of Sotheby’s, who earlier this year ran its first ever NFT-only auction. “I think, over time, more traditional art collectors have and will come to recognise the importance of digital art and NFTs as a growing movement with real staying power.”

NFTs often hit the headlines for the eye-watering sums associated with the sale of pieces. However, their impact on the art world spans far beyond the money that changes hands or moves between digital wallets.

George Harrap is co-founder Step Finance, a decentralised autonomous organisation (DAO): a portfolio manager for decentralised assets like NFTs. He says the art world’s digital revolution has cracked open the imposing doors traditionally associated with the sector, making it available to a new set of people.

“The NFT market caters to a completely new set of audiences that’s more digitally native, and they value different things besides what traditional art gives you,” he explains. While some think that NFT sales are cannibalising traditional art sales, Harrap argues that instead, it expands access to the area.

“It just so happens that this art form is completely different from traditional art. So the experience, the way people value art and the way people display it is completely different.”

“I think a lot of people feel like art is inaccessible and it’s something that tends to be associated with big money,” says Josh Sandhu, head of development at Grove Square Galleries and a self-confessed fan of NFTs. “But with this new world, it feels very different. You have people who have been dabbling in meme cryptocurrencies for the last few years buying an original Damien Hirst, purchasing digital land for games or buying digital horses to race. It’s quite wild.”

Emerging challenges

This democratisation of art is far beyond what McCoy originally envisioned, but he feels very positive about it. “There is this kind of third culture that I see coming together… [that is] natively online, natively on blockchain and natively decentralised in various ways,” he says. “There’s this real sense of energy in this kind of community.”

McCoy praises the increased diversity of the new audience, too. “It’s not a single entity,” he says. “There’s a new audience, new venues, new spaces, new money — it really is pretty exciting.”

But there are of course some downsides. Sandhu points to the enormous amount of energy used by blockchain in general and its impact on the environment. It’s a challenge “for the wider crypto market in general”, he says, and one which “raises all sorts of ethical questions.”

According to calculations published by computational engineer Memo Atken, a single NFT’s footprint is equivalent to an EU resident’s total electric power consumption for more than a month, with emissions that equal flying for two hours or driving for 1000km. Amid increased efforts globally to reach “net zero” – when total emissions produced match those being removed from the atmosphere – it becomes harder to justify their existence.

Still, Sandhu is sanguine. “As blockchain technologies develop, there’s less of an impact on energy consumption and thus the climate, with some specific projects having a net-zero footprint.” As the technology grows in popularity, he thinks, there will also be increased efforts to find sustainable solutions. “Ultimately, I suppose all of this hinges on whether major auction houses and galleries believe this is here to stay and is going to grow.”

For Fahey the future market for NFTs is clear. “I think we can expect to see a whole new appreciation for the medium in the coming months and years.”

NFTs and the rise of Beeple

On 1 May 2007 and every day for 13.5 years, a digital-first artist known as Beeple (real name Mike Winkelmann) published a piece of art online from his home in South Carolina.

On 21 March this year, a compendium piece of artwork that brought all these images together – called The First 5000 Days – sold as an NFT in an auction facilitated by the British house Christie’s for $69,346,250: the highest NFT sale to date.

As one of the most famous digital artists, Beeple has an incredible following online, particularly on picture-sharing app Instagram, where he has 2.2m followers (and rising). Over his years in the spotlight he’s been involved in a number of high-profile collaborations with celebrities and brands. These have ranged from British tennis star Andy Murray to international fashion brand Louis Vuitton, as well as performing artists like US-based rapper Childish Gambino and pop star Katy Perry.

According to Noah Davis, specialist in post-war & contemporary art for Christie’s, “acquiring Beeple’s work [was] a unique opportunity to own an entry in the blockchain itself created by one of the world’s leading digital artists.”

At a hackathon in 2014, Kevin McCoy, a digital artist and entrepreneur based in New York, and Anil Dash, an entrepreneur, had an idea. In a world where digital artwork was circulating freely and replicated all over the internet, they would use blockchain technology to enable people to own original works of digital art.

At the event, McCoy minted a gif he had created with his partner, Jennifer, and called it Quantum. He also made two other works at the same time, one of which, called Cars, he registered in a Namecoin cryptocurrency wallet. Later that day, Dash gave McCoy the $4 he had in his wallet to transfer ownership of Cars on stage at the event.

At first, McCoy and Dash described Quantum and Cars as “monetised assets”. Quantum would later be known as the first example of a non-fungible token (NFT), and Cars as the first transaction in a dynamic global market that is today worth billions of dollars.