Parametric insurance is gaining traction as a pragmatic way to cover previously uninsurable risks during times of cataclysmic change. Instead of paying a claim based on the value of the loss incurred, it pays out automatically when an event measured by a pre-agreed trigger occurs.

While not entirely new, parametric or index-based products are gaining relevance in a world beset by frequently-occurring and extreme events, and one which is increasingly measured, monitored and quantified by data.

An improved customer experience, combining speed and certainty, is a big part of its appeal and reflects the digitally connected world we inhabit. The proposition of an immediate and frictionless payout compares well with the cumbersome process administered by adjudicators and litigators in traditional insurance.

Proving the point, digital startups are catering for consumers who want to cover the risk of a cancelled flight, or not enough snow on their skiing holiday, and who want compensation now.

Companies such as FloodFlash, Blink, Skyline Partners and Setoo are harnessing the proposition of superior customer experience and developing products covering climate, energy, utilities and travel risk. Letting customers select the protections they want, using objective data sources to crunch premiums in real time, and guaranteeing fast payment through automated contracts, combine to make a winning formula.

“We believe that every time a consumer buys something online there is a concern and this is currently not being dealt with”, says Noam Shapira, co-founder of Setoo.

Fast and assured pay out improves customer experience

This sentiment could easily apply to other areas of insurance and the model’s potential to play a wider role in a data-driven universe is signalled by InsTech London’s report Parametric Insurance: 2021 outlook and the companies to watch.

“Parametric insurance is starting to offer attractive solutions where conventional insurance has failed,” says the report’s co-author, Matthew Grant, partner at the InsTech London. “Technology exists to define and deliver insurance coverage based on real-time reporting of accurate data.”

Swiss Re estimates of traditional insurance covering only 40 per cent of around $140 billion of economic losses from natural and man-made disasters in 2019 give credence to Grant’s viewpoint. And coronavirus has jump-started the debate about the role parametric insurance can play in assessing emerging risk and quantifying loss on a warming planet and volatile world.

“The pandemic demonstrated one of many ways that businesses can be interrupted without direct physical damage. This is relevant because parametric insurance allows for much broader “non-physical damage” business interruption coverage, so long as it is still associated with an objective and measurable event,” explains Peter Lacovara, senior vice president and alternative risk transfer leader at Marsh brokerage.

Parametric policies plug insurance gaps

Simon Young, senior director at Willis Towers Watson, points out that video footage from Wuhan in China, epicentre of COVID-19, constituted measurable data that could have been used to indicate risk. “CCTV from last autumn showed Wuhan hospital car parks filling up, an early sign of a medical crisis unfolding,” he says.

Interestingly, a parametric policy – PathogenRX, developed by Marsh, Munich Re and technology firm Metabiota, and triggered by mortality or infection rates – did provide cover for a pandemic, but no one bought it.

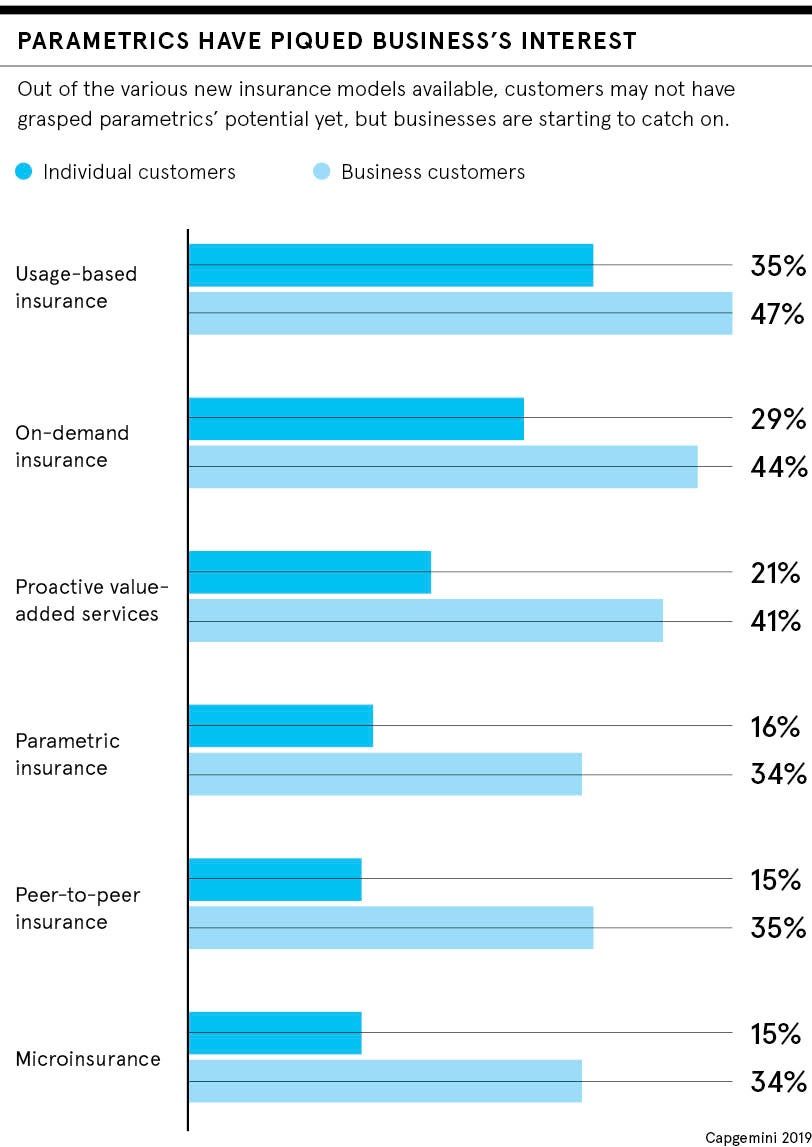

Young says there’s poor understanding of parametric insurance and a realignment of expectations is needed to realise its potential. “People confuse it with indemnification,” he says. “If you make it clear that it’s not equivalent, it could actually raise trust levels.”

Lacovara concurs: “Parametrics are complex products, even to professionals, so finding a way to make them accessible to the average buyer will be an important part of the story.”

For now, parametric insurance is established in agribusiness and catastrophe reinsurance where triggers are relatively easy to define. But the rapid growth of the internet of things and data capture will provide more and novel opportunities to create parameters that are proxies for underlying risk.

“In principle, parametric could play a role, but everything depends on whether it’s possible to identify a suitable parameter that describes the risk,” says Rainer Hartmann, head of agrisk partners at Munich Re.

More broadly, the insurance value chain is embracing digital technology and verifiable data that speed up transactions and add certainty, shoring up trust and customer experience. Blockchain, a distributed, immutable ledger, is streamlining dispute resolution, which currently costs the sector $9 billion a year.

Objective data shores up trust

Proof of Trust’s blockchain spins up anonymised adjudication panels, settling disputes faster for clients and releasing capital back to insurers. Applying data analytics to the dispute resolution life cycle also yields valuable insights, which can be shared by all parties, according to Sakhib Waseem, chief innovation officer at Proof of Trust.

Insurance consortia RiskStream and B3i use blockchain’s trust properties to reduce friction and strip out cost in transactions between broker, insurer and reinsurer members. Automation lowers the cost of processing and makes possible the insurance of risks that were previously uneconomical.

David Rutter, founder and chief executive of blockchain provider R3, says the distributed ledger technology is particularly apt for parametric insurance and its trust properties improve customer experience. “It provides data provenance and the certainty that data comes from an approved party,” he says. “The use of smart contracts assures that appropriate data was added at the right time according to pre-agreed formulae.”

Parametric insurance may still be in its infancy, but using measurable parameters twinned with automatic payment is a strong suit in an increasingly data-driven world. As Paul Ridge, head of insurance at SAS UK and Ireland, concludes: “Technology and data have a growing influence on the ability to either price the risk, transfer it or, ultimately, prevent it.”

Parametric insurance may still be in its infancy, but using measurable parameters twinned with automatic payment is a strong suit in an increasingly data-driven world. As Paul Ridge, head of insurance at SAS UK and Ireland, concludes: “Technology and data have a growing influence on the ability to either price the risk, transfer it or, ultimately, prevent it.”

Farming: exemplar for parametric practice

Parametric insurance is a good fit with agriculture because the physical nature of the environment and work mean risks like flood and drought are visible and measurable. “By nature, farmers are inherently good risk managers. They applied risk-mitigating strategies before insurance was ever available, using techniques such as crop rotations to spread risk,” says Rainer Hartmann, head of agrisk partners at Munich Re.

A parametric solution has relevance for the entire food production value chain, which is impacted by the same risk, but in different ways. The farmer, trading company and logistics firm are all impacted by the same risk – crop shortfall – because of excessive rain or drought and so this impacts the entire value chain. A farmer can’t repay loans or buy seed for next season, the logistics company has no transportation custom and the food processor can’t fulfil customers’ orders.

The growing use of data and digital technology in farming practices puts the sector in a sweet spot for parametric insurance. Farmers are using smart farming and collect data about the performance of their crop and their machinery, and access and share data on crop yields from satellite imaging. “It’s a natural step to use this data analytics to structure risk transfer solutions,” says Hartmann.

Parametric insurance is gaining traction as a pragmatic way to cover previously uninsurable risks during times of cataclysmic change. Instead of paying a claim based on the value of the loss incurred, it pays out automatically when an event measured by a pre-agreed trigger occurs.

While not entirely new, parametric or index-based products are gaining relevance in a world beset by frequently-occurring and extreme events, and one which is increasingly measured, monitored and quantified by data.

An improved customer experience, combining speed and certainty, is a big part of its appeal and reflects the digitally connected world we inhabit. The proposition of an immediate and frictionless payout compares well with the cumbersome process administered by adjudicators and litigators in traditional insurance.