When you walk into your local coffee shop and the barista has your oat milk matcha latte waiting for you five minutes before your train is due, that is personalisation at its best.

In contrast, the barista who targets the average customer might serve up the wrong drink at the wrong time of the day. Many in the insurance sector know just how this feels.

Nigel Walsh, a partner at Deloitte specialising in insurtech, says: “Insurance companies tend to engage with their customers once a year for a short period of time unless there is an event, a claim for example.”

Roy Jubraj, digital and innovation lead for Accenture’s UK insurance practice, adds: “The challenge for insurers is how to increase the frequency of engagement.”

More flexible, on-demand cover helps firms get closer to customers

Ignasi Barri, who heads up innovation for GFT, a provider of IT services for the financial services sector, warns this lack of engagement threatens the business model of traditional insurers faced with competition from insurtech startups.

Some startups are targeting customers more frequently, offering consumers cover only for the time they need it.

California startup Trov, for example, offers personalisation in the form of flexible, on-demand insurance for gadgets such as headphones, smartphones and laptops. From the Trov app, consumers can switch cover on and off as easily as they can their wifi connections.

Mr Walsh at Deloitte says changes in the way people live, particularly the rise of the sharing economy, mean insurance also has to change. “We can no longer afford to or want to own our own assets in the way we always have done,” he says. “I might not own a car, but might borrow my friend’s car for three hours. Why buy an annual policy when you only want it for a short time?”

Personalisation can make insurance simpler and fairer

Startups such as Cuvva and Metromile are targeting these asset-free millennials with personalisation as a result. Others are aiming to counter the idea that applying for insurance is too time consuming and involved with understanding jargon.

One such startup is buzzvault, which aims to help people build a digital inventory of their possessions via an app on their smartphone and use it to secure home insurance.

Householders survey each room using their smartphone’s video camera which is linked to a buzzvault-certified surveyor.

Chief executive Becky Downing says: “The customer can then view, update and amend their buzzvault. This way customers can add in anything that’s been missed, make any necessary corrections and, most importantly, decide what they want to cover.

“Using our mobile video survey technology allows us to use granular, validated data to price more accurately. This means that consumers with fewer possessions don’t pay over the odds for their insurance and wealthier households aren’t underinsured when it comes to claim.”

Accenture’s Mr Jubraj highlights Vitality, the health and life insurer which rewards healthy behaviour. “I think you will see that model shift itself into other insurance products,” he says. “The Vitality model has been a win-win. You can have better insights to avoid claims happening.”

How personalisation and connected tech are promoting prevention over claim

The idea of prevention rather than claim can also be applied to other areas. Many insurers are betting on the capabilities of sensors linked to the internet of things to change the way we are insured.

“Exploiting the data from all these sensors will allow insurance companies to be more predictive,” says GFT’s Mr Barri.

A home insurer doing this is Neos, which uses smart devices, such as its LeakBot, to protect homes.

Matt Poll, Neos’ chief executive and founder, says: “Once customers have the tech installed for a couple of months, they report they feel safer and can’t imagine life without it. Furthermore, when the tech kicks in and alerts customers to a threat that could have become a claim, they see the real value of smart, preventative home insurance policies.

“Five per cent of our customers have been alerted to a real threat in their homes, which means customers were saved the headache of a lengthy claims process and the severity of the damage that could have been caused.”

Earn customer data in exchange for better service

At the heart of all this is data. Mr Barri says: “You need to incentivise your customers sharing data. The value is in being able to customise the products so you can be more accurate on the risk-modelling or the underwriting process and it is quite likely the price is going to be less.”

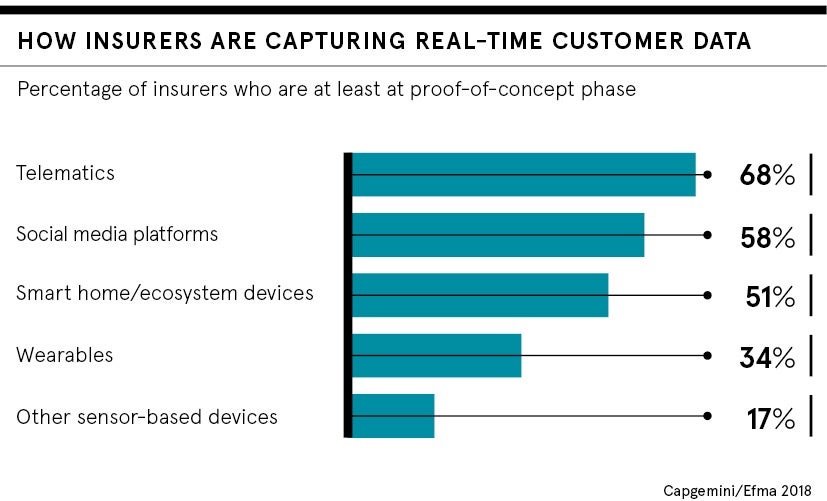

More insurers are now partnering with other companies, whether it’s Fitbit or Facebook, to gather data.

“With data from these sources you can provide hyper-personalisation,” says Mr Barri. “Rather than just targeting the one guy from generation X, insurers can target the Ignasi Barri who likes soccer, Snickers and gadgets.”

Many insurers are building apps to create direct relationships with the end-customer and cutting out brokers as a result, to understand their customers better.

As we start to have more interactions with our insurers, you can expect other products to change. Take travel insurance. “What if we have travel insurance that recognises where you are, based on your location? If you are in Paris, it can create the nudge to take out insurance,” says Mr Walsh.

Pay-as-you-live insurance is the apex of personalisation

Pay-as-you-use insurance is also going to be driven by changes in the way we live. Mr Barri highlights driverless cars as an example. “If I am not going to be the one driving the car, then maybe the insurance should be provided directly by the manufacturer,” he says.

Ms Downing at buzzvault says: “Increasingly digital-savvy consumers won’t put up with the status quo; they will look for better, smarter, easier alternatives. This new generation of consumers understand the value of their personal data and want to be empowered by it.”

The future, whether it’s your insurance cover or coffee, looks personalised.

More flexible, on-demand cover helps firms get closer to customers

Personalisation can make insurance simpler and fairer

How personalisation and connected tech are promoting prevention over claim