While the need to mine data for real-time insights is more important than ever given the uncertainty and unprecedented global market conditions, many investment banks still find their ability to store, access and analyse huge datasets can be inefficient and expensive, with legacy infrastructure often hindering the process.

As a result, the industry is increasingly turning to the cloud in order to gain access and leverage traditional and unconventional data sources as well as machine-learning technologies which help institutions gain invaluable market insights to help in their decision-making process. The need for reliable real-time analytics has been brought into sharp focus by the shift to working from home, with teams now more reliant than ever on the quality of their information to ensure their decision-making process is sound.

According to Cornelia Andersson, global head of mergers and acquisitions and capital raising at Refinitiv, in a world where the amount of data available has exploded, the challenge for investments banks is actually not just finding data, but being able to find the right data which is relevant, reliable and easily accessible. “While banking will largely remain a relationship-based business, access to high-quality data will become a competitive differentiator, alongside flexible and powerful analytics platforms,” she adds.

Enriching data insights

With budgets in decline, using available data more effectively will become increasingly crucial, says Matthew Hodgson, founder and chief executive of Mosaic Smart Data.

After years of record-breaking spending on market data, initial signs indicate participants are starting to wind back on overall spend as shown in Burton-Taylor’s most recent survey, which expects overall market data spending to decrease by more than 2 per cent in 2021, with some respondents expecting a 6 per cent or greater decline.

While banking will largely remain a relationship-based business, access to high-quality data will become a competitive differentiator, alongside flexible and powerful analytics platforms

Hodgson says this is driven by coronavirus-related uncertainty as well as a greater focus on costs as firms channel resources into initiatives with the goal of becoming more efficient and relevant to their clients. “Data analytics is a key driver of this capability and we are seeing emphasis on the need for real-time insights related to transaction and market data,” he says.

Investment banking is still a very traditional industry in many ways, but the sector is currently undergoing a digital transformation, led by the so-called bulge bracket top global investment banks, and data is at the heart of this.

According to Andersson, banks are increasingly looking to bring together internal proprietary data with external market data to generate new insights and identify new opportunities. “Traditional workflows and systems are being modernised and one of the new trends is traditional market data sources are used to enrich internal systems, creating a powerful combination of aggregated data, often supported by artificial intelligence based software”, she says.

Accessing reliable real-time market insights has become essential and alternative datasets are important to help institutions navigate volatile market conditions successfully. Market research estimates that hundreds of investment firms are already using alternative data to some extent. Refinitiv’s AI/ML survey, from 2019, found that some 70 per cent of firms are using alternative data.

Leveraging cloud infrastructure

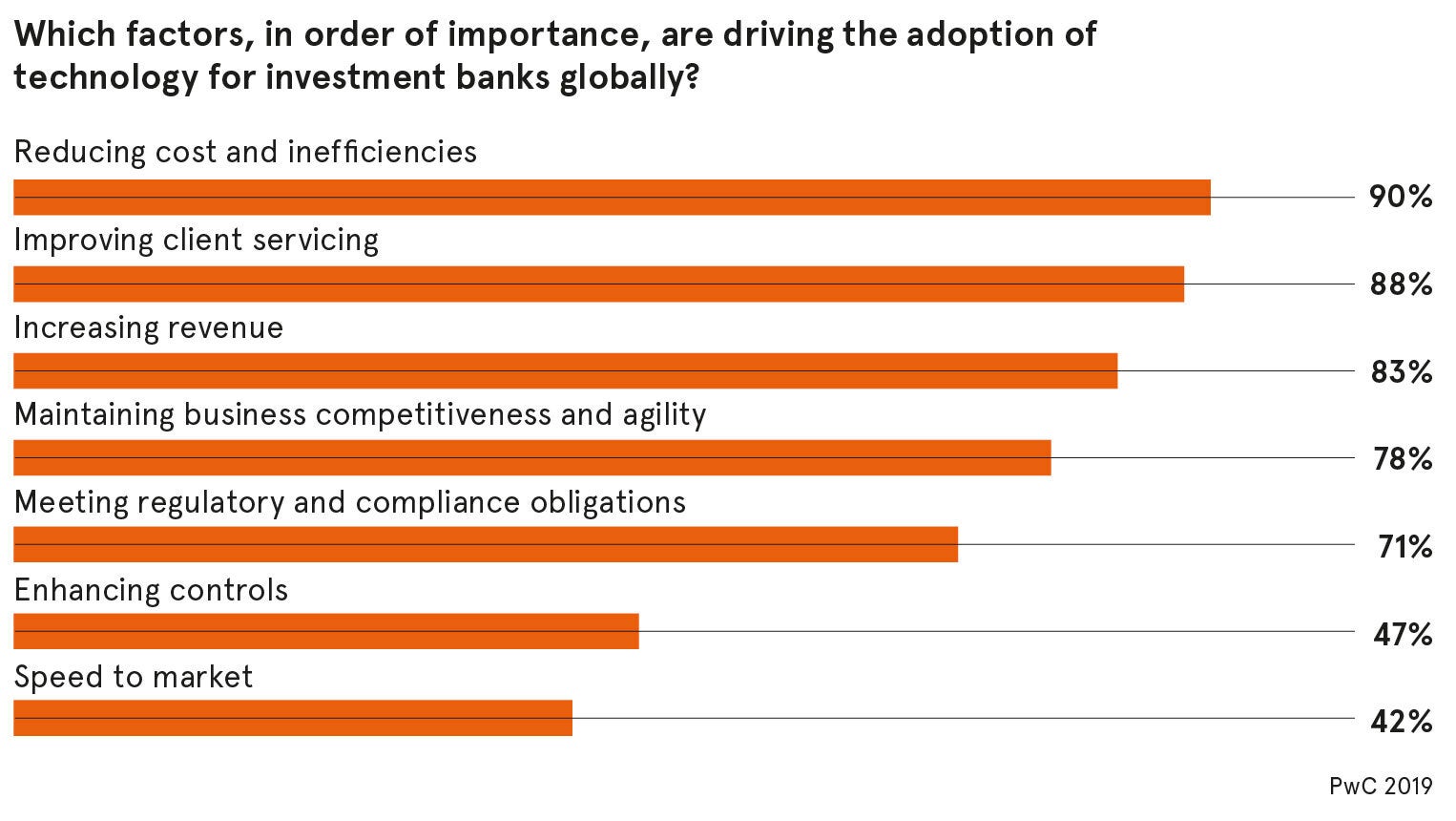

Sally Mewies, head of technology at Walker Morris, explains there are several key motivations driving organisations to adopt AI. “The inherent cost reduction to the business as a result of needing fewer people to analyse data is appealing, but this technology also enables companies to secure their place as market leaders,” she says. “Critically, perhaps now more than ever, AI provides a level of robustness and resilience.”

Hand in hand with the increased reliance on machine-learning to process and analyse the available market data is the use of these new technologies in the cloud. Cloud-deployed analytics allows firms to get to market far faster and at a significantly lower cost than on-site traditional infrastructure, explains Hodgson.

“As such we are seeing a much greater acceptance of, and adoption to, cloud-based and cloud-native infrastructure. The cost-benefits of cloud-based infrastructure are most relevant to the smaller and mid-sized players who have the ambition, and in many cases the talent, to compete with the bulge bracket tier-one firms, yet they simply don’t have access to the same resources,” he adds.

The shift to virtual working from home or regional offices has significantly emphasised the need for real-time analytics distributed across all key players in the organisation, Hodgson notes.

In fact, when uncertainty increases as a result of an external shock, the need for accurate and timely data also increases dramatically, Andersson observes. “The faster the situation changes, the faster investors need to understand trends and refine investment strategy. Data, and easy access to the right data, becomes critical. When there is uncertainty in the markets, the demand for information rises exponentially and those deal makers with access to high-quality data have a distinct advantage,” she concludes.

To find out more, read Resilience in Financial Services