“We are still in the tail of the third industrial or digital revolution where investment in digitalisation could drive significant productivity gains,” noted analysts from investment bank Morgan Stanley in a September 2016 report entitled Disruptions and productivity growth in the next decade of the digital revolution.

The digital revolution represents the move towards data-driven business. The computerisation of business is continually generating vast quantities of data. That information is fuelling the use of automated decision-making systems within finance.

“I am very optimistic about where we are going,” says John Lowrey, global head of electronic markets in equities at Citi, the banking giant. “Training artificial intelligence systems requires large datasets. Those who have the most data are the most able to adapt to the new environment and of course the banks and investment banks have reams of data. By 2020 we will really see radical change in the environment.”

That change is very apparent in capital markets. While many people still think of traders as brightly jacketed men shouting in a trading pit, and a few think of men and women staring at screens while shouting into telephones, very few people picture a computer server clicking away, making millions of decisions.

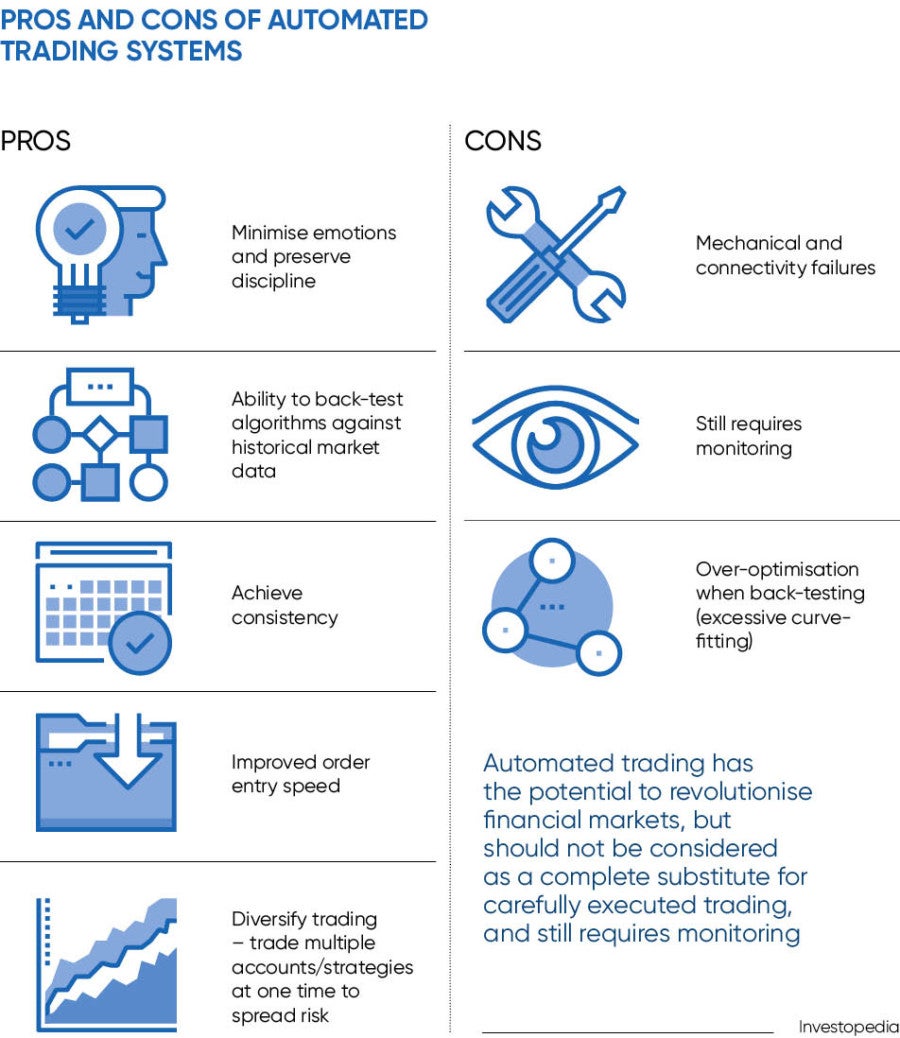

This move towards automated trading, which began in the late-1990s and early-2000s, across the banking and asset management environment was driven by two factors. Firstly, traders cost a lot of money and are fallible, and so reducing their number reduced costs. Secondly, many of their simpler tasks were time consuming and ate into their ability to tackle complicated problems.

However, the first stages of automation were rule-based decision-making systems, algorithms that took an input and triggered an automated response. Any change in market circumstances required a platform to have its parameters altered.

Now smarter systems are being developed, capable of learning, which can be trained across datasets and then adapt to changes in circumstance. These can be applied to a considerable range of processes by innovative financial services firms.

Joseph Pinto, global chief operating officer at AXA Investment Managers, says: “We are looking at automation on three levels. Firstly, how can we use big data and eventually artificial intelligence to provide new signals for our portfolio managers? Secondly, we are using machine-learning processes or automation to process a lot of data on customers, for example movement of inflows, outflows and trying to anticipate customer behaviour. The third layer is more traditional, sitting down with our providers and ensuring they can automate their process to lower fees.”

These automated trading systems are not only getting smarter, but as wider datasets become available, machine-learning systems can be used to understand a wide variety of inputs. The inclusion of internet-enabled sensors within devices ranging from cars to shipping containers to toasters is creating the internet of things, a vision of the physical world represented in data.

At the same time, the increased surveillance of every aspect of life, and the capacity of machines to search images and text as well as tables of figures, just as search engines do across the internet, creates the potential for running searches just as powerful across financially sensitive information.

Bartt Charles Kellerman, chief executive of hedge fund consulting firm Global Capital Acquisition, says: “In the past there was a guy with a counting device standing outside a concrete manufacturer, or outside a housing project, counting the number of trucks going in and out. That’s grown by leaps and bounds, so everything that moves is going to be monitored and fed into some centralised cloud, which is then going to be examined and cross-examined as a reflection of whether or not that data is going to impact a potential market move.”

These technologies are already much in evidence outside of the financial services environment. From search engines to shopping assistants they are becoming increasingly prevalent. However, applying these to the management of money requires a considerable level of trust. Even smart automation requires oversight and risk management. Nor can there be a lack of transparency as regulators and investors both require insight into the decision-making process.

“These are complex ideas when you use automation just for the investment process, or deep-learning or machine-learning,” says Mr Pinto. “And you need a simple way to explain it to your customers; you cannot sell it as a black box for sure. That’s the big challenge. So we are investing time and effort in creating transparency for users and clients, including creating tools like data visualisation. We find it really makes a big difference. The past is littered with opaque technologies that, when difficult to diagnose, were quickly abandoned by clients.”