1. Crowdfunding

According to Statista, crowdfunding transactions are likely to hit £68.7 million in 2019, up more than 14 per cent on last year.

It’s no way to find millions, with the average amount raised just £8,571, but it can be a quick and simple way for a small business to access funds. In one of the most notable crowdfunding successes of all time, Oculus started out looking for $250,000 on Kickstarter and ended up selling to Facebook for $2 billion.

The concept is simple: pitch your business idea on one of the many online platforms, such as Crowdcube, Seedrs, Indiegogo or LendInvest. In return, investors receive some incentive: usually shares, but occasionally early access to products.

Advantages include a lack of upfront fees, often along with a certain amount of publicity and the ability to test public response. On the downside, borrowers will need to put in a bit of work to make sure their idea gets visibility. Meanwhile, if the target isn’t reached, any money that’s been pledged will usually be returned to investors.

2. Peer-to-peer lending

Lending peer-to-peer works as a straightforward loan, except that the borrower is dealing with a large number of individual investors, rather than a single financial institution.

Interest rates tend to be lower than those of the banks and the application process is usually very quick; the money is often available within days.

On the downside, businesses must have at least two years of accounts filed with Companies House and a minimum annual turnover of £100,000.

There’s also a bit of a shadow over the sector at the moment as major provider Funding Circle recently slashed its forecasts for revenue growth, while other providers have warned of problems and Lendy fell into administration.

Meanwhile, the Financial Conduct Authority (FCA) is tightening up the sector, banning investors from putting more than 10

per cent of their investable assets into peer-to-peer loans unless they’ve received regulated financial advice.

3. Invoice Finance

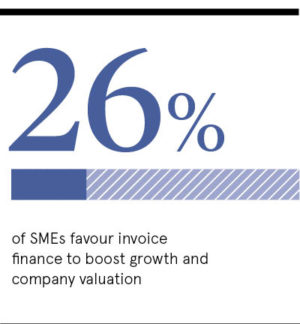

It isn’t particularly new, but invoice finance has become increasingly mainstream over the last few years. Indeed, according to a poll of 1,000 business owners by MarketInvoice, it’s the most popular funding route for small and medium-sized enterprises.

It isn’t particularly new, but invoice finance has become increasingly mainstream over the last few years. Indeed, according to a poll of 1,000 business owners by MarketInvoice, it’s the most popular funding route for small and medium-sized enterprises.

There are two types of invoice finance. Factoring involves selling invoices to a company which then manages the whole process of chasing and collecting payments. Invoice discounting sees the company doing this itself and is usually cheaper. Either way, the company has access to the money it’s owed immediately. And it’s often possible to use invoice finance for just one, particularly large or worrisome invoice, which is known as spot factoring.

The upside, of course, is a vastly improved cash flow, as long as things are going well. However, when a company gets into difficulty, invoice finance can potentially trigger a debt cycle and is sometimes seen as a sign of a company in trouble. It can also be more expensive than traditional banking.

4. Asset Finance

Asset funding reached a record high in the UK last year, says the Finance and Leasing Association, with new business totalling almost £33 billion. There is now a wide range of options tailored for specific purposes.

What they have in common is they relate to the value of a business’s physical assets, such as vehicles, machinery or other equipment.

Hire purchase and leasing are the two main types. With hire purchase, the borrower pays a deposit and owns the asset at the end of the term; with leasing, the asset is handed back. Through asset refinancing, it’s possible to release cash by borrowing against an asset the business

already owns.

Meanwhile, operating leases are often used for high-value assets. Rental payments are made throughout the term, but don’t cover the full cost of the asset. At the end of the term, the borrower can buy the asset for a residual value set by the lender, minus the rental already paid.

5. Pension-led funding

Company owners or directors can finance their business using funds from their pension. An analysis by Clifton Asset Management found that in the last four years they’ve done so to the tune of £1.45 billion.

Company owners or directors can finance their business using funds from their pension. An analysis by Clifton Asset Management found that in the last four years they’ve done so to the tune of £1.45 billion.

It’s unique among business funding methods in that the interest paid on the finance provided is paid back to the pension, leaving the owner or director better off overall. There’s also no requirement for a personal guarantee.

Loans can be taken against self-invested personal pensions (SIPPs) and small self-administered schemes (SSASs), and can be paid off at any time without charge. Loans must not exceed 50 per cent of the pension fund’s value and they’re generally recommended only when the pension pot is worth £50,000 or more.

6. Merchant cash advances

A relatively new concept, merchant cash advances are an alternative business finance option that’s becoming increasingly

popular among companies that use card terminals, such as retail and leisure businesses.

Borrowers can usually access up to a month’s turnover and regular repayments are made as a percentage of each card terminal payment until the full amount has been paid off. This means companies generally only have to repay what they can afford, making it a particularly attractive prospect for seasonal businesses.

Payments are made automatically through an arrangement with the card terminal provider, resulting in a streamlined process. And merchant cash advances are relatively easy to access, as lenders generally don’t need to run credit checks or check a borrower’s accounts; they just need to confirm the borrower’s volume of card payments with the terminal provider.

7. Credit Unions

Not-for-profit organisations, credit unions traditionally offer savings and loans to members with something in common, such as a particular locality or industry, for example. There are more than 500 in the UK, with a list available from the Association of British Credit Unions.

Not-for-profit organisations, credit unions traditionally offer savings and loans to members with something in common, such as a particular locality or industry, for example. There are more than 500 in the UK, with a list available from the Association of British Credit Unions.

Credit unions were originally aimed at individuals, but since 2012 have been allowed to extend their services to small and medium-sized businesses in the UK. Most now offer a range of business loans, such as startup loans, instalment loans, business credit cards and bad-credit commercial mortgages.

Interest rates are set by the FCA, with loans of more than £10,000 carrying an APR of 10.5 per cent, topping out at 42.6 per cent for loans under £1,000. Loans also carry a reducing balance interest rate, so the rate falls the day a payment is made and less interest is charged overall.

8. Grants

The good news is that there are hundreds of government grants available in the UK; the bad news is that the criteria are extremely tight and the application processes torturous. Many grants require matched funding from the applicant.

Grants for new businesses generally come in the form of equity finance, a direct grant or a soft loan. They’re offered by local, national and European government, although of course the future of European Union grants is now in doubt.

Many sources of funding are highly local and specific; there are currently 170 opportunities listed at the government website gov.uk/business-finance-support. It’s important to check the criteria thoroughly, as eligibility is likely to be severely restricted, perhaps requiring local hires or technology investment.

However, many businesses that have accessed government grants have flourished, including Swiftkey, the predictive keyboard app bought by Microsoft for a reported $250 million in 2016.