On the face of it, traditional banking and fintech are not a natural fit. But with high street banks hindered by legacy technology, they are having to place increasing trust in fintech investments.

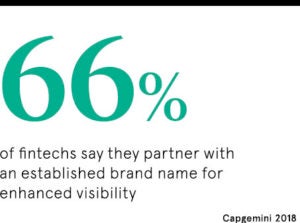

Many of the banking giants have partnered with or in some cases even acquired fintech businesses in a rapid bid to roll out more innovative products and services.

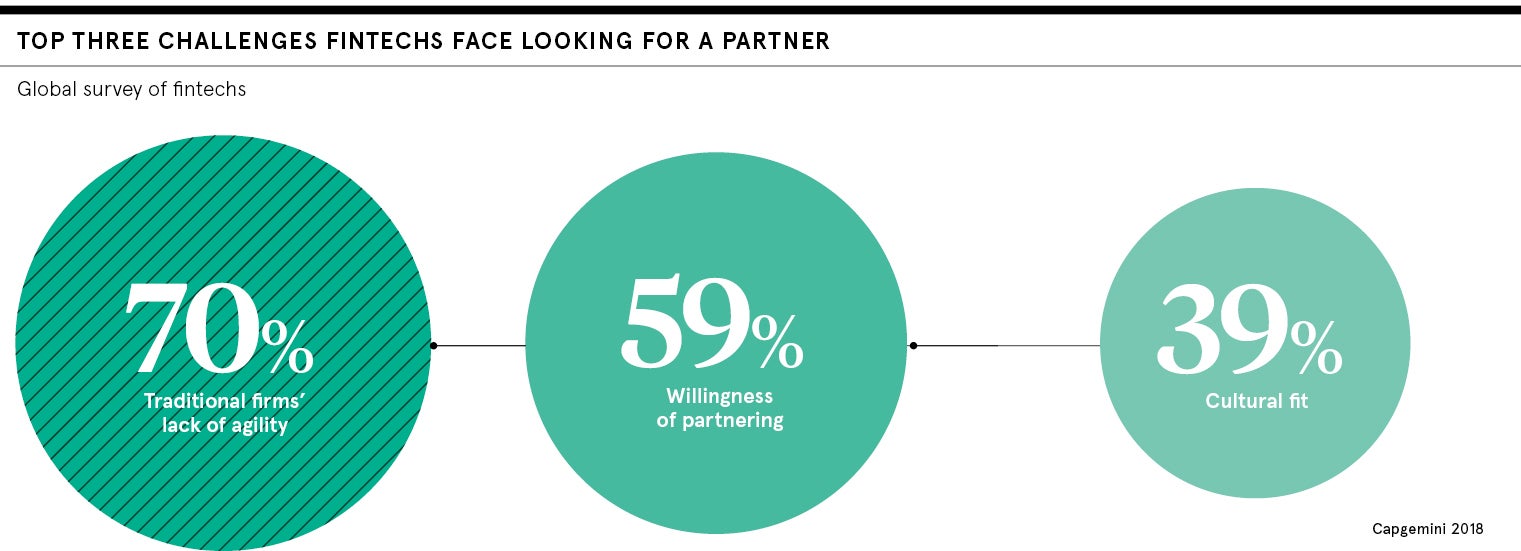

However, the relationship between fintech and banking can be far from harmonious. The two types of business are used to being competitors, while the differing cultures can clash when risk-taking fintechs are brought in to work with risk-averse banking institutions.

Anthony Morrow, chief executive of digital financial advice service OpenMoney, says: “Smarter, savvier mainstream banks have woken up to the fact that fintechs could help facilitate a much better service to their customers.

Fintechs often build the product, with their own money and risk appetite. Once in production, the risk banks take is much reduced

“But bringing together two businesses is never going to be easy and the challenge is even greater when you are combining a cutting-edge fintech with a traditional legacy bank.

“It can sometimes be hard to maintain the nimble culture of a startup when it comes head to head with the governance and administration challenges of bigger companies. Tension can often result.”

Ian Henderson, chief executive of AML Group, sees the large banks as constrained by rigid, hierarchical structures, as well as regulation. “Fintechs can behave more like loose networks: open, collaborative, agile,” he notes.

In Mr Henderson’s experience, these approaches are largely incompatible and he claims putting a fintech into a large bank is a good way of destroying its value, although he suggests ringfencing joint ventures can sometimes work.

Making it work

There are those from both the fintech and banking worlds who contest this view, including Paul Taylor, founder and chief executive of Thought Machine, a fintech that received an £11-million investment from Lloyds Bank last November to help with digitalisation at the retail bank.

There are those from both the fintech and banking worlds who contest this view, including Paul Taylor, founder and chief executive of Thought Machine, a fintech that received an £11-million investment from Lloyds Bank last November to help with digitalisation at the retail bank.

“We’ve found that all the banks we work with have put a huge amount of effort into making the projects work,” Mr Taylor insists. “They know change has to come and doing projects with fintechs is one way of pioneering this change.”

Rather than tensions existing between the entrepreneurial, risk-taking culture at fintechs and legacy banks, he believes there is a “symbiosis”.

“Neither party wants technology that breaks or is unsafe,” he says. “Fintechs often build the product, with their own money and risk appetite. Once in production, the risk banks take is much reduced.”

HSBC is working with hundreds of fintechs to help bring new ideas and improve the customer experience at the retail bank, according to Josh Bottomley, global head of digital at HSBC Retail Banking and Wealth Management.

“Of course, we have to manage this in a safe way for our customers and a good example is our First Direct partnership with Bud, where together we tested the ‘artha’ app in the FCA [Financial Conduct Authority] regulatory sandbox,” he says. “We’re now working to integrate the features from that trial into our own app.”

Using constructive criticism

Tension does not have to be detrimental and for some businesses, it can even help aid the innovation and development process.

Andrew Beatty, senior vice president of global banking at FIS, thinks tension and collaborative conflict is natural, but that ultimately mutual respect should prevail.

To achieve this, he suggests fintechs should seek and respect the financial institution’s expertise regarding financial services requirements.

“Both parties must apply constructive criticism appropriately,” he adds, noting that fintechs should also be confident in their vision and direction.

“The fintech should not blindly accept all requested changes from the incumbent bank, which could quickly take both parties off course and threaten the traction needed to progress in the engagement,” says Mr Beatty.

There are signs that open banking is helping ease the strain between traditional banking groups and fintech companies that are trying to work together.

Open banking has led to two key changes in the marketplace, according to Harpreet Singh, executive director at Brickendon, a financial services consultancy firm.

“Firstly, fintech firms are utilising the available data and providing better insight in the areas of analytics, leading to swifter processing and more efficient services,” he says. “Secondly, this has pushed banks to provide similar services while maintaining the impression of a robust, secure and safe environment.”

For Moneyhub’s chief executive Samantha Seaton, implementation of open banking has fundamentally changed the relationship between banks and the burgeoning fintech community.

“Establishment players that had been slow to implement technological change were forced to confront their tech inadequacies,” Ms Seaton notes.

But she also points to an ongoing “cultural mismatch” which, she says, is causing friction, as banks remain wary about embracing technologies that pose a challenge to their long-term dominance.

Ms Seaton explains: “This was made public in April when the Competition and Markets Authority felt it necessary to issue directions to five banks in respect of the Retail Banking Market Investigation Order 2017.

“The concerns raised related to delays in delivering certain aspects of the open banking programme, in particular with regard to mobile app functionality.”

Change on both sides

So, what does the future hold for the working relationship between banks and fintechs, and will either of these two very different organisations be prepared to adapt?

OpenMoney’s Mr Morrow warns that the sheer quantity of new entrants to the market, helped by easy access to venture capital, means there are “too many copycats around”.

He urges “something different” from the banks and fintechs. “Without this, it’s unlikely the bigger banks will see any merit in partnering with fintechs and they will instead remain stuck in their rigid ways, missing out on what could be something really special,” he says.

Yet Claire Bright, chief financial officer and head of strategy at DAG Global, sees the relationships between banking and fintechs becoming more blended, “as each side sees the benefits of working closer together”.

However the relationship develops, there are going to be bumps along the way. For Stuart Bungay, chief executive and co-founder of money management startup Tully, it requires change on both sides. Fintechs will need to invest more in risk and compliance functions while “to really push innovation and engage with fintechs, banks will have to create specialist teams who can engage quickly and easily on a proof-of-concept basis”, he says.

Making it work

Using constructive criticism