No one would dispute the seismic revolution that is taking place in financial services. But with plenty of customers still more comfortable with the type of banking service provided by Mr Mainwaring of Dad’s Army, can technology help the sector cope with the very different needs of different generations?

“It’s clear that customers want high-quality, personalised, digital interaction; the real challenge is how the banks can get there and maintain profitability over the next five years,” says Jeremy Anderson, global head of financial services at KPMG.

Educating an older generation

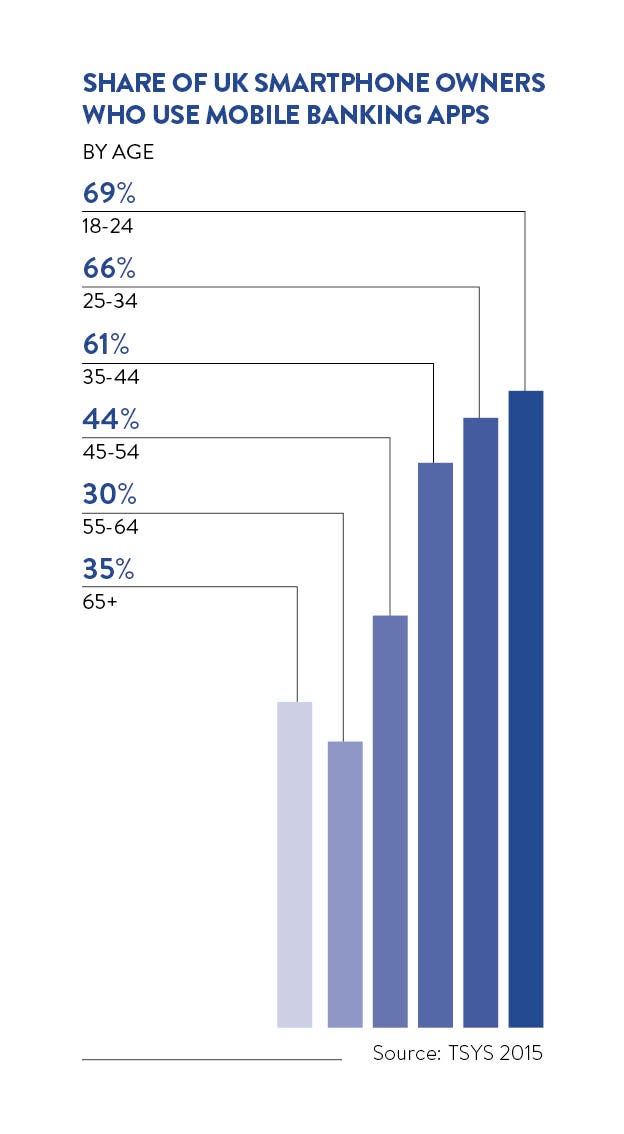

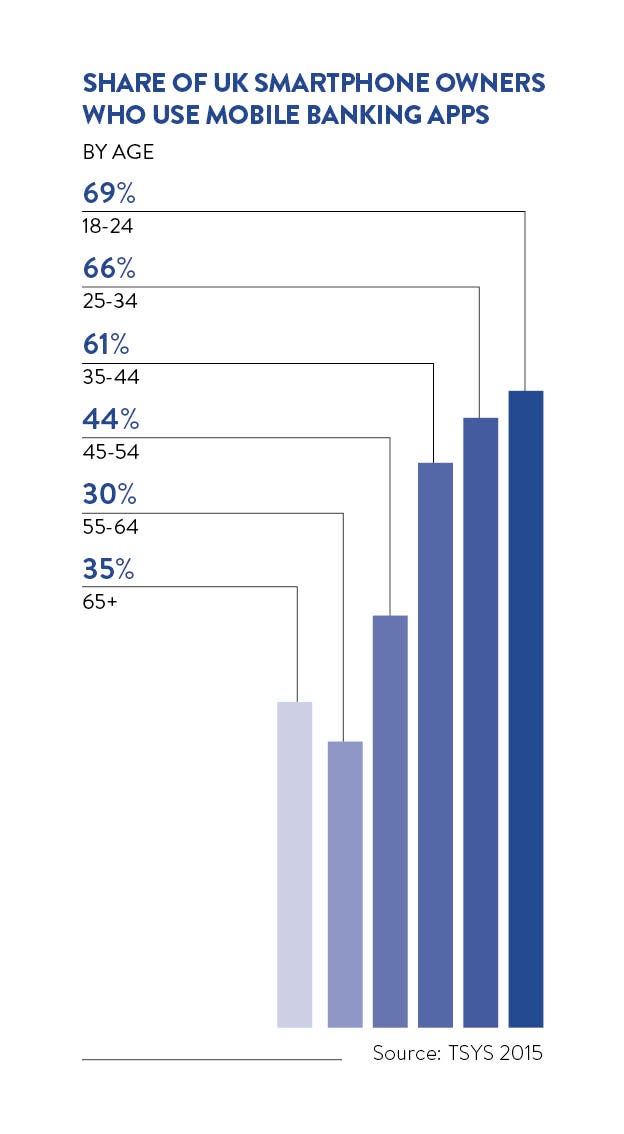

That customer expectations are changing as a result of changing technology is clear. Research from Temenos, a financial services software provider, found that 72 per cent of millennials, born between the early-1980s and early-2000s and who by 2020 will make up more than 50 per cent of the workforce, are active users of mobile banking.

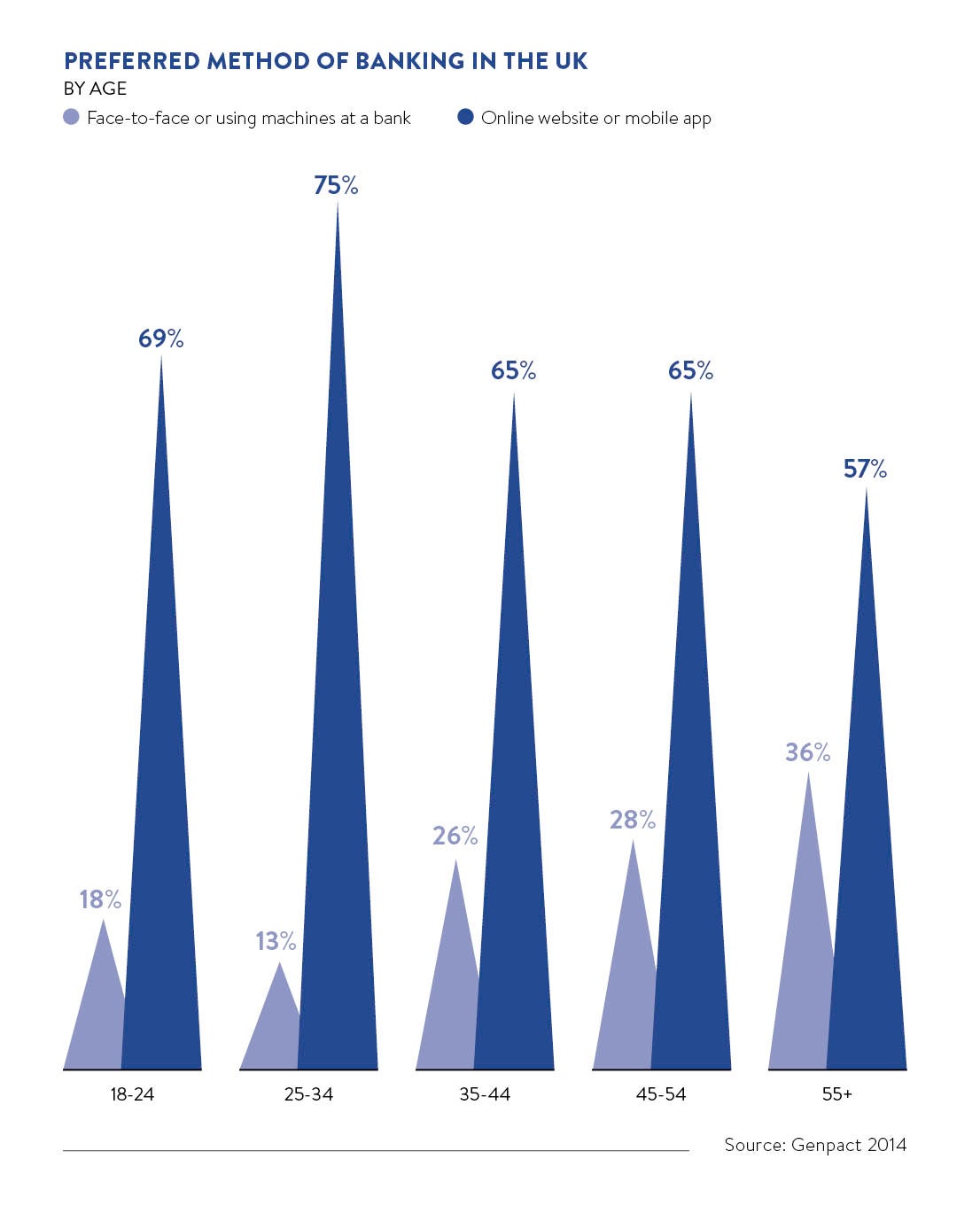

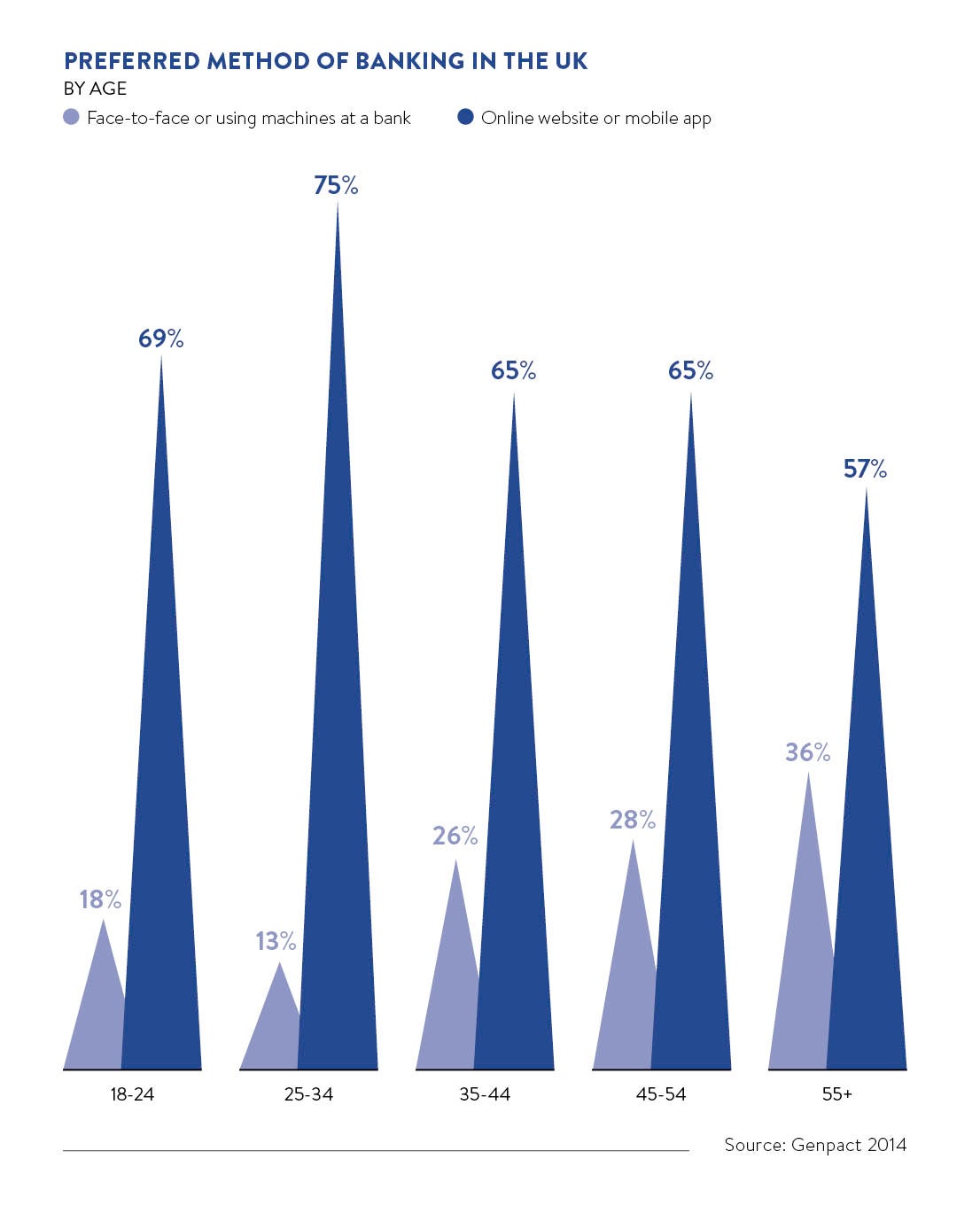

One problem for the sector is that although digital has been embraced by the younger generation, it is older people, with more savings and investments, who are more “profitable”. So the focus has moved from the technology to education and marketing; getting older people to trust and embrace digital.

The rise of silver surfers gives the lie to the idea that only those under 30 and living in Hoxton can use mobile banking

Barclays, for example, has been promoting its Digital Eagles scheme, offering free technology advice that is not just related to financial products. The bank has recognised that the more confident and comfortable people are using technology across all aspects of their lives, the more likely they are to use it in their financial life.

“We’re helping to boost the skills and confidence needed to make the most of the opportunities this new digital era holds,” says Ashok Vaswani, chief executive of Barclays personal and corporate banking. “There’s no one-size-fits-all approach.”

Certainly the rise of silver surfers, who have demonstrated their ability to use digital in the social space, gives the lie to the idea that only those under 30 and living in Hoxton can use mobile banking.

Understanding the millennial mindset

Segmenting the financial services customer base by age may not be a useful approach, according to Lawrence Wintermeyer, chief executive of Innovate Finance, a not-for-profit organisation serving the financial technology community. “The change in behaviour isn’t limited by generations,” he says. “My 70-year-old mother-in-law is tech-enabled. It has more to do with economics than age.”

He believes the digital revolution can be accessed by anyone of any age, particularly as the cost of holding a supercomputer in your hand is falling year by year, and that technology is changing behaviour.

Travers Clarke-Walker, chief marketing officer of the international division at Fiserv, a technology company focused on the financial services sector, agrees. “Millennials will happily have four, five, six payment apps on their phones,” he says. “Consumers now will go where the service is most easily and robustly provided, which leads to a fragmentation of access points for the provider.”

According to research from Temenos, the likelihood of millennials using the same wealth manager as their forebears is only about 10 per cent. That lack of loyalty may pose more of a problem for financial services than whether or not the over-50s use mobile banking.

“The behaviour and expectations of millennials is so different to baby boomers,” says KPMG’s Mr Anderson. “They are not interested in established and trusted brands, but more in recommendations from friends or even people they don’t know.”

A key issue for the sector is the ability to join up the different ways we access services. Lots of basic inquiries are directional and broad ranging; for instance, how much could I borrow to buy a house? A customer may go online to find that out, but then go into a branch and have to repeat all the details. All financial service providers are trying to have a joined-up conversation across multiple touchpoints.

In fact, younger people may be more likely to use the high street branch network than older; it’s not that they aren’t using digital channels, but they value face-to-face contact, depending on the product. If it’s the first time they have used a credit card or taken out a mortgage, they want the reassurance of speaking to someone.

Of course, technology can help with that; for example, Nationwide, the building society, has used a kind of video conferencing to put remote mortgage advisers into its branches. According to Cisco, Nationwide’s technology partner in this venture, it resulted in double-digit improvement in customer net satisfaction and two-thirds improvement in new mortgage business.

Mr Clarke-Walker says: “Some products require a degree of intervention. You have to ask how rich an experience it is to transact on a mobile phone; if it’s a particularly complicated offering or the individual needs a degree of assurance, it’s more appropriate to pass the query on to a human.”

Focusing on customer needs

Financial services can no longer rely on a monolithic sector where every company provides the same, not very good service; the sector needs to take lessons from other digital companies that have a laser-like focus on what the customer wants.

“Look at Vodafone’s mpay [one of the first mobile phone payment services],” says Mr Wintermeyer. “Remittance is one of the biggest growing areas in financial services and is broadly focused on foreign workers getting money back home. Vodafone focused on what the customer wanted and worked out a business that got the fees down to nothing by taking a cut from the currency exchange instead of charging the customer a fee.”

It is not just the younger generations, but all of us who are using technology to change the way we use financial services.

TECH IMPACT OF UK PENSION REFORMS

Last year saw one of the biggest shake-ups of UK pensions for many years. At last, those who had conscientiously put money aside into a pension scheme were able, aged 55, to access as much or as little of their pension pot as they liked.

Last year saw one of the biggest shake-ups of UK pensions for many years. At last, those who had conscientiously put money aside into a pension scheme were able, aged 55, to access as much or as little of their pension pot as they liked.

A bonus for Lamborghini dealerships, said many doubters. But it is more likely to mean a bonus for financial advisers, as consumers get to grips with complex and difficult decisions. Those advisers without the technology to help – perhaps by demonstrating different scenarios – will lose out quickly.

One of the hardest aspects for the consumer is that of collating pensions from different workplaces. Increasing job mobility means that, on average, you could end up with 11 different pension pots, according to the Department for Work and Pensions. Collecting, managing and possibly merging these pots is currently a nightmarish job, but one where technology could make a significant difference.

Companies too are demanding far more real-time analysis from their pensions advisers. Technology can be of real value here and predictive analytics much in demand. Also, the advent of auto-enrolment will see a tech-savvy generation coming into pension scheme membership. Such individuals are likely to require much greater access to information and analytics.

Educating an older generation

Understanding the millennial mindset