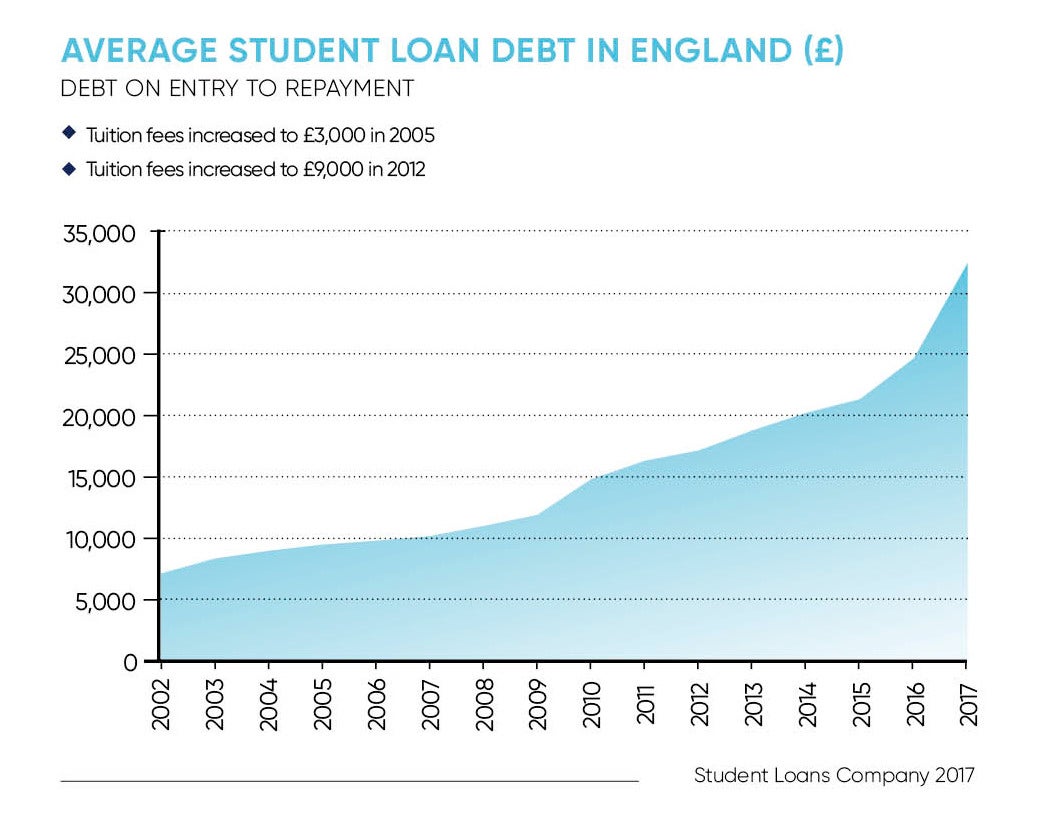

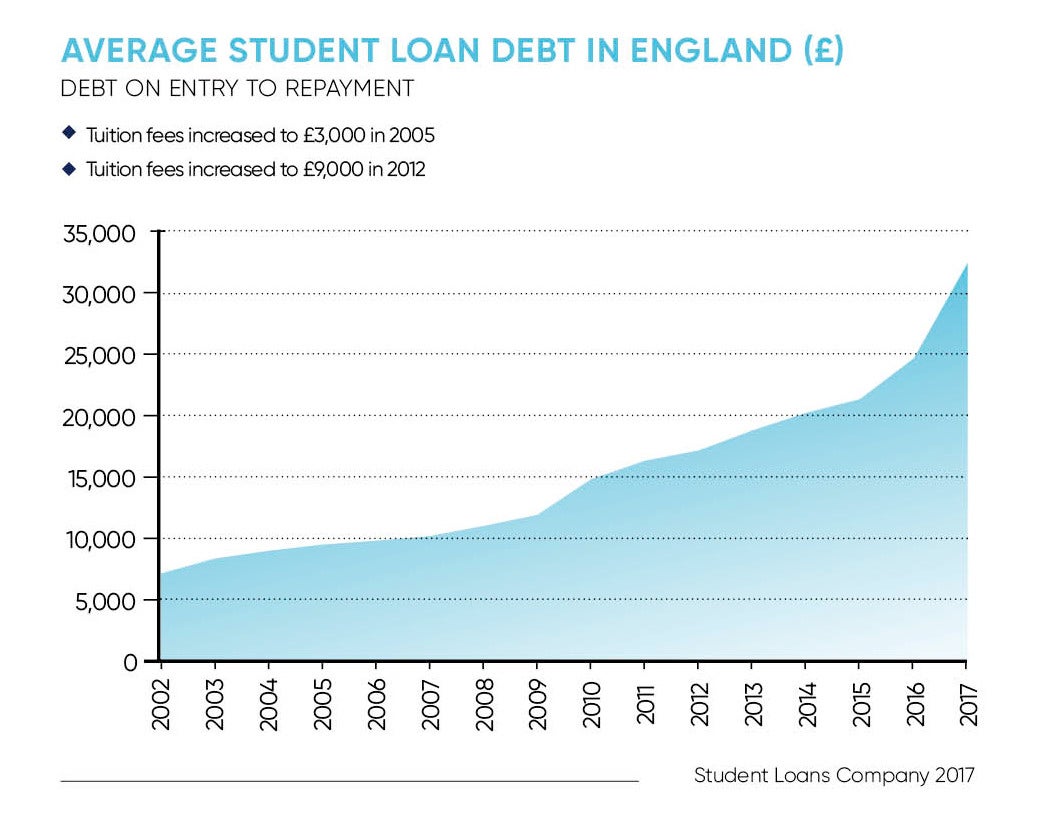

Students currently pay £9,000 a year to go to university in the UK. With this figure set to rise, if the government’s plan to raise annual tuition fees by £250, what financing options are available to students wishing to fund their higher education?

Traditionally, students take out a loan for the duration of their three-year or four-year university course, but this can be desperately expensive.

Students are often obliged to take out these loans from the government-owned Student Loans Company, as the traditional banks will not advance the cash due to little or no credit history or family financial support.

According to the latest data from financial services company Fidelity Investments, students face an eye-watering interest rate of 6.1 per cent, a 33 per cent hike from the previous year, with the retail price index (RPI) hitting 3.1 per cent in March 2017.

The level of interest charged on student loans is linked to the RPI measure of inflation and begins accruing the moment the loan is taken out. The interest rate is updated once a year in September, using the RPI measure of inflation from March plus a maximum of 3 per cent depending on earnings.

That is just the beginning for students. Maike Currie, investment director for personal investing at Fidelity International, says: “Graduates only begin paying their loan off when they start earning £21,000 per annum or more, at which point they pay interest and/or repay capital at 9 per cent of their income above this threshold.”

How fintech can help students

It’s not surprising that a number of financial technology (fintech) companies have identified a gap in the market to provide students with low-cost loans to help fund them through university.

One such London-based fintech startup is Prodigy Finance. This platform specialises in providing loans to international post-graduate students, in particular, who have secured places on select Masters courses at top-100 globally ranked universities.

Prodigy Finance assesses students through a predictive scorecard which uses data about their academic background to estimate what their future salaries will be.

There is also Dublin-based fintech company Future Finance, which lends to students in higher education, primarily in the UK. Its first loan in May 2014 was for £2,500 to a trainee nurse at the University of Surrey. However, a significant slice – 10 per cent of the total loan book – is for post-graduate students returning to full-time study for business and finance qualifications.

Future Finance tailors its debt to such borrowers, allowing them to make lower monthly payments while studying, often at lower rates than are available on the high street.

It’s not surprising that a number of fintech companies have identified a gap in the market to provide students with low-cost loans

In addition, there are a number of US-based fintech companies offering a range of financial products, including personal loans, such as Social Finance and Credible.com, but users have to be a US citizen or a permanent resident.

Professor Markos Zachariadis at Warwick Business School says: “There are a number of startups that help you save while at college and redirect the savings to repay the student loan faster, for example ChangEd.

“Perhaps the most directly helpful fintech popular student lender is CommonBond in the US, which has raised more than $80 million and given out more than $1 billion in student loans.”

CommonBond uses proprietary algorithms that look at traditional and non-traditional data points, and thus are able to provide lower fees and interest rates than banks for their student loan and refinancing products.

“All the above services are helpful for students and will certainly encourage young people to borrow and invest in their education,” Professor Zachariadis says.

Dr Andrei Kirilenko, director of the Centre for Global Finance and Technology at Imperial College Business School, says: “Platforms can play a role in helping students fund their higher education and perhaps give access to those who couldn’t access higher education due to their financial situation. However, they cannot eradicate an individual student’s personal debt.”

Jake Butler at student money website Save the Student says: “Fintech is currently best for budgeting on the go, travelling students, and those who want to save easily. We agree that fintech has a great potential for teaching students about money management and engaging them in the process.

“There are apps now that make saving easy and almost effort free, others use chatbots and gamification to make money transfers and cross-currency payments actually fun, and several are cross-platform across multiple accounts, giving a far greater insight into how their money is doing.”

How fintech can help students