- What is digital banking?

- What is omnichannel banking?

- What is open banking?

- Becoming a digital bank: case study

- Traditional banks and fintechs

What is digital banking?

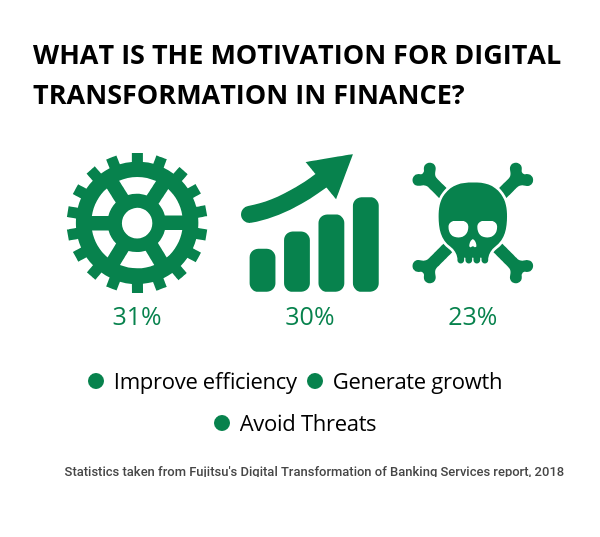

Digital banking is the digitalisation of banking services in order to reduce risk, improve efficiency and better serve customers. It allows customers to withdraw money, apply for loans, make payments online or on their smartphone and more. Looking to the future of banking, digital is no longer an option for firms who wish to survive - it is a must.

When it comes to retail banks (rather than corporate or investment banks) going digital, there are two elements: digitisation and digitalisation. “Digitising means converting into digital format anything which is currently manual or paper-based,” says Simon Paris, chief executive officer of fintech company Finastra. “Whereas digitalising is a whole new way of thinking.”

Once digitisation is complete, banks can start exploring revolutionary business processes which were not available to them before, from iris recognition to artificial intelligence to offer superior banking services.

Digital banking simply makes life easier for consumers - Ian Bradbury, Fujitsu

The future of banking is digital

While security and cost-efficiency are strong motivators for banks, the true value of digitalisation is what it can do for the customer. “Digital banking makes life easier for consumers,” says Ian Bradbury, chief technology officer for financial services at Fujitsu. “People are increasingly enjoying the simplicity of managing all their finances in one place, setting up automatic payments or making deposits, any time and anywhere, without the need to queue in a bank.”

And with an increasing number of challenger banks and fintechs in the game, competition for the customer has never been higher. As Flavia Alzetta, chief executive officer of digital banking company Contis points out, traditional banks have an advantage in both the range and complexity of the products they offer. “Traditional banks have a 360 degree offering. If they were to put the customer first, they already have a very strong base to continue to occupy their place.”

More importantly, they have an existing clientele, which many of their younger competitors are still trying to build. “The customer is king and very expensive to acquire. Banks need to realise that if you look after customers they will reward you with loyalty,” continues Ms Alzetta, “customer expectations have evolved over the years, and there is no reason why they should not be met.”

What is omnichannel banking?

Omnichannel banking allows a customer to access their banking services, in real time, through any channel they choose, be it the physical branch, an ATM, a call centre or online. Implementing it means allowing customers the freedom of choice to access their finances anywhere, at any time, via any medium.

“Choice is the way forward, always”, says Ms Alzetta. But, she continues, although retail banks have begun to embrace an element of omnichannel banking, it has yet to develop to its fullest. “Omnichannel banking has been implemented mostly in terms of transactional activity. What would be a real novelty would be to rethink the most complex products and services banks provide, such as mortgages.”

The opportunities, should traditional banks fully embrace omnichannel banking, are extraordinary. In essence, it could mean a comprehensive, joined-up experience for the customer, at every stage. “If you call up to enquire about a credit card, and say ‘I’ve got a question about my mortgage too’, you shouldn’t be transferred,” says Mr Paris. “When you go into the bank and tell them you’ve been speaking to someone on the phone, they shouldn’t say ‘you’ve got to go back through the call centre, because I’ve got no idea what you’ve been doing’. It goes-hand in-hand with open banking.”

Often the biggest challenge for traditional banks is not the customers, but maintaining a technological DNA. You can’t push the job onto the CIO or CTO any more, the full board have to be involved in technological decisions - Matthias Kröner, the Fidor Group

What is open banking?

Open banking means using open data to move towards greater transparency and ease for banking customers when they use various financial services. Open banking means that customers will be able to access all financial services in one place - whether they are looking for a loan, a mortgage, or to pay their bills.

This revolutionary idea is often tied to a piece of European Union legislation, known as the second Payment Services Directive (PSD2). PSD2 requires banks to open access to a customer’s data and information, if authorised. The desired goal for the customer is greater ease when it comes to account services and payments. For example, when buying something online, PSD2 will mean the consumer will not be redirected to Paypal in order to pay through them.

Although it is impossible to talk about open banking without mentioning PSD2, the two are not synonymous. Where PSD2 regulates how banks must act, open banking fundamentally means embracing a new mindset entirely, one which puts the customer’s needs right at the heart of banking.

What open banking will do for customers

If implemented correctly, open banking will help retail banks return to their roots as providers of financial services.

Rather than offering customers unwanted credit cards or unnecessary overdrafts, retail banks could use their platform to assemble a number of financial services and personalise them for the customer.

Take the example of buying a house. A mortgage is a product, the financial service is helping you to buy. Open banking would allow financial institutions not only to sell the customer a mortgage, but the most competitively priced one, as well as offer insights on house prices in the area, provide home insurance and find the best deal on gas and electricity. “The point is that none of these needs to have come from my bank” says Mr Paris. “What my bank has done is assemble the products and services which make sense for me.”

Banks are now presented with more opportunities than ever, and are facing an exciting future - Ian Bradbury, Fujitsu

Becoming a digital bank: Bank Leumi and Pepper

Bank Leumi, Israel’s oldest bank, was so convinced that the future of banking meant better serving customers, they were willing to spend time and money, and even cannibalise their own clientele, to create a mobile bank from scratch.

When Rakefet Russak-Aminoach joined as chief executive officer in 2012, she decided the existing digital strategy was not transformative enough. “The retail banking model - where people visit branches and consult bankers in person - is passé. Digital tools have become people’s first choice.”

They decided not simply to digitise Bank Leumi’s current operation, but to replace all of the bank’s core IT legacy systems and build their own product on a new technological platform. “We could just have created Leumi.com,” explains Ms Russak-Aminoach, “but that would have been a digital skin covering an essentially non-digital body. We believe you need a fully digital body to grant your customers the experience they deserve.”

The result was Pepper, Israel’s first mobile-only bank. Crucially, although Pepper was a new digital entity, it was built on the reputation and customer base of Bank Leumi, thus circumventing the trust issues digital banks often encounter.

“Customers have said that they would trust a tech giant like Amazon to be their bank,” says Pepper’s chief executive officer, Michal Kissos Hertzog, “but when it comes to it, many prefer a more traditional option. Luckily Pepper gets the best of both worlds, we have different people, different DNA, a different strategy, but we took our cybersecurity and our reputation from Leumi.”

What can traditional banks learn from fintechs?

What Bank Leumi and Pepper teach us is that both traditional banks and fintech companies have their strong suits, although interaction between the two has had mixed results.

Mr Paris believes the relationship has gone through three phases. The first saw traditional banks detect fintech as a threat and attempt to squash them through regulation. The second came as the banking industry recognised the true value of fintech and set out to partner with or acquire them. We are now in the third phase. “Banks realise that simply acquiring a fintech company does not solve the problem, as the relationship is still one-to-one. What is needed is for a fintech to have access to thousands of banks and vice versa.”

The question is, will traditional banks consent to learn from or work with fintechs in any real sense? Matthias Kröner, founder and former chief executive officer of the Fidor Group, one of Europe’s first digital banks, thinks not. “I don’t think a big bank corporation is culturally able to deal with innovation”, he says. “It’s a question of compliance. In order to embrace the innovation of fintechs, you need a special governance structure that allows for a fail-fast, laboratory approach. Traditional banks are too afraid of risk.”

One challenge for fintechs is keeping the innovation level high. The bigger an organisation gets, the more you have the tendency for everyone to lean back - Matthias Kröner, the Fidor Group

So what is the future of banking? It is certainly digital and, as a result, more open, more transparent, more ambitious. Most importantly, it lies in the hands of the customer. Any financial services provider looking to make it to 2030 must embrace this truth, and use all the digital and technological tools at their disposal to make their offering as customer-centric as possible.

What is digital banking?

The future of banking is digital