Managing risk in financial markets is a well-established discipline. Whether investing in equities, bonds or currencies, widely accepted practices protect market practitioners when they are buying, selling or intermediating. Risks are typically aligned into different categories, including market risk, credit risk and operational risk, and complex formulae are used to determine how much capital should be kept in reserve to absorb losses. When investing in cryptocurrencies, however, many of these traditional assumptions fall flat.

The product is still new and relatively untested, volatility is unpredictable and, with a small, albeit growing, investor base, the market is much less liquid, making it tougher to unwind positions. This doesn’t mean investors should avoid cryptocurrencies altogether, but it does necessitate a different approach to risk.

“Volatility and unpredictable liquidity are a reality of this market. Sadly, with weak governance, fraud is also a real possibility. This is compounded with new currencies proliferating at an extraordinary pace, as the barriers to entry for an initial coin offering are very low,” says Richard Longmore, managing director of capital markets consultancy Finoesis and formerly a senior manager in fixed income, currencies and commodities at UBS.

Investing in cryptocurrencies can bring huge rewards as well as risks

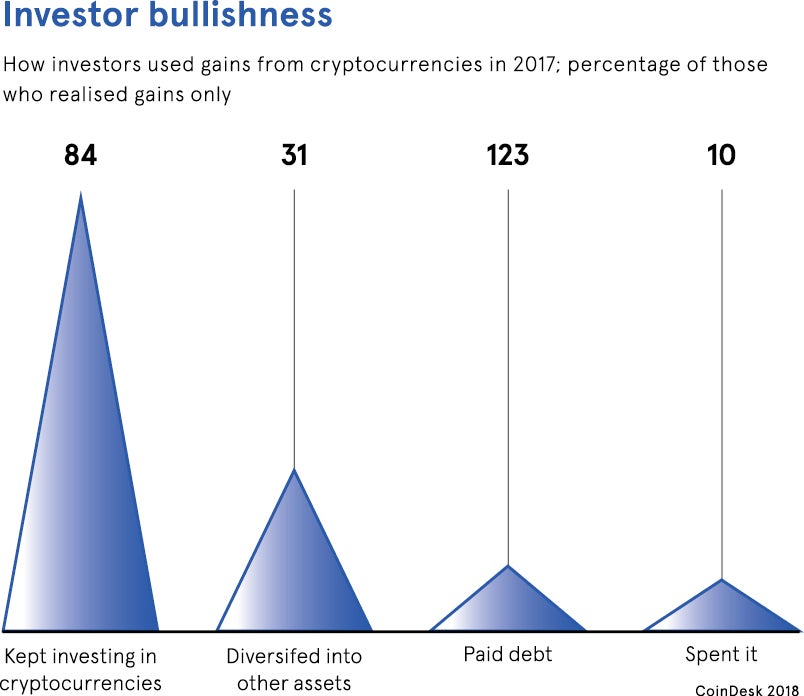

The risks may be different and tougher to manage but when investing in cryptocurriencies, as in any financial market, participants need to balance risk with reward. Following a huge spike in the value of bitcoin at the end of 2017 – it rose from $7,000 to almost $20,000 – some investors have already realised huge gains. The attractive rewards are luring new participants into the market every day, including banks, asset managers and hedge funds.

As these institutions move in, it represents a landmark shift for this emerging asset class, which had previously been largely the domain of individual day traders who had little to lose from dabbling in bitcoin. For institutions, the risks of investing in cryptocurrencies can be much greater, not least because they are typically managing money on behalf of others.

“Mark-to-market considerations are clearly a large issue for institutional investors. Volatility in these currencies is a given and thus the danger of stop losses triggered in a wild ride is ever present,” says Mr Longmore.

“Consider also know-your-customer and anti-money laundering requirements. Being what they are, cryptos present enormous difficulties. An individual investor might not have too many concerns, but an institutional investor runs considerable risks from both a reputational viewpoint and from possible sanctions.”

While volatility has eased since the end of last year, the epic move in bitcoin has increased risk appetite both for existing and newer participants, with the realisation that even just a modest exposure to cryptocurrencies could turn out to be lucrative.

Illiquidity is a major risk when investing in cryptocurrencies

Even if only investing a small proportion of the portfolio in cryptocurrencies, however, investors should be mindful of the risks they face. Every practitioner will have an opinion on what the biggest risk may be, but few would contest that the illiquidity of crypto assets is one of the toughest risks to manage.

It is a reality in any emerging asset class that until participation becomes mainstream and widespread, liquidity is likely to be unpredictable. This means that while it may be easy to take on a position and buy into a currency, it can be much harder to unwind, particularly at times when the market is under stress and prices are plummeting.

Simon Tobler, head of trading at Swiss startup Crypto Finance AG, likens investing in cryptocurrencies to trading currencies such as the Argentine peso or Thai baht in which there is far less turnover and lower liquidity than in major currencies. Before joining Crypto Finance, which provides asset management, brokerage and storage for crypto assets, he traded foreign exchange options at Credit Suisse.

Mr Tobler says: “Bitcoin trades more like emerging market currencies than the majors, because it is highly illiquid with few big market makers and no corporate flow. The illiquidity leads to sharp intraday moves, and makes it difficult to manage your risks and adjust your positions in real time.”

If the market continues to attract new participants, liquidity should improve, but this will take time, particularly for institutions that must secure multiple approvals to trade new products. Even then, their participation is likely to be modest at first.

“Liquidity is increasing,” says Gabriel Wang, analyst at research and advisory firm Aite Group. “As the market cap of cryptos is rising fairly quickly, market makers, exchanges and over-the-counter desks continue to pop up in the market, and the current market size has attracted more and more institutional interest and order flow. This is driving up liquidity and trading volume.”

Investors must be aware of regulatory risk

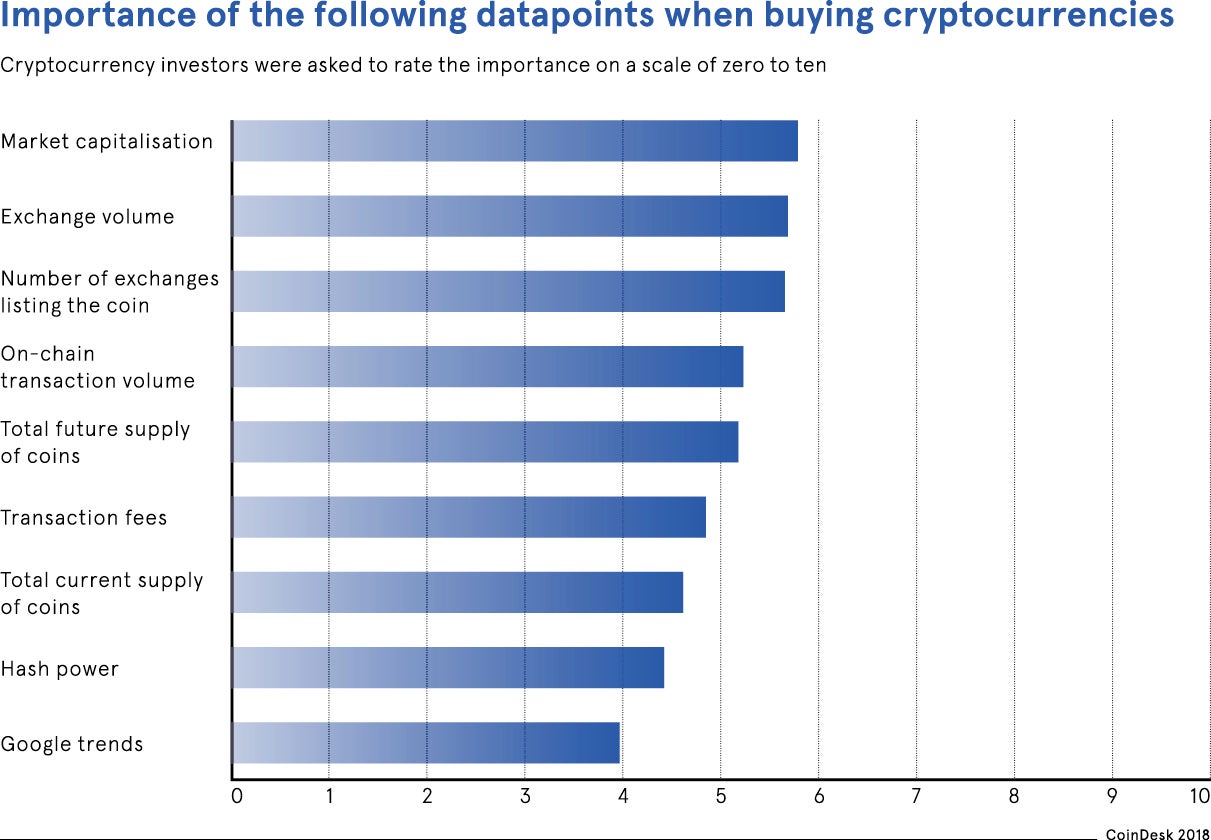

Beyond liquidity, more idiosyncratic risks should be considered. In a market that is still developing, there are legitimate concerns over the potential for fraud and market manipulation, so investors must take necessary precautions. More established assets such as bitcoin or ethereum may be a safer bet than the newer coins, for example.

Regulatory risk is also important, as central banks and regulators around the world have taken very different stances on this evolving asset class. In China, for example, exchanges and financial institutions have been banned from handling crypto assets. While officials in other countries may have been less heavy handed, with most central banks keeping a close watch on the sector, further intervention is always possible.

“Political and regulatory risk has declined as this space has become more accepted, but investors should certainly be careful when investing in the newer coins because there is a risk of sudden discontinuation or regulatory intervention,” warns Mr Tobler.

Managing this unique combination of risks is not straightforward. Whereas standard practice in financial markets would be to model key risks and set aside capital for a worst-case scenario, these idiosyncratic risks are much more difficult to measure and manage when investing in cryptocurrencies.

Investing in cryptos: little downside but potentially unlimited upside

When investing in a high-risk asset class, investors would typically diversify across multiple products, but this approach is difficult in the crypto world as most coins are very highly correlated as they tend to move in the same direction. Diversification, therefore, offers little protection in the event of a sudden price move.

“Due diligence is always advised, but in the world of cryptocurrencies, the level required, given the landscape, is exponentially higher and more difficult. A mindset change is required not only from the requirements of a considerably more volatile and illiquid market, but given its extraordinary speed of evolution,” says Mr Longmore.

The most prudent approach for new investors might be to hold just a very small proportion of their portfolio in cryptocurrencies

Given the unpredictability of risk and the potential for high returns, the most prudent approach for new investors might be to hold just a very small proportion of their portfolio in cryptocurrencies. This would give some exposure without excessive risk as the market continues to mature.

“By the end of 2017, a lot of portfolio managers had to explain to their clients why they had only achieved single-digit returns in traditional asset classes, while some crypto funds had earned up to 2,000 per cent from recent volatility. There is ultimately little downside from investing 1 per cent of the portfolio in cryptocurrencies, but the potential upside is almost unlimited,” Mr Tobler concludes.

Investing in cryptocurrencies can bring huge rewards as well as risks