China remains a one-party state, but the country’s communist rulers are embracing capitalism with caveats and restrictions.

China has a reputation for disregarding copyright and human rights abuses. However, it also has an appetite for acquisitions, and generally plenty of money to invest in Western property and technology.

“We are seeing a lot of cash,” says Salmaan Khawaja, a director in Grant Thornton’s corporate finance team and an expert on Chinese mergers and acquisitions (M&A).

China’s State Council is promoting the Silk Road Economic Belt and the 21st-century Maritime Silk Road, better known as the Belt and Road Initiative.

This is a development strategy, proposed by China’s President Xi Jinping, which focuses on connectivity and co-operation between Asian and European countries. It underlines China’s push to play a central role in global affairs with a trading network centred on Beijing.

It was also promoted by Premier Li Keqiang during visits to Asia and Europe, and the most frequently mentioned concept in China’s People’s Daily in 2016. Attention has focused mainly on infrastructure investment, construction materials, railways and highways, automotive, property, power transmission systems, and iron and steel.

Mark Collin, group director of ventures at ThoughtWorks, a global technology consultancy, says the broad picture is “a demand for British brands, products and European luxury from increasingly wealthy Chinese consumers”.

According to Josh Wong, a partner in London-based Signature Litigation, the Chinese “have a fascination with British brands and many have been successful in China, but not all investments have worked”.

He cites the failed Bright Foods Shanghai investment in UK cereal brand Weetabix. Bright Foods sold its holding to a US buyer.

However, Mr Wong believes that Chinese people retain a high regard for British culture, education and business. “Jane Austen’s novels and books about Sherlock Holmes’ adventures are incredibly popular in China. They reinforce the image of Britain as a country where people act in a genteel fashion and with integrity,” he says.

There are challenges for branding experts, but the opportunities may far exceed the problems, as Mr Collin explains: “A wide range of Chinese investors are seeking UK opportunities, with Farfetch and Skyscanner being notable success stories. Huge investments are being played out by Baidu, Alibaba and Tencent, which are snapping up all or significant portions of UK companies.

“Also there is a thirst for investment from boutique Chinese investment funds in fintech, advanced manufacturing companies and internet of things-based businesses.”

The UK Department for International Trade and China-Britain Business Council, as well as UK and Chinese delegations, are powering tech investors, including Jeneration Capital, Bluepool, Capital and SILK Ventures.

In addition, startup investors are racing to get a foothold and UK-based funds, such as GP BullHound, are responding to a burgeoning flow of money into the UK by creating initiatives to connect investment with opportunities.

Technology is a key sector which the Chinese and other Asian investors are concentrating on, according to Paul-Noël Guély, managing partner at Arma Partners, an independent corporate finance and M&A advisory firm focused on global communications, media and technology.

Transcontinental transactions have become increasingly commonplace as the communications, media and technology sector continues its decentralisation away from its centre of gravity in Silicon Valley

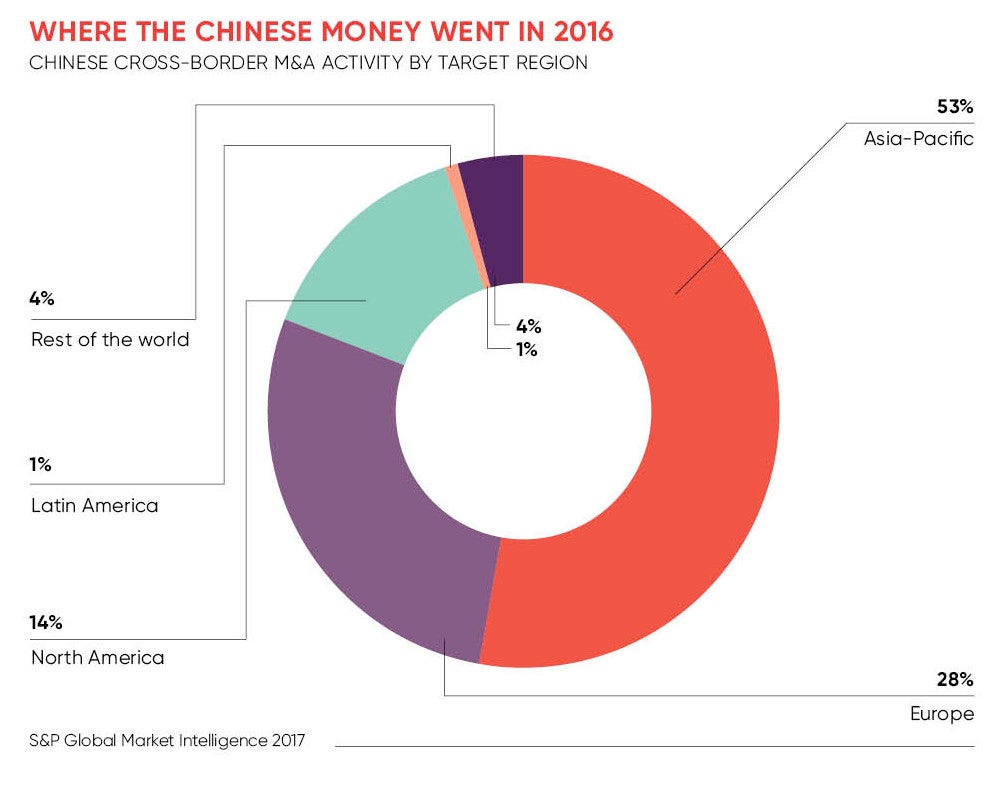

“The growth in cross-border M&A activity by Chinese and other Asian investors has been particularly prominent in the communications, media and technology sector,” he says. “Transcontinental transactions have become increasingly commonplace as the sector continues its decentralisation away from its centre of gravity in Silicon Valley to a far more diverse range of geographies.

“A whole constellation of factors explains Chinese and other Asian acquirers’ growing interest in overseas tech assets. These range from the gradual movement in Japanese corporate culture towards viewing acquisitive growth as a legitimate and important means of creating value for shareholders.”

But in spite of the opportunities, there are still barriers which must be overcome. “Chinese companies, not unlike those of other countries that have moved into innovation in past economic cycles, have been perceived as copycats,” says Jon Calvert, chief executive of ClearViewIP. He claims they have shown little respect for the intellectual property rights of third parties and the legal frameworks that enforce them.

So Western travellers along the Silk Road are likely to meet Chinese companies keen on investing in them. But to prosper, they must conquer the challenges along the way.