Cryptocurrency investments have had a spectacular year of growth which has thrust them into the mainstream. To accelerate the next wave of growth, however, the industry needs more education and products that look familiar to users of traditional financial instruments.

Cryptocurrency investments have had a spectacular year of growth which has thrust them into the mainstream. To accelerate the next wave of growth, however, the industry needs more education and products that look familiar to users of traditional financial instruments.

Already, on the heels of a remarkable 2017, the asset class has shown signs of growing legitimacy as large, familiar institutions become involved.

For instance, Goldman Sachs launched its own cryptocurrency trading desk earlier this year; Japanese bank Nomura announced a venture to explore a custody solution for bitcoin; and some large investors ventured into bitcoin exposure last year such as commodity fund Old Mutual Gold & Silver.

But what are these investors getting involved in?

Each cryptocurrency network offers unique functionality, built for different end-uses. Investors can buy and exchange the core ‘tokens’ of these networks (critical to network operation), with the exchange happening much like traditional currencies; this exchange market forms the basis for investing in the crypto-asset class. But, unlike traditional currencies or most other tradeable assets, cryptocurrencies are outside the control of any single entity, central banks and financial institutions included.

As a result, policymakers around the world are still challenged to fit cryptos within current legal and regulatory frameworks. Despite controversy around the use-cases and lack of clarity from some jurisdictions, the growing crypto-finance industry has pressed forward in both infrastructure and popularity; and in some cases, the industry has managed to package the new assets in a familiar format for investors.

For instance, in June 2017 one of the UK’s largest brokerages began offering access to bitcoin exposure through XBT Provider’s exchange-traded product (ETP) listed on Nasdaq in Stockholm; and subsequently, they followed with access to an Ether-tracking ETP later in the year.

The ETPs, Bitcoin Tracker Euro and Ether Tracker Euro, are traded on the Nasdaq exchange in a similar manner as other legacy financial products, making it much simpler for investors to access exposure via their existing brokerage accounts.

The ETPs, Bitcoin Tracker Euro and Ether Tracker Euro, are traded on the Nasdaq exchange in a similar manner as other legacy financial products, making it much simpler for investors to access exposure via their existing brokerage accounts.

The response was enormous, with assets under management by CoinShares, the parent company to XBT Provider, rising from $20 million to almost $1.7 billion by the end of 2017.

Products like ETPs and index products, and infrastructure such as custody solutions, all help the crypto-investment evolution move from a nascent retail market to one where family offices, hedge funds and institutional investors can invest. True, any asset class that is only ten years’ old will take time to find acceptance by institutions, but that time can be reduced if the industry can create products that look and operate in a familiar manner.

For instance, our ETPs are ultimately supported by buying the underlying assets within the rules presented in the prospectus and based on terms approved by the exchange. As a result, investors can rely on the brokers who trade on the exchange and with whom they are already familiar.

This familiar path via a known vehicle type offers bridges for the trillions of dollars of available investment capital to enter the crypto market. With more capital, you have more liquidity to aid in the continued growth of both the technology and asset markets. Notably, to date there are no other publicly traded products like ETPs available for traditional investors.

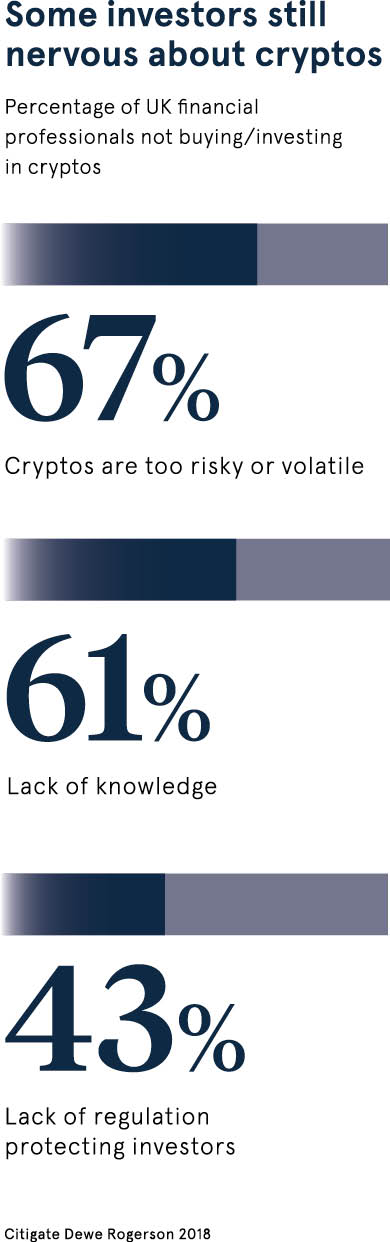

Investors are still wary of volatility, despite this volatility being natural for a still-emerging asset

Investors have thus far been attracted to cryptos for their substantial outperformance, which has come with very low correlation to other assets. This means they have proven to be excellent tools for diversifying a larger portfolio. However, investors are still wary of volatility, despite this volatility being natural for a still-emerging asset.

Investors are also still wrangling with questions about the fundamental value of an asset that has no physical form. However, the main strength of cryptos is in fact that they are digital with no link to the physical world. So asking about a crypto assets’ tangible or physical value is an old, analogue conversation carrying rhetoric from a world that was not digitally driven. Perhaps a key challenge in professionalising the asset class is to retrofit terminology that we’ve used in analogue assets to enhance understanding by existing players. Time will help.

Looking ahead to the next 12 months, one potential big development for cryptos as an asset will be sovereign wealth funds adding them to portfolios, and nations and non-profit organisations employing them for humanitarian purposes. Organisations that cannot get dollars into places like Venezuela or Africa due to economic blockades could start to use crypto networks to move assets outside the existing system, without the need for permission from a central authority and without the ability for corrupt actors to misdirect the funds.

When respected organisations are leveraging the core features of these networks for good, that’s when the world will truly take notice of how powerful this paradigm shift really is – and that moment is rapidly approaching.