Open banking has shaken up the retail banking sector. Ever since the initiative came into force in 2018, fintech firms have been able to make direct connections with consumer accounts and use banking data to power a new wave of slick, highly tailored financial products. But what about corporate customers? How do they stand to benefit from the innovation and competition that stems from open banking?

“Much has been made of the opportunity open banking creates for retail customers,” says Michael Bridgman, group product manager at GoCardless, which helps businesses collect recurring payments from customers. “In fact, corporates are likely to enjoy at least as many benefits. In some sense, the impact will be similar to consumers: speed and ease of receiving credit will be improved, expense management and classification will be faster and more automated, and instant and consistent visibility on cash positions globally.”

Open banking in both the retail and corporate sector is underpinned by application programming interfaces (APIs) that allow different organisations’ computers to exchange information. These APIs expose a range of data to third-party financial service solution providers, enabling them to build products and services that are highly tailored to specific needs. In addition, they also allow customers to authorise payments directly with a third party, rather than having to engage directly with their bank account.

In essence, this means “corporate customers can access best-of-breed solutions and integrate them into their operations effectively and efficiently”, says Mike Hampson, chief executive of Bishopsgate Financial, a UK-based consultancy specialising in change management within the financial sector. “Tighter integration means more efficient payment processes and better management of working capital.”

Connecting seamlessly

Additionally, open banking could help corporates to connect seamlessly with their end-customers. Simon Lyons, head of ecosystem engagement at the Open Banking Implementation Entity, offers an example of how this might work in practice. “Typically, there has always been a barrier between some high-volume corporates – such as utilities, government, credit cards, insurance and wealth managers – and their customers when it comes to collecting payments outside the traditional methods [like] direct debit,” he says.

“Open-banking technology can remove this barrier entirely, and enable corporate customers to prepare a payment for a client in advance, which makes later reconciliation much easier and simpler.”

In other words, open banking supports a shift from the pull-based authorisation model of direct debit to a push-based one initiated by the consumer upon receiving a request for payment. This allows organisations to collect large, variable payments with less risk of failure due to insufficient funds in the customer’s account.

Some financial services firms are already providing additional value-added services on the back of access to open banking data. “For instance, Mastercard is partnering with a fintech, Cardlay, to unlock corporate card data to provide automated expense management and VAT claim processes to their commercial clients,” says Kanika Hope, global strategic business development director at Temenos, a leading provider of enterprise software for financial institutions.

The benefits of tighter integration between bank and corporate customer systems are particularly notable when it comes to enterprise resource planning (ERP). “Open banking enables real-time integration between the corporate’s ERP and treasury systems and the bank, greatly enhancing visibility for both the bank and the corporate treasury,” says Hope.

“Banks can use it to access accounts payable and receivable data in real time from their corporate clients allowing them to make better-informed credit decisions and accordingly tailor their propositions to the corporate’s specific business context, proactively offering appropriate hedging and other working capital products.”

Faster loans, less fraud

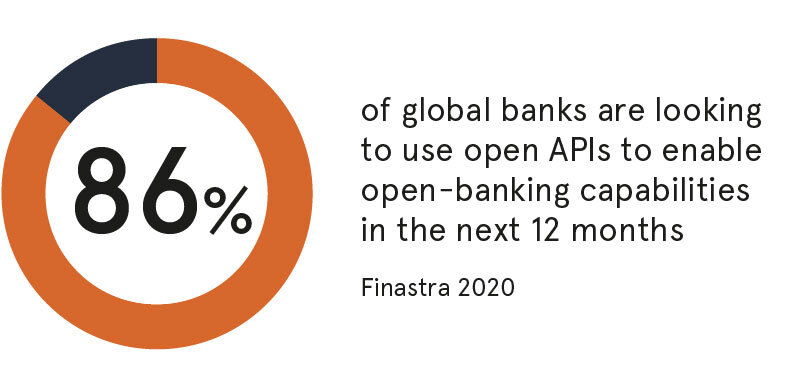

In the case of loans, open banking will reduce application and approval times, while also reducing fraud risk, says Paul Thomalla, global head of payments at Finastra. “With the right data security in place as mandated by PSD2 [EU Payment Services Directive], businesses applying for finance can see their application time reduced from days to hours, as they will no longer need to source paper bank statements.”

Furthermore, corporates that integrate their ERP system with the bank can also use workflows and alerts to control access and user actions, and remove the risks of fraud and error associated with manual extraction of files from an ERP, adds Thomalla.

Open banking also allows treasurers to view all a company’s accounts from one dashboard, giving them a real-time view of cash flow and liquidity across the business. “Multiple bank accounts could be normalised and aggregated, giving individuals an up-to-date view of multiple bank accounts in multiple currencies [where open banking is supported] and allowing them to transfer funds between accounts while maintaining a complete view of their daily finances,” says Bridgman.

Open banking encourages greater collaboration between financial institutions and fintechs, which enables the whole industry to be more innovative

The ability to initiate payments securely from within the ERP system is another major benefit for corporates. “Combining the ability to make payments with ERP supplier management functionality will provide a single source of truth for everything from supplier procurement to payment fulfilment,” Bridgman explains.

In terms of accounts receivable, API integrations between banks and ERPs will give corporates the ability to track all payments accurately into the business in real time, doing away with the need for end-of-day statements, a further big win when it comes to streamlining financial processes.

Ultimately, open banking encourages greater collaboration between financial institutions and fintechs, which enables the whole industry to be more innovative, says Thomalla. And it’s something that now stands to benefit corporate customers just as much as retail consumers.

To find out more, read Resilience in Financial Services