Get this: “Hello! I am in need your help with a substantial business transaction. I am offer you a share of $10 million held in a foreign account and only to be released into a UK account. Please to be sending me your bank details for excellent business. This is a genuine offer! Blessings!”

You can spot it’s a scam, right? But while most of us can recognise an unknown princeling’s email as a con, it seems we struggle in other areas. Crypto is the latest tool to hand for the scammers; more than £87,000 is lost to binary options scams every day in the UK, according to figures from the Financial Conduct Authority (FCA), and the amount is rising.

“This is an incredibly raw market,” says Fred Ellis, intelligence analyst and financial investigator with City of London Police. “The underlying technology is sound, but a lot of companies that in any other walk of life wouldn’t get looked at twice are selling on the back of bitcoin’s reputation.”

Digital technology opens the door for a new style of fraudster

Financial scams are, of course, as old as time. From tulips to penny stocks, many people have lost a great deal of money to silver-tongued salesmen. Now digital technology offers tricksters a way in. Simon Taylor, founder of digital consultancy 11:FS, who also helped create Global Digital Finance, a trade body consulting on a code of conduct for crypto assets, says: “A lot of people are not digitally literate and that creates a lot of vulnerability.”

Interestingly, initial coin offerings (ICOs), the means by which crypto companies raise money, are changing the age profile of investment scam victims, as much of the hype around crypto happens on social media. According to the FCA, under-25s were six times more likely to trust an investment offer they received via social media compared with over-55s.

This year has seen an explosion in ICOs, which raised $11.8 billion in the first five months of 2018, more than double the $5.5 billion such offerings raised in all of 2017, according to The Wall Street Journal analysis of nearly 900 offerings listed on ICOBench.com.

“It is similar to the investment boom in Latin America in the 1820s,” says Charlie Hayter, chief executive of Cryptocompare, which charts prices and data from global crypto exchanges. “It’s as if a whole new region of the world is opening up. This new form of digital birth certificate that exists anywhere and any time is a revolutionary concept transcending global boundaries and has rapidly increased the ability to move capital, but you have to be incredibly careful.”

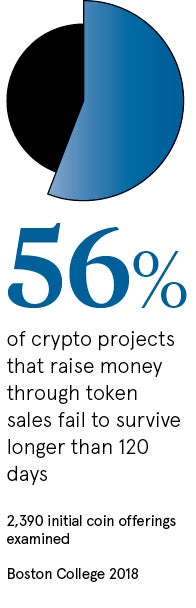

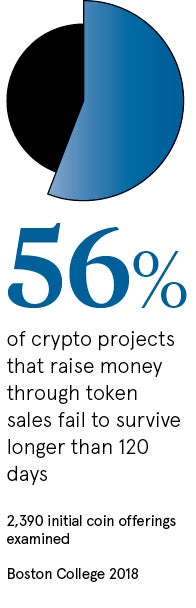

In this new market, many ICOs may fail

The fact that some ICOs are scams does not, of course, mean that all are, but when a market is this new, many products will fail.

“Some ICOs are launched by people who are not used to dealing with this kind of money, but suddenly find themselves holding $10 million from Pakistan,” says Mr Ellis. “They may not be fraudulent, but if the product fails they still have the money.”

It can be impossible to distinguish between the good, the fraudulent, the well intentioned, whose skills may not be up to making a brilliant idea work, and the just plain incompetent. With absolutely no investor protection or regulation, it is up to investors to do their homework.

The first and most important piece of advice is not to invest anything you are not prepared to lose; there is no safety net here. Key to success is the people involved.

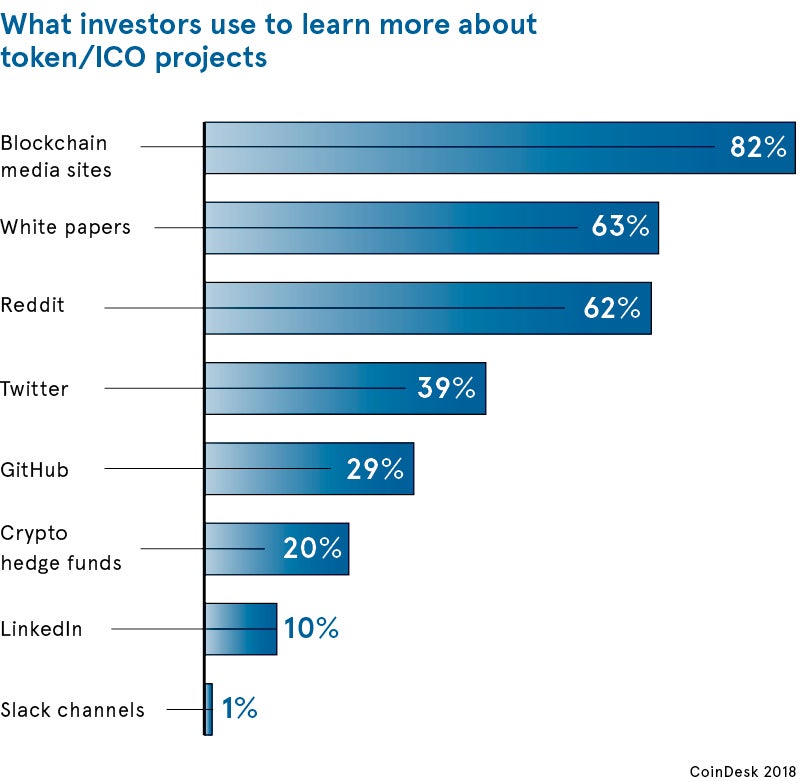

“Look at the core people in the team,” says Mr Hayter. “It needs more than an icon heading it up. You need to go beyond social media, which is just noise, to find out about the team.”

But don’t take anything on face value, as scammers have been known to impersonate key crypto figures, so check when social media accounts were created. Search out the forums that exist to discuss crypto and make sure you understand token economics and the process; check out the Action Fraud or FCA’s scamsmart website as well.

“You’re walking around the net with a briefcase full of cash and need to understand how to protect yourself,” says Mr Taylor. “Get educated about the process; for example, do you understand how to ‘lock’ your briefcase?”

If you don’t understand: don’t buy

Most ICOs rely on a white paper to sell their pitch; read it very closely. “It will often focus on a problem, but not give any details about how it will solve the problem,” says Mr Ellis.

In fact, read lots of white papers, since the scammers often simply cut and paste. Don’t be fooled by jargon or a “buzzword salad”; if you don’t understand it, don’t buy. White papers should be concise and easy to read, and any that make promises of big returns, particularly alongside pictures of fast cars and luxury watches, need even more careful scrutiny.

Remember the oldest line in the rulebook: if it looks too good to be true, it is

Make sure the team is happy to undergo an audit, both of their white paper and their code as transparency and openness are a sign of good intent. Are they making an effort to comply with standard investment regulations, such as know your customer, even though there is no legal necessity to do so?

Ultimately, normal investment rules apply. Until you know your personal investment goals, your risk appetite, how long you plan to invest and what level of profit or loss you are happy to accept, you should not be putting money on the line. Don’t buy what you don’t understand and remember the oldest line in the rulebook: if it looks too good to be true, it is. No matter what the unknown princeling says.

Digital technology opens the door for a new style of fraudster