There will come a time in the not-too-distant future when bankers around the world will look back and see this moment as a turning point in trade finance.

Hardly a day goes by when there isn’t a fresh example of blockchain, or distributed ledger technology, used on a new deal, whether it’s transporting iron or soybeans, trading in yuan or dollars, moving goods from China or Argentina. A full proposition, a commercially acceptable model, is tantalisingly close.

The aim of this bit of fintech is to disrupt an archaic paper-based and bureaucratic business. The fact is, cross-border settlements and financing transactions are based on an inefficient and clunky model, which has changed little in decades. And the prize is of untold riches: a slice of the $16-trillion market for global trade.

“Pilots have shown the value a blockchain platform can deliver to the entire ecosystem. We know the technology works well and we’re extremely keen to see a shift from industry pilots to widespread commercialisation next year,” says Vinay Mendonca, global head of trade products and propositions at HSBC.

What blockchain could really do for trade finance

The focus is on reducing friction and cost, boosting speed and increasing the transparency of cross-border trade with digitised accounts on a distributed ledger. The technology, also called DLT, can now be used to settle a letter of credit in a few hours compared with ten days via the old system.

If used effectively, the tech could unlock what the International Chamber of Commerce (ICC) has identified as a potential $1.5-trillion opportunity gap in global trade finance. This is where deals, which don’t get funded because of a lack of trust, transparency, funding or opportunity, start to flow.

“Increasing numbers of banks and global corporates have grasped the fact that digitalising bills of lading, letters of credit and bank guarantees gives them huge efficiencies and greater security. This is especially true in South Asia and the Far East,” explains Andrew Raymond, chief executive of Bolero.

“Consignments will not sit in ports incurring huge penalties because of delays in updating and transferring bills of lading to confirm rightful ownership. Sellers will get paid much faster, transforming their use of working capital. Opportunities for fraud will hugely reduce, while back-office automation in drafting documents will slash overheads.”

It sounds like a global trading utopia, created with a wave of the magical blockchain wand. Yet industry has yet to see a real breakthrough moment that makes everyone scramble to get on board. There are barriers to widespread adoption within trade finance. If it was so easy to unseat this stubbornly paper-based system, it would have happened by now. A shift in mindset and the status quo is sorely needed.

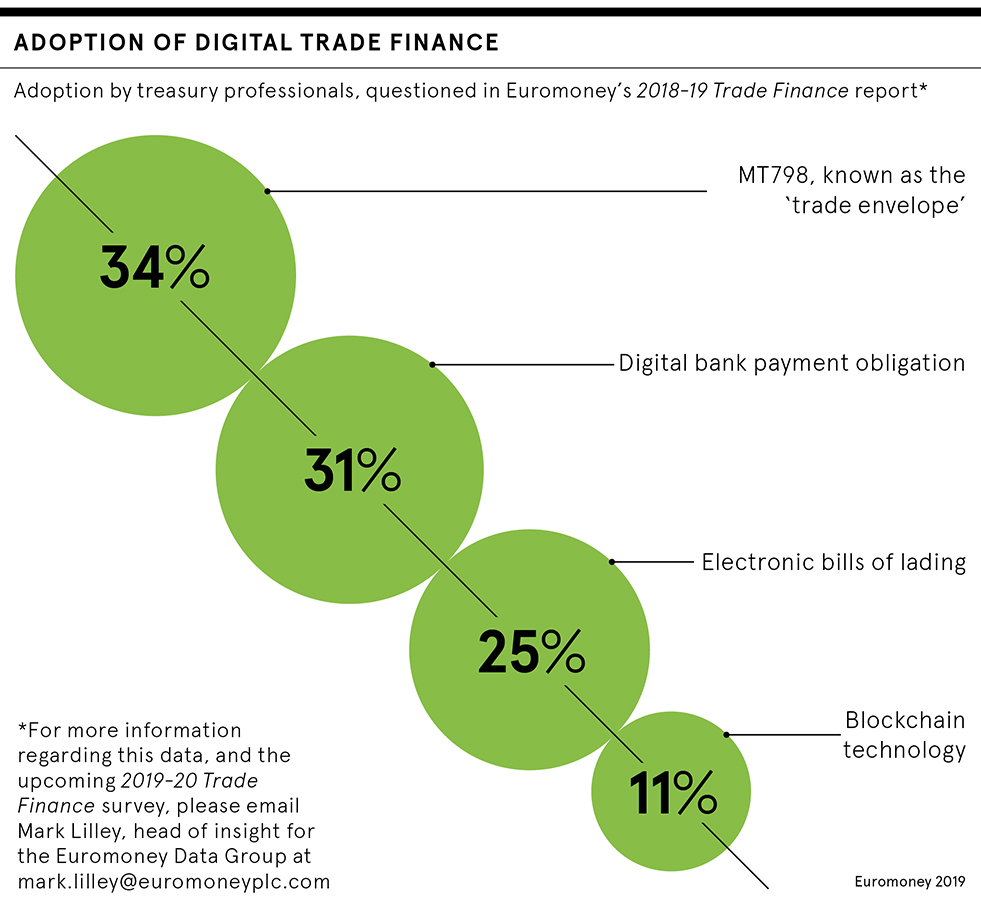

“Blockchain scalability levels are increasing, but it hasn’t reached mass adoption. When it comes to DLT, many firms aren’t ready to invest, according to a survey we conducted,” says Ed Thurman, head of global transaction banking at Lloyds Bank Commercial Banking.

What are the challenges of using DLT?

Regulation is another challenging area. Legislation is generally slower to adapt to a changing landscape in age-old industries; supply chain finance is no different. In addition, there’s a need for global business standards when it comes to data structures and agreed digital documents, which the ICC is looking into.

“Part of the issue is also building sound internal business cases to implement this technology. Many trade finance and trade credit functions within an organisation are not necessarily the highest priority right now,” says Saleem Khan, global leader of data innovation at Dun & Bradstreet.

Yet there’s a huge number of consortia, banks, and blockchain and tech companies getting in on the act, with rallying calls for there to be a more unified approach. Global trade partners, whether they’re financial institutions, shipping companies, large corporations or logistics firms, will all need to talk the same digital language if they’re to succeed. Tech interoperability is a key phrase, otherwise there will be no efficiencies.

“There cannot be too many platforms, as the main constraint we face is the network effect. You need to be able to reach a very large number of banks and corporates for the platform to be useful,” Baptiste Audren, head of fintech at Komgo, points out.

There are also security and privacy concerns. “Even if digital certificates for each transaction are anonymised, in a small network of users it can be easy to identify participants by analysing the transaction flow,” says Kuangyi Wei, executive director of growth and strategy at Parker Fitzgerald.

“Technological solutions are possible, although they could also reduce the benefit of using DLT by slowing the clearing of transactions or reducing the ability to confirm the veracity of information on the ledger.”

Looking forward to blockchain benefits

Despite any hiccups, there’s a lot of optimism among financial services providers that blockchain will eventually conquer trade finance and usher in a new digitally driven era of decentralised records. It’s not a matter of if, but when.

“The next step is to ensure low barriers of entry for clients and banks with access to tech interfaces or APIs [application programming interfaces] that allow customers and banks to easily connect to blockchain platforms. Additionally, low fees and on-boarding charges for the use of such platforms will accelerate adoption,” says Mr Mendonca at HSBC, the world’s biggest player in trade finance.

“The next step is for clients to move their ongoing flows on to the platform. We’re working with many to normalise that process and expect to see an increased flow from them in 2020. In parallel, we continue to see an increasing rate of first-time adopters.”

Faster, cheaper, less opaque trading aren’t the only benefits, as digital ledgers will give an immutable source of truth on all trade deals. This has huge implications for creating more sustainable and low-carbon supply chains in the midst of the climate crisis.

“Thanks to big data, we now have access to a generous source of information on environmental, social and governance items that, if leveraged correctly, could help meet sustainable development goals. The opportunities are incredible and endless,” Charley Cooper, managing director at blockchain firm R3, concludes.