When he was chancellor of the exchequer in 2014, George Osborne pronounced that the UK would become the global capital of fintech. The industry concerned – the digital-first, innovative technology companies serving the financial services industry – thereby secured a place on the Conservative party’s policy agenda.

Osborne then launched independent membership organisation Innovate Finance to represent the UK fintech community at Canary Wharf’s Level 39 co-working space in London’s Docklands.

The Treasury began to host leading regulators from the Financial Conduct Authority and chief innovation officers from Britain’s largest banks to mingle at 11 Downing Street with the founders and chief executives of what are now well-known UK fintech brands, such as Starling Bank and Monzo.

However, this was a world before Brexit directed the UK government’s attention elsewhere and coronavirus became a pandemic to throw personal lives and the viability of businesses all around the world into turmoil.

What was covered in the fintech review?

Fintech as a concept is about using innovative business models and emerging technology to provide progressive financial products to help support personal lives and businesses. In 2020, with COVID-19 subjecting most of the country to lockdown, the UK government launched a six-month independent review of the country’s financial technology sector, citing it as “vital” to the UK’s economic recovery.

Announced in chancellor Rishi Sunak’s debut budget in March, but launched in July due to COVD-related delays, the Fintech Strategic Review is being led by Ron Kalifa, a former chief executive of international payment processing company Worldpay. It aims to identify priorities for regulators and policymakers, as well as for the industry itself.

The review has five workstreams: skills and talent; capital funding and investment; national connectivity; policy and regulation; and international attractiveness and competitiveness.

Its report will provide recommendations on each workstream and address three objectives of ensuring UK fintech has “the resources to grow and succeed”, encouraging “widespread adoption of fintech solutions” and “maintaining and advancing the UK’s international reputation”.

Anne Boden, founder and chief executive of UK challenger bank Starling, is participating in the review’s national connectivity workstream, which will make recommendations for supporting the growth of regional fintech initiatives through improvement of regional connectivity and leveraging the strengths of other fintech hubs.

“The review provides the sector with a crucial opportunity to be heard at the highest levels. I really hope the government is listening. At a time of great economic uncertainty, the UK’s thriving fintech sector is driving innovation and economic activity. My hope is that the review will ensure fintech is front and centre of the government’s thinking on business and trade policies,” says Boden.

How major players see the future of fintech

UK fintech unicorn OakNorth is a bank for small and medium-sized companies that provides business and property loans. It is participating in four of the five pillars of the review. Head of regulatory affairs Nick Lee says: “The UK fintech sector has been very successful over the last five years, but it is imperative that we don’t rest on our laurels and instead work to ensure we can remain a world leader for the next decade and beyond.

“COVID-19 has highlighted the strength of the fintech sector as the world economy increasingly makes a structural shift to become more digitalised. There have been countless examples over the last several months of fintechs providing the solutions to many of the challenges arising from the pandemic.”

Jamie Campbell, co-founder of Fronted, a recently founded UK fintech aimed at the UK rental market, is equally bullish on the industry’s role in financial services and the wider UK economy.

COVID-19 has highlighted the strength of the fintech sector as the world economy increasingly becomes more digitalised

“The fintech industry is solely responsible for the improvements in the UK’s banking and financial services sector since 2008,” says Campbell. “It is, in a lot of ways, a metaphor for a new generation of finance, without it an already over-burdened crop of young people would be far worse off than their parents and excluded from a finance system not built for them.”

However, more established sector companies caution the review not to ignore the wider fintech ecosystem and ensure voices are heard beyond the cohort of startups and entrants that have appeared in the UK over the past decade.

Samir Pandiri, president of Broadridge International, which has been operating in London for more than 20 years, says: “What’s vital is that the crucial response to COVID doesn’t crowd out longer-term policy-making for economic competitiveness, and we are confident that the chancellor and the City minister understand that well. What’s critical is that clients of fintechs, large and small, make their voices heard, so it’s not just fintech firms making their own case.”

Making products that work across the UK

The importance of talent and growth outside of the capital features prominently among leading players in the fintech sector.

Jeppe Rindom, chief executive of fintech Pleo, a Danish provider of company cards to automate expense reports, with offices in London, says: “The most valuable thing this review should offer is a strategy for national connectivity to help our approach spread out of its organic hubs, which tend to be focused around existing tech hotspots in capital cities.

“There’s no point in a product that works in Shoreditch, but not in Sheffield or Manchester. If we can truly engage with audiences outside London, then I expect to see even more talent emerge, which will drive more innovation and in turn more funding and investment.”

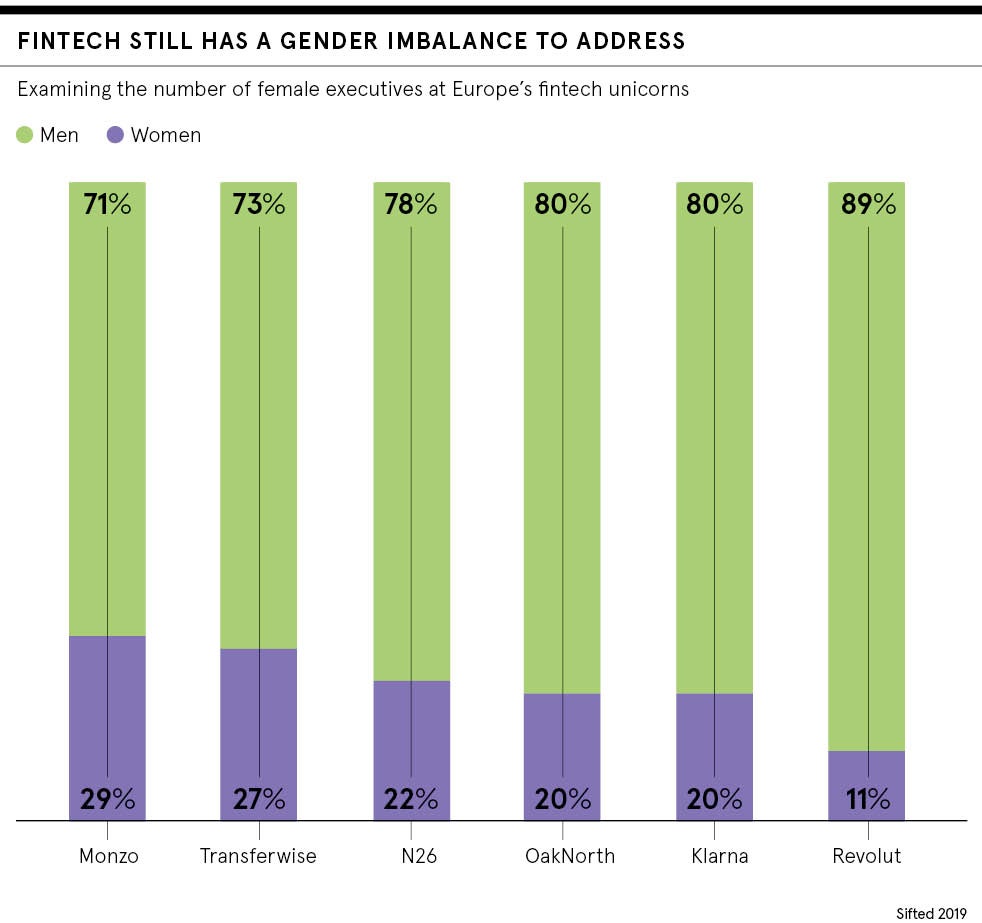

Rosie Turner, co-founder and co-chief executive of InChorus, which provides tools for human resources and employees to ensure inclusive work environments, adds: “Recent stats from Sifted show that only 17 per cent of fintech execs in the UK are women and there is a significant lack of ethnic diversity too. We consequently believe there is a firm need for the review to focus heavily on skills and talent, and to ensure greater diversity within the sector.”

OakNorth’s Lee concludes: “We must work together, government, regulators and the industry, to ensure we remove barriers to growth and create the conditions in which our fintech sector can continue to innovate, bring fresh ideas and compete effectively. If by the middle of this decade we have examples of UK fintechs that have scaled up, demonstrated consistent profitability and competed globally, we will know the strategic review has been a success.”

The Fintech Strategic Review is due to report to the Treasury at the start of 2021.

When he was chancellor of the exchequer in 2014, George Osborne pronounced that the UK would become the global capital of fintech. The industry concerned – the digital-first, innovative technology companies serving the financial services industry – thereby secured a place on the Conservative party’s policy agenda.

Osborne then launched independent membership organisation Innovate Finance to represent the UK fintech community at Canary Wharf’s Level 39 co-working space in London’s Docklands.

The Treasury began to host leading regulators from the Financial Conduct Authority and chief innovation officers from Britain’s largest banks to mingle at 11 Downing Street with the founders and chief executives of what are now well-known UK fintech brands, such as Starling Bank and Monzo.