There’s a common complaint from risk managers. Their beat covers multiple territories and in every location there is a different system. Reports are filed differently, processed differently and the data generated is different. Then the risk manager is asked to pool the data and it’s impossible.

This is a serious issue. Fragmented data means there’s limited overview. Trends can’t be identified. And it’s time consuming to deal with many local systems. The optimum solution is to move to a unified pan-European claims and incident management system so there is one system in use across the entire continent.

Willem van der Hooft, business development director of Van Ameyde, says: “We see the same issues across the board. Risk managers who are responsible for a multinational scope are facing different processes and different systems with almost no integration between them.

“Risk managers then have to spend valuable time consolidating and matching data from different sources, and in the end they have to base their risk management strategy on incomplete information.”

The optimum solution is to move to a unified pan-European claims and incident management system so there is one system in use across the entire continent

The solution? Move to Van Ameyde for claims management and standardise everything across the continent.

There are three reasons to consider doing so.

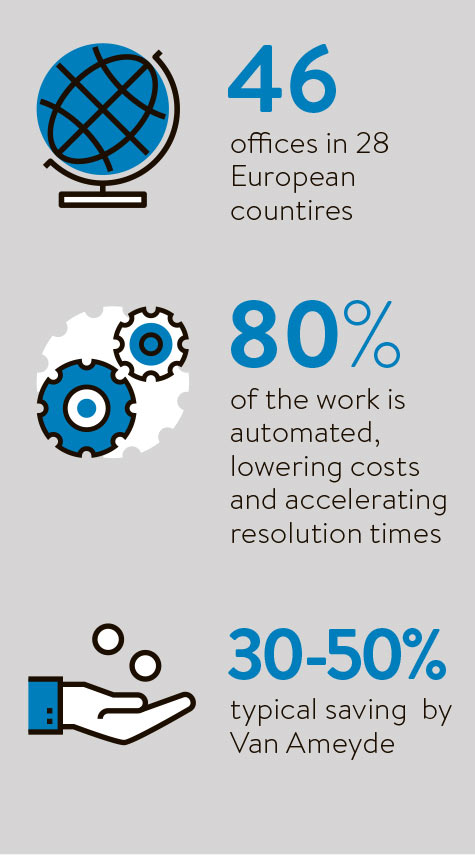

The first reason is Van Ameyde’s presence across Europe, with 46 offices in 28 European countries. A single solution can be rolled out in every territory. The nightmare of data fragmentation, multiple rival systems and unique local practices is ended.

A second big advantage is Van Ameyde’s scale of solution. Every part of the claims journey is covered, from first notification of loss and triage to recovery of uninsured losses. From this moment every step is handled by the outsourcer.

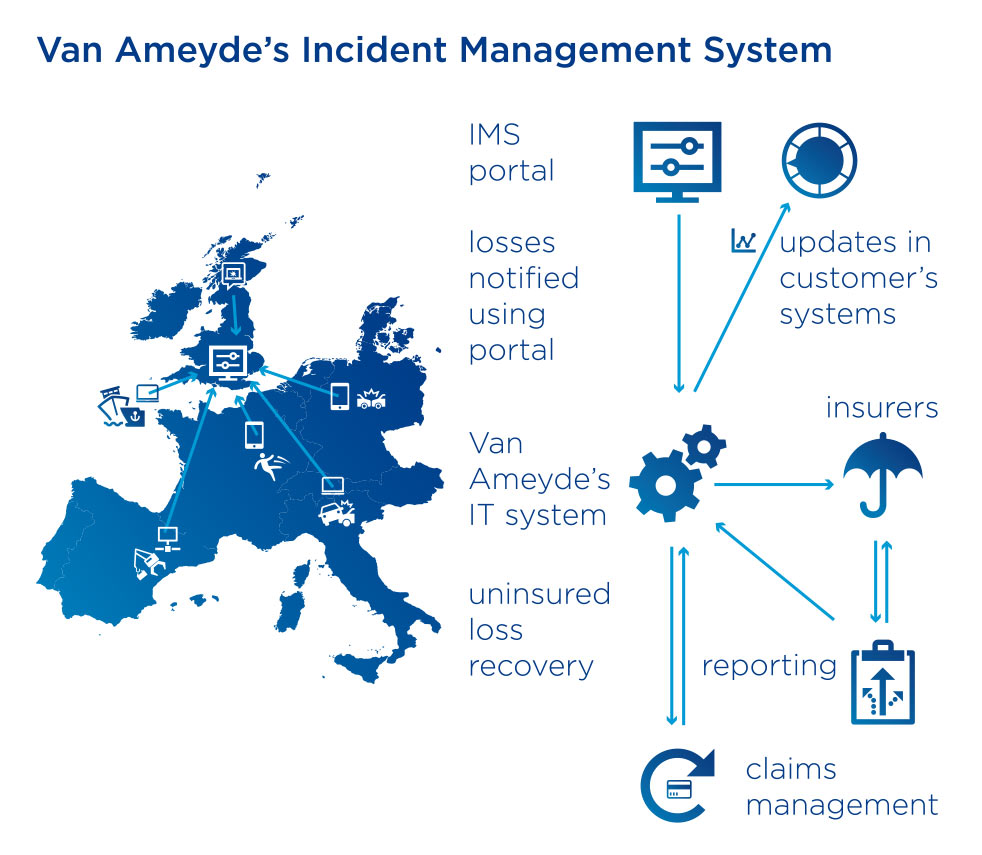

The third benefit of the deal is the advanced use of technology. Van Ameyde offers an online management system. Around 80 per cent of the work is automated, lowering costs and accelerating resolution times. Van Ameyde offers a wide variety of data analytics tools.

Mr van der Hooft stresses the advantages: “It becomes easy to identify common themes. All systems are ISAE 3402 compliant – an assurance standard compulsory for many stock market-listed firms.

“The new arrangement means managers can view pan-European data on claims in real time. Costs are down. Typically Van Ameyde enables savings of 30 to 50 per cent. And claims handling is smoother. Senior management can focus on strategy, rather than matching and consolidating data.”

The platform is ideal for large corporates in any sector. The same specifications are common across industries. There is a need for a single management system across regions, for economies of scale offered by a specialist and for an uplift in productivity derived by unifying all data so it can be analysed as a whole.

A global car rental giant offers a textbook example of how to improve incident and claims management. It worked with Van Ameyde to create a bespoke solution for its European operations. Like many corporates, the client faced difficulties with its IT systems. It had a different set-up in different locations to manage its fleets. This made it a challenge to merge data into a whole and get a unified overview.

The company moved to Van Ameyde’s Incident Management System. This online portal standardised incidents and claims across Europe. Using this new infrastructure, the client worked with Van Ameyde to identify areas for improvement, such as uninsured loss recovery.

As part of the continuous optimisation review, Van Ameyde and the client established processes to ensure quality of service delivery and cost-efficiency gains in casualty and liability claims management, and this risk has been fully entrusted to Van Ameyde.

Today, the company’s data is clear, accurate and reliable. Productivity is up, and risk assessment and detection have vastly improved. Financial planners have the data they need to make accurate reports and forecasts.

“Claims management is a really important part of insurance, as well as risk management,” says Mr van der Hooft. “Yet many companies have sub-optimal systems, resulting in lower productivity. We cover the whole of Europe with one solution which works everywhere.”

It’s not the only area where a partner can help. Van Ameyde also offers risk assessment and auditing services, which help identify risks and result in practical recommendations. The analysis will take into account the company’s unique requirements, such as its multi-office locations, supply chain, security, IT systems and compliance.

Valuation of fixed assets can be provided for the purpose of GAAP (generally accepted accounting principles) and IFRS (international financial reporting standards) or indeed insurance. Irrespective of the company’s size, risk managers can all make use of this specialist service.

Risk managers play a vital role in companies. They need the best solutions and technology available. It is essential they be given a unified pan-European reporting and claims management system. Trade doesn’t stop at borders – nor should claims management.

To find out more visit vanameyde.com or call in at Booth 85 at the Airmic 2016 conference