The insurance industry is not the only business to struggle with understanding its data. But the sheer volume of information hitting insurers’ desktops on a daily basis means it cannot ignore the importance of acting now to embrace the latest technology in order to get to grips with the issue.

Richard Brown Director VIPR

The industry faces an important question around managing delegated authorities, which have served the insurance sector well for many years, but can be hard to monitor. With delegated authorities, the underwriters “give away their pen” and allow third parties to write risks on their behalf. Such third parties, called coverholders, operate throughout the world writing business in their local markets on behalf of Lloyd’s and the company market.

Without proper controls working with delegated authorities can pose risks because of a lack of knowledge or visibility over the business. An in-depth understanding of the data produced by these coverholders is needed. Having proper systems in place not only ensures restraint over the business written, but also enables an understanding of where the risks lie and where the profits or losses are being made.

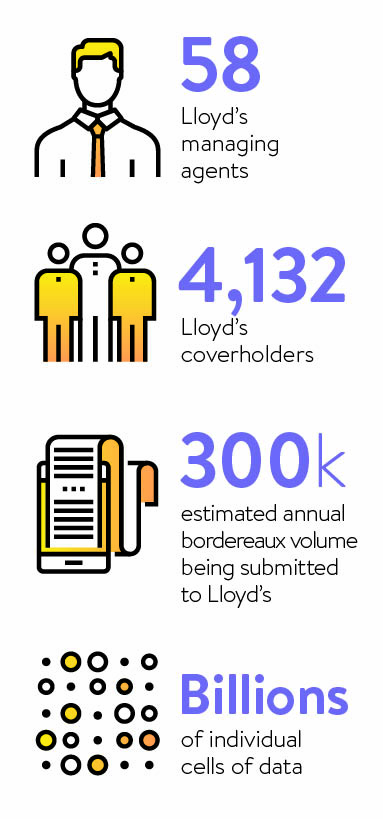

In the Lloyd’s market alone there are around 4,000 coverholders operating globally and between them they sell millions of policies annually. This means a huge amount of data is fed back to the Lloyd’s carriers, requiring extensive analysis and checking.

One of the difficulties faced is that there is currently little standardisation of this data, so it is presented to the market in multiple formats. This makes it extremely difficult to analyse and check without advanced software tools.

VIPR’s Intrali system enables data to be mapped to a common standard

Thousands of spreadsheets are being presented each month, containing information on premiums written, premiums paid and claims made. All of this needs to be cleansed, validated and checked against the contract terms to ensure that the coverholder is abiding by the agreement between itself and the insurer.

Each spreadsheet can contain thousands of rows of data with multiple columns, so a single document could contain millions of individual cells of data. It is an impossible task for the human brain to absorb and check.

Fortunately, there are now a few software solutions that can help solve this issue. VIPR’s Intrali system enables data to be mapped to a common standard, so spreadsheets can be imported into the system, and automatically cleansed, checked and formatted. As a result, data can be quickly and easily interrogated.

On its way through the system, the data can also be validated against the contract terms so that any breaches such as limit or aggregate violations can be highlighted. Now widely used in the Lloyd’s market for insurance, the system can also be applied to help any other industry cleanse, validate and standardise large sets of disorganised and non-standard data.

This detailed understanding of information not only makes sense from a business perspective, but is now essential in order to satisfy the ever-increasing oversight from regulators and to comply with the latest reporting requirements. In insurance, without using such systems, it is difficult to understand how companies will comply with the new Solvency II Pillar 3 requirements that mandate advanced and timely reporting. The requirements come into full force next January, with strong penalties for non-compliance.

This detailed understanding of information not only makes sense from a business perspective, but is now essential in order to satisfy the ever-increasing oversight from regulators and to comply with the latest reporting requirements. In insurance, without using such systems, it is difficult to understand how companies will comply with the new Solvency II Pillar 3 requirements that mandate advanced and timely reporting. The requirements come into full force next January, with strong penalties for non-compliance.

Without the right technology in place, the traditional insurers will also find themselves under increasing threat from new entrants that embrace the latest technology from the start. This will give those new entrants a leading edge in terms of understanding their business, and in creating operating efficiencies and more competitive pricing for the consumer.

A good example of this is MGAM, a new managing general agent, which has recently worked with VIPR to implement technology across the whole range of its business from bordereaux to coverholder management, accounting systems, and online quote and bind platforms.

Not only does this work give MGAM an in-depth understanding of its business, but it also now has the ability to roll out new lines of business to coverholders quickly and efficiently, in the knowledge that the proper controls are in place to manage risk.

The quote and bind solutions enable coverholders to transact business in real time, with automatic production of compliant documents including quote sheets, policy documents and endorsements. Renewals can be automated and any mid-term adjustments can be calculated at the touch of a button because all the necessary data is contained within the online system.

These changes also give comfort to the regulators that business is well controlled and everything is being carried out in a compliant manner.

The insurance market is starting to embrace technology, albeit slowly, and we believe the will is there to support these changes. Costly IT failures in the past cannot be allowed to stifle future innovation and should not be used as an excuse for inertia. Software has moved on in leaps and bounds over recent years, and processes that were challenging a few years ago can now be achieved with ease.

Ultimately, companies have to innovate in order to survive. Those that lag behind risk the same fate that befell Woolworths, Polaroid and Kodak. Change is inevitable, so companies must adapt. Businesses must embrace the new systems, not only to satisfy the regulators, but also to improve their operations and survive the onslaught of innovative competitors.

To find out more about VIPR’s solutions visit www.viprsolutions.com