Apple’s forthcoming launch of Apple Pay, the company’s contactless payment system that allows owners of an iPhone 6 or an Apple Watch to pay by touching their devices on contactless pads, has been embraced by almost everyone.

Geeks love it and the banks are totally onboard with First Direct, HSBC, NatWest, Nationwide Building Society, Royal Bank of Scotland, Santander and Ulster Bank already in place, and Bank of Scotland, Coutts, Halifax, Lloyds Bank, MBNA, M&S Bank and TSB Bank joining this autumn. The only people a bit so-so? The retailers themselves.

Marks and Spencer and Waitrose will offer the basic £20 contactless service, Tesco has no plans to formally adopt the system although stores with contactless payment facilities in place will handle Apple Pay, while Asda and Sainsbury’s won’t take payments at all.

Mobile should be at the heart of business relationships – instead most leading retailers have little idea what to do with it

Apple Pay also offers a system, using fingerprint recognition, that lets users make higher value or in-app payments without having to re-enter their credit card information or share sensitive personal details with the company. So far it’s leading-edge seamless retailers such as Argos, JD Sports, Selfridges, Ocado, Topshop and Zara who have welcomed this move.

“Mobile is retailers’ biggest channel without a strategy,” warns Danny Bride, head of retail at IBM. “It accounts for more than 50 per cent of e-commerce and it’s a way for stores to drastically reduce waiting times for customers, thereby saving a fortune.”

Mr Bride points to IBM projects with Boots to reduce queues during the store’s busiest period at lunchtime by allowing shoppers to both pay for an item and earn Boots Advantage Card points with a single wave of their smartphone. “Mobile should be at the heart of business-to-customer, business-to-employee and business-to-business relationships – instead most leading retailers have little idea what to do with it,” he says.

UK consumer retail spending on mobiles and tablets is forecast to hit £53.6 billion a year by 2024, according to research from Barclays, but only 3 per cent of retailers believe they are truly mobile-ready, while 70 per cent say they do not have a mobile-enabled website or app in place. Barclays’ research also predicted that, by 2024, 42 per cent of all retail sales will involve a mobile device at some point in the purchase decision process, from checking prices to reserving items for collection.

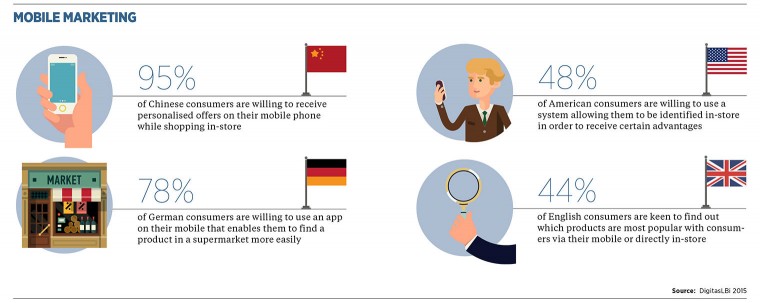

“The question every retailer should be asking themselves is what they are doing about it,” says Richard Lowe, managing director and head of retail and wholesale at Barclays. “Mobile devices offer excellent opportunities for location-based marketing, and as the supporting technology develops, it will allow retailers to pinpoint the precise location of shoppers and send personalised offers relevant to their vicinity.”

One location-based smartphone tool retailers can use to their advantage, according to Gartner analyst Van L. Baker, is the Bluetooth LE beacon. This in-store signal pulses out a data “greeting”, searching for Bluetooth-enabled smartphones. If a shopper has opted in to the retailer capturing their data, the phone replies and triggers searches on the shopper’s purchasing history and personal profile. The store then has the chance to make specific offers on the spot.

The temptation, Mr Baker warns, will be for retailers to broadcast generic promotional offers to anyone within range of the beacon, which is likely to be seen as spam. He urges retailers to be judicious and deliver a highly personalised shopping experience.

It’s a warning John Lewis has taken seriously. The high street giant recently launched incubator JLab in partnership with tech entrepreneur Stuart Marks. The first startup backed by JLab is Localz, an iBeacon technology designed to trigger shoppers’ click-and-collect orders to be picked as they enter the shop, or help customers navigate their way around stores based on their online wish list. Mobile point-of-sale software means store staff can take payments anywhere in store using a tablet.

“Mobile helps us join up our channels to offer a seamless experience,” says Sinne Veit, the company’s director of online. “Especially with big-ticket items, in-store is often the start of the journey. Our app already offers barcode scanning, so customers can read reviews or share with friends and their other half, and then consider the purchase at home. Location-based services are just one of the areas we’re looking at adding to that,” she says.

The key to successfully handling this sort of click-and-collect, mobile or location offer, according to Adyen UK country manager Myles Dawson, is an omni-channel for payments. “Unless the back-end is in place across the group, there’s the chance of chaos,” he cautions. “There are companies where online delivers click-and-collect items to stores which have that item in stock.”

Since Adyen’s 2006 launch, the payments company has grown to handle more than 250 payment methods and 187 transaction currencies serving 3,500 online businesses, including Facebook, Dropbox, Airbnb, Netflix, Spotify and Groupon. Now it’s moving into bricks and mortar, tying up deals with Moss Bros and Superdry. Provided there’s a good omni-channel in place, Mr Dawson explains, mobile payments offer retailers speed and huge amounts of data, meaning every transaction with the retailer online, mobile or in-store gathers customer data.

“The future of retail should be such a seamless transaction – like taking an Uber – where I can walk into a store, see something I like, walk out with it and there’s enough in place for the security tag to be disabled and payment taken from my account without me having to do anything,” he says.

The closest retailer to this vision is Shell. The company is rolling out a smartphone app across the vast majority of its 1,000 UK service stations in a deal with PayPal that allows automatic payment of a pre-set amount. Drivers link their PayPal account to the app, set a spending limit, scan a QR code on the forecourt and the pump will stop automatically when the spending limit is reached. The petrol is then paid for automatically. It’s a smart solution – although, of course, most petrol stations have huge signs banning the use of mobile phones.