Use a checkout in 2016, whether in person or online, and the chances are you will be met with a plethora of payment options, some of which were unavailable just a year ago.

In July 2015, Apple Pay entered the market and gave consumers the ability to pay for their shopping with a wave of their mobile phone and a thumbprint. Smartphone apps now enable their users to split a restaurant bill, reimburse a friend or pay for a taxi without the use of cash or cards.

In shops, tap-and-go, contactless payment terminals have become ubiquitous. On the other side of the counter, as the customer-facing technology has accelerated, so too have the options available to retailers. Retail staff can process purchases without a traditional point-of-sale system, taking payment via a tablet and e-mailing a receipt before the shopper has left the store.

Cash, cheque, chip and PIN, contactless, biometric, wearable and mobile phone payments –there is an overwhelming array of choice when it comes to opting how to pay. But this decision takes place at the point in the shopping process where consumers desire speed, simplicity and security above all else. Whether sat on a train or stood at a till point, the average shopper just wants to pay and go.

Communicating the benefits of payment tech

So what is driving this wave of new payment options? Innovation is not propelled by customers demanding new ways to pay, but by technology providers creating new products. Therefore, it is imperative that retailers help explain and market the advantages incoming payment options offer. If not, they may fail to be embraced by consumers.

As Gary Munro of payments consultancy Consult Hyperion says: “What you don’t want is a niche product. Technologies are not cheap to bring to market. The payments industry is good at the tech – these companies know how to make complex cryptography and how to ensure a

As Gary Munro of payments consultancy Consult Hyperion says: “What you don’t want is a niche product. Technologies are not cheap to bring to market. The payments industry is good at the tech – these companies know how to make complex cryptography and how to ensure a

transaction works seamlessly, for example. It’s not so good at communicating the benefits to the public.”

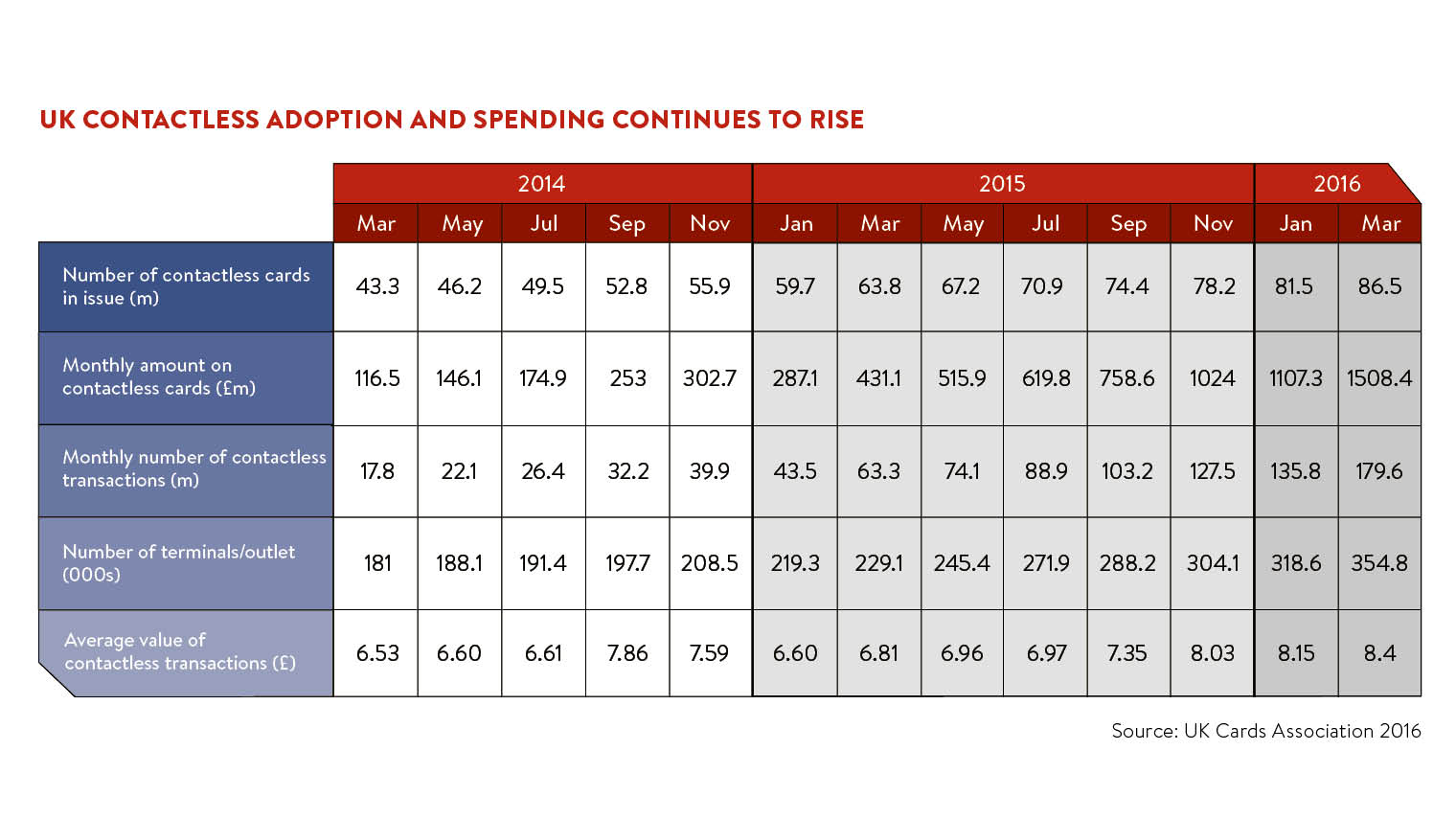

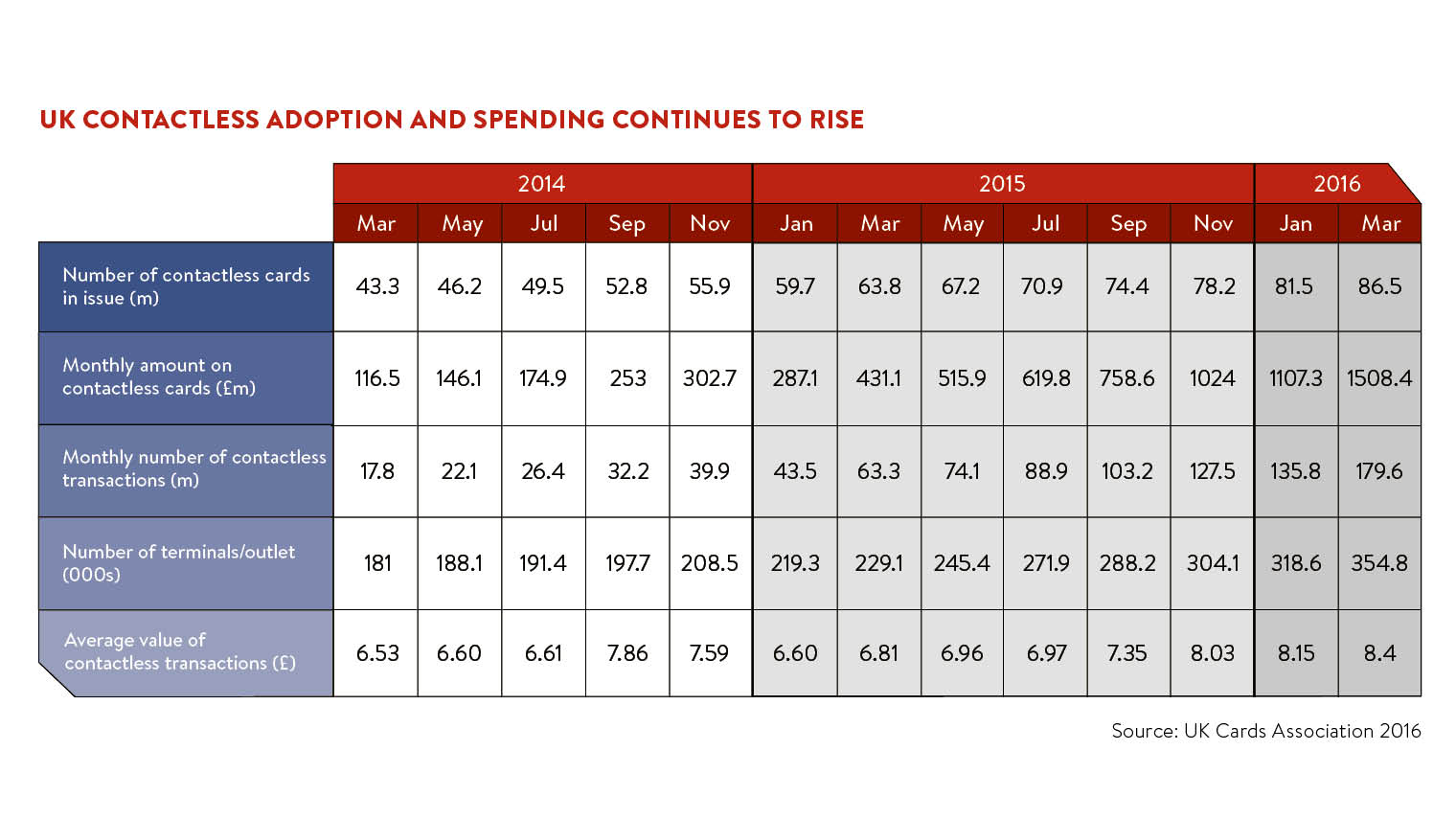

The slow rise of contactless payments in the UK is a case in point. The first transaction terminal was available almost a decade ago in 2007. But it only really took off during the 2012 London Olympics, when Games sponsor Visa included a dedicated marketing campaign to promote the technology around the event site.

Mr Munro says: “The major retailers didn’t get on board at the start. But when businesses like Marks & Spencer began to offer contactless, it started to get ingrained in people’s consciousness. McDonald’s was also a big and important adopter.”

The benefit of using mobile payments over card or cash is not immediately obvious, but that should change when consumers get used to leaving their wallets at home

Four years later, paying via contactless credit or debit card enjoys high acceptance among shoppers. The UK is the leading user of contactless payments in Europe, along with Spain and Poland, according to market research firm Euromonitor. The UK Cards Association reported there were 159.1 million contactless transactions in February 2016, which is the equivalent to about 63 a second.

Mobile payments lagging

Lagging behind contactless is the use of mobile phone payment. The push to increase mobile payments is an attempt to capitalise on a boom in smartphone use. An independent study carried out by UK payments processor Vocalink estimates that 84 per cent of the UK population used a smartphone in 2015, up from 60 per cent in 2013. Despite this, the study says only 12 per cent of the more than 5,000 16 to 75 year olds surveyed used their smartphone to pay for something last year.

Figures on the infiltration of Apple Pay in its maiden year in the UK have not been made public. But as Mr Munro asks: “Is Apple Pay any easier than tapping your card? Not really. Contactless has become a norm, where customers are disappointed if a retailer does not offer it. Mobile payment options like Apple Pay need to become a norm, too. The next generation will expect to use smartphones to pay, but that change in behaviour will take a bit of time.”

Philip Benton, senior research analyst at Euromonitor, adds: “At the moment the benefit of using mobile payments over card or cash is not immediately obvious, but that should change when consumers get used to the idea of leaving their wallets at home.”

It’s a behavioral change the payments industry is keen to speed up. This month Barclays announced the launch of its Android contactless payment service in June, the first in the UK, beating Google which has plans to launch a similar Android app later this year.

Electronics giant Samsung is piling in too, as it gears up to release its rival to Apple Pay in the UK in 2016. Mr Munro says Samsung Pay “will turn the tap on a bit more” when it comes to people choosing mobiles over cards and cash, simply because “there will be more mobile phones with the ability to pay for things”.

Mr Benton agrees: “There are more Samsung users in the UK than Apple users, so it is introducing mobile payments to a new audience. Samsung Pay also has the potential to be more disruptive than Apple Pay or Android Pay due to the technology used, which allows consumers to make mobile payments on older payment terminals which don’t yet support contactless payments.”

Another potential boost to mobile payments is increasing high-speed internet coverage in the UK. “The majority of online payments used to be done from a laptop or tablet,” says Mr Munro. “With the rise in 4G access, and with wi-fi now readily available on trains and buses, travel time is becoming time when the customer browses shops and makes purchases on their smartphone.”

Looking to the future

As retailers race to keep abreast of the technology that is available, yet more payment trends continue to emerge. By 2020, being asked to enter your PIN code into a keypad to authorise a sale may well have largely disappeared. In a move pushed through by card payment providers Visa and MasterCard, by the end of the decade all retailers will have to provide contactless to be able to take card payments.

And beyond cards, store staff may find a multitude of new devices waved across payment terminals. London financial technology company Kerv offers a wearable contactless-enabled ring. Barclays already sells contactless wristbands, a key fob and a sticker – which can be affixed to a phone, say – that are linked to the customer’s debit or credit cards.

As consumer usage of these new options increases, so too will confidence in their security, says Mr Benton. “I would expect the current contactless payment limit of £30, which was only introduced in September 2015, to increase again in the next 18 months,” he says. Apple Pay already offers shoppers the ability to pay for big-ticket items via enabled devices.

Despite this, it is worth noting that cash is still the most popular, albeit a waning, way to pay among consumers. According to Payments UK research in 2015, the consumers still paid by cash for more than half (52 per cent) of all their transactions in 2014. This figure is forecast to drop below 50 per cent by the end of 2016.

Some forward-looking retailers are encouraging customers to leave behind notes and coins completely. Both supermarket Waitrose and healthy food chain Tossed have opened stores in 2016 which are entirely cashless, a trend Mr Benton says he expects to progress in the next two to three years.

Head of European retail at software company ThoughtWorks Mark Collin warns that retailers need to be careful not to prize innovation over ease for their clientele. “Mobile phone payments and grocery shopping, for example, doesn’t always work – the shopper’s hands are often full of items,” he says.

Whatever the payment method is, ensuring it is integrated into what the customer wants is key. “Until we get to a point where it all starts to consolidate, retailers will have to learn how to deal with a lot of payment options,” Mr Collin concludes. “Simplicity of checkout is where everyone is trying to get to now.”

Communicating the benefits of payment tech

Mobile payments lagging