Competing with a global brand like Amazon can be a tall order for small retailers, especially given the retail giant’s audacious mission statement to be “Earth’s most customer-centric company, where people can find and discover anything they might want to buy online”.

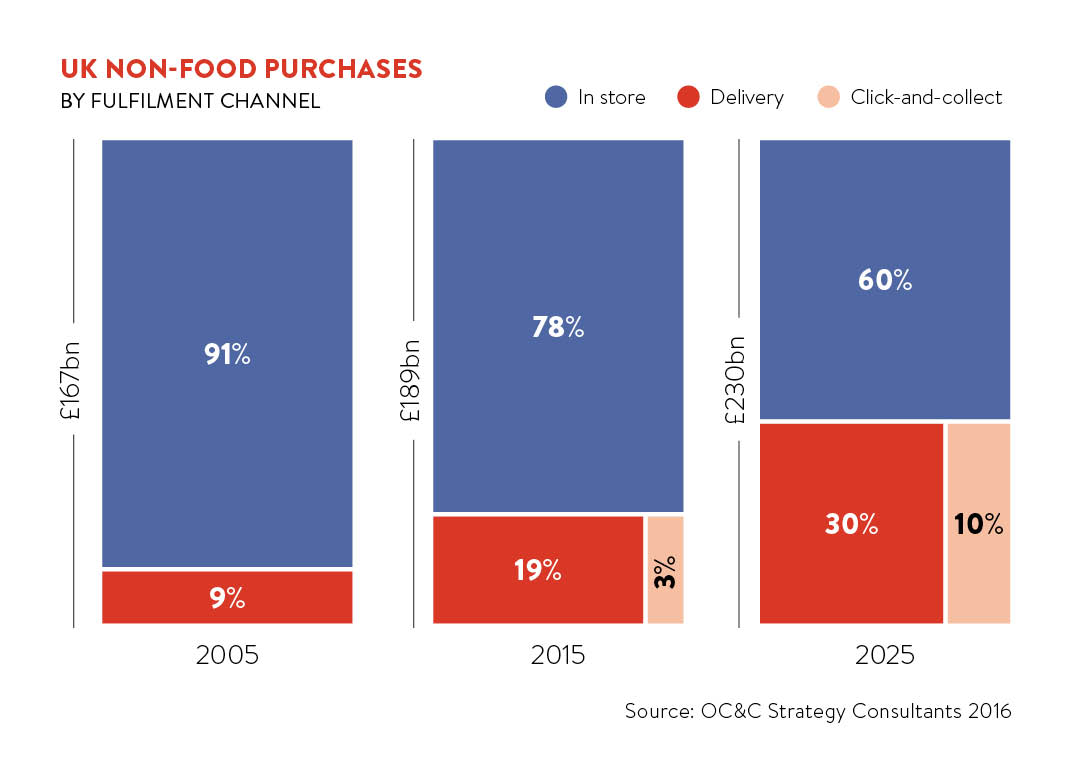

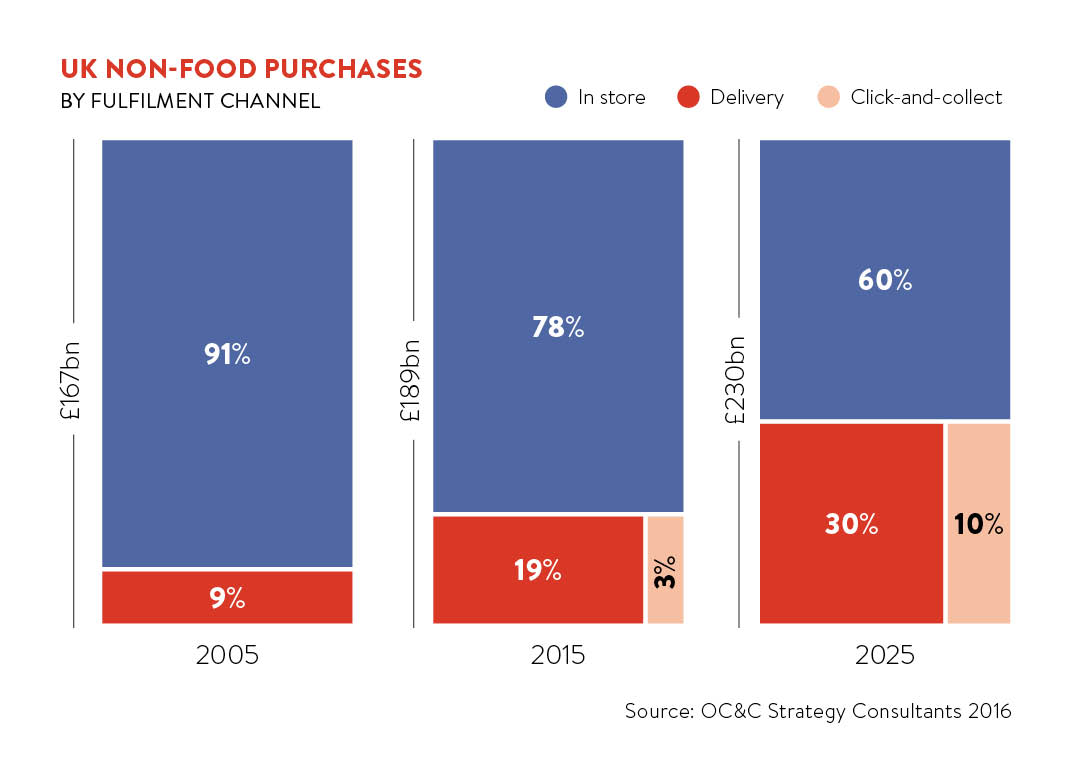

Increased consumer expectations present another challenge for small and medium-sized enterprises (SMEs). A recent study by OC&C Strategy Consultants found that in the last two years the number of shoppers opting for next-day delivery grew by 50 per cent, while those willing to wait between three and five days fell by 10 per cent. It also predicted that home delivery and click-and-collect sales will double in the next ten years, and that by 2025, 40 per cent of all non-food sales in the UK will be made online.

Nevertheless, for SMEs that have convenience, cost, choice and a great customer experience built into their delivery and returns strategy, competing in this sector is entirely possible.

Understanding customer needs

The first thing they need to know is exactly what delivery services their customers want, says Chris Field, independent retail analyst and chairman of Retail Connections.

“It doesn’t make sense to offer all customers a delivery-in-30-minutes service, if 80 per cent of them are happy to wait 24 hours or longer,” he says. “Better to invest in understanding your customers and offer them delivery services that enable you to make a profit, while suiting their needs. This way, if you make a loss on one item, it isn’t necessarily an issue because you know that particular order is for a loyal, high-value customer.”

“It doesn’t make sense to offer all customers a delivery-in-30-minutes service, if 80 per cent of them are happy to wait 24 hours or longer,” he says. “Better to invest in understanding your customers and offer them delivery services that enable you to make a profit, while suiting their needs. This way, if you make a loss on one item, it isn’t necessarily an issue because you know that particular order is for a loyal, high-value customer.”

Consumer trends are increasingly focused on speed and choice. They want delivery options and locations that unite them with their purchases wherever and whenever they want it. This means that SMEs have to compete on service rather than product alone, where there is increasing transparency on product and prices, says Madeleine Thomson, UK retail and consumer leader at PwC.

“SMEs can overcome their lack of scale by maximising various partnerships in the market,” she says. “These include CitySprint’s ‘On the dot’ service that allows retailers to offer same-day and one-hour timeslots for delivery, and potentially compete with Amazon Prime Now. For larger and more cumbersome items, peer-to-peer delivery company Nimber offers shippers the chance to connect with a network of ‘bringers’ and receive offers on delivering items in a cost-effective and personal way.”

Doddle’s pick-up and drop-off service, created to eliminate the pain of missed deliveries for consumers, also provides retailers with a long-term solution to managing growth in delivery volumes from e-commerce sales.

Partnering up

Chief executive Tim Robinson says: “For retailers, home delivery can be hugely inefficient. It’s harder to achieve savings via consolidation because you have to make hundreds of stops to individual addresses, which increases the time and therefore cost. Click and collect, by contrast, enables retailers to make consolidated deliveries to a network of stores, their own or through a third party such as Doddle.”

Organic supermarket Planet Organic recently teamed up with independent store delivery service Hubbub to deliver its natural food and drink, health and beauty, and household goods within one-hour timeslots to London post codes. Through Hubbub customers can combine their orders from multiple independent stores into a single delivery that can be received the same day.

Planet Organic founder Renée Elliott says: “Although it means that we share space with other brands and stores, ultimately the range of produce available in one place means this partnership has opened up our offering to a new audience looking to order from like-minded retailers across London.”

There are also cost-benefits for the retailer and customer. Because the single deliveries include goods from multiple stores, the cost charged to retailers by Hubbub for facilitating each delivery is shared by the stores the consumer orders from.

The technology used so skilfully by the likes of Amazon to steal a march on competitors is increasingly being turned to the smaller retailer’s advantage

Ms Elliott adds: “By pooling our efforts, we can protect our margins, get our brand and products in front of a new audience as part of a broader range and offer same-day one-hour delivery slots that beat those offered by Amazon Fresh.”

Fashion retailers in the middle-to-premium market range face some of the biggest challenges in providing fast and free or subsidised delivery. Their lack of purchasing scale and relatively long order cycles mean they don’t have the agility of fast-fashion retail brands such as Zara and H&M. Operating on tighter product margins leaves them less to invest in free or subsidised delivery.

A solution, says Eric Fergusson, director of retail services at eCommera, is to bring more production back on shore to reduce lead times and enable a more effective use of data to forecast future demand accurately.

He says: “Ultimately it’s still about the basics, having a single view of stock and one view of customer, in order to track customers’ behaviour across channels and deliver on customer promise.”

Benefits for SMEs

The technology used so skilfully by the likes of Amazon to steal a march on competitors is increasingly being turned to the smaller retailer’s advantage. Recent innovations in supply chain technology, for example, have made enterprise technology accessible to much smaller companies.

Michael Latimer, vice president of sales and marketing for TrueCommerce Europe, says: “This has introduced new opportunities for SMEs to take advantage of efficiencies that historically wouldn’t have been available due to price restrictions. Warehouse management, ordering and invoicing, carrier management, drop-shipping, as well as many other efficiencies, are now all within reach of SMEs.”

According to Karl Wills, chief executive of home-parcel box Pelipod, internet of things technology will enable smaller firms to turn the tables. He says: “A delivery box or pod can be placed outside a house, only allowing entry to couriers who are given a unique code, and recording deliveries by photographing its contents and sharing via e-mail.”

This solves the issue of parcel theft and fraud, while customers can avoid having to pay for a specified delivery slot to coincide with them being at home. It can also provide valuable insights for retailers in the form of customer data.

Another long-standing source of frustration for SMEs is the integration of delivery and returns services into an existing e-commerce website. Today e-commerce platform integration can be achieved using the technology solutions available from brands such as Shopify and ChannelAdvisor.

Amazon has set delivery expectations soaring among consumers, who expect similar offerings when shopping elsewhere, and has been hugely successful at encouraging customers to contribute to delivery costs by stealth.

As Jason Tavaria, head of direct at online delivery platform Shutl, points out that few other retailers can offer services like film and music subscriptions to encourage customers to sign up for a premium service such as Amazon Prime, which in turn provides high customer satisfaction through faster delivery. The answer, he says, is for retailers, regardless of size, to look at what they do best.

He says: “Consider the realistic alternative add-ons that could encourage customers to pay for premium delivery services, thus ensuring those high satisfaction levels – for example, access to a VIP service team, exclusive shopper evenings or enhanced warranties.”

Smaller retailers can also maximise on the one thing that Amazon doesn’t have – a nationwide presence of store locations. Mr Tavaria adds: “Retailers with physical stores should look at how these can be utilised to best advantage, for instance improving click-and-collect facilities or servicing all local customers with same-day delivery. For smaller local retailers, being physically closer to the customer is a huge advantage, which should make it easier to fulfil orders and returns.”

Understanding customer needs

Partnering up