Fraud has existed since time immemorial. The first recorded instance was in 300BC, committed by an incompetent Greek seafaring merchant called Hegestratos. He planned to defraud an insurer by sinking his ship, empty of cargo, and selling the corn supposed to be on board. Unfortunately for Hegestratos, his scheme was discovered and he drowned after escaping his passengers, no doubt angry at his plan to kill them.

Fast forward to the 21st century and the capabilities of fraudsters have reached new heights, to the point where they now pose the risk of destabilising global economies and governments.

Fraudsters destabilising democracy

In 2016, Colombian hacker Andrés Sepúlveda confessed to rigging elections across Latin America during an eight-year period. Since then, the UK’s Brexit vote and the United States’ election of Donald Trump as president have come under scrutiny as investigations probe whether or not hackers influenced voters with fake news.

“The fraud schemes we see are always changing, as the ways in which people interact with each other change,” says Fran Marwood, investigations partner in the forensic services team at big-four accounting firm PwC.

“Fraud has evolved massively over the 20 years I’ve been investigating it. The two biggest factors have been the increase in global communications, and the huge developments we’ve seen in technology and the use of data. Smartphones are only just over ten years old, which puts the changes into perspective.”

Financial fraud threatening integrity of national banks

Financial crime and other fraud has the capacity to destabilise global economies through its ability to steal increasingly large sums of money and change the path of history as fraudsters manipulate events for their own means.

But while the impact of electoral fraud has demonstrated its power to threaten economies’ growth, financial fraud still continues to rear its head. In January it emerged that a middle manager and a subordinate in India’s Punjab National Bank had quietly executed a fraud since 2011, stealing some $1.8 billion.

“The fraud didn’t go down well with the regulators, with the political machinery and of course with the general public,” says Tarun Bhatia, managing director and head of South Asia in Kroll’s investigations and disputes practice. “It happened in a sector which has seen similar issues, so there was also concern around lack of learning and processes in place.”

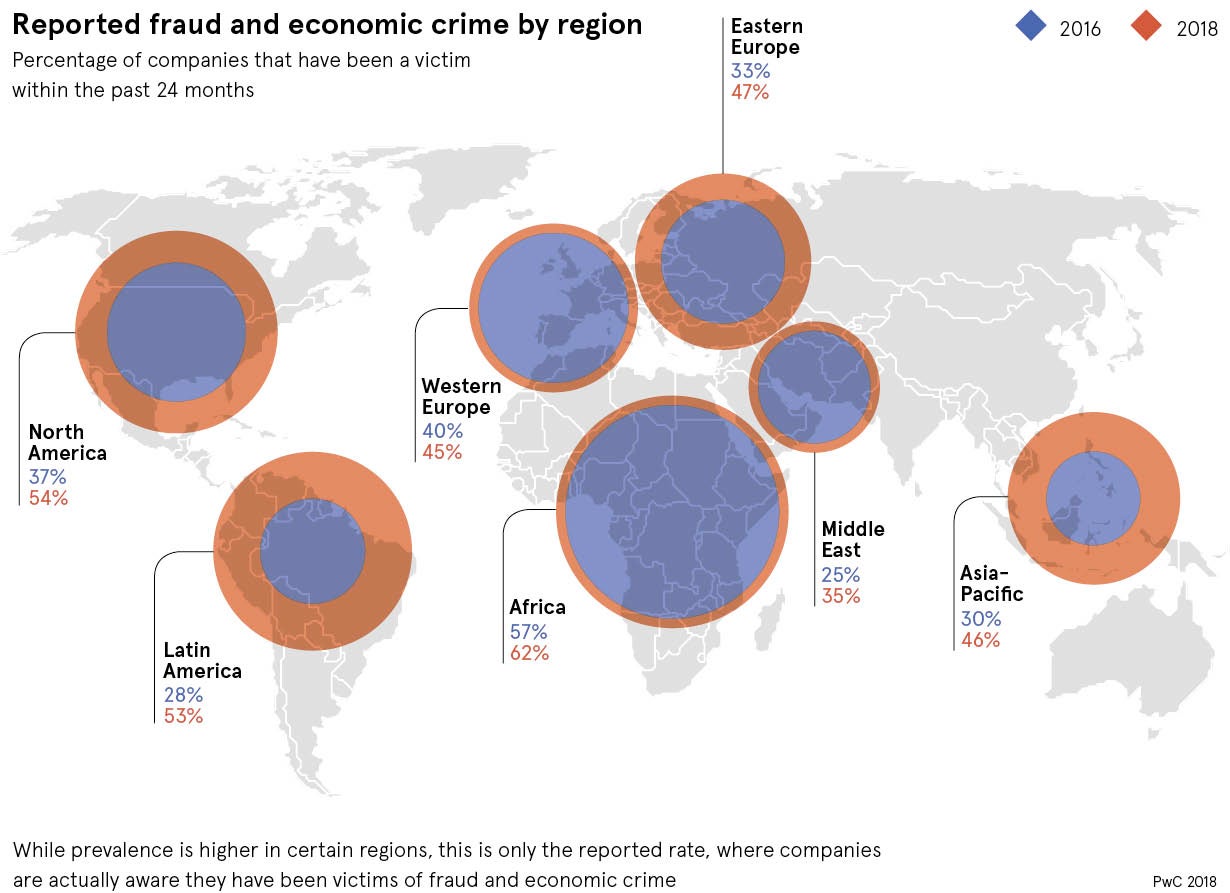

A PwC report published earlier this year found that more businesses had experienced fraud in 2017 than in 2016, increasing to 49 per cent of respondents from 36 per cent previously. The firm’s Global Economic Crime and Fraud Survey also found that cybercrime is predicted to be the most disruptive fraud facing organisations over the next two years.

The power of misinformation

As problematic as they are, financial crimes are far from the most sinister plans that fraudsters could hack to destabilise global economies. Campaigns of misinformation can also trick populations into letting their guard down, with potentially devastating results.

A recent study by the American Journal of Public Health found that online trolls from Russia posted tweets for and against vaccination, with the aim of sowing discord among the US population. “Accounts masquerading as legitimate users create false equivalency, eroding public consensus on vaccination,” the report says, explaining that the trolls were attempting to bring further division to US society, as well as eroding public faith in important vaccines.

A sudden drop in vaccine use could significantly destabilise global economies and the US might be the first victim. Illness costs countries billions every year, but a serious pandemic, caused by a rise in infectious diseases due to less people vaccinating their children, could decimate economies. The Spanish flu, which lasted from 1918 to 1920, is thought to have killed 100 million people and wiped around $4 trillion from global GDP, around 5 per cent of the total.

Fraudsters sowing discord to stop countries from fulfilling important vaccination programmes could have a similarly devastating impact. The World Bank forecasts that a global pandemic would have an equally disastrous effect on the 21st-century world economy.

Those tasked with fighting fraud and preventing the destabilisation of global economies have to stay one step ahead

Fraud and fraudsters are changing all the time

The threat posed by fraud to destabilise global economies should not be underestimated. Criminals get more organised and pose different challenges to those who are trying to thwart them.

“It’s starting to get more and more sophisticated to stop fraudsters attacking,” says Nick Mothershaw, director of fraud and identity solutions at Experian. “They’ll up the ante and we’ll get better at defending. It’s a guerrilla warfare; it continues to be so, but we are getting better at it.”

The fact is that the fight against fraud is an ever-evolving arms race. The threat fraudsters pose to businesses, governments and other organisations means those tasked with fighting fraud and preventing the destabilisation of global economies have to stay one step ahead.

“The biggest factor here is technology, and the opportunities that it presents fraudsters to steal cash and other assets,” Mr Marwood says. “I have no doubt that these opportunities will increase and develop over time. Technology has two sides though, and can be highly effective in preventing and detecting fraud. The worst-case scenario is that government, businesses and individuals don’t keep up with the fraudsters.”

Fraudsters destabilising democracy

Financial fraud threatening integrity of national banks