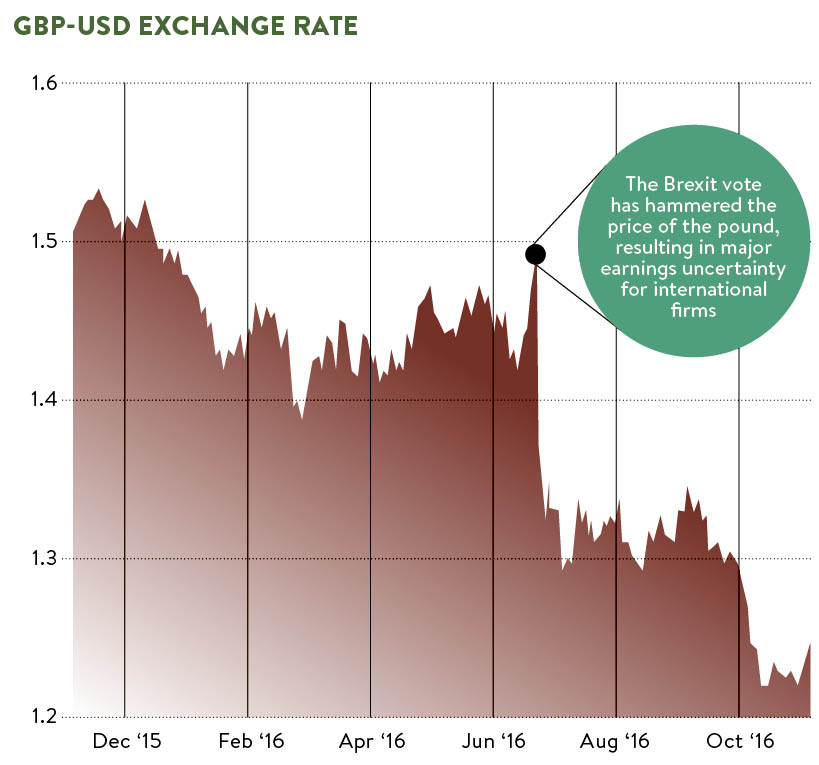

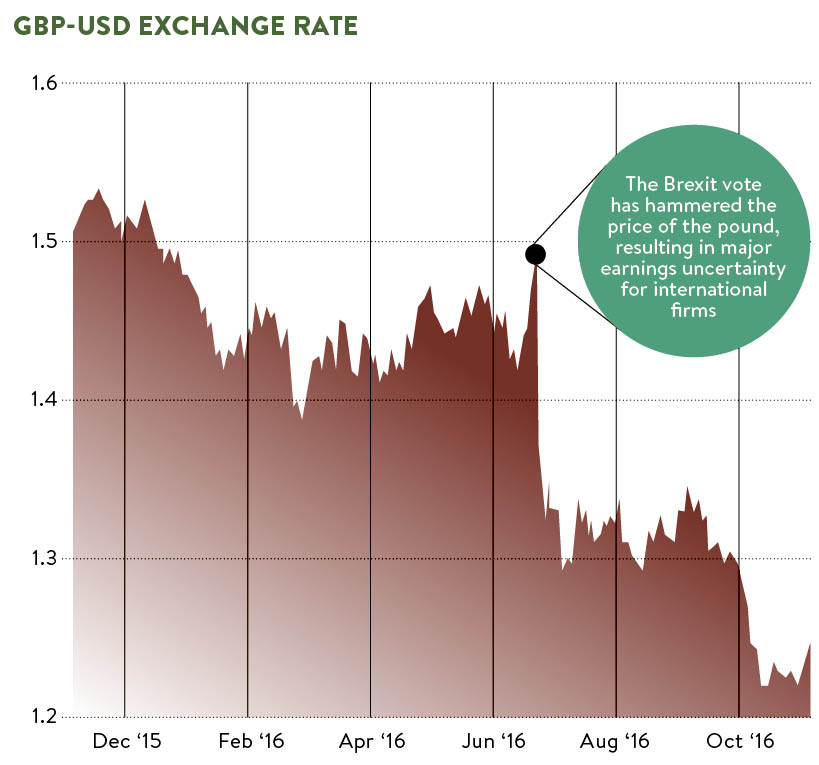

Compared with the relative stability of recent years, the past few months have been a challenging time for the British pound. The outcome of the UK’s referendum on continued European Union membership has seen confidence in the currency slide as uncertainty has built over the future of the British economy.

Since June, company finance executives have found themselves dealing with the fallout from the referendum result and its impact on markets.

The fall of sterling against major currencies has been one of the most perceptible consequences of the result ahead of actual Brexit.

Sterling’s devaluation has been among the biggest documented across global currencies since the start of the year and has affected businesses throughout the country.

“The situation that UK companies are in at the moment is not unique,” says Ranko Berich, head of market analysis at foreign exchange company Monex Europe.

“FX volatility in general has increased over the past two years.

“What is specific to the UK is just how dramatic the fall has been over the past couple of months.

“We’ve seen businesses that would never have considered hedging their long term cash flows or their capital expenditure and have now seen the kind of moves that can happen and are thinking they should hedge [currencies].”

Mr Berich says the drop in sterling had seen margins narrow since the result and forced chief financial officers (CFOs) to reconsider how they tackle currency risk.

The scale of the fall in sterling will have caught some people underprepared

“Given that we’re seeing bouts of volatility that are more pronounced than they have been for the past ten years, it has become more of a pressing issue,” says Monex Europe head of treasury Neil Maffey.

“We are now seeing a marked change in the need for CFOs to have a specialist focus on the implications of currency across the board,” says Mr Maffey. “As opposed to it being a functionality that has to be done, it now seems to be something that is being approached in a far more considered way.”

Change brings challenges

Some companies have been slow to adapt, however. Following years as one of the global financial system’s more robust currencies, the scale of the fall in sterling will have caught some people underprepared.

Some companies have been slow to adapt, however. Following years as one of the global financial system’s more robust currencies, the scale of the fall in sterling will have caught some people underprepared.

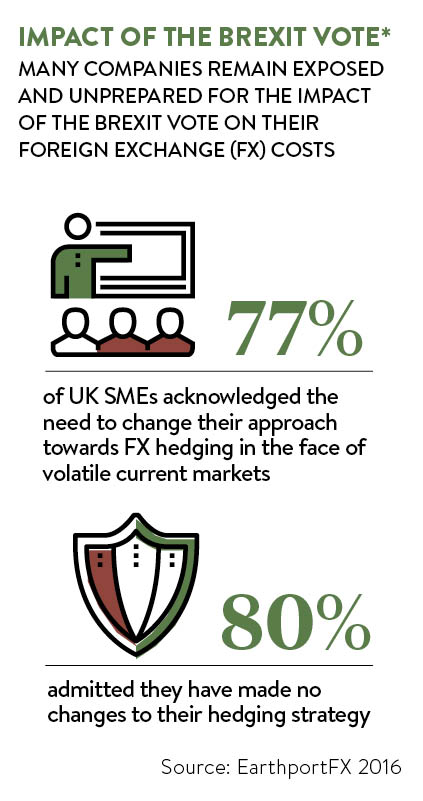

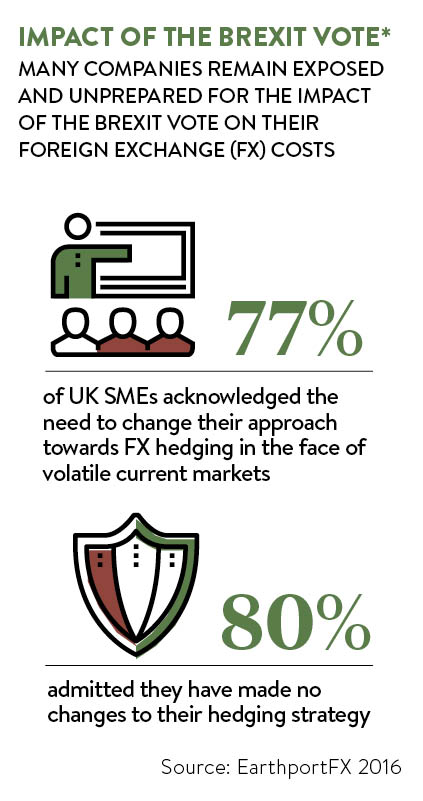

Indeed, a survey in August by cross-border payments specialist EarthportFX of 75 small and medium-sized enterprises with foreign exchange turnover of less than £10 million found many smaller businesses had yet to address the issue.

While 77 per cent acknowledged the need to change their approach to foreign currency hedging, 80 per cent admitted they had made no changes following the referendum result.

Yet, while 40 per cent of respondents suggested the result would have a negative impact on their business in the long term, just over half were unsure how the result would affect them.

“The referendum result has increased FX costs by 30 per cent immediately after the referendum announcement and corporates are in a very difficult position where their costs are higher than they were,” says Peter Theuninck, head of FX market strategy at EarthportFX.

UK’s expanding exports

Signs have been mixed so far, however. For those exporting business abroad, the potential for expanding their overseas sales may be tempting.

Recent data from Markit and the Chartered Institute of Procurement and Supply (CIPS) revealed that UK Manufacturing Purchasing Managers’ Index (PMI) hit its highest level since mid-2014 in September, showing the sector has continued to expand despite existing concerns.

While the domestic market was a prime driver of new business wins, the weakened sterling exchange rate had driven up new orders from abroad, according to Markit and CIPS. Similarly, the Markit/CIPS UK Services PMI, which measures the strength of the services sector, also picked up in September following a referendum-inspired drop earlier in the year.

Michael Teixeira, CFO at UK-based customer acquisition company MVF, says the fall in sterling has affected many UK companies who import costs in different currencies.

“If you have any part of your activities overseas, whether that is clients, revenues, staff or purchases, then you have a foreign exchange risk,” he explains. “It’s very hard to try to hedge or manage that away.”

Mr Teixeira says larger companies may be better placed to manage currency risk through their banks, but smaller or fast-growing companies face a different situation.

Lower sterling valuations may be something businesses will have to live with for some time

“Our business is digital customer generation; we spend a lot of money online with companies like Google and Facebook and we spend that money to generate more clients for our customers. In some cases, we’re spending money in one currency and we bill our clients in a different currency,” he says.

“The devaluation of sterling is a great opportunity for exporters, you have a sterling cost-base and can bill clients in dollars or other currencies; it’s a great opportunity to undercut your competitors in terms of cost.

“If you’re looking to expand abroad, as we are with our operation in the US, it makes great sense to us to invest and grow.”

Time to prepare

While economic indicators suggest that much of the initial concern over the economy may have been overdone, lower sterling valuations may be something businesses will have to live with for some time.

Jonathan Loynes, chief European economist at London-based consultancy Capital Economics, forecasts a further fall against the US dollar over the next year, fuelled by a rise in US interest rates. However, Mr Loynes says the decline in sterling is likely to soften the economic impact of Brexit.

“Of the outcomes of the EU referendum, the one most imminently felt by UK businesses is the impact of the weakening pound,” says David Whitehouse, managing director and co-head of UK restructuring at global valuation and corporate finance advisory firm Duff & Phelps.

With Brexit Article 50 expected to be triggered at the end of the first quarter of 2017, CFOs have little time to prepare for any further currency shocks.

“While uncertainty over the UK’s trade relationship with the EU post-Brexit lingers, companies need to start putting in place plans that will help them navigate a more volatile currency environment or review measures they had taken before the vote to leave, such as currency hedging,” says Mr Whitehouse.

“However, as a volatile or weaker pound could be a reality for the long or at least mid-term, businesses with international operations and suppliers will need to look beyond currency hedging and review the way they select or negotiate with suppliers, or consider passing on higher costs to customers both domestically and internationally.”

EarthportFX’s Mr Theuninck says: “Until Article 50 [is activated] and we start understanding exactly how Europe intends to engage in negotiations, we can’t really say with much certainty how the market will play out.”

Monex Europe’s Mr Berich adds: “Nobody has a crystal ball. It’s probably more important to identify potential moves and how they affect the business as opposed to forecasting. That’s quite an important distinction. Investors should be identifying quantified market risk as it affects the business and not attempting to make a call.”

While costs for imported items are likely to increase, there may be opportunities for those with more export-focused business. Others still may prefer to take a more proactive approach to currency risk.

“The key thing for a company exposed to foreign exchange risk is to understand it very well,” says Mr Teixeira at MVF. “Oftentimes companies will only have a vague understanding of what foreign currency risk; it’s important to analyse it numerically in some detail.

“You might not even remember or know what currency a contract is denominated in and what proportion of clients you are billing in sterling or dollars. Ideally you want to have a natural hedging in place; if you’re buying in dollars you should be selling in dollars.”

Change brings challenges

UK's expanding exports