Financial wellness has become a buzz phrase in the last few years. For employers, it refers to anything that supports the financial security of their employees and often involves a move from narrow benefit packages to wider and more flexible programmes of benefits and education.

A host of recent research has shown the impact of financial wellbeing issues in the workplace. For example, a recent report by the Reward and Employee Benefits Association (REBA) showed that 25 per cent of employees say that financial concerns affect their ability to do their job.

The 2017 Willis Towers Watson Global Benefits Attitude Survey also highlights a direct correlation between employees’ financial concerns and performance at work through sick days, productivity or engagement. The survey says employees are looking to their employers for support. Some are responding with programmes that support financial wellbeing, but employees are lukewarm about what they have seen so far and engagement remains low.

Meanwhile, wellness product providers talk of an explosion in the market over the last few years. A survey by workplace financial education provider Nudge Global showed a significant increase in employers providing a financial wellness programme between 2013 and 2016. In 2016, 45 per cent of companies had a financial wellness programme or were implementing one, up from 26 per cent in 2014, and 50 per were considering it, up from 20 per cent.

But some of these programmes are still narrow and there is room for progress towards holistic financial planning covering all the areas that employees need help with such as debt, pensions, saving, tax and insurance. In 2016, 96 per cent of companies wanted to provide holistic financial education, but only 42 per cent did so.

Financial wellbeing expert Jason Butler says: “I detect a much stronger awareness that financial wellbeing solutions are an important part of recruitment and productivity. But I’m less convinced that it is translating into significant tangible action.”

He says many good tools and services have become available to support wellness. For example, financial advice firms provide paid-for seminars and personal advice for those who need it. Technology companies provide digital education platforms that provide individualised insights and prompt employees to action at appropriate moments. Others provide wellness content linked to products such as loans and savings accounts, perhapworkplace wellbeings at a negotiated discount for the employer.

“The challenge for employers is that they need help understanding which platforms, interventions and seminars they need, and who will pay for them,” says Mr Butler. “Each firm’s needs are different. For example, if you employ lots of millennials your needs will differ from companies with lots of part-timers, older workers or gig economy workers. Public sector differs from private and so on.”

Minh Tran, director at benefits consultant Willis Towers Watson, says provision of holistic financial planning is increasing, but from a small base of early adopters. He agrees that employers are increasingly aware that helping address financial worries should promote a more engaged and healthy workforce, and so attract talent.

Employers are increasingly aware that helping address financial worries should promote a more engaged and healthy workforce

Mr Tran says providing a wider choice of flexible, alternative savings, such as workplace individual savings accounts, general investment accounts and even debt facilities, helps maximise the impact of existing benefits budgets. It also recognises the diverse needs in the workforce, which should improve employee engagement. In future, he expects tax-efficient financial advice using the recently introduced pension advice allowance will also be popular.

There may be some short-term obstacles but, in the long term, broader workplace packages will become more common as companies need them to attract the best talent, he says.

Mr Tran says Willis Towers Watson’s research shows that the way to improve engagement with wellness programmes is to use new technologies together with an effective communication strategy across multiple platforms and channels, including mobile, PCs, paper based, group presentations and one-to-one sessions.

The REBA survey confirms that the role of technology in holistic planning is set to increase. It shows that 19 per cent of employers have a wellness technology platform in place, but 61 per cent have one in planning or development.

Andy Woolnough, human resources and payroll solutions director at software firm Equiniti, says: “To help win and keep the best talent, employers have become more proactive in recognising the different needs of different generations in their workforce.

“People analytics – technology that uses data to link ‘people strategy’ to wider business strategy – is a growing part of that. Software can also give people individualised information in the right time and context for them, and measure the value of each strategy more precisely. Plus it can make finance more user friendly with techniques such as gamification [making software work like a computer game].”

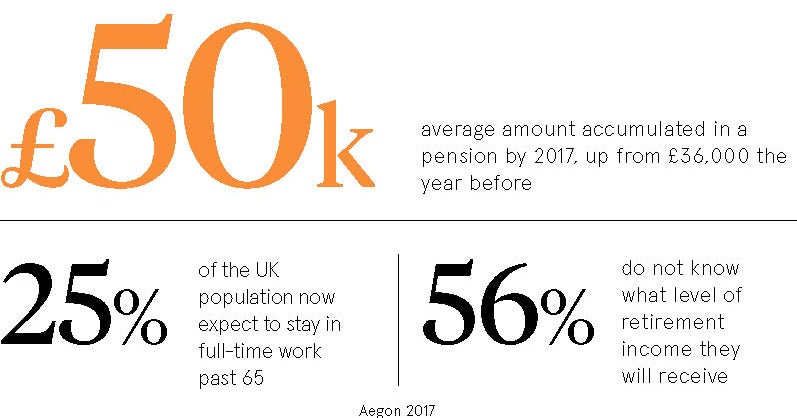

Rory Murphy, chair of the Merchant Navy Officers Pension Fund, agrees that companies will offer more holistic planning as awareness grows. However, saving for retirement is still a crucial part of financial wellness for everyone and it needs to start early. There is a danger that greater flexibility will be at the expense of pension provision, leaving employees with insufficient retirement savings later in life, he says.

Financial advice will also help support wellness and Mr Murphy says companies should offer it using the new allowance. “I expect they won’t because they tend to focus on short-term profits and shaving costs,” he says. “But the evidence shows that if you invest in and look after your staff, you will get a better return in productivity. Enlightened companies with wellbeing programmes that include financial education will tell you that their productivity is increasing 5 to 10 per cent.”