Tim Rea, an experienced technology investor, has his fair share of horror stories from a career spent working for and investing in early-stage companies.

Sometimes these tales involve the intellectual property (IP) that entrepreneurs, often mistakenly, assumed would be the bedrock for their plans to earn a fortune.

Mr Rea, currently boss of Palringo, a mobile group messaging business, recalls helping a hardware-oriented company, which had been actively encouraged to patent their work and by doing so build a portfolio of IP as a foundation of their growth strategy.

There is a tension between economic valuation of IP-based businesses and valuations derived from speculative investing

When the scientists who ran the startup decided to sell the portfolio to fund a change of direction, they were in for a nasty surprise. “They could only realise a fraction of the perceived value,” says Mr Rea.

The lesson, he says, is “it is easy to get patents, but not easy to get patents on things that are [actually preventing copying] of something important”.

Overvaluing IP

Dr Justin Hill, a partner at Olswang, the media, telecoms and technology focused law firm, says there is a tendency for early-stage companies, particularly technology businesses and their investors, to overvalue IP.

“There is a tension between economic valuation of IP-based businesses and valuations derived from speculative investing,” he says.

“In early-stage technology companies, it can be difficult to set accurate benchmarks or make concrete predictions. The value of a patent depends on the scope of claims – whether it covers something important – and whether it is valid and enforceable in practice. It also depends on alternative technologies.

“The inherent pace and disruptive nature of the sector makes valuation of technology assets more challenging. External influences, like changes in regulatory environments, can materialise suddenly.

“When valuing IP that otherwise looks good, it is important to consider the commercialisation risks properly. For example, it is essential to also consider the size of company, pace of growth and rival technologies, access to capital, the product offering, the barriers to market that the IP actually provides, to name a few.”

Getting it right

It’s understandable then that the risk of undervaluing or overvaluing IP is an occupational hazard in early-stage businesses. But just because something’s difficult, it doesn’t necessarily mean you shouldn’t do it.

Dr Hill says there are considerable risks involved in ignoring the issue altogether. “Startups necessarily prioritise their time and resources, but all too often, a failure to get to grips with IP issues means opportunities are missed or potential risks aren’t managed effectively and are therefore allowed to develop into material risks,” he says.

“The nature of IP means it can be very difficult and expensive to recover and keep pace with peers. You only get one chance to do it right.

“IP underpins the value of most technology startups. Companies should, therefore, identify key IP and register it early, but also conservatively value exactly what they’ve got.

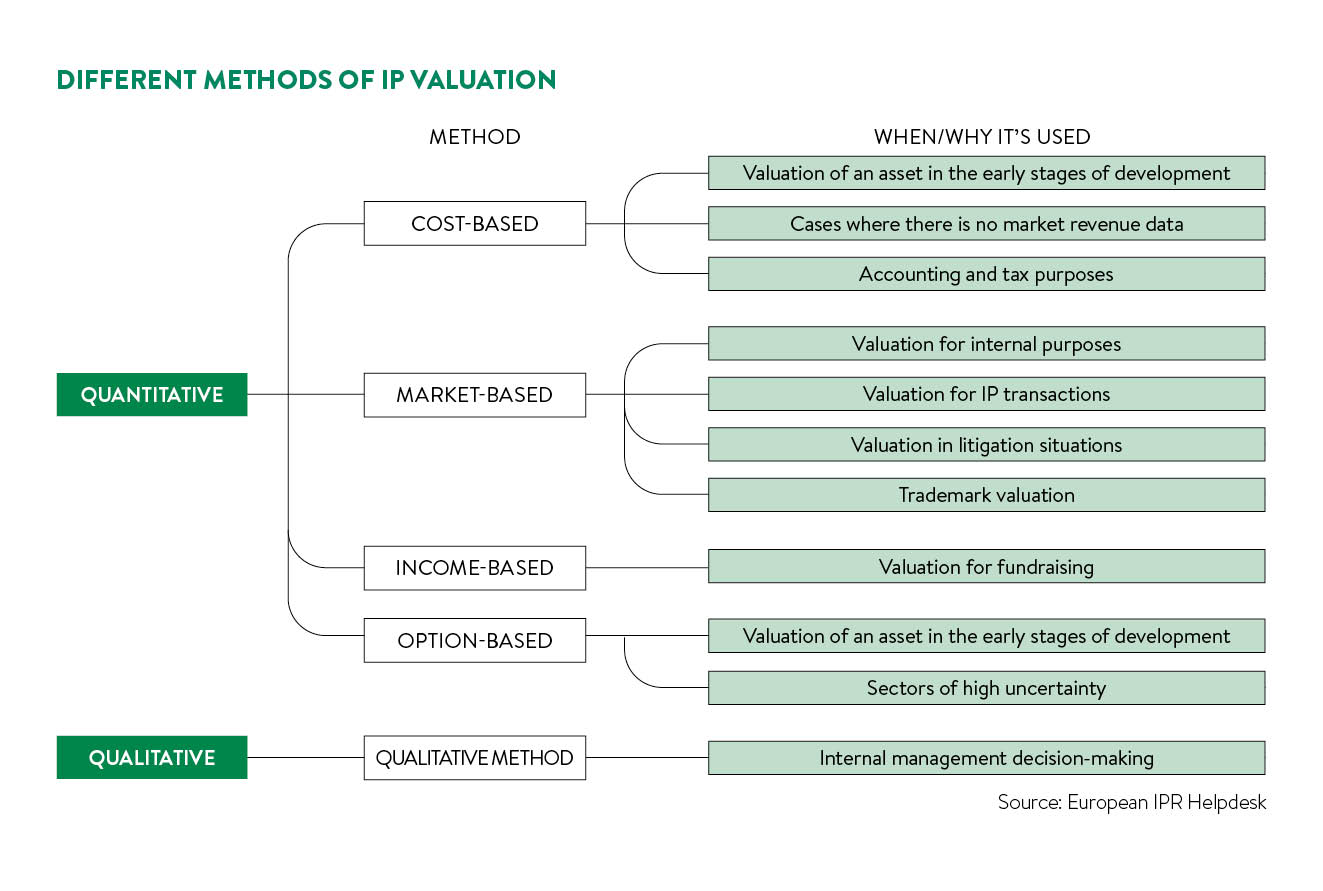

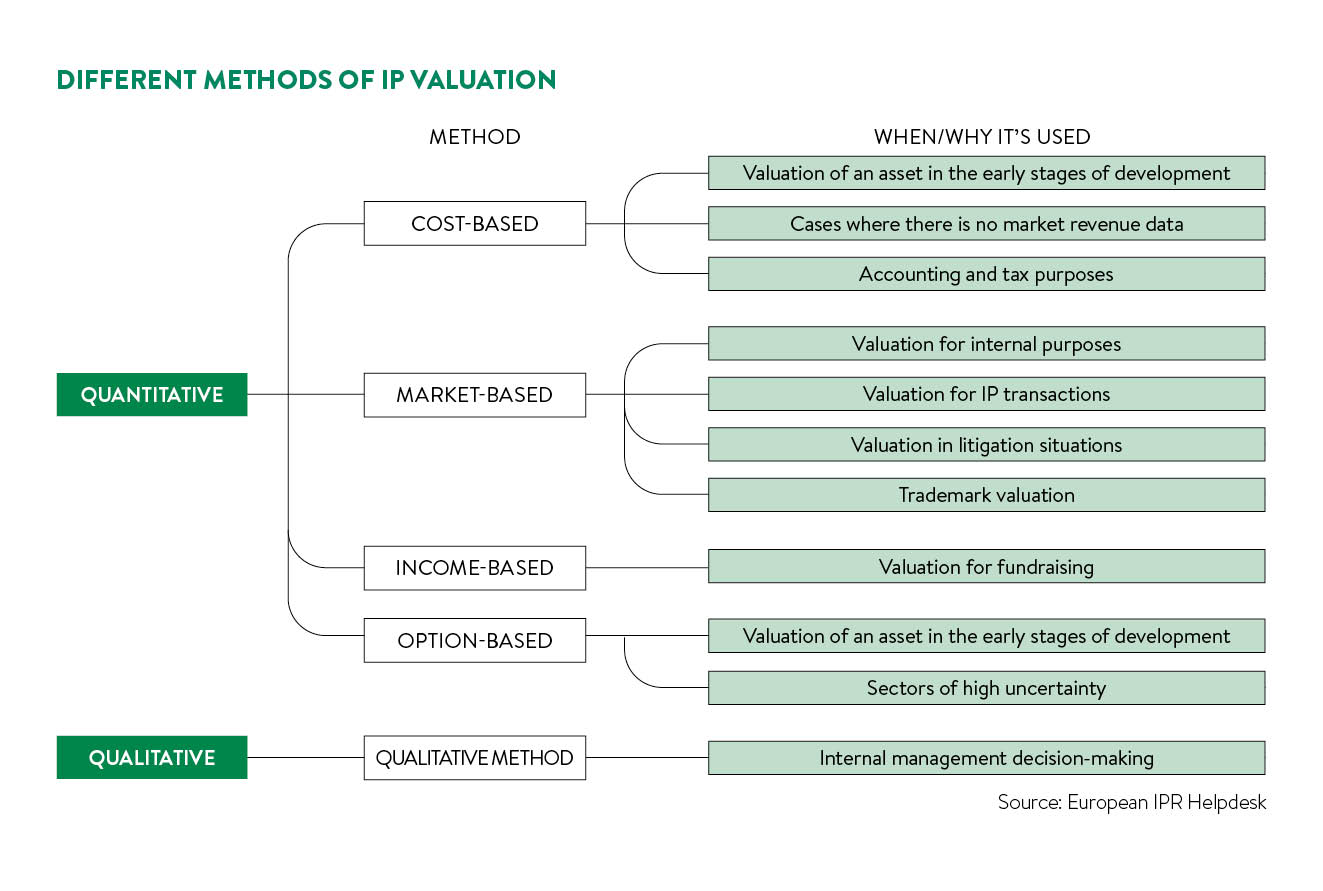

“An array of intangible assets is recognised by valuers, but the core IP for consideration remains trademarks, patents, designs, copyright and trade secrets.”

Dr Hill recommends getting a simple, low-cost IP audit or “health check” before formal valuation of IP so it is understood, for example, what the immediate sales opportunities linked to these assets are.

Then, an early-stage company with a handful of rights across patents, trademarks, copyright, design and trade secrets can receive a valuation for between £5,000 and £15,000, he says. Larger portfolios will cost more.

Maintaining a balance

However, Mr Rea says becoming too distracted by building IP value in a young venture can be as dangerous as ignoring it completely.

He cites the example of an early-stage company he observed “charging off with a process that was going to see them try to get tens of patents in their space by simply protecting everything they could think of, with no thought as to what value each individual patent was going to bring”.

Mr Rea calls this the “how high can we make our stack of paper” approach, whereby companies end up hoping people look at the sheer volume of protection and won’t see there isn’t much of value at the core of the business.

“Often startups waste too much time and money trying to patent stuff and there are advisers out there who will happily tell them it is a worthwhile exercise and ‘it only costs you $5,000 to get a patent’,” he says.

This kind of advice should be heavily caveated because it can sometimes merely represent the start of a process “that could take and cost you quite a bit of money”, says Mr Rea. Better to have one valuable patent than scores of dubious ones.

Identifying value

Komixx, a production company which buys options on IP rights for books to turn them into family and children’s film and TV shows, relies on identifying the right IP and then paying a sensible price for it.

Joint chief executive Andrew Cole-Bulgin admits valuing IP can be tricky. “It’s about creativity, it’s about subjectivity and someone’s trash is another’s treasure,” he says. “Identifying IP with commercial potential and assessing the level of investment needed to realise this is complex, but vital to getting the valuation correct.

“The metrics we use to add and assess value are unique to every idea that we look at. For example, we use trend data analysis often looking into markets and product trends as far as two years in advance of where we are today.

“We also use a lot of data analysis through independent research companies to help inform us of family trends and changes to attitudes connected to our audiences.”

Mr Cole-Bulgin points to Komixx’s recent optioning of rights from 15-year-old author Beth Reeks, who writes under the name Beth Reekles and self-published her work on Wattpad, the online writing community.

“With 19 million ‘reads’, we knew this would be hot property if we applied a digital strategy to our development of the work and kept the interest from the readers already invested in it,” he says.

“The skill to create valuable IP is in the initial identification, the research and a clear strategy for the channels of exploitation.

“Couple this with the understanding that the money you invest doesn’t just stop with the initial acquisition, it will also involve continued planned expenditure, then you are well on your way to delivering valuable returns for years to come.”

Overvaluing IP