The word unicorn suggests the stuff of legend and folklore, an unattainable fantasy, yet a league of unicorns - startups valued at more than a billion dollars - have emerged on to the scene. And the UK is fast becoming a hub for such lucrative ventures.

You don’t have to look very far to spot a unicorn at the very top of its game; on a typical holiday you might opt for an Uber from the airport, stream music for the ride from Spotify, and end up at your Airbnb apartment complete with pool - who needs hotels?

The one factor, however, that all unicorns have in common is their end-goal to revolutionise an industry and disrupt the market with an innovative business model. While we can’t provide you with that all-elusive idea that is sure to transform your business from startup to unicorn, we can share some key learnings from successful disruptive startups to get your entrepreneurial juices flowing.

Investment and financing

Great ideas, no matter how life-changing they are, can’t take off without investment. From IPOs to equity crowdfunding and invoice trading we explore the financing options available to startups to help them grow and achieve more.

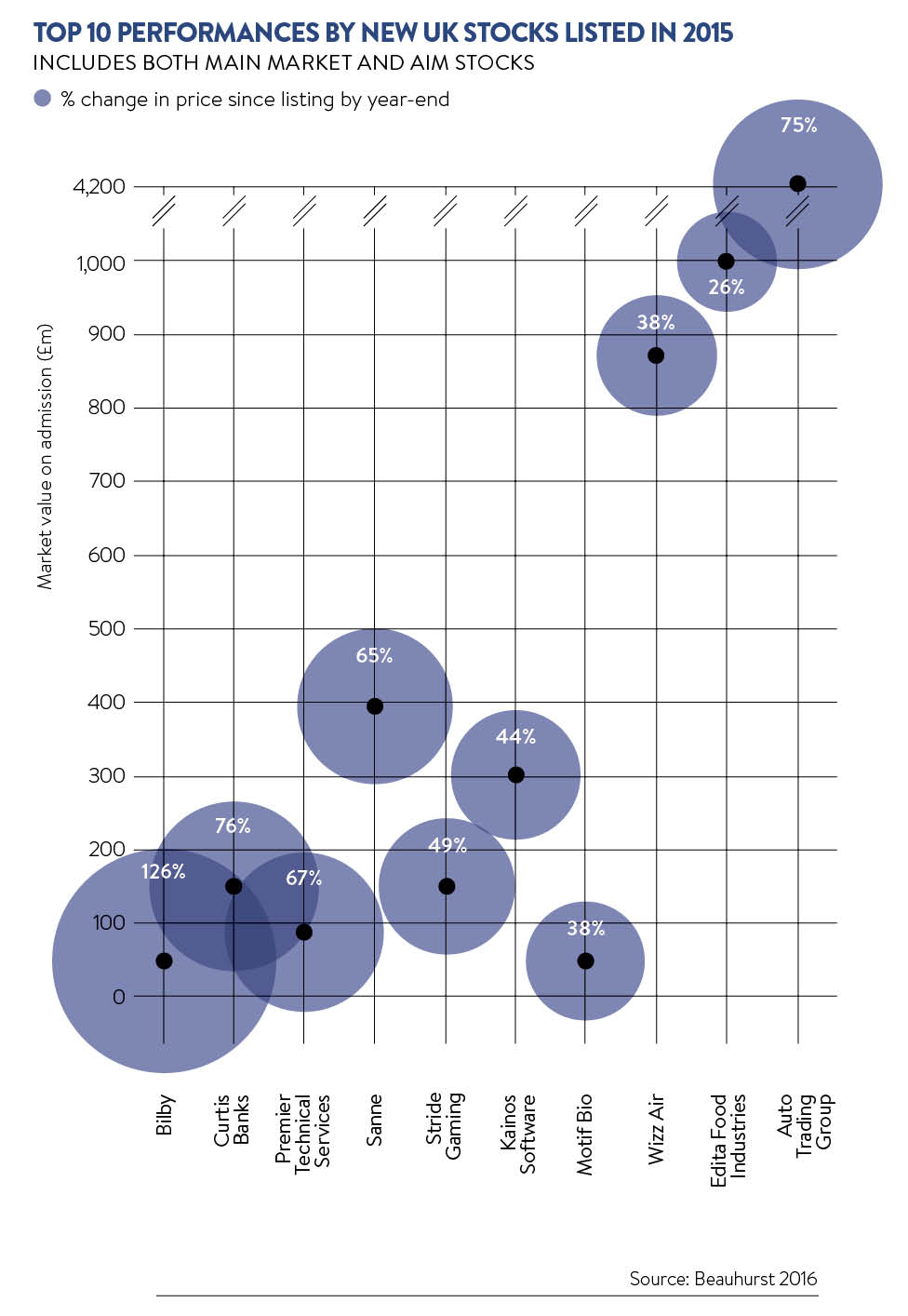

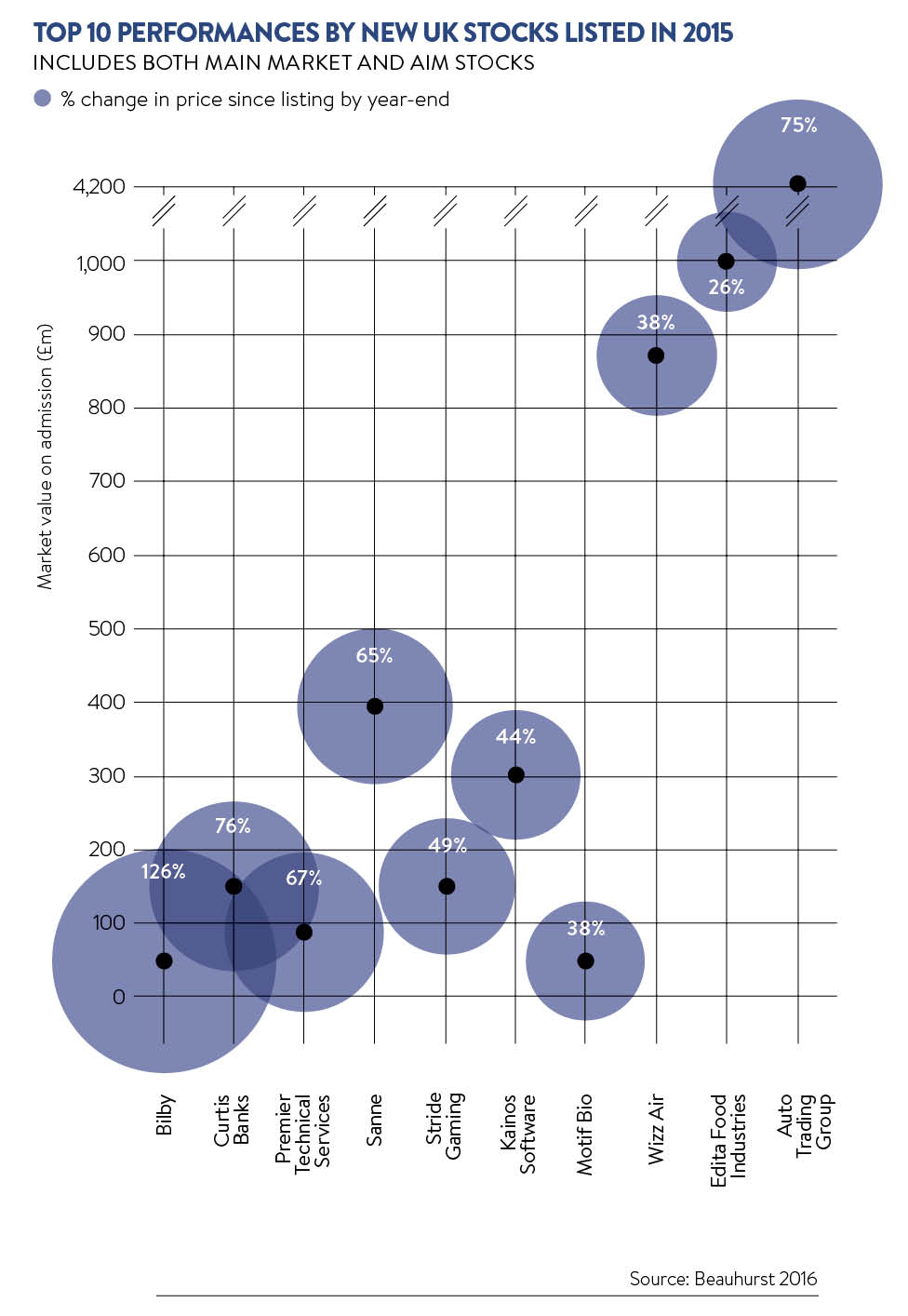

IPOs

Selling equity publicly via the stock market is a common fundraising option. Startups often raise money this way in the hope of growing their value faster however Danny Cox, chartered financial planner at Hargreaves Lansdown, says: “The core downsides of selling equity in a company are the potential loss of control and loss of future earnings.”

Big Four firm EY reported that London’s IPO activity fell 46 per cent last year with proceeds declining by 37 per cent to $15 billion, partly due to the slowdown in Chinese growth and falling oil prices.

Head of Downing Ventures, Matt Penneycard, expresses his frustration with the unicorn concept: “We don’t have IPOs in the same way in this country. There’s absolutely not a viable public exchange for tech companies. There may be in the future, but we just don’t have a version of Nasdaq.”

There are nevertheless IPO success stories including Rightmove whose market capitalisation rose from £621 million in December 2008 to £3.5 billion at present.

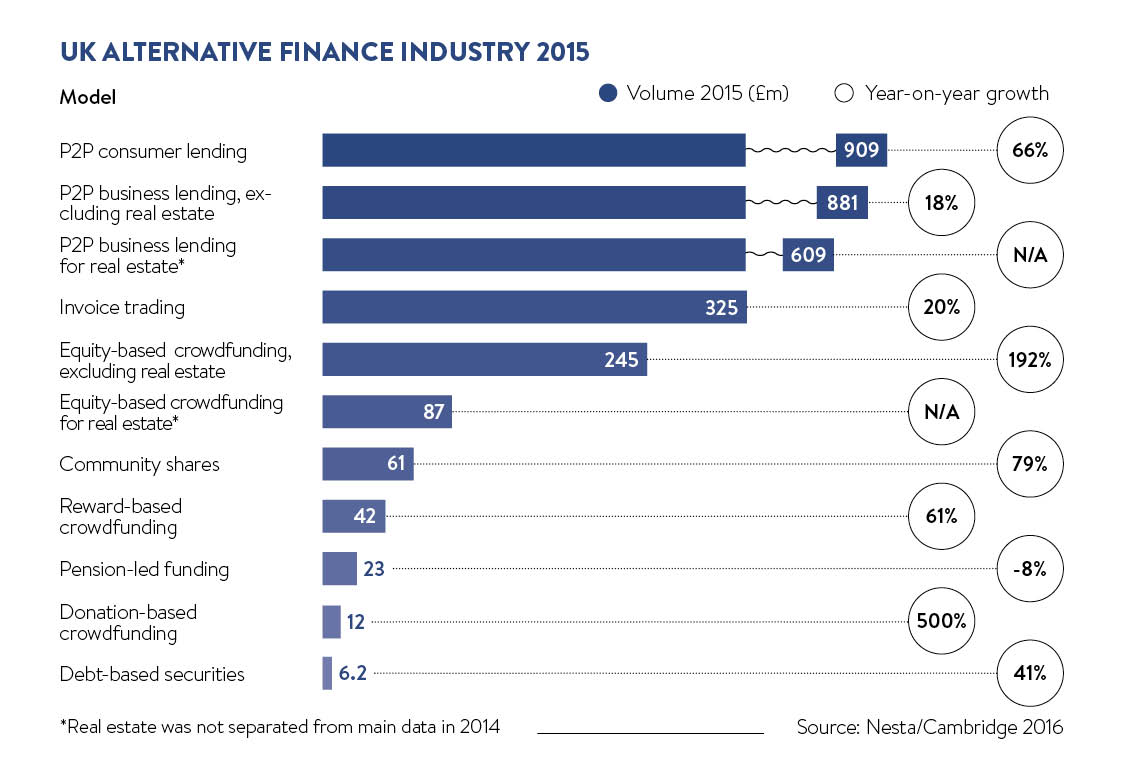

Alternative finance

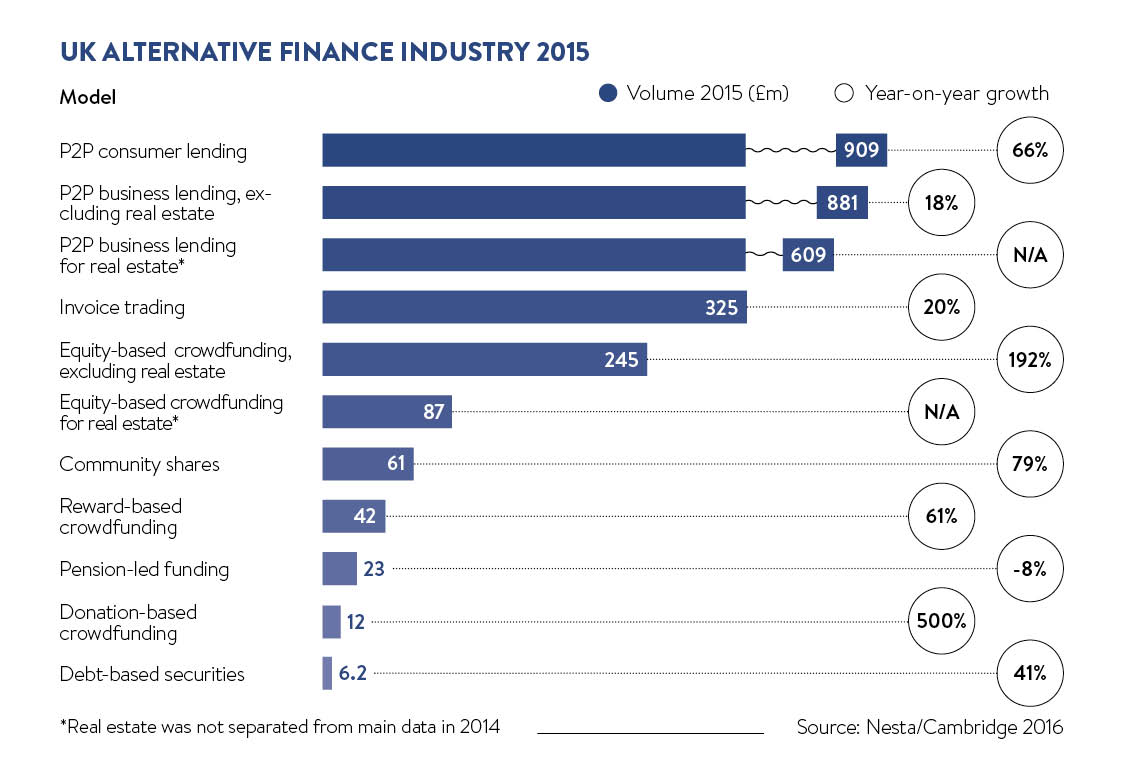

If IPOs aren’t an attractive means of financing your dream startup, alternative financing is on the rise and could be the perfect solution. Last year, the total value of loans and investments made on crowdfunding and invoice trading platforms rose almost 90 per cent to more than £3 billion, according to a report by innovation charity Nesta and the University of Cambridge.

“Peer-to-peer finance is entering a new phase,” says Nesta’s Peter Baeck, the report’s co-author. “After the crash, it was an alternative to scarce bank funding. But the market has evolved and now it’s the first choice for some entrepreneurs because it can be cheaper and faster than traditional debt and equity arrangements.”

Small businesses raised almost £150 billion in 2015 by making requests to crowdlending sites such as Funding Circle, ThinCats and RateSetter, which offer debt finance. Both Santander and RBS direct startups to Funding Circle when they’re unable to offer them finance.

So how does it work? A company’s credit is calculated based on cash flow and loans of between £5,000 and £3 million can be arranged within a week. However, crowdlending platforms typically charge fees at around 5 per cent of the amount borrowed with interest rates of 7-10 per cent which can be higher than bank charges.

Equity crowdfunding is another popular option with businesses raising £323 million in 2015, up 295 per cent on the previous year. JustPark, an app that helps drivers find cheap parking spaces, raised £3.7 million on Crowdcube last year making it Britain’s largest crowdfunding deal.

“There has been a conscious shift towards the crowd among entrepreneurs. Customers become evangelical shareholders and it helps differentiate these companies from their competitors. Venture capitalists have embraced it too because they understand the business benefits,” says Crowdcube co-founder Luke Lang.

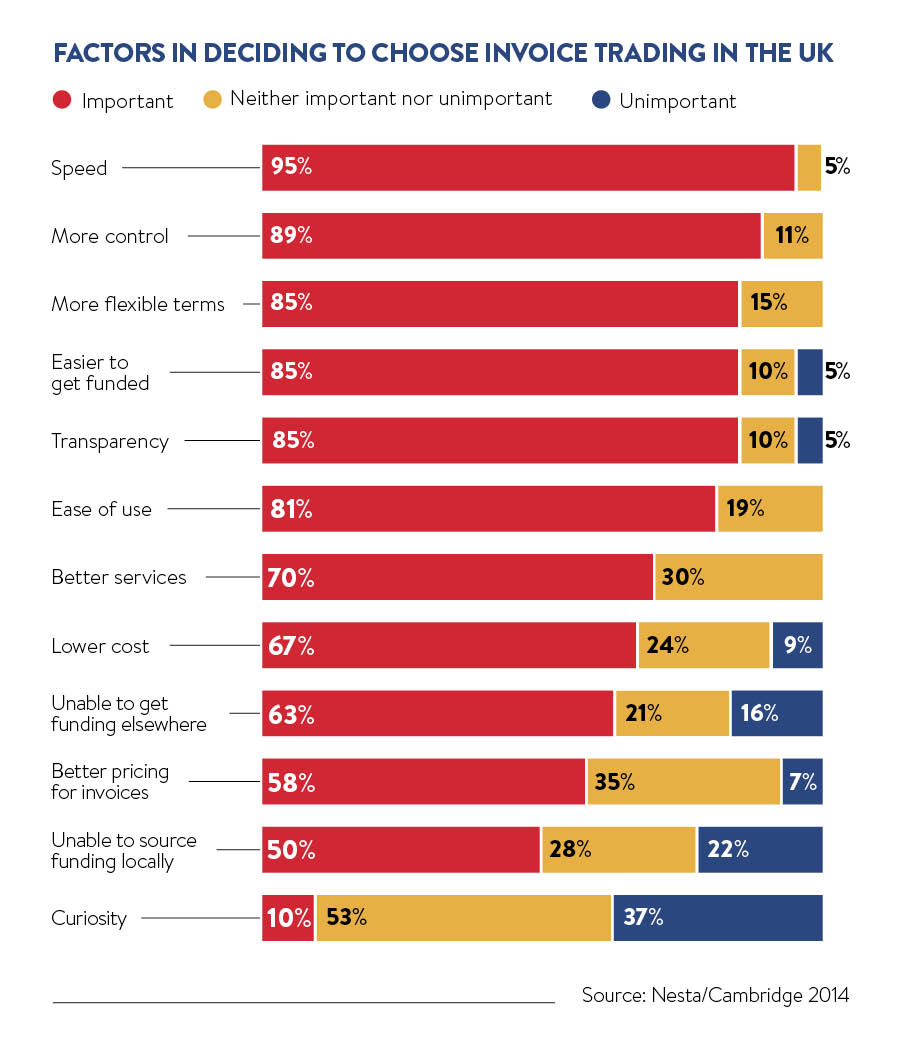

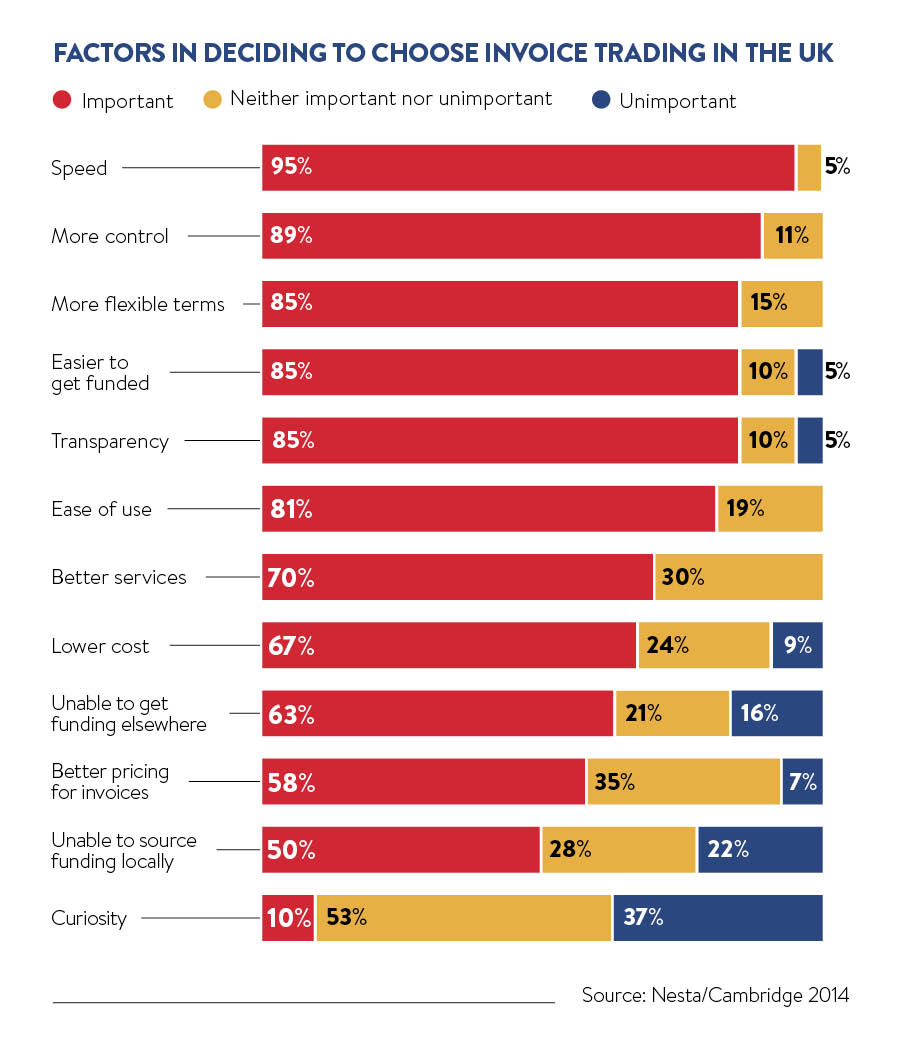

Invoice trading is another alternative finance option for startups focusing on growth. It allows everyday investors to buy invoices in an auction, driving up competition and pushing down costs to invoice owners looking to maintain cash flow.

Invoice trading could even have scope to boost the UK’s economic output. Ruth Chamberlain, UK manager of new platform Investly, argues: “Invoice trading has the potential to eradicate late-payment terms by simply making the timeframe of an invoice irrelevant,” she says. “It will help strengthen businesses across the country, which will ultimately aid the economy and make Britain stronger.”

MarketInvoice founder Anil Stocker urges more growing firms to consider alternative lending sources. “When most businesses think of finance, they still think only of their bank – that’s a culture we need to break,” he says. “It’s just a matter of awareness – and that takes time.”

Supportive environments

Level 39, Europe’s largest incubator of fintech startups

Collaboration and support is at the heart of successful enterprises. Property Partner founder Dan Gandesha explains: “To found a disruptive business you need people you can bounce ideas off. It takes more than just money. You need guidance from people who’ve been through the phase of hyper-growth. The US has had that for a while and I think we have it in the UK now too.”

Startup incubators and accelerators are just one way to build a supportive environment teeming with collaborative ideas and initiatives. Crammed into three floors of One Canada Square is Level39, Europe’s largest accelerator of fintech companies. The skyscraper, which houses dozens of young companies with the potential to reach unicorn status, offers the perfect conditions for disruptive startups. Barclays Bank, UBS, Citibank and Santander also have business accelerators. Tax schemes mean that investors can write off losses, but ultimately nine out of ten of these startups succeed.

Check out the top 6 disruptive startups here

Harnessing technology

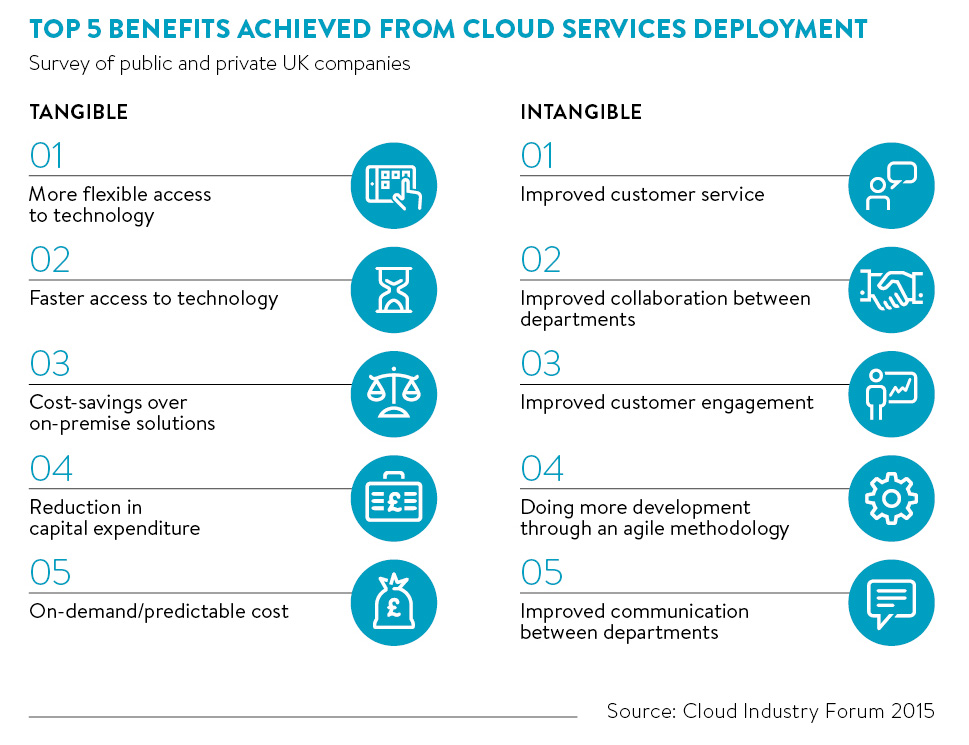

If you’re looking to collaborate more freely and expand your business whilst cutting costs, the cloud is your best bet. “Reduced costs, collaborative learning opportunities and ease of use makes cloud technology a natural choice for people seeking to acquire, develop and enhance skills,” says Sim Venture’s managing director Peter Harrington.

Not only does the cloud enable startups to see a complete picture of their business, it also updates in real-time, opening the doors to information available at your fingertips 24 hours a day, seven days a week.

Developing a social strategy at the heart of your business model is also vital to collaboration and information sharing. Take Yoni Assia, who built his stock trading platform eToro into a global name by harnessing social. All trades are visible on eToro’s social media platform so that investors can learn from the best performing traders.

See more Raconteur Guides for Business

Leadership and employee engagement

Managing millennials

Smart cities mean big business

Investment and financing