Image above: Head office of legal process outsourcing provider Exigent in Cape Town, South Africa, a popular location for outsourcing legal services

Within the past decade, legal process outsourcing has had a major impact on the way top law firms operate – except, you might say, on the things that really matter most about being a lawyer.

By applying the latest technology and harnessing the skills of legal process experts, outsourcing companies have relieved the burden on law firms from processing the vast amounts of due diligence, search and similar routine work.

This has allowed firms to focus on what they do best – applying their creative, analytical legal minds to the problems and priorities of the client.

Collaboration for client satisfaction

The result has been transformational in the way law firms operate. Clients have become more focused on driving value from their law firms and will often not tolerate anything less than the optimal (or at least creative) way of delivering services.

As Nicola Stott, global managing director of Exigent, an outsourcing provider, points out: “The financial crisis and other economic pressures have meant that lawyers across the board – whether in firms or in-house corporate – are expected to do more for less.”

But this can raise deep questions about what it means to be lawyer and where the distinctive character of a firm is to be found. After all, the topic of the moment – thanks to Richard and Daniel Susskind’s book The Future of the Professions – is how far machines and artificial intelligence are going to take over. If lots of firms are using the same back-office services provided by outsourcing companies, where is the character of the firm to be found?

“It really comes down to a question of attitude and outlook,” says Ms Stott. “Firms can differentiate themselves by the way they adopt more innovative, flexible and cost-effective ways of working through alternative delivery models. Corporate clients want value; it’s all they talk about. Aligning legal tasks and activities with appropriately skilled and experienced people for a fair and reasonable price – without jeopardising the outcome for the client – speaks to value.”

So it is clear that the discussion about how far outsourcing services can go has still a long way to run. Bob Gogel, chief executive of outsourcing provider Integreon, draws comparisons with what has been happening in the financial services industry. As he points out, there is fierce rivalry between the banks over, for example, the provision of credit cards. Nonetheless, behind the scenes there is an enormous amount of co-operation through co-ownership of the agency which processes the transactions.

This prompts the challenge that Mr Gogel now lays down to law firms. In a nutshell, he is saying, put aside your rivalry over things that do not matter, such as your billing systems for clients, and collaborate in developing a common interest structure which can act on behalf of a group.

“I would love to get together with, say, five of the big firms to develop something along these lines,” he says. Of course there are issues of security and confidentiality, but “Chinese walls”, restricting information flow, are already part and parcel of how legal outsourcers operate. The participating firms could then enjoy the benefits of scale or pass the price savings on to clients. But either way it would be a cheaper, more efficient way to act, says Mr Gogel. Indeed, it would be the logical conclusion of how to exploit optimally what legal outsourcing has to offer.

[embed_related]

Taking advantage of the benefits

Whether the large law firms will pick up on this prospect remains to be seen. But in the meantime there are still plenty of firms, especially medium-sized outfits, for whom the penny still has not dropped about the benefits of outsourcing.

“We know firms who are missing out on work because they are being slow to innovate in this area,” says Ms Stott. “General counsel are becoming increasingly assertive and saying to their legal providers, ‘You really have to consider these alternatives because the benefits are so clear – if you don’t, then we won’t be using you’.”

Those who don’t move with the times and the technology will just be left behind

Ms Stott concedes that it is a “bit of a head scratch” for some law firms to take on board that these are the new rules of the game. “But that’s life. Things cannot go on as they have in the past. Those who don’t move with the times and the technology will just be left behind,” she warns.

A good example of this is the fulfilment of due diligence in a mergers and acquisitions (M&A) transaction. “We can confidently say that utilising alternative delivery models that combine smart technology with appropriately skilled people would save at least 50 per cent on due diligence costs without jeopardising quality,” says Ms Stott.

One of the key reasons for this is that outsource providers are free of many of the financial obligations and overheads which hang heavy on law firms, elements such as the need for expensive offices, large public relations teams and very expensive staff. They are lean and highly focused with no need for the fancy trimmings.

A no-brainer

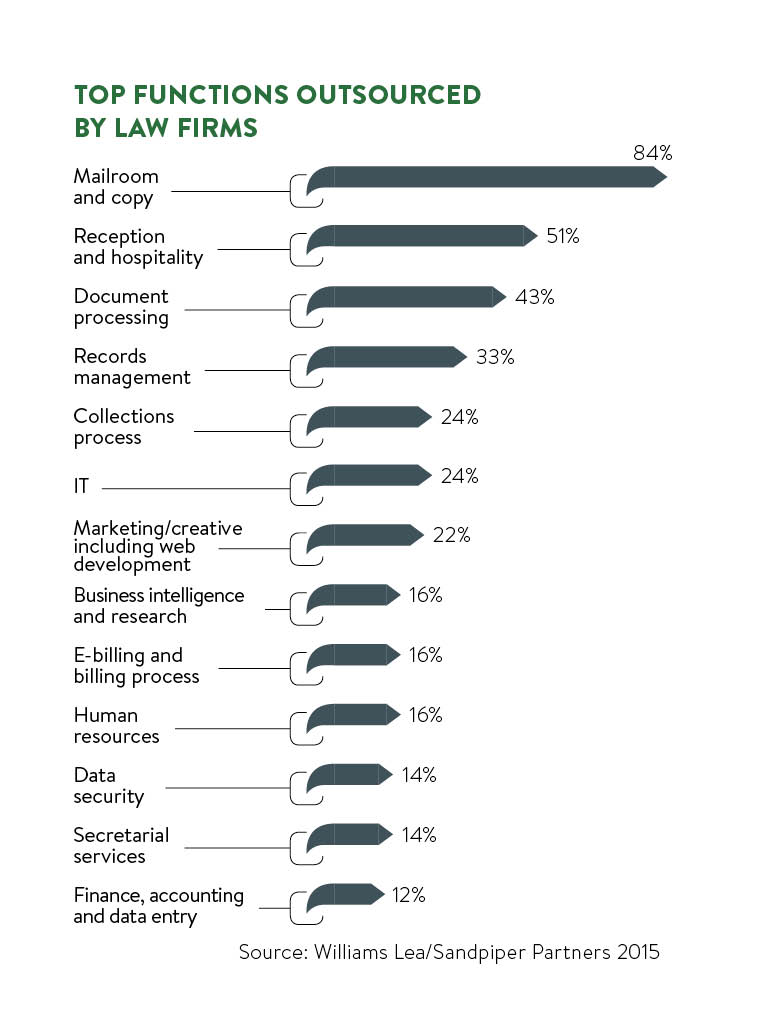

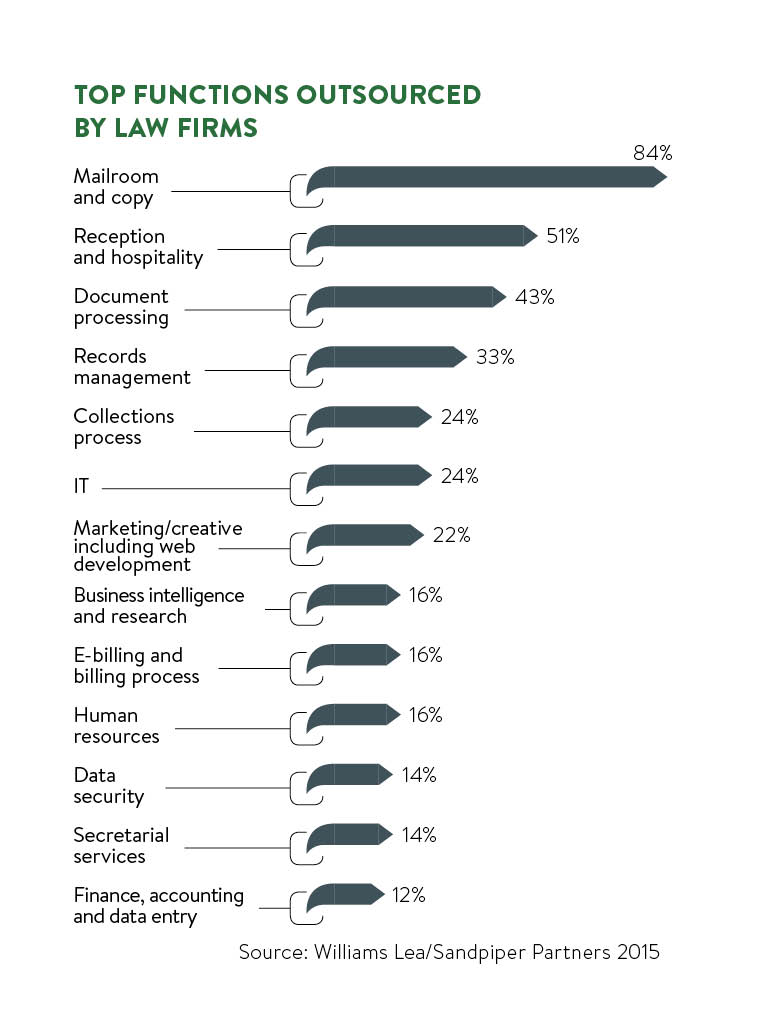

What is remarkable, moreover, is the way a growing number of services are being added to the list. With its roots in activities such as litigation support, document review and e-discovery, the offer now made by leading outsourcing providers extends to cover fields such contract strategy and review, M&A transaction support, information governance, corporate compliance, as well as a range of other consultancy services.

Part of the reason for this is that in-house counsel, just as much as law firms, are now coming for their services. The reasons why are well exemplified by the growth in the appetite for a well-designed contract strategy.

“Contracts are negotiated with great care and enormous attention to detail, but once signed they are often simply put to one side and forgotten about,” says Ms Stott. It’s crazy really because an organisation’s contract portfolio is a very valuable asset; a potential gold mine in some cases with overlooked details such as price increase triggers. Where a large company has hundreds, maybe thousands, of contracts with a range of clients or providers, it can easily lose sight of critical details and dates.

“Visibility of and accessibility to key terms is essential for any kind of meaningful obligation management, not to mention the hidden value or ticking bomb that could otherwise be missed. The technology is there to automate this process, but a contract strategy that includes a risk-based assessment to deal with the legacy contract portfolio is important. With all this key data at their fingertips, in-house counsel can deliver meaningful commercial metrics to their board,” she says.

From a general counsel’s perspective, this is manna from heaven. Nobody likes being caught out by nasty surprises and the possibility of generating additional income from existing contracts is very welcome at a time when in-house legal departments are expected to be profit producers, not just cost centres.

“Heads of legal now need to be able to show to their chief financial officers that they are contributing to the profitability of the business, not draining resources,” says Ms Stott.

Through the clever use of legal outsourcing, they can now achieve this either directly themselves or through the law firms they appoint. Legal outsourcing is not rocket science – in fact, it could be a no-brainer.

CASE STUDY: INTEGREON AND RECOMMIND

When law firm Ashurst LLP acted for a financial services business in alleging that there had been negligence by an auditing company, it faced a demanding deadline to identify key documents from an enormous volume of material.

It turned for assistance to Integreon to provide as many as 80 legal reviewers for a process of linear review. It also brought in technology company Recommind to provide an e-discovery platform to apply advanced analytics and, in particular, predictive coding to ensure the deadline and disclosure requirements could be met.

Two workflows were then followed. The Integreon team, supervised by Ashurst’s lawyers, started reviewing documents and the results of that review were then used to “train” the predictive coding technology to initiate a concurrent, analytics-driven, prioritised review.

With each iteration, the results of human review were used to refine the predictive coding engine’s training to improve the relevance of the next suggested document set and thereby increasing reviewer efficiency. In due course, as the presence of relevant documents in the unreviewed set fell to near zero, it became apparent that human review of the remaining documents was not worth the effort.

Throughout the review there was good co-operation between the law firm and its legal outsourcing suppliers. Recommind and Integreon’s data science and project management experts guided the Ashurst legal team with regard to technology, best practices and defensibility. Subsequently when the other side posed specific challenges, Recommind’s consultants supported the solicitors and barristers in their presentations to the court.

Collaboration for client satisfaction