The optimal insurance company has three “employees”: a computer, a dog and an actuary. The computer runs the insurance company, the actuary feeds the dog and the dog bites the actuary if they try to touch the computer.

This joke has supposedly been making the rounds among insurtech companies, which are shaking up an industry that has traditionally been slow to adopt new technologies. Granted, you can easily compare quotes online these days. But there are still forms to fill in, policies to print out. And for many tech-savvy millennials, the claims process must seem positively glacial unless, of course, they happen to be one of Lemonade’s customers.

Because of data and AI advancing so much in the industry, carriers can now do a lot more for their customers

Open the Lemonade app and a chatbot called AI Maya will kit you out with a personalised policy in just 90 seconds. The company promises no paperwork, and takes a flat fee of a customer’s premium while setting aside the rest to pay claims and purchase reinsurance. AI Jim, another chatbot, reviews claims and runs them through 18 anti-fraud algorithms. Simple ones are approved and paid out in seconds; more complicated claims are handed over to the company’s human team for review.

“A lot of our customers are first-time insurance buyers,” says Yael Wissner-Levy, head of content and strategic communications at Lemonade. “From the kind of feedback we’ve had, they either felt that insurance was too bureaucratic or they thought it was too expensive. Those are two things that we think we’ve solved.”

Insurance firms beginning to leverage AI technology

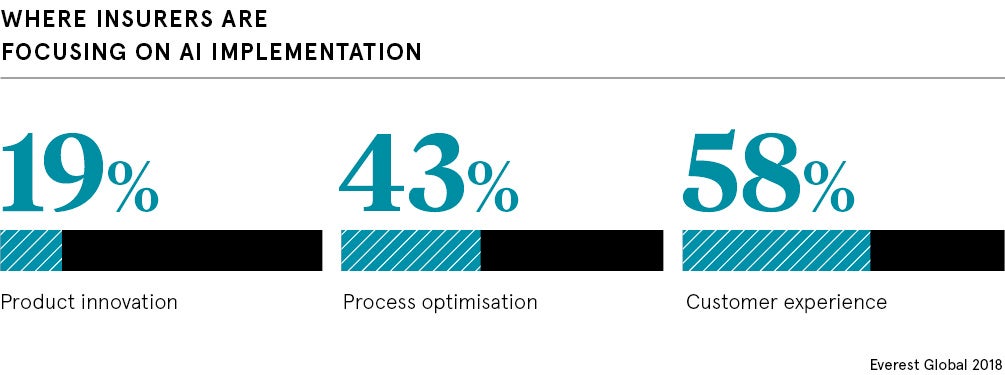

Lemonade isn’t the only insurtech firm that’s built its business around artificial intelligence (AI) and big data, and traditional insurers are also getting in on the act. Recent research by Genpact, a global professional services firm that offers a modular AI-based platform, found that 87 per cent of insurers are investing more than $5 million in AI each year, and more than half are planning to transform many of their existing business processes over the next three years.

“The emergence of insurtechs and changing customer expectations have been key drivers to adoption and commitment of investments in AI and other new technologies,” says Sasha Sanyal, global business leader for insurance, corporate social responsibility and diversity at Genpact. “Insurers are using AI to make smarter underwriting decisions, better manage risk, detect fraud and create positive customer experiences.”

Berlin-based insurtech company Omni:us works with both startups and traditional insurers. Its products, Omni:us Claim and Omni:us Policy, digitise and analyse complex documents to streamline the claims handling and policy-quotation process. After classifying incoming documents and assigning them to virtual piles, for example health invoices, car repair invoices or theft reports, the AI extracts any valuable data, examines it and passes it on to the insurer.

“Our AI keeps learning through elements like transfer learning [storing knowledge gained while solving one problem and applying it to a different but related problem],” says Martin Micko, chief operating officer and founder of the company. “So even with documents the system has never seen, the AI engine processes them correctly in a similar way to a human being.”

How AI can spot and stop insurance fraud

According to the Association of British Insurers, more than half a million insurance frauds, totalling £1.3 billion, were detected in the UK during 2017, while in the United States the FBI estimates insurance fraud robs the US insurance industry of a whopping $40 billion a year. AI and machine-learning tools enable insurers to spot and flag unusual patterns that a human might miss, potentially helping to reduce these huge sums, as well as the cost of customer premiums.

Shift Technology’s AI-driven fraud detection solution, Force, is already used by more than 70 insurers around the world. It analyses vast amounts of data from multiple sources to generate a fraud score for each claim and has an average hit rate of 75 per cent, higher than many other automated fraud detection systems. “You don’t want to falsely suspect claims because you’ll annoy your customers and you don’t want your fraud handlers to spend time on unsuspicious claims, so it’s very important to optimise the hit rate,” says Jeremy Jawish, Shift’s co-founder and chief executive.

Companies such as Hanzo also offer web-crawling AI tools that can sift evidence of a fraudulent claim from social media accounts, for example from pictures of someone who claims to have been injured in a car accident skiing in the Rockies. Other innovative AI-based solutions include Guidewire’s Cyence Risk Analytics platform, designed to help the insurance industry quantify cyber-risk exposure, and Cape Analytics that uses AI and geospatial imaging so insurers can understand the risk profile and value of property assets.

How AI can help insurers serve their customers better

In the future a personal assistant on your smartphone could even alert you when you’re about to engage in activity that could increase your insurance premiums, as the insurance industry shifts from a repair-and-replace model to a predict-and-prevent approach.

“Because of data and AI advancing so much in the industry, carriers can now do a lot more for their customers,” says Ari Libarikian, senior partner with McKinsey & Company in New York, who leads the company’s advanced data and analytics practice in insurance. “They can help monitor risk, they can help predict risk and they can help give advice to customers on how to reduce risk going forward. That means the frequency and severity of losses comes down over time.”

Mr Libarikian believes that by 2030, AI will inform every major decision an insurance company makes. But the optimal company will have far more than three employees and they’ll definitely be allowed to touch the computers. “There’s no substitute for good old-fashioned claims and underwriting experience,” he says, “and that will very much still be part of the organisation.”