Over the last 20 years and more, chief financial officers (CFOs) in industry after industry have taken the plunge and embraced innovation. From banks to technology companies and, more recently, telecommunications, global organisations have realised that modern finance architectures can deliver better insights and cut cost and resource requirements.

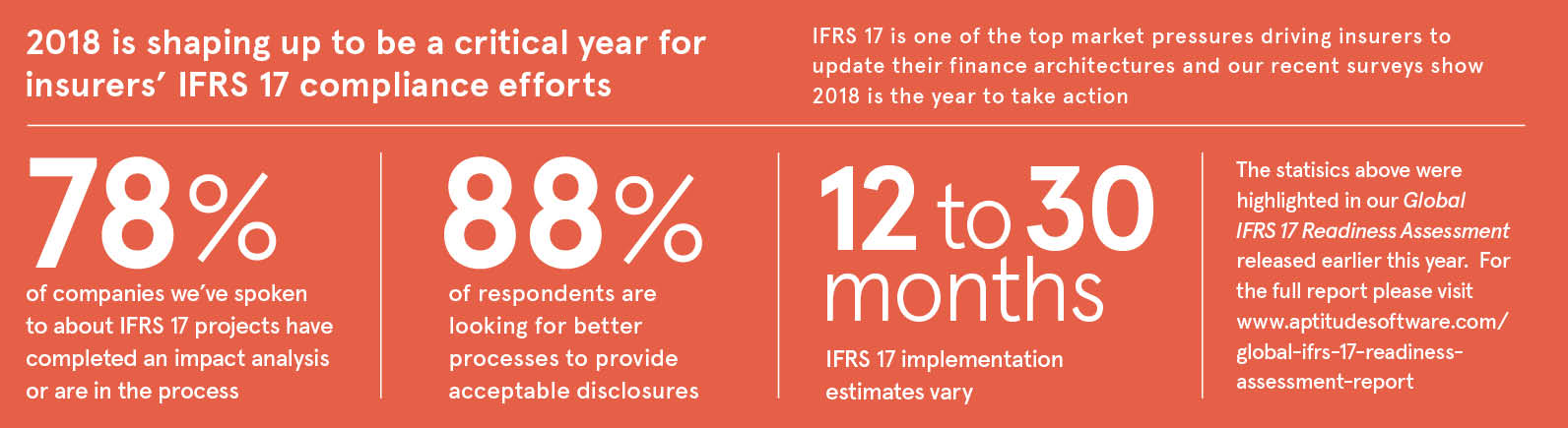

Now, 2018 is the year of reckoning for insurance. With growing demands from customers, the emergence of disruptive technologies and significant regulatory changes, like International Financial Reporting Standards (IFRS) 17 and 9, it’s little wonder CFOs of many insurance firms have been left reeling.

How prepared they are for these changes varies considerably, according to Tom Crawford, Chief Executive of Aptitude Software. The firm, which has offices across the globe, has been equipping CFOs and helping firms compete by providing the data foundations and accounting capabilities needed to drive business forward.

For years, Mr Crawford points out, insurers have underinvested in back-office systems, thereby limiting their ability to provide insight into their businesses. M&A activity has added to the complexity as a variety of very different systems have, in effect, been bolted onto each other.

We were able to help them bring all that data together to deliver global financial reporting and enable the CFO to provide sharp financial insights back to the business

“Most insurers have older financial architectures with many different actuarial systems providing various levels of detail. One client of ours had over 140 source systems, for instance,” he says. “These older systems restricted transparency and led to a constant worry about how to survive audits. We were able to help them bring all that data together to deliver global financial reporting and enable the CFO to provide sharp financial insights back to the business.”

In these times of complex challenges, many CFOs want to play a greater role and to add value to the business. “If I had more time, I would spend it on forward-looking, ‘What if?’ type analysis for the company at large,” Anna Miskin, CFO of VitalityLife, said at a roundtable event organised by Insurance ERM, the online resource for enterprise risk management, last summer.

“For example, the focus of product development in the actuarial function is on the profitability and value generation of the product itself. However, I also want to know what it is likely to do to my business mix, acquisition costs, liquidity, capital, competitive position and so on.”

Despite their best intentions, only 6 per cent of CFOs and senior finance executives feel certain that they understand the current suite of technologies, and only 31 per cent know what is available to them, according to a 2017 survey by FSN, a business systems and news analysis provider.

Mr Crawford says: “Any time spent ‘bean counting’ or dealing with backwards-looking reporting limits the ability of CFOs to be more proactive and to take a more strategic view of the business. We know more and more CFOs are being tasked with managing company-wide data, data analytics initiatives and technology in general, so this puts them in a good position to make data-driven decisions and recommendations to the board.

“To ensure they really are valued business partners, CFOs must have credible, readily available data that’s easy to analyse. We think FWD Group, one of our customers, is a great example to the industry. They are focused on creating fresh customer experiences, with easy-to-understand products, supported by digital technologies. They were one of the first global insurers to take action on IFRS 17, embracing the regulation to support innovation with back-office excellence.”