Globally, some $15 trillion of financial agreements are signed every year. A growing number of these contracts will be carried out electronically. However, all too often firms still rely on a patchwork of semi-automated and manual processes.

Globally, some $15 trillion of financial agreements are signed every year. A growing number of these contracts will be carried out electronically. However, all too often firms still rely on a patchwork of semi-automated and manual processes.

This is inconvenient for customers resulting in around $75 billion of lost sales a year and it unnecessarily costs firms about $50 billion annually because of inefficiencies, according to research by Dealflo, the world’s only service focused on end-to-end automation of financial agreement processes for products such as loans, motor finance and pensions.

“Customers who are familiar with the ease and convenience of services such as Uber or Amazon are no longer prepared, for instance, to have to print out a 20-page contract, sign it in various places, scan it and e-mail it back,” says Abe Smith, Dealflo chief executive. “Alongside this, increasingly complex regulations, more aggressive regulators and bigger fines are adding to the risks that firms expose themselves to because of blind spots in semi-automated or manual processes.”

He points out that the errors and risks involved in substandard e-signature procedures, as well as those that rely on a physical or human element, have contributed to the $200 billion that financial services have been fined since 2008.

He points out that the errors and risks involved in substandard e-signature procedures, as well as those that rely on a physical or human element, have contributed to the $200 billion that financial services have been fined since 2008.

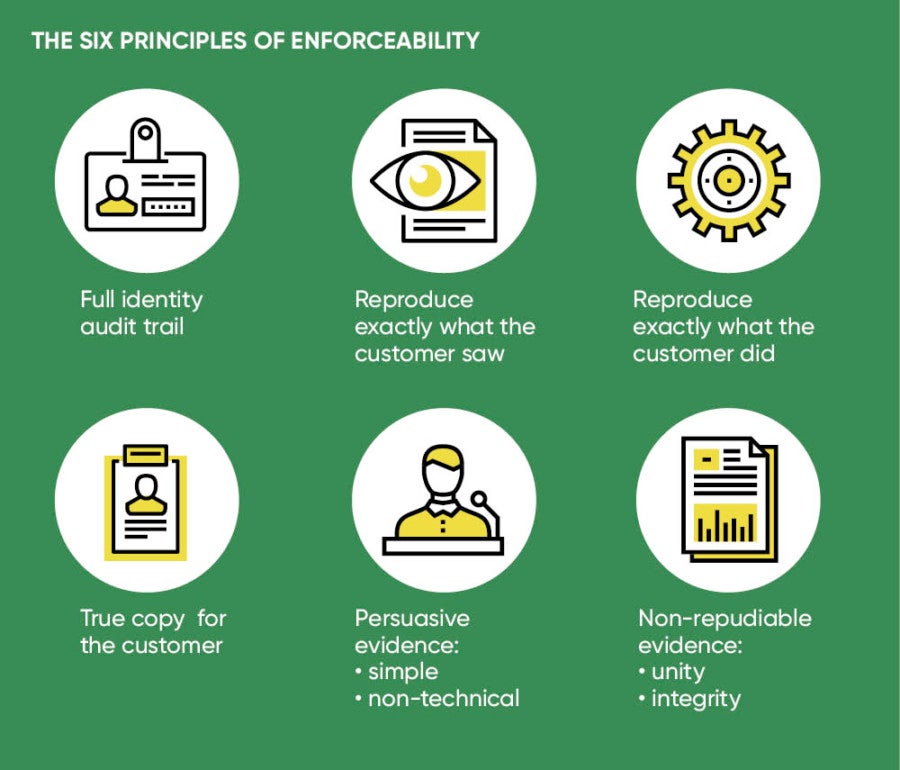

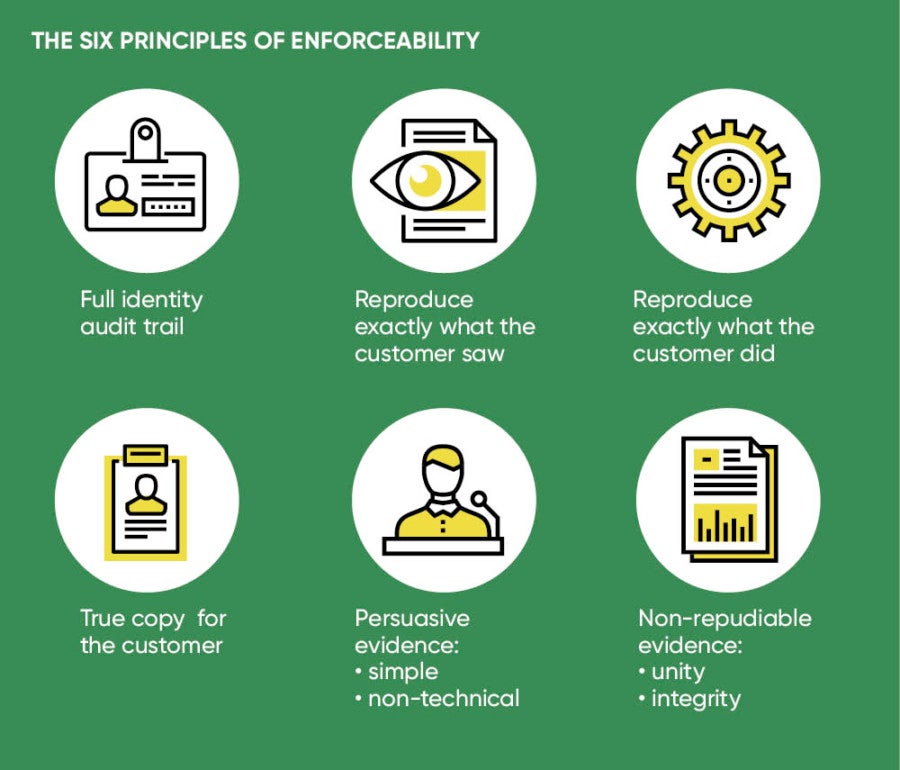

“To protect themselves from fines and regulatory action, firms have to understand the difference between ‘legality’ and true contract ‘enforceability’,” says Mr Smith. “Organisations might have adhered to legal advice to generate an agreement but, if a customer takes them to court, can they convincingly prove they’ve done all the right things? That’s what the legal community means by ‘enforceability’. Legal experts have identified six principles that every financial services firm should address to mitigate the risks of automation.”

The first is to be able to produce a full identity audit trail to satisfy regulatory requirements. Second, they must be able to reproduce exactly what the customer would have seen on the screen when they came to sign. Third, firms need to be able to show what the customer did when they signed.

“Here, for instance, it’s advisable not just to keep a written log of the customer’s actions, but to be able to record and replay a visual log of what was presented to them and how and when they interacted with the workflow,” says Mr Smith. “More often than not in financial services transactions this isn’t just signing a contract, but fulfilling additional activities such as verifying the customer’s identity, showing supplementary documents like pre-contract information or uploading proofs.”

The fourth principle is the capability to demonstrate that the version the customer saw on the screen as well as the one they took away with them and the master copy are all the same. Five, should an agreement be challenged, the firm in question needs to be able to provide evidence that the customer, the judge and the regulator can all understand as non-IT experts. “If the evidence is too technical, it just won’t be convincing or compelling,” adds Mr Smith.

According to the sixth principle, and arguably the most important, firms need to reference all evidence in a single electronic package, which has to be given integrity ideally with digital signature, to ensure it is court admissible and cannot be challenged.

Carrying out agreement processes in a manual or semi-automated way represents an operational risk because providers have little control over them

When done correctly, other advantages of end-to-end automation include improved sales conversion with easier know-your-customer, anti-impersonation checks and a process less prone to errors. Not only are operational inefficiencies reduced, but the entire sales process is captured and electronic agreements can be easily retrieved. Modern financial services companies have compliance at their heart and by automating, they’re able to design, control and evidence this process for every deal signed.

Recognised by Deloitte as one of the fastest-growing technology companies in Europe in 2016, Dealflo has developed a platform that specifically addresses these six principles of enforceability while delivering an unrivalled digital customer experience.

Dealflo process £20 billion of financial agreements annually for many leading financial services companies, including BNP Paribas, BMW Financial Services and Prudential. “By using our automated systems, customers find that processes are faster, more efficient and more likely to generate increased sales,” says Mr Smith. “They’re also freed from the risks of non-compliance. Carrying out agreement processes in a manual or semi-automated way represents an operational risk because providers have little control over them.”

A growing number of financial services firms are using Dealflo’s cloud-based platform to digitise and secure the financial agreement process, whatever the contract type, customer type, risk or geography, enabling them to satisfy the six principles of enforceability. They appreciate the automation of the end-to-end procedures from workflow management through to ID-verification, e-signature, evidence capture and secure vaulting.

Dealflo clients are also reporting an increase in sales of between 10 and 25 per cent with a reduction of up 90 per cent in the time taken to complete a deal – in many cases down from days to just a few minutes.

The platform enables lenders to prove customer intent when signing agreements by uniquely embedding evidence into the electronic agreement itself that replays the customer’s journey through every step in the process. The signed agreement is given a tamper-proof seal and securely vaulted, ready to use as evidence in potential customer, legal or regulatory challenges.

“Firms come to us because we give them the reassurance that their digital agreements are secure, compliant and legally enforceable,” says Mr Smith. “Our service delivers the user experience that customers expect and it helps firms to stay in control of their compliance. The financial sector spends billions of dollars to manage financial risk at the front door. Our service allows firms to prevent legal and regulatory risk coming in through the back door while scaling safely and efficiently.”

For more information please visit dealflo.com