Owners of successful small businesses have historically been perceived to have master juggling skills. Offering a product that people want to buy is not enough; it falls to the owner to manage every aspect of the company, from marketing to sales, strategy, hiring, banking and admin. The latter two, in particular, are a necessary evil of doing business.

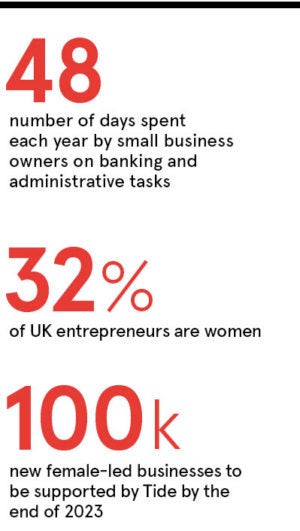

Of the 5.7 million small and medium-sized enterprises (SMEs) in the UK, 5.5 million are smaller companies that tend not to have a dedicated finance function. This means a huge number of business owners are doing their company’s banking and admin themselves. According to research by Worldpay, small business owners in the UK spend 48 days a year on this area of running their company.

That equates to approximately a fifth of the working year that company owners aren’t spending on trying to grow their business as they are bogged down by administrative tasks. Or, as is often the case, many lose their Sunday afternoons to doing expenses. The result is not only a drain on time and energy, but a damaging loss of productivity.

“It’s not the best use of their time,” says Oliver Prill, chief executive at Tide, the SME banking platform. “And by doing banking and admin in a technologically unsophisticated way, small businesses are also lacking a clear overview of their cash flow.

“Not having their cash flow under control is the biggest reason for small businesses failing, rather than any inherent business problem. Real-time visibility of cash flow at all times means you can act on any issues or challenges in a timely manner and not when it’s too late.”

Since its official launch in 2017, Tide has become a market-leading business banking platform for SMEs by enabling them to reduce the time they were previously spending on banking and admin, as well as providing a crucial overview of cash flow. As a platform play, Tide offers e-money current accounts provided by PrePay Solutions and partners with other providers, such as Xero, Sage and Iwoca, to create a go-to place for SMEs that want to simplify the management of their company.

“This is a huge productivity boost waiting to happen,” says Mr Prill. “A platform such as Tide provides easy-to-use solutions that free up time for small-business owners to focus on what they know best, thereby experiencing better productivity and in the end growing their company faster. We’re passionate about SMEs; it’s the only market we serve.

“We offer invoicing and expense management on the platform and a credit solution that’s currently in beta with Iwoca where you enter three pieces of information, press a button and within a minute you get a credit decision. Everything we do is focused on providing a rich, usable set of tools and features for small businesses.”

“We offer invoicing and expense management on the platform and a credit solution that’s currently in beta with Iwoca where you enter three pieces of information, press a button and within a minute you get a credit decision. Everything we do is focused on providing a rich, usable set of tools and features for small businesses.”

Tide doesn’t only provide SMEs with technology solutions for banking and admin, it also supports its vibrant community of members by offering and facilitating advice, guidance and networking. It encourages members, such as accountants and lawyers, to provide tips on a wide array of topics, including master classes covering marketing, managing growth, funding, public relations strategy on a shoestring, and diversity and inclusion.

The company is also eager to further causes its members care about. Earlier this year, the Alison Rose Review of Female Entrepreneurship found that only 32 per cent of UK entrepreneurs are women. In response, Tide has committed to supporting 100,000 new female-led businesses start out by the end of 2023, and will run events showcasing female entrepreneurs, workshops with expert speakers and a mentoring scheme.

The UK banking landscape is set to change significantly as branches continue to close and digital propositions offer better support and services to SMEs. A healthy market is categorised by a multitude of different offerings and providers, and platforms that support SMEs will bring them together to save even more time for business owners.

“That means more tailored and easy-to-use solutions,” says Mr Prill. This autumn, Tide will launch features that improve expense classification and online payroll, followed by more comprehensive credit solutions and sophisticated international payments. “We’ve built only 10 per cent of the platform we want to build. There’s much more to come,” Mr Prill concludes.

For more information please visit www.tide.co

Owners of successful small businesses have historically been perceived to have master juggling skills. Offering a product that people want to buy is not enough; it falls to the owner to manage every aspect of the company, from marketing to sales, strategy, hiring, banking and admin. The latter two, in particular, are a necessary evil of doing business.

Of the 5.7 million small and medium-sized enterprises (SMEs) in the UK, 5.5 million are smaller companies that tend not to have a dedicated finance function. This means a huge number of business owners are doing their company’s banking and admin themselves. According to research by Worldpay, small business owners in the UK spend 48 days a year on this area of running their company.

That equates to approximately a fifth of the working year that company owners aren’t spending on trying to grow their business as they are bogged down by administrative tasks. Or, as is often the case, many lose their Sunday afternoons to doing expenses. The result is not only a drain on time and energy, but a damaging loss of productivity.

“It’s not the best use of their time,” says Oliver Prill, chief executive at Tide, the SME banking platform. “And by doing banking and admin in a technologically unsophisticated way, small businesses are also lacking a clear overview of their cash flow.