Some of the world’s largest companies, Apple, Amazon, Facebook and Google, are experts in gathering and deriving insights from data. The importance of data is soaring. IDC predicts that by 2025 the amount of global data will grow to 163 zettabytes. That’s ten times the amount generated in 2016.

Yet, in the financial world, firms are already unable to handle the data at current levels.

Firms are having to fall back on manual processes, including large teams of people working on spreadsheets. At countless organisations the only way to spot errors in data silos remains the archaic method of paper and a highlighter pen. Alternatively, huge budgets are sunk into enterprise systems that take months to deploy and still fail to deal with complex, unstructured data.

SCALE OF THE CHALLENGE

“It’s incredible, isn’t it?” says Dr Christian Nentwich co-founder and chief executive of Duco, a company focused on providing the solution. “This is 2017 and we still have paper and pen to find errors. The general public would be horrified.”

Some companies think the answer lies in Excel or commissioning a bespoke software tool. “You’ll see companies ring up their favourite consultancy and ask for a reconciliation system which is supposed to do the job,” says Dr Nentwich. “They cost millions and yet you still wind up with people working manually.”

The reason the industry finds it so hard to find the right solution is that the job is genuinely difficult. The IT systems involved are numerous. Each has its quirks. Engineering a tool for each and every one is laborious.

Furthermore, there are so many tasks. There’s compliance, post-trade reconciliation, counter-party datasets, migration projects, data preparation and so on.

This explains why there is such excitement around machine-learning. The ideal solution is a self-learning tool which can map on to any dataset, learn the layout and automate the entire error-discovery process.

In 2010, Dr Nentwich and Michael Marconi, a fellow computer scientist, founded Duco to create such a system. The company’s flagship product, Duco Cube, is used by financial institutions globally to handle error detection. Machine-learning lies at its heart.

“Duco Cube compares data,” says Dr Nentwich. “It learns what the data is and how it is formatted. Then it finds inconsistencies and immediately presents the results in an intuitive way. Everything is automated.”

The approach is uniquely versatile. It is possible to apply the same methodology to a dizzying variety of data tasks. “We focused first on reconciliation,” says Dr Nentwich. “We have ten major banks on the platform. But we work equally well with data preparation and normalisation.”

Duco Cube is used by financial institutions globally to handle error detection. Machine-learning lies at its heart

Alongside banks, the platform is used by brokers, asset managers, hedge funds, fund administrators, service providers and exchanges – any firm that needs to manage complex data.

There are applications in the medical sector, in retail and in logistics. “We are astonished to see how our system gets used,” says Dr Nentwich. “The secret is that we are not hard coded to a single application. We are more like a Swiss army knife.”

PUT THE USER IN CHARGE

A critical factor in automating reconciliation and error detection is letting the end-user implement the system. With so many jobs to perform, any dependencies or bottlenecks can severely hamper the business. Duco Cube makes life simple for users via a hosted, web-based platform, which even non-technical people can implement. “It’s self-service,” says Dr Nentwich. “In no way do you need a computer science degree to use it.”

The machine-learning algorithms operate in the background. Users are generally unaware anything clever is going on, merely that the system works.

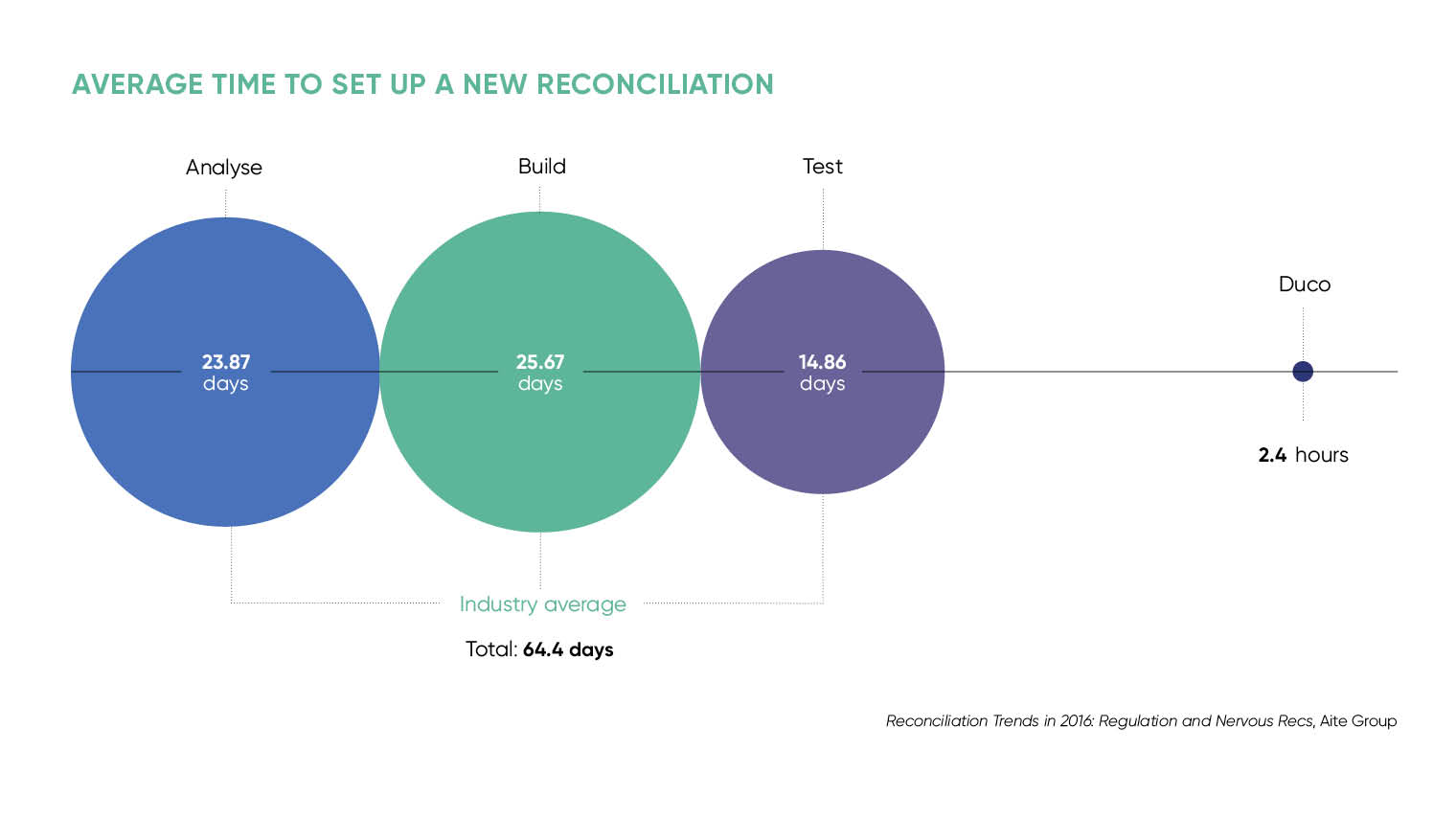

The result is a fast, fully automated approach to post-trade reconciliation, error discovery, data preparation and other related jobs. According to Aite Group, the industry average for analysing, building and testing just one reconciliation process is more than 64 days. With Duco Cube it’s 2.4 hours.

“We’ve seen a big appetite for this sort of service,” says Dr Nentwich. “Our revenue is growing more than 100 per cent annually. We have offices in London, New York and Luxembourg, and clients on every continent.”

In March, Société Générale Bank & Trust (SGBT) announced it would be using the Duco Cube platform to automate securities, cash and internal system-to-system reconciliations. Yves Dupuy, chief information officer at SGBT, says: “With it we can set up and automate a variety of processes with ease, without major development projects. The technology also introduces an additional degree of control, transparency and auditability across our business.”

Another tier-one bank deployed Duco Cube for regulatory requirements. A spokesman explains that their old system simply couldn’t handle the new challenges introduced by MiFID II (EU Markets in Financial Instruments Directive), EMIR (European Market Infrastructure Regulation) and US Dodd-Frank Wall Street Reform: “We had three of our largest regulatory reconciliations loaded on to the system, with 60 to 70 per cent of the data that needed to go on there, and the platform just ground to a halt.” The bank adopted Duco Cube.

A change manager concludes: “With Duco you just put in the two source files and the system does all the magic for you. With our old system that process would have taken me a few days, but I’ve just circumnavigated this by clicking on a button. That’s pretty amazing.”

Cost pressure will only accelerate the demise of the old methods. A penalty for non-compliance can outweigh the entire cost of migrating to a machine-learning platform. Not to mention benefits of reduced risk and enhanced digital agility.

With the right data tools at their disposal, companies can analyse data to find more efficient ways of serving customers. It may even be possible to craft new business models and services. Strong data systems mean organisations have the insights and speed they need to outpace insurgents.

“Machine-learning and self-service applications are transforming this industry,” says Dr Nentwich. “They’ve taken some time to develop, but now they’re here it’s the only way to survive.”

To find out more please visit: du.co