LinkedIn founder Reid Hoffman is a devoted student of the pivot: that inspired moment when an entrepreneur switches strategy. “In Silicon Valley, entrepreneurs tend to celebrate a daring pivot,” wrote Mr Hoffman. “They see an opportunity. They act and they don’t look back. Later on, they sound a bit like Caesar reporting to the Roman Senate: ‘I came, I saw, I conquered.’”

And yet, he says: “The truth is a lot messier.” Masters of the art of the pivot such as Stewart Butterfield prove Mr Hoffman’s point. Mr Butterfield is famous for two brilliant pivots. He founded Flickr as a chatboard for a computer game. The ability to share photos on the chatboard impressed users, so he switched focus to that, with spectacular results.

Mr Butterfield hit gold with a second pivot, with Slack. Today Slack is a wildly popular corporate messaging service used by IBM and eBay, but it began life as a side-project to help programmers work on a game he was developing. The side-project proved successful, so he pivoted and developed it into a $7-billion venture.

Finance departments need to help their companies course-correct, or even change direction, whenever needed

However, as Mr Butterfield insists, there was never a single change of direction. Instead, his plans were repeatedly modified. At one point, he went through 15 ideas, ranked in order of merit, to see if they would work. Again and again, it’s a process of updating and finessing plans that delivered results.

It’s a lesson that chief finance officers (CFOs) are starting to learn. “Finance departments need to help their companies course-correct, or even change direction, whenever needed,” says Rob Hull, founder of Adaptive Insights, a Workday company, whose core offering is a platform for agile business planning. “This ought to be obvious. And yet we see finance departments sticking to a quarterly or annual plan, unable to help their businesses make rapid decisions. It’s obsolete thinking.”

Kelly Wall, vice president of accounting at global media company Legendary Entertainment, says her team has come out of the “dark ages” of Excel, moving to a cloud planning platform. “This has changed the role of finance at Legendary. Together we collaborate with our business partners and, when we’re all working from the same source of data, we can make confident decisions quickly. And that’s key for the media business, where audience interest, consumption models and demographics are constantly in flux.”

Yet finance departments still rely on spreadsheets. And they continue to struggle to embrace flexible thinking. Top-down planning remains the dominant model for most businesses, says Doug Henschen, vice president and principal analyst at Constellation Research. In the top-down approach, the finance team allocates resources to objectives within a financial strategy. They cascade that strategy downward into budgets and operational plans for functional teams. Then they reconvene at the end of the year to kick the whole process off again. This process no longer works in disruptive times, when companies are likely doing their best to fend off new competitors, says Mr Henschen.

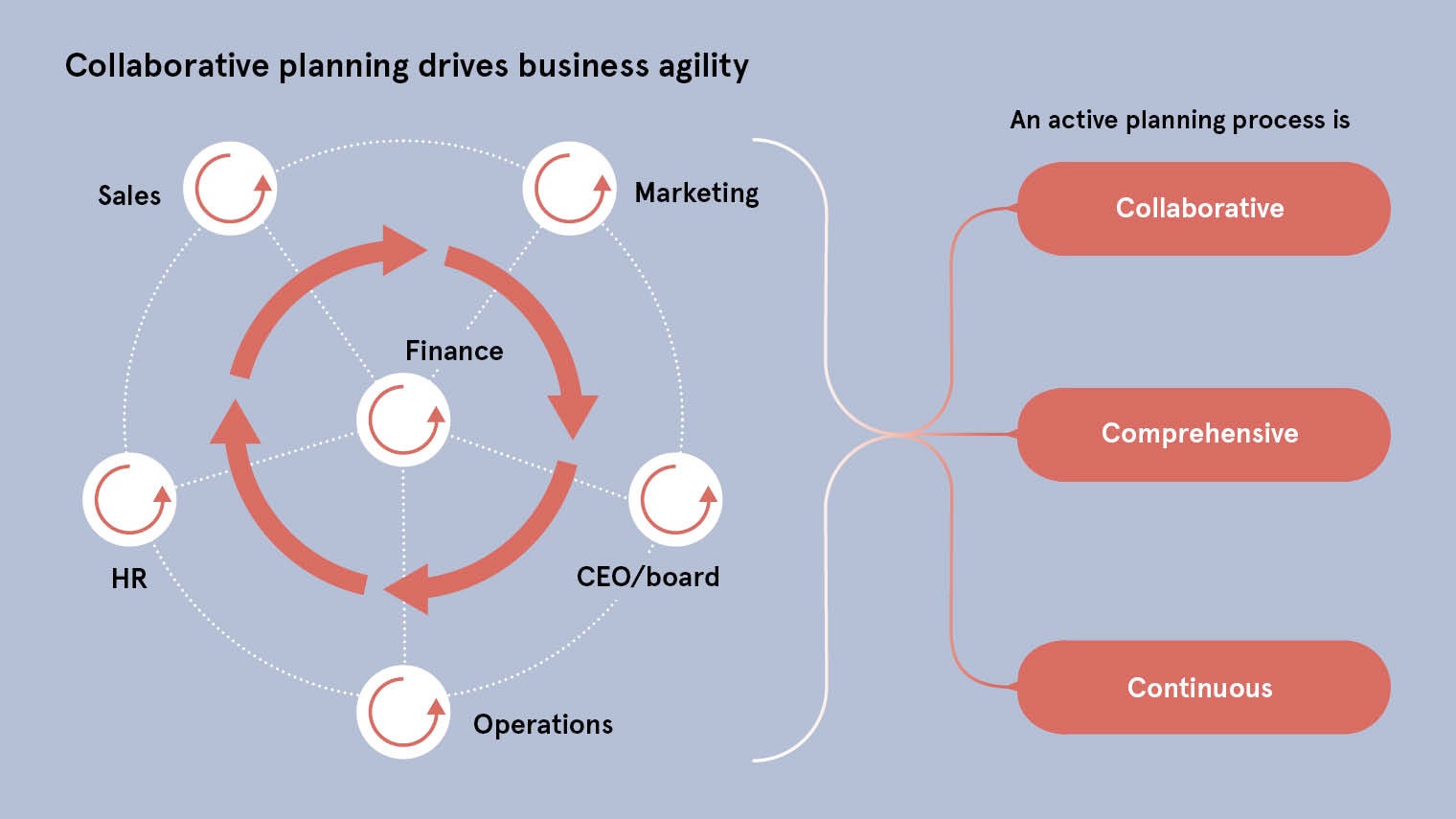

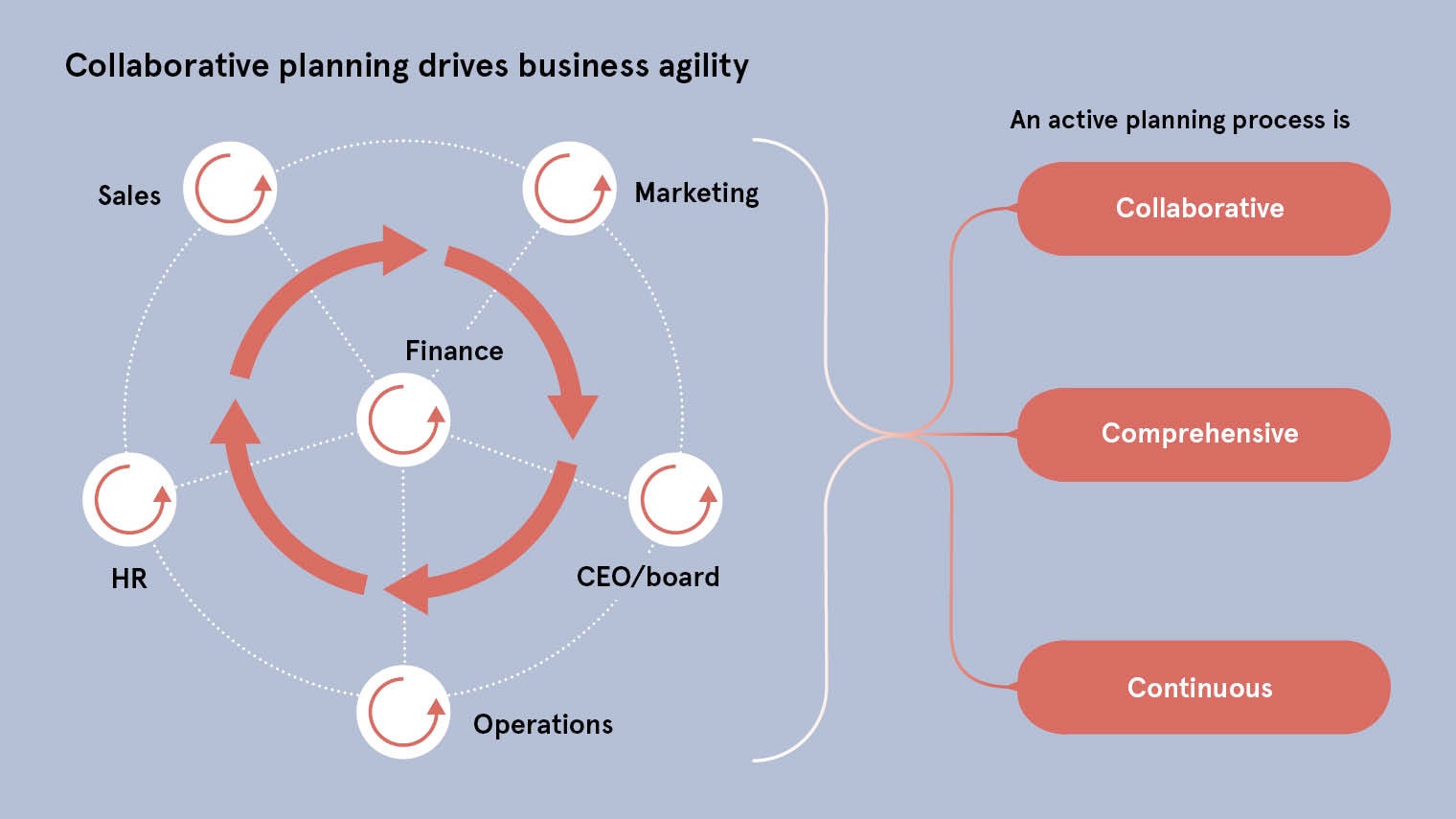

“CFOs and finance teams at leading companies have embraced continuous, collaborative approaches, working with sales, marketing, human resources and key business unit leaders to revise plans and course-correct throughout the year,” he explains.

Today’s business climate demands a change. According to a 2018 Deloitte survey of CFOs, the pace of change in the business environment is making it inevitable for businesses to keep changing their goal post and thus 55 per cent of CFOs believe that it is a challenge to execute against their plans or strategies. It was the top risk listed by CFOs.

CFOs and their teams should be able to give the business the data and insights needed to adapt without having to wait for the next quarterly or annual review. Collaboration across the enterprise, bringing together the right expertise and data for an informed plan, is also critical for business planning.

Adaptive Insights’ Mr Hull sees cloud-hosted business planning tools as an important part of change. “The cloud offers a long list of benefits for finance teams who want to be agile. A cloud planning process means everyone is using the same data. And when you end arguments about who has the right data, you can focus on strategy. You can build a comprehensive model of the business and easily test scenarios, planning on a continuous basis. And cloud-based tools encourage collaboration. It becomes an active planning process.”

The benefits of these tools dwarf those of legacy systems and traditional spreadsheets. Jim Bell, CFO at P.F. Chang’s, knows this first hand. With more than 300 locations of the Asia-themed restaurants worldwide, he knew he needed a new approach to business planning.

“We wanted to move planning beyond finance and out to the restaurants where the action is,” he explains. Now the global business has extended budgeting, planning and forecasting to individual restaurant operators, for the first time putting every restaurant in sync with corporate finance. “This is the new mode of planning. Empowering those closest to the business with the information they need, so they can adjust personnel, expenses and so on, using real-time data. I actually don’t know how companies are still managing finance with spreadsheets.”

The requirement is for finance teams to enable their companies to be agile. These organisations should be able to make data-driven decisions quickly, so the business can pivot, in small or dramatic ways.

Companies such as DHL, Specsavers and Boston Scientific, among others, have moved to cloud-based planning processes. And they’re not alone. “Cloud-based planning solutions are seeing double-digit annual sales gains,” says Mr Henschen. “They’re already the default choice for small and mid-sized companies, and now even the largest enterprises are moving to the cloud to make their planning processes nimble.”

LinkedIn’s Mr Hoffman talks about the “never-ending need for change”. He warns: “Just when you’ve managed a key transition or successfully applied a counter-intuitive rule, the game board changes and you have to do it all again.”

To find out what agility can mean for your business, please visit www.adaptiveinsights.com/agility