Customers expect to be able to pay for goods and services in an ever-increasing variety of ways, while regulation increases as open banking becomes more prevalent.

It becomes a minefield of technology and data regulation; compliance with extensive legislation that takes the focus of the merchant away from what they are good at: selling or providing a service to their customers.

But for the merchants able to find their way successfully through this labyrinthine series of decisions, there is a considerable prize to be had in increased customer loyalty and higher profits.

When it comes down to it, money has the value that we as a society ascribe to it, that the central banks across the world print on it and tell us it is worth, and the value changes over time relative to other currencies and as a result of outside influences, such as inflation.

So when you think about the future of money, it is just as possible to assign value to some other sort of “currency”, which could include the value of your personal data and the way in which this is used by retailers, leisure services and online sellers.

The importance of data cannot be underestimated. Merchants who are looking to maintain and grow their businesses must be aware of the increasing need to collect and use data in a way that encourages customer loyalty, ongoing interactions and sales, while ensuring the highest levels of security.

However, additional regulation and the rising requirements to ensure the highest levels of data security mean many merchants are struggling to align their interests, their customers’ interests and the ability to provide sufficiently strong encryption mechanisms that can address all these needs. Going it alone for a smaller retailer, or even a larger retailer in some cases, can be so onerous that the opportunities presented by the proper use of data collection are passed by.

Merchants who are looking to maintain and grow their businesses must be aware of the increasing need to collect and use data in a way that encourages customer loyalty

Introduction and implementation of the General Data Protection Regulation (GDPR), essentially the right to be forgotten, and the heinous penalties that can be applied in the case of GDPR data breaches have made it even more difficult for merchants, especially smaller firms, to get to grips with just how they can help their customers to have a better experience whenever they interact with them.

Yet customers are increasingly impatient when it comes to paying for goods and services. Many are no longer happy to wait while they have their card read, enter their PIN into a terminal, and have the system produce a paper receipt they then carry in their wallet for months and never look at again.

Instead, paying “on the fly” is increasing in popularity; using a phone to pay with systems such as Apple Pay or contactless card payments are the tip of the iceberg when it comes to developing increasingly speedy solutions to encourage customers to come back and buy again.

The Capgemini Top 10 Trends in Payments 2019 report highlights the increasing use of digital identity as the key driver for the rise in the need for security, as an increase in fraud is expected. The survey highlighted that between 2014 and 2018 new account fraud was expected to rise by 44 per cent, with losses rising from $4 billion to $8 billion over the period.

The report says: “Increasing identity theft and scenarios such as synthetic ID fraud are spurring new defensive moves against attacks.

“Regulations such as PSD2 [Revised Payment Service Directive] combined with the open banking trend require robust measures for identity management. The European Banking Authority is encouraging risk-based authentication, wherein several layers of security must be passed to minimise violation risk.”

In reality, for merchants this creates a headache of migraine proportions as they struggle to keep up to date with the ongoing and constantly changing requirements for security, while providing payment options for clients from the use of contactless cards to phones, cryptocurrencies, e-wallets and even their voice.

However, data security is just one part of the equation. Retailers for their part are also using the data gathered in these transactions to tailor the experience their customers enjoy, whether that is by identifying trends in sales, which allow buyers to get their stock levels right to maximise profits, or by identifying specific customer purchasing behaviour at particular times.

The use of personal data to target customers with offers and loyalty schemes they will actually engage with is also a powerful tool for retailers to wield in the constant fight to win business. You can use data analysis to identify whether someone is a good customer of yours or a bad customer, how much on average they spend with you each interaction, or each month or each year.

This becomes enormously powerful when you then start to use it to generate marketing that specifically targets sets of customers, whether they only buy in the winter or respond specifically to offers providing discounts over a certain level.

Consumers are becoming much more accustomed to having their needs and desires catered to at a more granular level. Advertising targeted at their interests is something that Facebook, Google and Amazon do extremely well, and as a result it is becoming more integrated into our general purchasing behaviour.

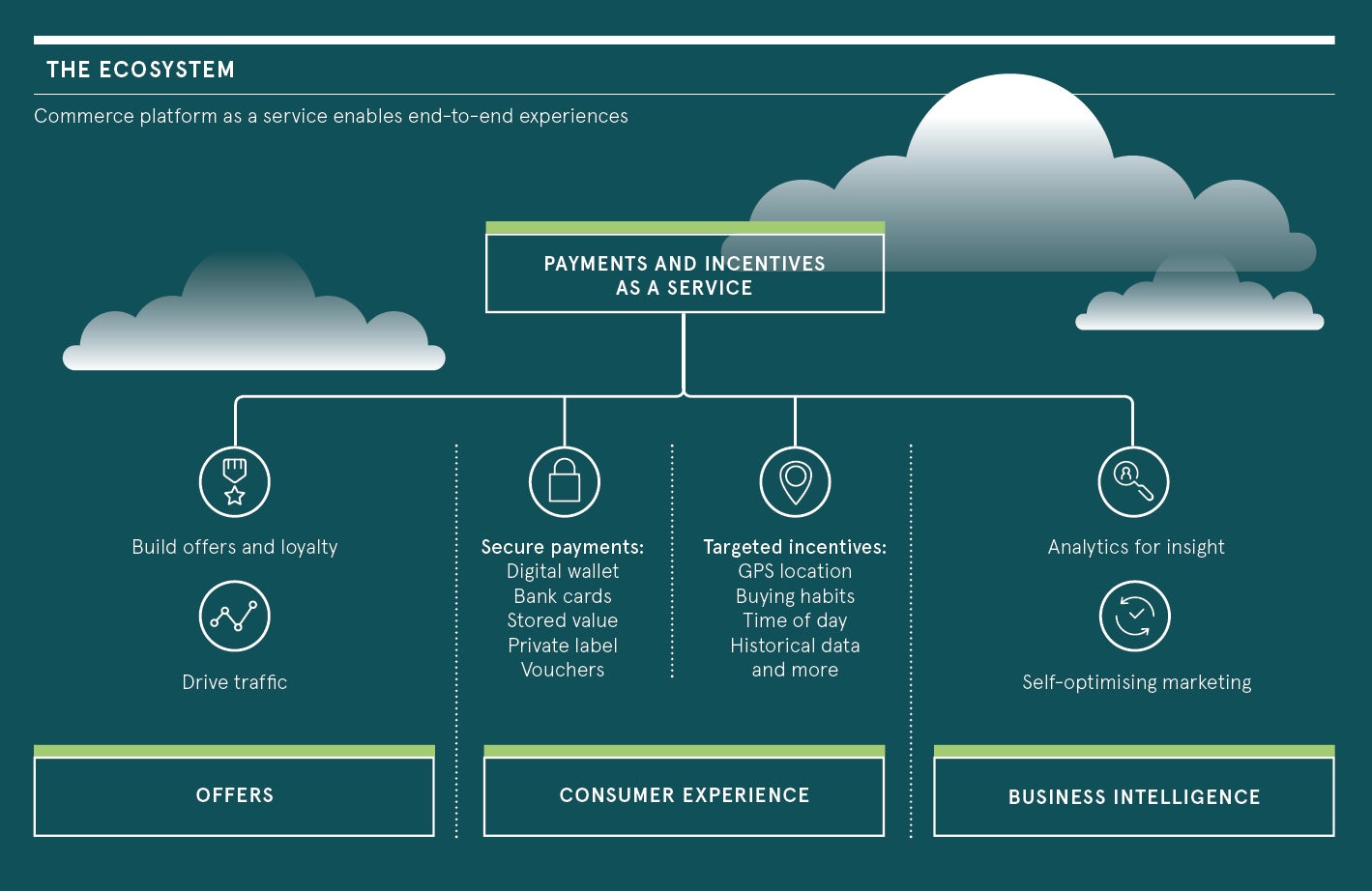

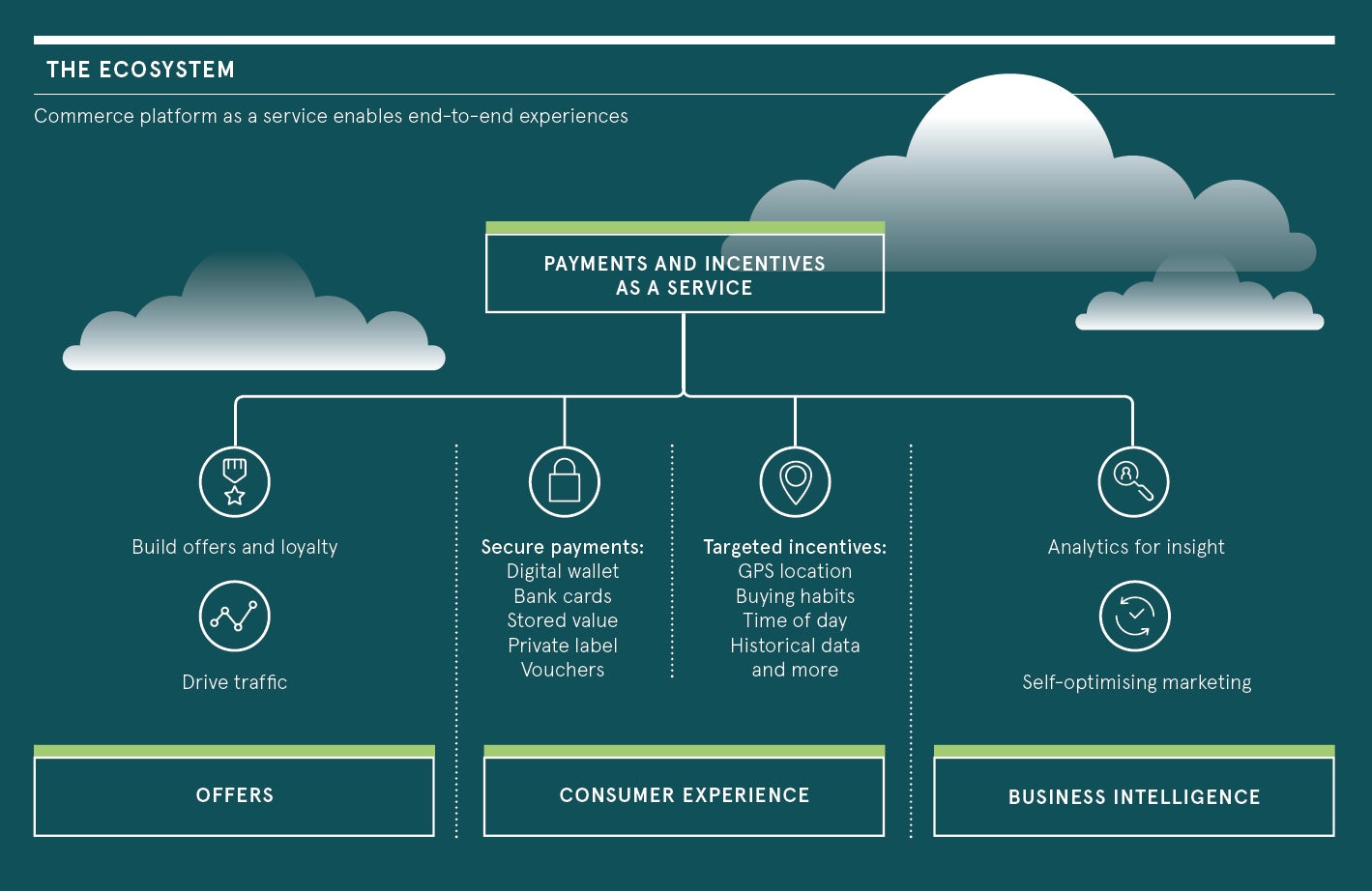

While very few businesses may have the financial clout, technical knowledge or ability to collect, analyse and then retarget data in the same way as these retail behemoths, it is not an impossible task to integrate such services into your business if you choose the right payments partner.

Resolving all these elements of the customer-retailer interaction is not easy. The best way is to use a strong, constantly updated, highly secure platform that can be integrated across a range of retail assets your company might have, everything from a point-of-sale system to an online portal.

Choosing a partner that provides a solution that can work across all sectors, with specialist data collection and analysis capabilities, and the highest level of encryption available sounds like the Holy Grail. But it really does exist.

For more information please visit uk.freedompay.com