We’re awash with information, from Facebook and Twitter to wall-to-wall news coverage, but much of this is clatter. Knowledge has substance, coherence, meaning and value. The leading companies of 2020 knew that, which is why they invested time and resources in studying and understanding their markets. The innovators of 2021 will do the same.

“It is impossible to stay on top of the innovation in your market without patent analytics,” says Matt Troyer, director of patent analytics at Anaqua, which serves more than 50 per cent of the top 20 US patent filers and top 20 global brands.

In 2020, there were more than four million patents issued globally, according to the patent statistics as analysed by Anaqua’s AcclaimIP platform. China was responsible for 2.7 million of these, which suggests it dominates the innovation game. “Look a bit more closely, though, and this is not a true picture of what’s going on,” says Troyer.

As of January, only 139,000 of the Chinese patents were issued outside China, which indicates the rest do not have wide commercial or social value. “If the patents had commercial value, their owners would have registered them elsewhere as well,” he says.

“There has been a steady increase in the numbers of patents issued over the past 20 years and China’s share of this increase has remained fairly constant.”

There were nearly 720,000 patents issued globally in 2001 and just over 1.3 million in 2020, excluding those registered only in China with no counterpart elsewhere.

“Companies use our patent analytics software for a competitive edge,” says Troyer. “They can see if an idea has been patented before and make sure their own innovation is as new as they think. Without novelty, a patent application will fail.”

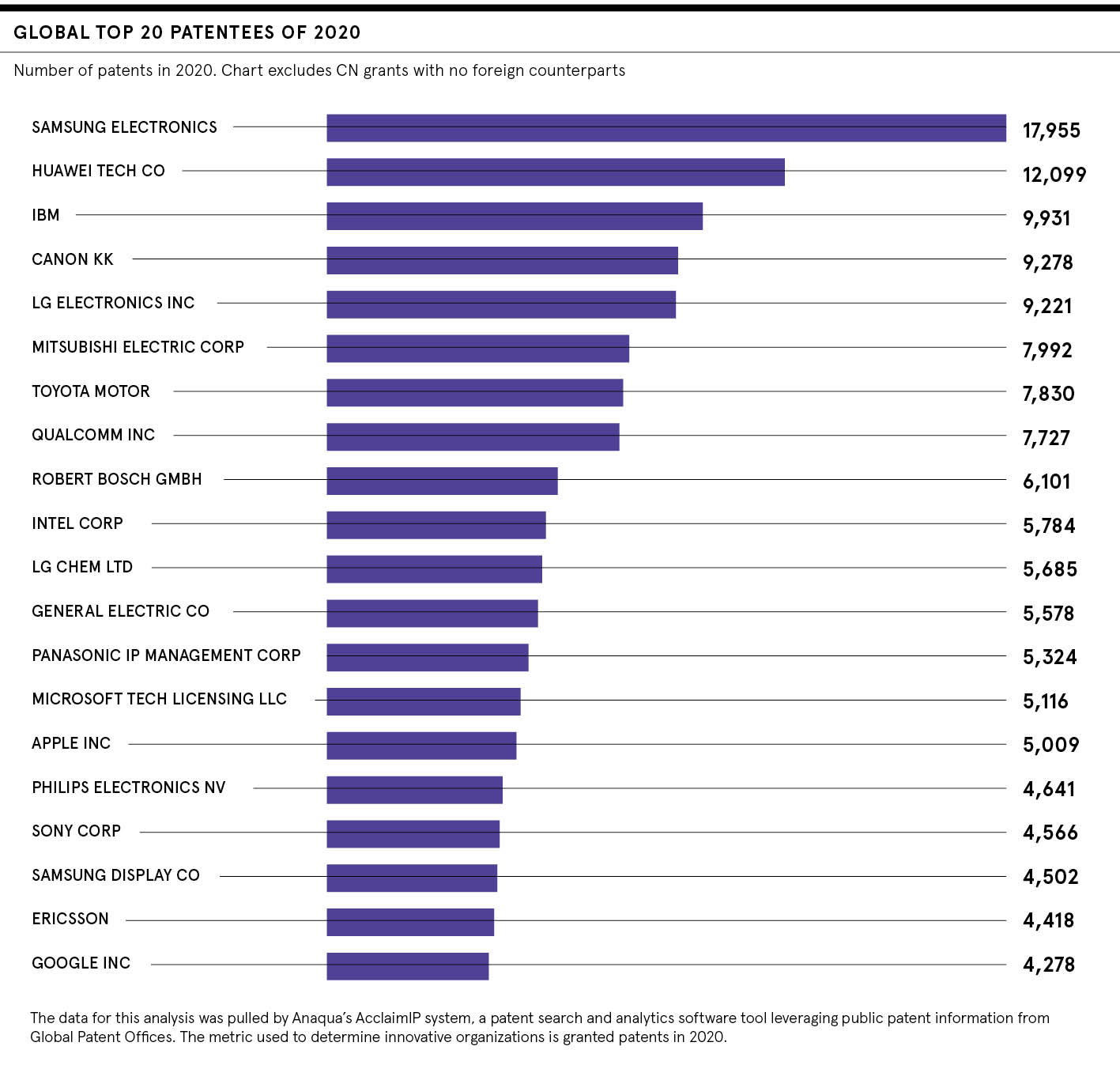

In the lead of companies on the innovation list is Samsung Electronics, with 17,955 patents. It is followed by Huawei Tech (12,099), then IBM (9,931), Canon KK (9,278), and LG Electronics (9,221).

Companies use our patent analytics software for a competitive edge

Innovation is booming. Global patent filings rose 2.3 per cent, the highest rate for some years, according to figures for the most recent 12-month period, published in the World Intellectual Property Indicators 2020 report from the World Intellectual Property Organization (WIPO).

But this does not include China. The figures, which cover 2019, show a 3 per cent fall in global patent applications, the first decline in a decade, with the inclusion of China.

Nevertheless, WIPO’s report is optimistic. The decline “was driven by a drop in filings by Chinese residents amid an overall shift in regulations there aimed at optimising application structures”, it says. There was a 5.9 per cent increase in trademark filings and a 1.3 per cent increase in industrial design filing activity.

Even though the statistics predate the coronavirus pandemic, WIPO is convinced there is a “strong foundation of IP activity that will serve as a base for new advancements as the pandemic subsides”. Taking account of the time needed for research and development (R&D), COVID-19’s impact on patents would not be expected for a number of years.

With this in mind, a further AcclaimIP patent data search by Anaqua reveals how quickly innovative companies have adapted. The first patent mention of COVID-19 appears in March 2020, before many people outside China had heard of the virus.

Patents offer businesses the economically critical ability to protect their knowledge from competitors, but they also offer a function as close as you’re likely to get to picking the lock on a rival’s R&D department.

“They offer a trade-off for businesses,” says Troyer. “Patent owners get the right to exclude others from using their inventions, usually for 20 years, in exchange for full disclosure to the public, including rivals. Nowhere else do you have such a wealth of technical information and documented details of your competitors’ innovation. It is the most comprehensive corpus of data on your competitor’s innovation activity and roadmap.”

Patent applications can also alert managers to disruptors or new players and show how competitors are positioning themselves. Large corporations use patent data to monitor start-ups entering their space or universities that may have developed licensable innovations.

“Mapping a patent landscape, for example, identifies the patents in a technology and divides them up by patent owner, inventors, technology, date and countries where filed,” Troyer explains. “Patent landscapes help business managers evaluate their competitive position and navigate the patent thicket prior to introducing new product features or entering new markets.

“Fortunately, in this increasingly competitive and inventive world, patent analytics give businesses the power to sift real knowledge from the clatter to make informed decisions.

“It doesn’t make sense for a business to waste time and money losing the right to exploit its own innovation or filing patents on something that’s already been invented.”

See for yourself the performance of AcclaimIP. Start your free trial here

AcclaimIP analytics

What does it do?

AcclaimIP is a patent search and analytics software platform designed for IP professionals who need to perform detailed searches, refine results and visualise the output for business audiences. It enables users to make fast searches of patent data so they are able to make better decisions with more confidence in the relevance of the results looking at numerous factors. These include citations, classes, patent scores, data visualisation and custom fields.

How does it empower you?

IP risk management: identifies, analyses and responds to potential perils of patents to minimise risks.

Research prior art for your own innovation: inventions need to be useful, novel and non-obvious to be patentable.

Map patent landscapes: patents filtered based on patent owner, inventors, technology, date and filing country.

Monitor your competitor’s activity: this will be disclosed in each patented invention.

Monitor technology: for competitive monitoring, companies watch patents for specific technologies.

Promoted by Anaqua