Investors will always remember the moment capital markets acknowledged the impending doom posed by the coronavirus crisis, causing unprecedented turmoil in their portfolios. It wasn’t long before the age-old lessons on diversification were being recirculated in investor forums and publications, though when most traditional asset classes are affected, it’s easier said than done.

Decorrelation is one of few ways investors can seek protection in times of turbulence, but various market events have shown traditional asset classes are more correlated than many people think. The benefits of diversification only work properly when the portfolio’s assets are truly uncorrelated. No amount of diversification can guarantee immunity to losses, of course, but achieving real decorrelation in an investment portfolio will reduce risk and volatility.

Among the rare, genuinely diversifying asset classes is insurance-linked securities (ILS). Though not mainstream, the size of the investable ILS market is approximately $100 billion. Comprising a suite of instruments, of which the catastrophe bond is the best known, ILS enables insurance and reinsurance companies to transfer insurance event risk from their balance sheet to capital market investors.

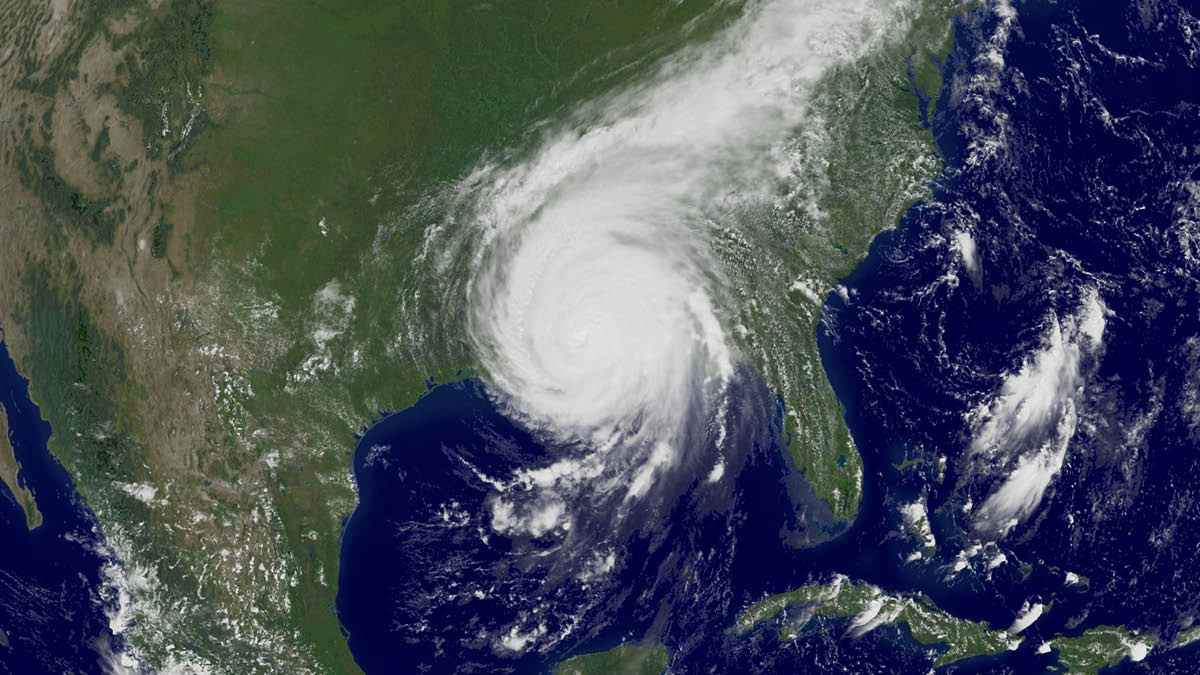

ILS reduces volatility for insurance and reinsurance companies by sharing the burden of insurance claims after a natural catastrophe while offering investors the ability to access long-term, attractive, risk-adjusted returns, which are uncorrelated to most traditional asset classes; a stock market crash does not make a hurricane or earthquake any more or less likely to happen. By isolating the insurance claim component, investors are immune to the impact broader financial market turmoil may have on the asset bases of those insurance and reinsurance companies.

“ILS has been the most successful attempt in converging the insurance industry with the capital markets,” says Vegard Nilsen, chief executive of Securis Investment Partners LLP, an asset management company specialising in ILS. “With interest rates at record low levels, investment returns across traditional asset classes are not only expected to be lower, but also more correlated and volatile.

“In a wounded economy, which has seen a spectacular level of monetary intervention, the fiscal toolbox is empty and this should be a concern. Uncorrelated investment strategies and fixed-income alternatives are more relevant than ever. Our value proposition is to provide investors with the ability to access investable insurance risk in its purest form,and to eliminate exposure to the issuer in a structure where the collateral – the investments made – is entirely ring-fenced and protected.”

Born in the mid-1990s, when the first catastrophe bond was issued amid a shortage of insurance cover following Hurricane Andrew, the ILS market has evolved significantly since, driven by the fundamental goal of securitising insurance event risk. Today there are several mechanisms available to transfer insurance risk to investors.

The insurance and reinsurance events investors are exposed to relate mostly to natural catastrophes, but also include life and health-related risks. Securis invests exclusively in ILS, via a range of different funds, for an investor base predominantly made up of large pension funds and institutional investors. Securis manage approximately $4.5bn of assets on behalf of its investors.

ILS has been the most successful attempt in converging the insurance industry with the capital markets

A catastrophe bond is similar to a fixed-interest bond, but rather than being exposed to the default or bankruptcy of a corporation, it may be exposed to contingent event risk arising from low-frequency, high-severity insurance events, such as the occurrence of a large hurricane or earthquake. When certain conditions are met, the bond defaults. The investor collects a regular coupon for the duration of the bond and, in the absence of that event, the capital invested is returned upon its maturity.

The global financial crisis in 2008 was the first real test and proof of concept for ILS and it lived up to expectations. Securis posted performance that year in line with what it had modelled and expected, uncorrelated to the capital markets and more traditional and well-known assets. ILS had its own challenges during 2017 and 2018 when there were an unusually high number of natural catastrophes around the world. This demonstrated how both the ILS and capital markets are cyclical in nature, only amplifying the value of a diversified investment portfolio with proper decorrelation.

“ILS can be very helpful for investors who have the governance capability to properly implement and manage an ILS allocation within a diversified investment programme,” says Weston Tompkins, head of investor relations for Securis in North America.

Investors should treat it like any other strategic asset class: do your due diligence, educate yourself and get to know the investment manager. ILS does act unlike anything else in their portfolio and for all the right reasons.

“The incidence of hurricanes or earthquakes isn’t related to global GDP or any of the capital markets, so ILS is an unquestionably diversifying asset class. It’s really easy to understand: if the wind doesn’t blow and the ground doesn’t shake, you should typically make money. There should be a positive return premium for underwriting potentially large global property catastrophe losses and historically that has been the case. Implementation can be incredibly complex, but that is why Securis exists.”

For professional investors looking to embrace the diversification opportunity that ILS presents, Espen Nordhus, Founder and Executive Chairman, recommends a strategic long-term allocation, with at least a five-year perspective.

“Take a long-term view and be prepared to adjust your committed capital over time,” Nordhus adds. “If ILS outperforms the rest of your portfolio, reduce your position. If it underperforms or there is a meaningful market dislocation, add to ILS despite the preceding returns. This is the most critical point for a long-term successful ILS experience, as it means you’re reducing your allocation when expected returns are declining and increasing allocation when return expectations are increasing.”

Q&A: Leading the evolution of ILS

Vegard Nilsen, chief executive of Securis Investment Partners, reveals how the company has helped shape the evolution of insurance-linked securities over the last 15 years and continues to lead the charge

What role has Securis played in the development of this burgeoning asset class?

When Securis was established in 2005, very few investment managers were deploying investors’ capital to provide protection to insurance and reinsurance companies via a fund product. There was a significant amount of innovation and invention prevalent in those early days. Asset managers were in many ways spurred on by the large reinsurance companies seeking avenues to pass on risk.

Fifteen years on, it’s clear we were a disruptive force and now actually compete with the reinsurance companies. The universe of insurance risks is very broad and Securis has always been at the forefront of extending the part of it that is accessible to ILS investments. This has not meant to branch out into areas where insurance risk is combined with market risk or credit risk, but rather to find new markets for insurance risk participation and genuinely diversifying risks for our investors, increasing risk-adjusted returns.

What approach do you take to ensure you can continue to innovate in this space?

As an example, we created an Insurance Solutions Group last year to focus entirely on pursuing new strategic ideas. We see a number of opportunities to deploy life financing technologies to the non-life space, where the combination of taking on insurance risk together with financing can be a powerful combination to enhance returns, particularly in the areas of insurance premium financing, commission financing and speciality risk financing.

Securis also has one of the longest track records in the Life ILS space, a highly specialised proposition which involves risks including mortality, life expectancy, lapse (when a policy is cancelled or modified) and morbidity. The success of a Life ILS transaction should be down to highly predictable actuarial risks that can be analysed, not the risk of a counterparty failing to pay us or any general market risks like equity shocks or interest rate rises.

“This is why particular focus is paid to putting in place appropriate collateral ring-fencing structures for most of our life transactions. This, in turn, allows us to produce a highly diversified, return maximising portfolio for our investors, with minimised exposure to traditional market risks” Andrea Cavalleri, CIO (Life) adds.

How will the continued effects of climate change impact the ILS market and asset class?

Climate change has the potential to impact all asset classes. The climate is changing, for example average sea surface temperatures have risen approximately 1.1 degrees Celsius since the late 19th century and sea levels have risen 20cm in the same period. And although it has a negative impact on our planet, that doesn’t automatically make it negative for ILS as an investable asset class.

If the assumption is that climate change creates a more volatile climate, you should also assume the need for insurance will increase, the market will grow and the additional risk will drive insurance premiums up, which will ultimately benefit our investors. It’s also important to note that natural catastrophe risk is not just a function of the hazard or climate, but rather the exposure to the hazard.

Hurricane Katrina cost the insurance industry $39 billion when it flooded New Orleans in 2005. That’s $63 billion in present-day values, however contemporary analysis suggests the damage would have been 60 per cent less had the levee systems been at current standards, following reconstruction and improvements which have reduced the city’s vulnerability to storm surge. Our modelling estimates that a repeat of Katrina, with present day exposures and protections in place, could in fact cost the insurance industry less than $25 billion.

How do you evaluate risk in a complicated climate environment?

Securis employs around 70 people with a unique mix of capital markets and insurance experience in addition to a number of technical experts, actuaries and mathematicians. We apply a robust and sophisticated approach to the risk models and tools we use to evaluate catastrophe risks. However, the concept of evaluating catastrophe risk using models adjusted to represent the current climate, rather than just the full available historical record, has been around in the catastrophe modelling community for a long time.

Climate change is one of several risk factors that must be considered, quantified and priced accordingly. We are very familiar with the tools and approaches, have adapted them based on our own analysis and continue to use the philosophy of non-stationary distribution of risk when pricing risk. Many aspects of climate change are gradual, it may take decades, even centuries, for trends of changes to be observed – while ILS can adapt quickly.

Herbie Lloyd, CIO (Non-Life) adds, “We are very well positioned to model, analyse and price risk to reflect changes in exposure, construction vulnerability and the insurance-related impacts of the changing climate. The short-term nature of insurance policies allows for annual repricing when policies are renewed and renegotiated, so new science, better data and updated views of natural catastrophe risk are readily adopted into our investment decision making framework.”

What is your own company stance on the environment as well as other ESG components?

We believe ILS has inherent ESG-friendly characteristics as through insurance, investors in ILS support rebuilding following natural catastrophe events for non-life, and after illness or death on the life side, i.e. within, an element of social return for investors. Longer-term, insurance promotes resilience and incentivises good risk management.

As a signatory of the United Nations Principles for Responsible Investment, we are firmly committed to the environmental, social and governance (ESG) agenda. At a corporate level, we are developing a more sustainable working approach, which will result in both environmental and social benefits with reduced reliance on physical infrastructure, minimising waste and extracting efficiencies through utilising cloud technologies.

Our most valuable resource is our team. Our culture is built around an inclusive, ambitious and dynamic environment that encourages transparency, integrity, collaboration and creative thinking. We encourage staff to embrace the concept of corporate citizenship, and we’re dedicated to making a positive impact in our local communities and globally, through the Securis Foundation, our Charity.

We also recognise corporate governance and ethical conduct as essential drivers of long-term success. Embedding proper, transparent practices in our organisation is core to Securis’s risk management framework and operations in a globally regulated environment.

For more information please visit securisinvestments.com

Promoted by Securis