Warranty and indemnity (W&I) insurance, which mitigates risks in mergers and acquisitions, has been around for several decades. But as firms attempt to tackle risk in complex deals and the business environment remains challenging, its popularity has soared.

The upturn of M&A insurance purchases is in part due to products improving, with insurers able to offer comprehensive coverage more specifically tailored to different types of deal and different industries.

The products can also help throughout the full life cycle of a deal and its integration, according to Mary Duffy, global head of M&A insurance at AIG. “The whole process is now much more user-friendly at all stages,” she says. “Buyers and sellers, who are working through deals, aren’t slowed down by W&I insurance – it is a much more streamlined process and at the same time the pricing has come down.”

Key to any relevant M&A coverage is the insurer’s level of relevant expertise, with underwriters who have themselves worked as lawyers, accountants and other professionals at firms carrying out complex, multinational transactions.

The highest rate of claims (23 per cent) is on deals of more than $1 billion (Figure 1). According to Ms Duffy, the problems in the larger deals reflect the added complexity of such transactions, typically involving multiple jurisdictions and subsidiaries. “There is in essence a lot that can go wrong here,” she says. “Regardless of how good your due-diligence process is as a buyer, if you’re doing a multi-billion-dollar deal, it is hard to have addressed every element with complete confidence. It is easy for details to be missed.”

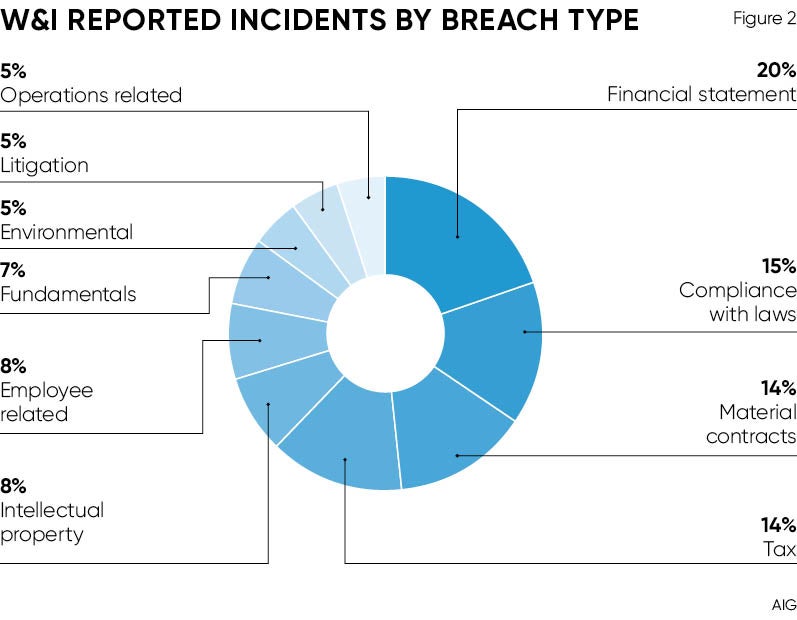

According to AIG’s research, insurers are frequently paying out significant sums of money when material claims are made against these W&I policies. Between 2011 and 2015, roughly 55 per cent of the most material claims were for more than $1 million. Some 7 per cent of the largest claims involved payouts of more than $10 million. In addition to accounting claims, compliance and tax issues feature strongly (Figure 2).

While M&A insurance payouts are usually highest in significant multinational deals, businesses engaged in smaller or mid-sized deals “equally need to protect themselves and support transaction execution”, says Angus Marshall, AIG’s UK head of M&A.

No matter the scale of an acquisition, W&I insurance responds to claims that surface throughout the later integration period. “We want our clients to think beyond the closing and to the prospect of how their insurer will respond if they do have a problem further down the line,” he adds.

AIG sees its research as helping shape effective M&A insurance products for the future, as well as increasing discussion in the boardroom so businesses can understand how they can apply the right risk mitigation for deals. The high payout rate is equally helpful to businesses as they seek confidence that their coverage will protect them effectively should something go wrong.

In the context of a tough economic climate and increasingly complex acquisitions, the popularity of M&A insurance is sure to continue its strong rise across industries and in deals of all sizes.

To find out how to manage risk and improve execution in your mergers and acquisitions please visit www.aig.co.uk/manda