Liability insurers are highly averse to risks they cannot accurately quantify and that could present major payouts. Insurers’ risk aversion can be traced back to their being swamped with claims in the wake of deaths linked to asbestos in the latter half of the last century, a phase that nearly broke the Lloyd’s insurance market.

Liability insurers are highly averse to risks they cannot accurately quantify and that could present major payouts. Insurers’ risk aversion can be traced back to their being swamped with claims in the wake of deaths linked to asbestos in the latter half of the last century, a phase that nearly broke the Lloyd’s insurance market.

Since those claims, “many insurers routinely insist upon exclusions for various emerging risks in their policies”, explains Bob Reville, chief executive at insurtech firm Praedicat. The company found in a recent survey that 83 per cent of underwriters see their job as “protecting their company against the next asbestos”, which might be mobile phones, wifi, nanotechnology, 3D printing, fracking or anything else. “When they do that job by adding exclusions, this can leave their clients exposed,” says Dr Reville.

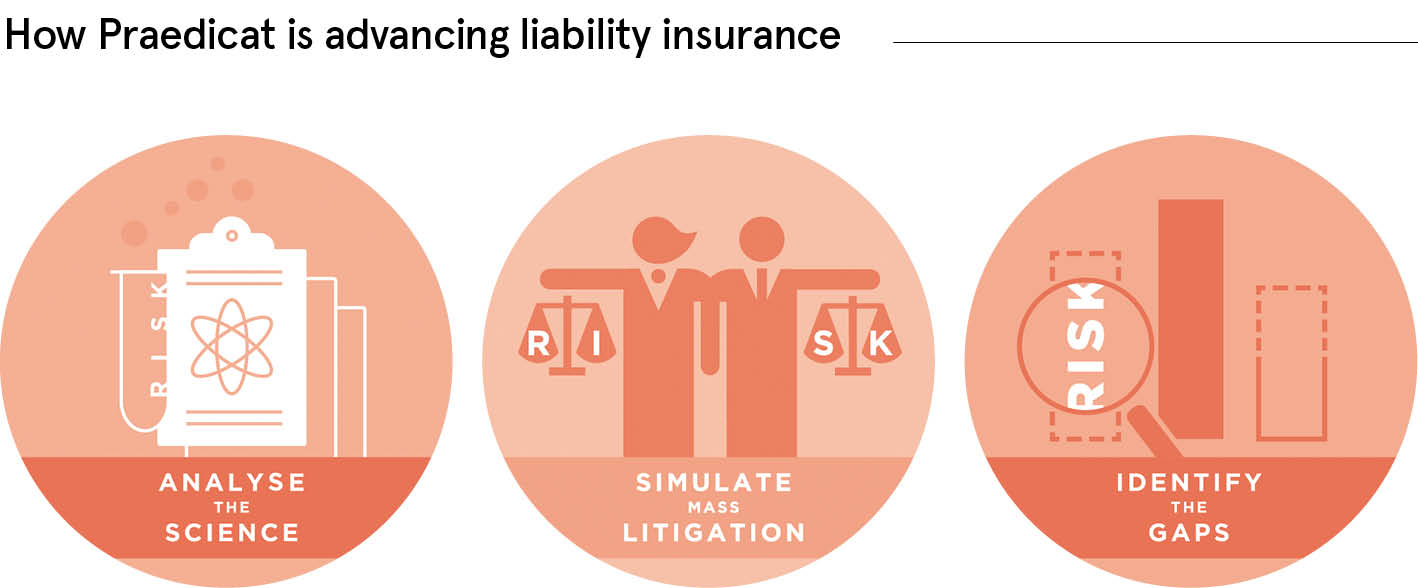

Using smart data modelling, Praedicat is helping insurers tackle coverage gaps, and match products and risk

While in personal insurance some 98 per cent of tort risk is covered, it is estimated by Towers Watson that covered commercial tort risk has been almost reduced by half since 1973 when asbestos litigation started. This would represent more than $60 billion in lost revenue opportunity for insurers and a significant danger for clients who want to take calculated risks to drive innovation.

Using smart data modelling, Praedicat is helping insurers tackle coverage gaps, and match products and risk. They can supplement traditional insurance with coverage for named perils, which are specifically selected low-probability, but potentially high-cost, risks.

Algorithmic search, machine-learning and natural language processing enable the company to extract clear analysis from vast amounts of peer-reviewed science so emerging risks can be better quantified and predicted. “Scientists are the world’s emerging risk group, trying to find the next asbestos,” says Dr Reville. “And we assimilate the essential information they’re finding, helping insurers to see around the corner.”

Addressing risk on a named peril basis is aimed at creating transparency, and allowing the risk to be managed and measured. This risk opportunity can then be spread to global reinsurance and capital markets.

“The effect on the industry will be so substantial that it could eventually double in size, given the extent of opportunities currently undercovered or excluded,” Dr Reville forecasts. “We estimate that a $15-billion reinsurance market will emerge to support insurers in this regard.”

With the technology and the data, Praedicat can quantify real litigation risk, he says. “When insurers run our models, they can identify a set of 30 or so such large-scale risks driving overall risk in each portfolio. Then they can assess the exposure to each one of them and transfer some risk to reinsurance on a named peril basis,” explains Dr Reville. “We can assess the dangers and what the magnitude of litigation could be.”

As an example, one chemical used in plastics, called di-(2-ethyl-hexyl) phthalate, or DEHP, is described by some scientists as having a risk of causing autism and other harms. Praedicat estimates that it could result in a one-in-a-hundred-year loss for industry of $117 billion.

The company’s latency risk management programme addresses such downstream risks and myriad others, working with insurers to manage their total aggregate exposure, limit exclusions and steer the portfolio. It also works in emerging risk consulting, to help insurers deliver risk engineering services at scale and assist their own clients in mitigating dangers.

This empowers insurers’ clients to innovate. “Companies had faced a big problem when developing products: if they made something that is incredibly useful and ended up included in countless other items, we didn’t know the downstream consequences in the wider environment,” says Dr Reville. “For insurers, now they can measure and much more accurately anticipate what that risk is. By including these named perils, businesses can innovate fully.”

Praedicat’s techniques, therefore, begin to enable the liability insurance market to function more like the property catastrophe market, with insurers much better able to account for risks by managing accumulation or the concentration of insured risks.

Andrea Scascighini, reinsurer Swiss Re’s head of casualty treaty underwriting in southern Europe, the Middle East and Africa, says the company is working with clients to manage accumulations. He adds: “Named peril reinsurance provides transparency in coverage, and facilitates innovative and tailor-made solutions.”

Meanwhile, XL Catlin’s global chief underwriting officer for casualty insurance, Nancy Bewlay, describes modelling of named peril risks as “opening up new coverage possibilities” and a “great opportunity to respond to coverage gaps” that currently exist.

Given the technology’s capabilities, there is now the emergence of “named peril clash reinsurance”, which helps reinsurers define with much greater precision where specific risks have a common cause. This helps reinsurers become more confident of their own resilience to multiple-risk circumstances.

There is also “excess casualty top-up”, which can effectively be used to provide companies with add-on insurance coverage for any one potentially expensive peril. This change in approach empowers insurers to “manage risk rather than avoid it or be unaware of it”, Dr Reville says.

Praedicat’s data-driven technology equally helps insurers’ compliance, specifically with regard to Solvency II regulations. “Our clients are using our product to develop submissions for regulatory and rating reports. It shows they are employing best practices for emerging risk management and thinking about their capital on the casualty side,” Dr Reville explains.

“After Solvency II was introduced, the initial focus was entirely on property insurance and now there’s an increasing focus on casualty insurance. We are providing a vehicle for how solvency can be measured and managed in a way that also supports growth in the industry.”

As insurers and reinsurers are empowered by data analysis and modelling, the industry can confidently cover named peril. This opens up a huge source of revenue. For the businesses they cover, there will be full protection through the truly comprehensive insurance they need for bold innovation.

To find out more about how to cover named peril please visit praedicat.com