The pandemic compressed rates of digital adoption, including contactless payments, from years into months. Between the first quarter of 2020 and the same period in 2021, more than 100 markets saw contactless as a share of total in-person transactions grow by at least 50%, according to Mastercard. In the first quarter of 2021 alone, the company saw one billion more contactless transactions, compared to the same period of 2020. Particular momentum was evident in the US and Brazil where, combined, contactless penetration nearly trebled year on year.

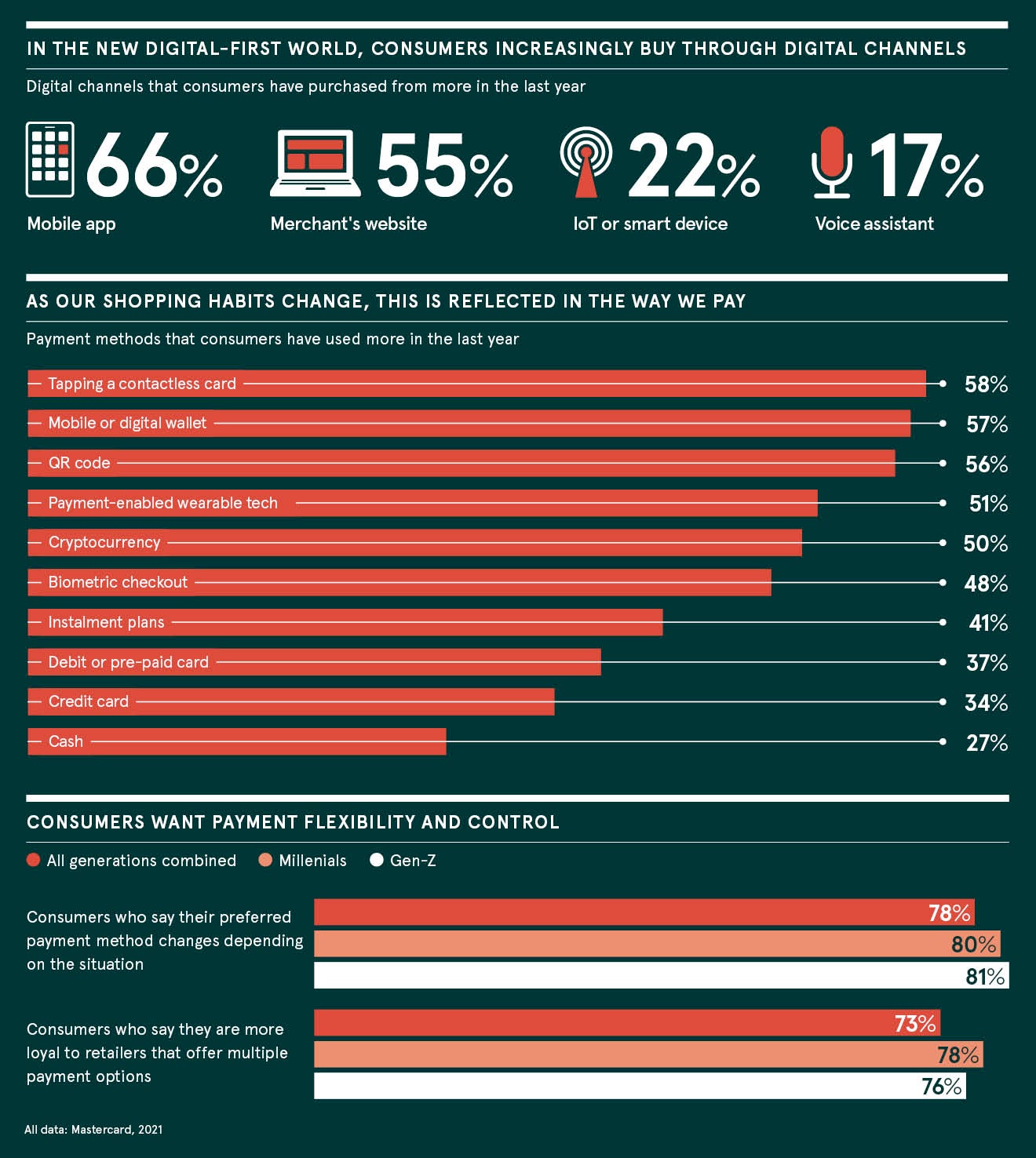

The growing appetite for using digital payments in a range of scenarios, whether buying groceries, shopping online, paying a bill or sending money to friends and family around the world is fuelled by recognition of their benefits. According to a recent Mastercard study, 53% of respondents would try a new payment method to save time. Three quarters of respondents to the same study, including 81% of millennials and 80% of Generation X, were open to using digital payment methods to help them save money.

Yet while people continue to demand more choice, often favouring different payment methods for different kinds of transactions, too many options can begin to have more of a paralysing effect, especially without education. The proliferation of choice, if unaccompanied by the necessary knowledge, is as much a challenge as it is an opportunity.

“We get bombarded with choice and it’s not clear why we might want to use one method over another,” says Paul Stoddart, president of new payment platforms at Mastercard. “It’s often not clear to consumers how payment methods differ, such as when money will leave their account and be received, or the fees associated with sending and receiving payments at home and abroad. Choice is good so long as the implications are clearly available and understood by all involved.”

A range of emerging technologies are helping to enable a more passive, intuitive choice for people while still retaining full control and flexibility. By assessing huge volumes of information quickly and accurately, AI-powered systems, for instance, can suggest a preferred payment option or move money between a person’s accounts to maximise savings and rewards. And in the area of connectivity, the technologies that support the internet of things can make payments invisible within a consumer’s set parameters, such as a smart fridge that orders milk when it runs low.

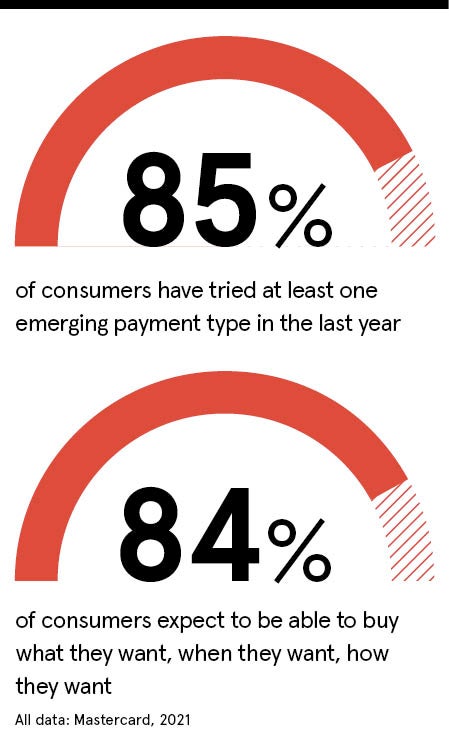

Voice and other biometrics allow faster, more secure authentication, while natural language processing via voice or using chatbots is becoming a primary mode for people to pay using a mobile device or no device at all. Real-time payments facilitate faster, smarter and arguably more secure payments, providing people with instant access to their funds and enable just-in-time payments, such as payment on delivery. Mastercard’s research found that 93% of consumers will consider using at least one emerging payment type in the next year.

Open banking, meanwhile, is transforming the entire digital ecosystem, fuelling competition and innovation in financial services to empower consumers to use their own data for their benefit. In Europe and places such as India and the US, open banking is enabling more seamless payments. More broadly around the world, account information services can help people manage all their money in one secure place, prove their eligibility for affordable credit, and even improve their overall financial wellbeing.

Having evolved from a single rail payment processor focused on cards, to multiple rails, such as bank account-based payments and blockchain, Mastercard is now leading the industry. It enables consumers to pay with whatever method they desire, through whichever device they wish to pay on — even allow them to pay now or later — while providing flexibility and control. The company already has innovation hubs in Ireland dedicated to research and development of new payment solutions, and another focused on innovating for financial inclusion in Kenya. It is currently developing even more.

“Our goal is to provide any and all of the payment methods that might be available to a consumer or business in a given market,” says Stoddart. “Our goal is to ensure our customers, such as banks and payment service providers, can provide all the payment services they might need through a single access point and relationship. The ease of managing a relationship with just one party is a benefit, but they also save on the cost of having to support multiple technical relationships with varying degrees of contractual liabilities or obligations.

“Within the product technology layer, we have increased and expanded our range of card payment services, including more digital card solutions. We’ve increased our capabilities beyond cards to include bank account-to-account payments, which often includes instant or real-time payments, and digital (including mobile) wallets. And we’re starting to support select cryptocurrencies directly on our network — those that meet our high standards for consumer protections and compliance — to increase payment choice availability.”

The payments ecosystem will continue to evolve at a rapid speed, even when the accelerating force of the Covid-19 pandemic has ended. To ensure consumer expectations are met reliably and securely, partnerships will be crucial. While newer, non-traditional providers, including fintechs and ‘Big Techs’, are increasingly trusted to provide a greater user experience, banks are still the most trusted to hold people’s money and data. To provide the innovative, inclusive and trusted payment experiences people expect, providers should leverage each other’s strengths. Competition breeds innovation, but collaboration is in consumers’ best interests.

Mastercard is partnering with its customers, industry leaders and regulators to accelerate the future of payments to benefit all participants in the payments value chain. The company connects consumers, businesses, governments and financial institutions to a powerful digital economy that empowers people with flexibility and control, however they interact.

“There are cyclical and seasonal trends that continue to drive growth within the payments ecosystem, and the introduction of new technologies to serve different use cases and needs will fuel further growth,” says Stoddart. “Mastercard is unique because we are able to contribute across the full breadth of the ecosystem, providing payment infrastructures, applications and services that use associated data to develop further richness in our solution.

“We have long been at the forefront of payment innovation and continue to lead our industry into its next generation, riding the waves of change. From cards to bank account-based payments, digital wallets and now blockchain, we are converging our payment capabilities to provide the seamless experiences people expect. We’re working to ensure the future is inclusive and sustainable, innovating with our partners to build trust and inclusion for everyone, everywhere.”

To learn more, visit mastercard.com/startwithpeople

Promoted by Mastercard

The pandemic compressed rates of digital adoption, including contactless payments, from years into months. Between the first quarter of 2020 and the same period in 2021, more than 100 markets saw contactless as a share of total in-person transactions grow by at least 50%, according to Mastercard. In the first quarter of 2021 alone, the company saw one billion more contactless transactions, compared to the same period of 2020. Particular momentum was evident in the US and Brazil where, combined, contactless penetration nearly trebled year on year.

The growing appetite for using digital payments in a range of scenarios, whether buying groceries, shopping online, paying a bill or sending money to friends and family around the world is fuelled by recognition of their benefits. According to a recent Mastercard study, 53% of respondents would try a new payment method to save time. Three quarters of respondents to the same study, including 81% of millennials and 80% of Generation X, were open to using digital payment methods to help them save money.

Yet while people continue to demand more choice, often favouring different payment methods for different kinds of transactions, too many options can begin to have more of a paralysing effect, especially without education. The proliferation of choice, if unaccompanied by the necessary knowledge, is as much a challenge as it is an opportunity.