The old norms of insurance cause a lot of customer pain: ever-rising premiums, slow and undifferentiated service, complex procedures and poor communications. But big changes are afoot. Customers want better for less as rapid technology advancement continuously raises service expectations – and disruptive new entrants are riding the wave. Inward-looking insurers ignore this at their peril. “We believe the industry has passed the point where it’s possible to grow profitably by sticking to the old rules,” says Douglas Badham, Curzon & Company partner. Successful net customer growth now depends on embracing a new set of rules.

The old norms of insurance cause a lot of customer pain: ever-rising premiums, slow and undifferentiated service, complex procedures and poor communications. But big changes are afoot. Customers want better for less as rapid technology advancement continuously raises service expectations – and disruptive new entrants are riding the wave. Inward-looking insurers ignore this at their peril. “We believe the industry has passed the point where it’s possible to grow profitably by sticking to the old rules,” says Douglas Badham, Curzon & Company partner. Successful net customer growth now depends on embracing a new set of rules.

All customer contact is precious and should be as convenient as possible. Policyholders expect to be treated as valued customers, able to interact 24/7 across joined-up access points as they do in other sectors. Seamless access boosts retention and reduces overall cost to serve, and requires digital enablers to be at the heart of the insurer’s operating model. “Insurers can no longer hide behind data security and Financial Conduct Authority (FCA) regulation as reasons not to allow multiple channel completion of processes,” says Mr Badham.

We believe the industry has passed the point where it’s possible to grow profitably by sticking to the old rules

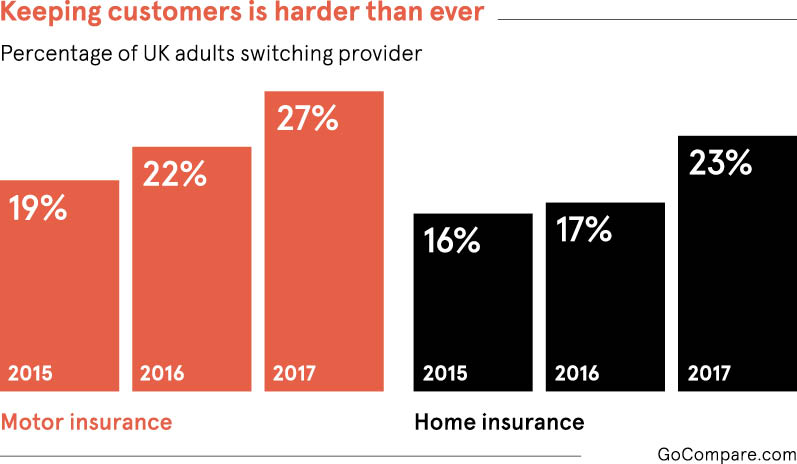

The focus must be on retention from day one. Keeping customers is harder than ever: switching, reducing or dropping cover has been rising steadily due to household cost-cutting and self-researched offer-hopping, leaving some underinsured. Use of comparison sites also means consumers leave bigger data footprints, which ratchets up competitor targeting of renewal dates. To defend against this, care and consistency must be core to the entire customer journey. The jolt when a frictionless sales process gives way to a clunky claims procedure won’t be tolerated.

As Mr Badham explains: “Optimising claims experiences and making best use of technology to help customers minimise the cost of a claim, or not have to claim, is how retention battles will be won.” Take the LeakBot recently introduced to homecare cover, which alerts customers to first signs of a leak before worse damage ensues. Alongside claims experience, affordability is a prime reason for customer exit and another cornerstone of retention effectiveness will be the increasingly precise, personalised renewal pricing artificial intelligence can deliver.

Have more meaningful customer communication more of the time. Too often insurers’ attempts to communicate have an adverse rather than positive impact. Providers need to treat every customer touchpoint as an opportunity to demonstrate the value of their cover, particularly since April 2017’s FCA renewals regulation, which requires every renewal notice to encourage customers to shop around. The best will use analytics to provide genuinely beneficial, timely insight that allows customers to understand and minimise their risk, for example: “You are regularly braking sharply and exceeding speed limits.” According to Mr Badham: “What’s happening in health insurance, where providers are transforming from benign payers to lifelong wellbeing partners, is likely to be followed in motor, home and other lines.”

Rebuild or build a brand based on trust and followership. Insurance has become something of a dirty word in recent years, with many incumbents losing customer trust. Restoring it is partly about making the move from a back-office-centric operating model to one that delivers digitally driven customer management and contact excellence. On top of this, compelling brand proof points are crucial to fend off powerful non-insurance brands that have taken a foothold, such as John Lewis, and to combat price erosion from online distribution challengers. It won’t be a case of outspending them. The insurers who cut through the noise of comparison tables and “expert” web articles will be those earning and sustaining customer advocacy through trusted recommender communities and app-based insurance aggregators such as Boughtbymany and Brolly.

There’s no hiding place from the disruption. Shedding the old rules and becoming a genuinely customer-driven insurer – in the customer’s eyes – is what it will take to thrive in the new environment.